- Short positions have fallen in recent days due to the rise in BTC prices.

- Implied volatility increased, which could make traders more cautious.

Like Bitcoin’s [BTC] prices soared and optimism in the cryptocurrency sector soared as well. However, there was one segment that was not happy with the rise of BTC: bears who had taken short positions on the king coin.

Read Bitcoin’s [BTC] Price forecast 2023-2024

Bears take a back seat

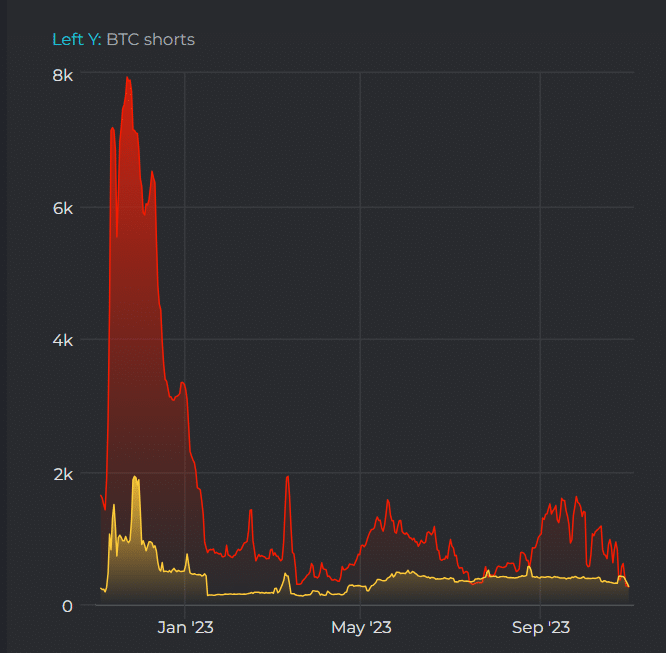

According to Datamish, Bitcoin short positions on Bitfinex recently reached their lowest level of the year. At the same time, hedged short positions, which provide protection against potential losses, have surpassed unhedged short positions.

This data suggested that those betting against the price of Bitcoin became less active, possibly due to the declining bearish sentiment in the market. This shift could indicate growing confidence among traders in Bitcoin’s price prospects.

Source: Datamish

Low correlation

The increasing positive sentiment around Bitcoin can be attributed to its reduced correlation with NASDAQ, a major stock market index. This correlation between Bitcoin and the NASDAQ, which measures how they move together, was now at its lowest point since August 2021 at the time of writing.

This move made Bitcoin less dependent on the performance of the NASDAQ. As a result, traders can view Bitcoin as a more independent and potentially less risky investment, contributing to positive sentiment.

Bitcoin’s weekly correlation with the Nasdaq is the lowest since August 2021 pic.twitter.com/MlKwwVqGMy

— Will Clemente (@WClementeIII) October 30, 2023

If Bitcoin’s price is not heavily influenced by the NASDAQ, it can provide a way to balance a portfolio. For example, if stock prices fall, Bitcoin may not follow the same path, which can help reduce overall risk.

Diversification can protect against large losses in one part of your portfolio. A more diverse portfolio can be more stable over time.

So if Bitcoin is less tied to the NASDAQ, it could be a diversification tool, appealing to those looking for a mix of assets in their investments.

Rising implied volatility

Furthermore, trading can also be affected by Bitcoin’s implied volatility. This metric measures how much the market thinks the price of Bitcoin could move.

Is your portfolio green? Check out the BTC profit calculator

Recently, this implied volatility for Bitcoin has skyrocketed. So, traders might choose to be more cautious or try to take advantage of the increased price movements. It could affect the way they approach trading in the future.

Source: Het Blok

At the time of writing, BTC was trading at $34,406.07. Over the past 24 hours, the price of BTC has fallen by 0.35%

Source: Santiment