- Are stablecoin reserves holding back liquidity flows into Bitcoin?

- Bitcoin ETFs have grown significantly recently and may have also affected the price of the crypto

Stablecoins play a crucial role during Bitcoin’s bull and bear markets. They are the medium through which liquidity flows to BTC and they also provide a buffer to retain value during bearish times. However, could stablecoin liquidity hold Bitcoin back?

CryptoQuant founder Ki Young Ju postulated in a recent analysis that stablecoins are unable to generate bullish momentum. The statement assumed the most bullish scenario, taking into account both Bitcoin and stablecoin reserves. He said,

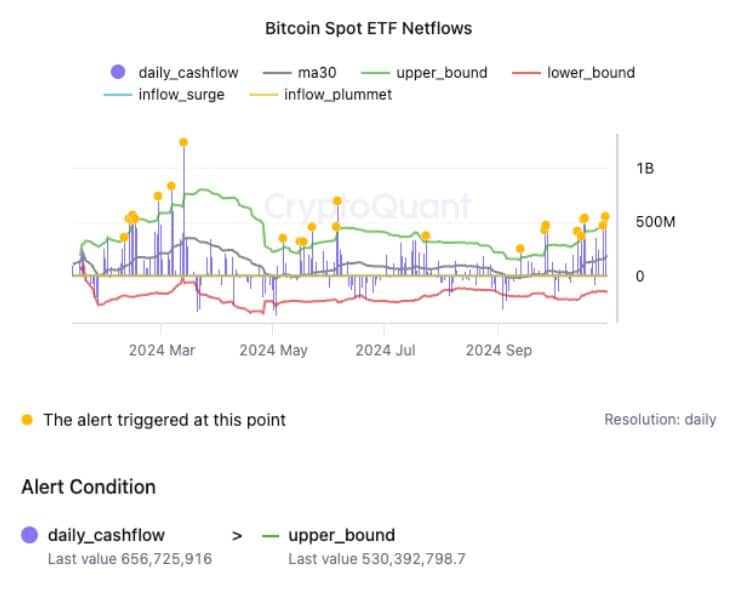

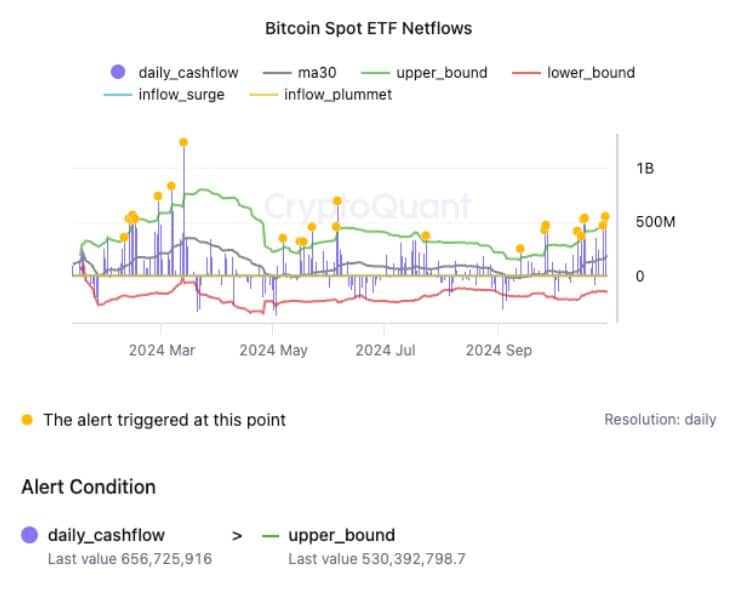

“Over the past two weeks, we have seen significant ETF inflows, led by BlackRock’s IBIT.

If spot ETF inflows could slow down at some point, BTC/USD buying pressure from brokerage firms like Coinbase Prime could weaken, potentially pushing the market back into stagnation.”

According to the exec’s analysis, Bitcoin reserves exceeded stablecoin reserves by more than six times. This means that current stablecoin reserves may not be sufficient to meet peak demand for Bitcoin.

Bitcoin had a market cap of $1.38 trillion at the time of writing. On the contrary, the collective market cap for stablecoins was $172.887 billion at the time of writing.

Here it is worth noting that the latter grew from just $123.74 billion in September 2024 – the lowest level in the past three years.

Source: DeFiLlama

Bitcoin ETFs have driven demand

The analysis also examined the role of ETFs in Bitcoin’s price action. It noted that a cooling in demand for Spot ETFs over the past two weeks was followed by weak demand.

The analysis also played with the idea that Bitcoin’s price action threatened to cause stagnation if demand for Spot EFT were to decline to an extreme low.

Source:

This observation coincided with the latest price action and ETF flows. For example, Bitcoin ETFs recently experienced a slowdown in demand on the last day of October, after previously reaching a week of positive flows.

The latest ETF data shows that Bitcoin ETFs ended the week with net outflows. ETFs are included, for example $54.9 million in outflows on Friday. Meanwhile, BTC is struggling to get back above $70,000 – confirming a slowdown in demand.

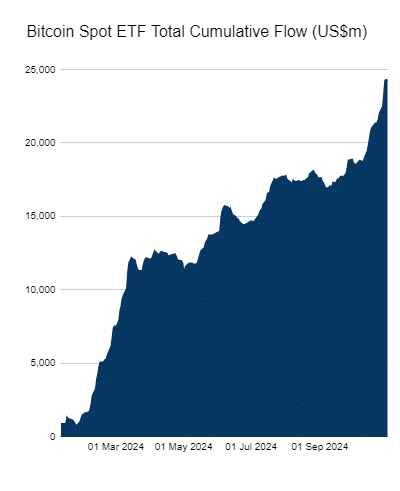

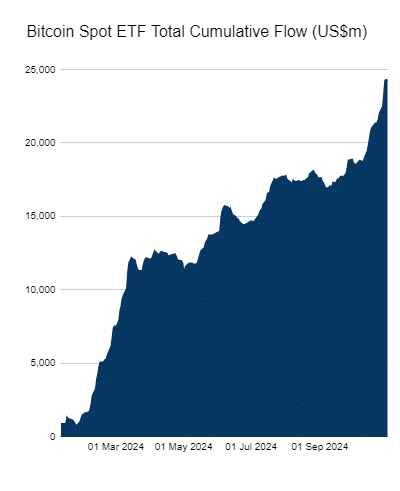

Anyway, Bitcoin ETFs Soared 62% from their approval date earlier this year. Here’s how the ETF flows have performed so far:

Source: Farside.co.ke

At the time of writing, Bitcoin ETFs held over $24.4 billion. This impressive growth is a sign of growing demand from the institutional class.

Meanwhile, the latest outflows are likely related to the uncertainty surrounding the election period. It will be interesting to see how things will develop after the elections.

Institutional investors have also responded to the revival of global liquidity, underscoring potentially good news for the holder. This is because lower interest rates have paved the way for risky sentiment.