- Rising exchange rate and walk in put options suggested that Bitcoin can soon be confronted with sales pressure

- Bitcoin’s Options Market revealed an increased demand for downward protection

Bitcoin [BTC] Can be on the way to turbulent waters. A sharp increase in whale activity and the growing caution on the option market blink early warning signals.

As the exchange rate ratio climbs to the highest level in more than a year and Options Outpace calls in both volumes and premium places, traders seem to be scraped for potential disadvantage.

The shift in sentiment suggests that some of the largest players in the market may be preparing to sell, which increases the possibility of more volatility in the coming days.

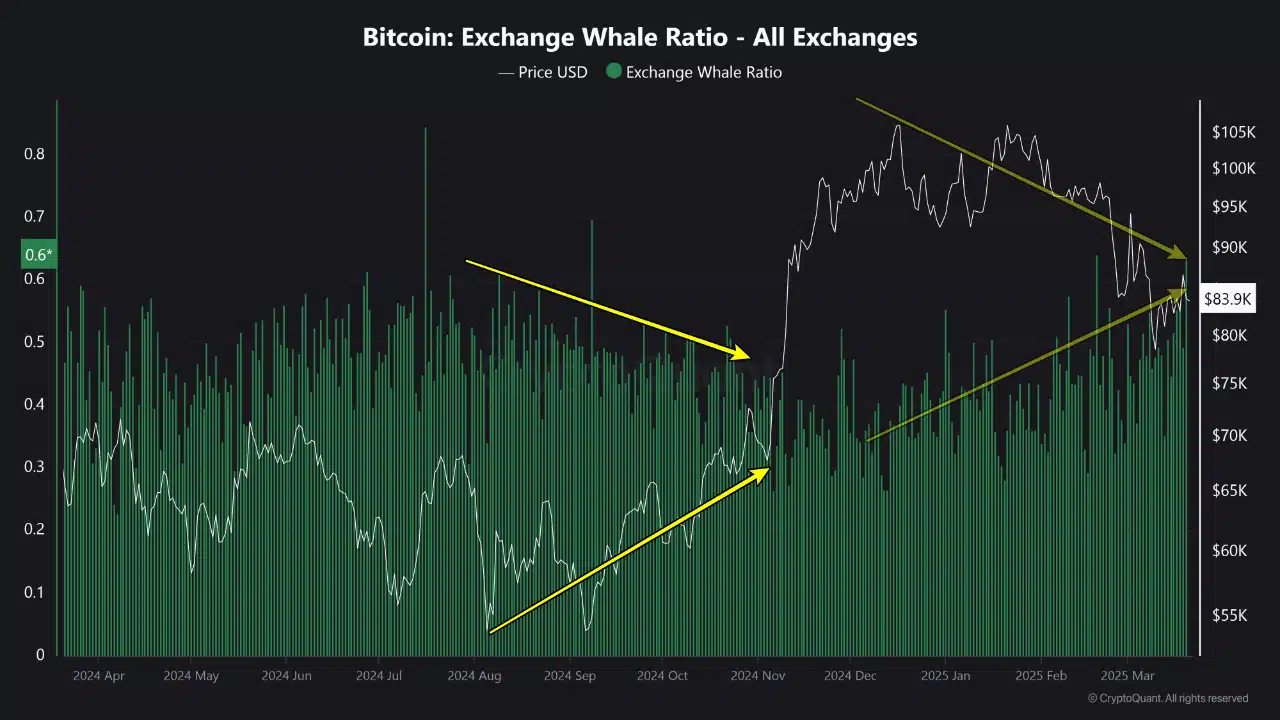

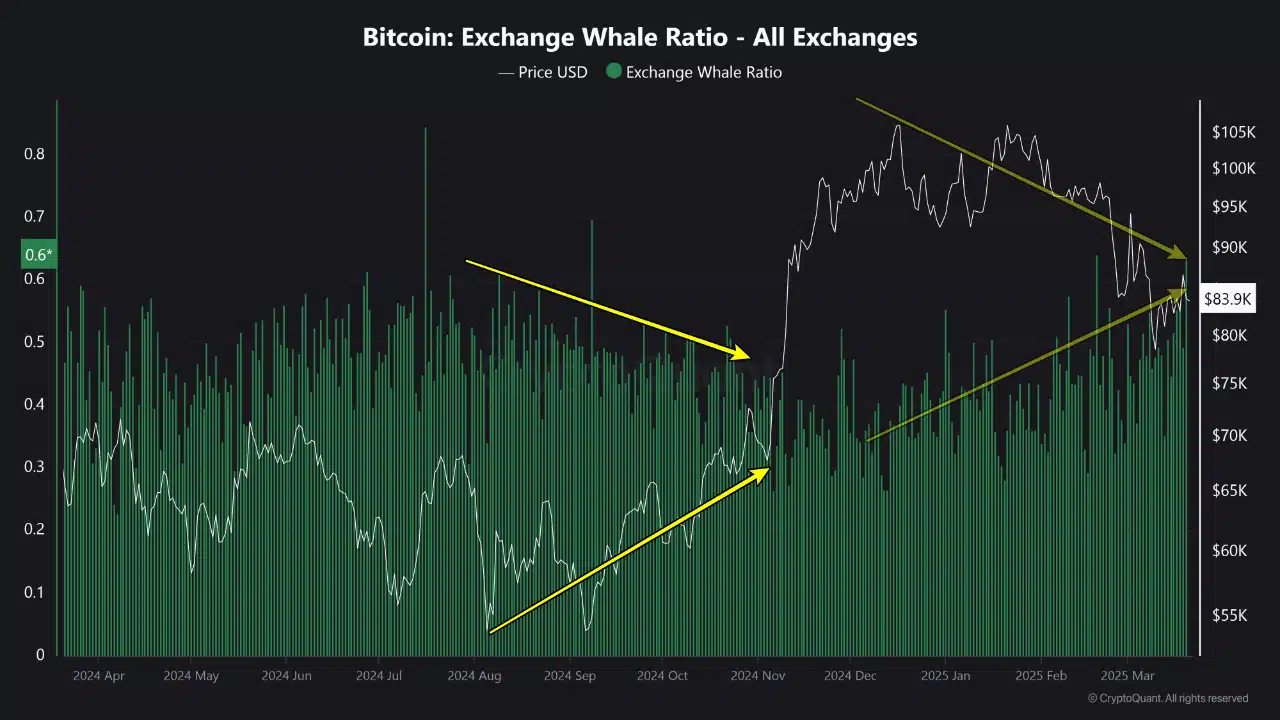

Change whale ratio – A signal of potential sales pressure

The exchange rate ratio Climbed to 0.6 – the highest reading in more than a year.

This peak indicated that large holders, or whales, are now responsible for a significant part of Bitcoin who introduce exchanges. Historically, such behavior precedes the tendency to precede large market movements, which often indicate a walk in sales activities.

Source: Cryptuquant

As is apparent from the graph, comparable peaks were followed by remarkable price decreases in mid -2024.

