In the intricate dance of global finance, traditional economic indicators and the burgeoning Bitcoin and crypto market are becoming increasingly intertwined. Recent macroeconomic data out of the US indicates a cooling economy, and this could have profound implications for Bitcoin and other cryptocurrencies.

Macro Data Snapshot: A Cooling US Economy

Yesterday’s data release paints a clear picture of a slowing US economy:

- Job openings: The July JOLTS report indicated a significant drop in job openings, from the previous 9.165 million to 8.827 million, well below the expected 9.5 million.

- US ADP nonfarm employment change (August): Actual numbers came in at 177,000, falling short of the estimate of 195,000 and showing a sharp decline from the previous 324,000.

- US GDP (quarter on quarter) (second quarter): The actual growth rate was 2.1%, slightly below the estimated 2.4% and just above the previous 2.0%.

- PCE prices (Q2): The actual figure was 2.5%, slightly lower than the estimate of 2.6% and a significant drop from the previous 4.1%.

- Core PCE prices (Q2): The actual data showed 3.7%, just below the estimate of 3.8% and lower than the previous 4.9%.

- Real consumer spending (Q2): The actual figure was 1.7%, slightly above the estimate of 1.6% and lower than the previous 4.2%.

- Pending home sales (July): The month-over-month data showed an increase of 0.9%, beating the estimate of -0.60%.

- Awaiting Home Sales Index (July): The index stood at 77.6, slightly up from the previous 76.9.

Implications for Bitcoin and Crypto

The cooling US economy, as evidenced by recent macro data, could set the stage for a (last) significant rise in BTC and crypto prices before a recession. Why? Because bad news is good news for the currently short-sighted financial world. Bad numbers mean that the US Federal Reserve will not raise rates any further and that quantitative easing (QE) is getting closer. The long-term consequences in the form of a recession are overlooked.

Joe Consorti, a renowned Bitcoin Layer analyst, marked the significant drop in job vacancies and slowing job growth in August. He stated: “The number of job openings in the US stands at 8.827 million, the lowest level since September 2021. Even worse, last month’s data was grossly overstated. Cracks are appearing in the job market. The effect of interest rate hikes is finally visible.”

He further emphasized the paradox of weak economic data driving stock market gains, suggesting: “Bad news is good news right now. Sour data eases investor fears of an aggressive Fed, fueling hopes of an easing policy to support asset prices. I don’t make the rules.”

Michael van de Poppe dug takes a closer look at the relationship between traditional economic indicators and Bitcoin’s performance. According to him, the most likely case is no more interest rate hikes as the economic numbers come in horribly, which will push gold, silver and Bitcoin up.

He pointed to the inverse correlation between yield markets and Bitcoin, suggesting that with returns showing signs of peaking, Bitcoin could be poised for an uptick. “The 2-year returns are even more pronounced than the 10-year returns, indicating that a potential top is in the making,” says Van de Poppe.

He explained that the previous top in November 2018 marked the low point for Bitcoin. After that, BTC broke, but the top of returns resulted in the bottom of the bear market for Bitcoin. The continued sell-off on yields resulted in more and more strength in the Bitcoin markets. Van de Poppe added:

The first real high in November 2022 also marked Bitcoin’s low point. And the last time there was a substantial sell-off in the yield markets (March ’23), Bitcoin’s price started to rise significantly.

Also macro analyst Mortensen Bach’s forecasts for the next 6-10 months suggests a potential downturn for the USD, a fall in interest rates, and a rebound for both stocks and crypto. According to him, the expansion phase of the financial markets is coming to an end. However, there is one last step forward for the markets.

While he believes the soft landing story is nonsense, he warned of the consequences of the Federal Reserve’s aggressive rate hikes, stating: “The FED has raised rates by 500 bps in 12 months to try and manipulate the economy to cool down. This was a big mistake and we will pay the price for it, probably in 2024.”

Crypto trader Daan highlighted the impending fears of a recession and the potential for interest rate cuts and more money printing in the near future. He noted: “Recession fears will soon be all over the media. Bring on the interest rate cuts and money printing! (Not yet, but I doubt it will last much longer than ~6 months).”

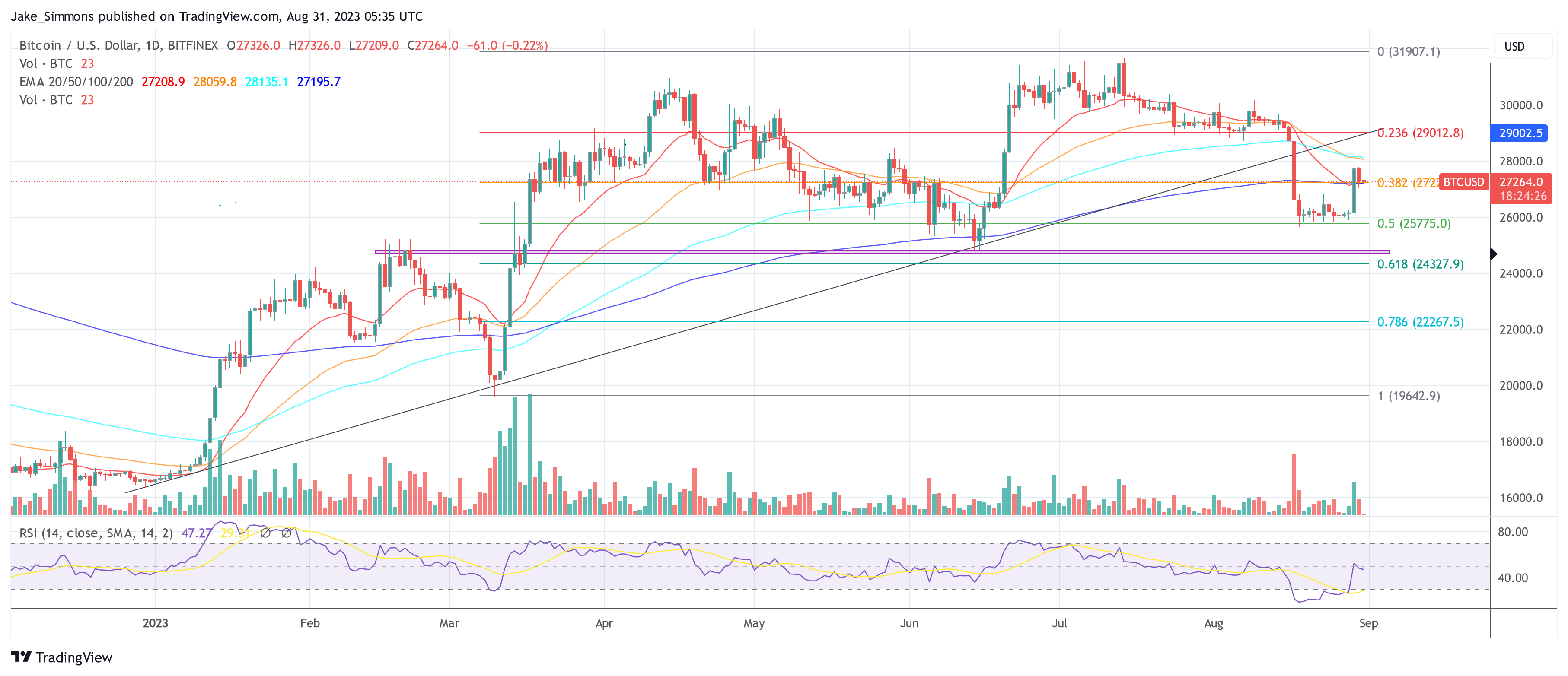

At the time of writing, BTC was trading at $27,264.

Featured image from iStock, chart from TradingView.com