The newest walk coincided with Bitcoin’s recent price racement of his all time-one sign that whales could again be a red-raised assets pending the weakness of the market. If the trends from the past retain, increased whale ratio levels can violate volatility.

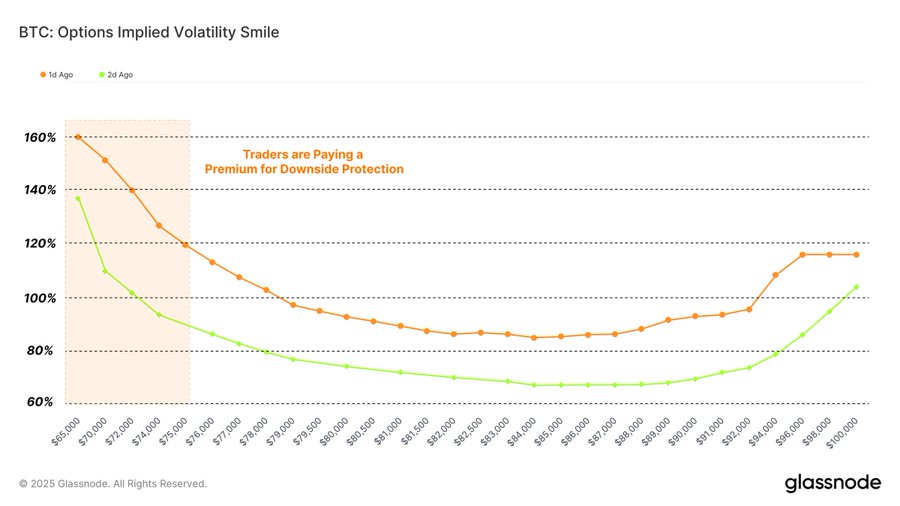

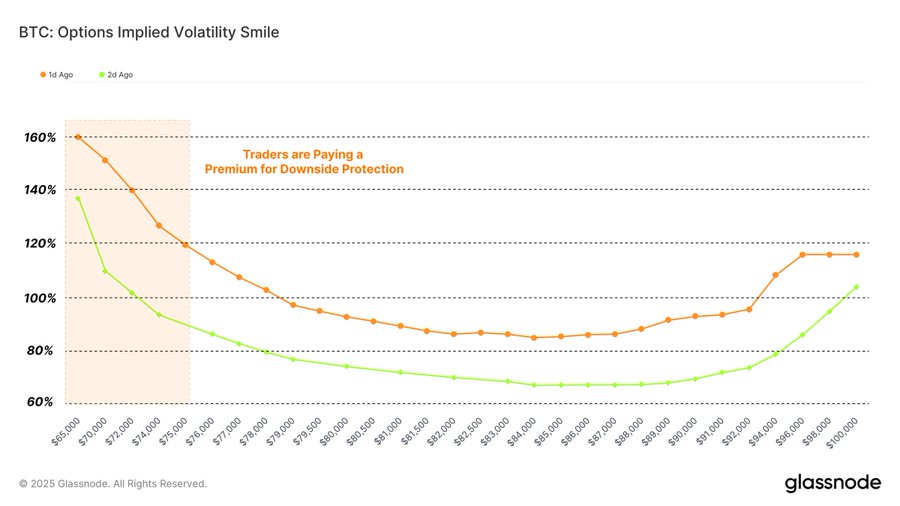

Bitcoin Options Market – Growing demand for downward protection

The option market of Bitcoin is also cautiously signs of caution.

Options enable investors to cover themselves at price changes and the time positioning of the press revealed a clear tilt according to risk aversion. The implicit Volatility Smile Chart emphasized that traders pay a premium for put options, compared to calls, especially for exercise prices below $ 80,000.

Source: Glassnode

This pattern Can be interpreted to refer to the growing demand for downward protection, while investors are braced for possible decreases.

The steep left distance on the graph hinted with an increased fear of short -term volatility and seemed to strengthen the shift from the wider market to defensive strategies. This increase in premiums is also a sign of investor sentiment that is wary, in accordance with whale activity in the chain, while she points to a more cautious prospect for Bitcoin in the short term.