- Analysts predicted a likely breakout of BTC and a rally towards $75,000-$80,000.

- The recovery in investor demand supported the outlook, but rising debt levels could be risky.

Bitcoin [BTC] price charts indicated a potential shift in market structure, marking a likely breakout from the $50,000-$72,000 price range that began in March.

According to analyst Stock money lizardsthe range outbreak could happen within two weeks. If so, the analyst predicted that BTC could reach $75,000-$80,000 if the recent drop below $60,000 is defended as a “higher low.”

“If this higher low is confirmed, we will break this upper resistance within two weeks. Next goal of $75-$80,000.

Source: Stock Money Lizards

For context, BTC has been making higher lows since August, a price action trend that signals a potential shift in market structure, especially if a higher high is on the horizon.

Increasing demand versus risk

Investor interest in the world’s largest digital assets also improved, indicating a slow but steady recovery in demand in the fourth quarter compared to the second and third quarters.

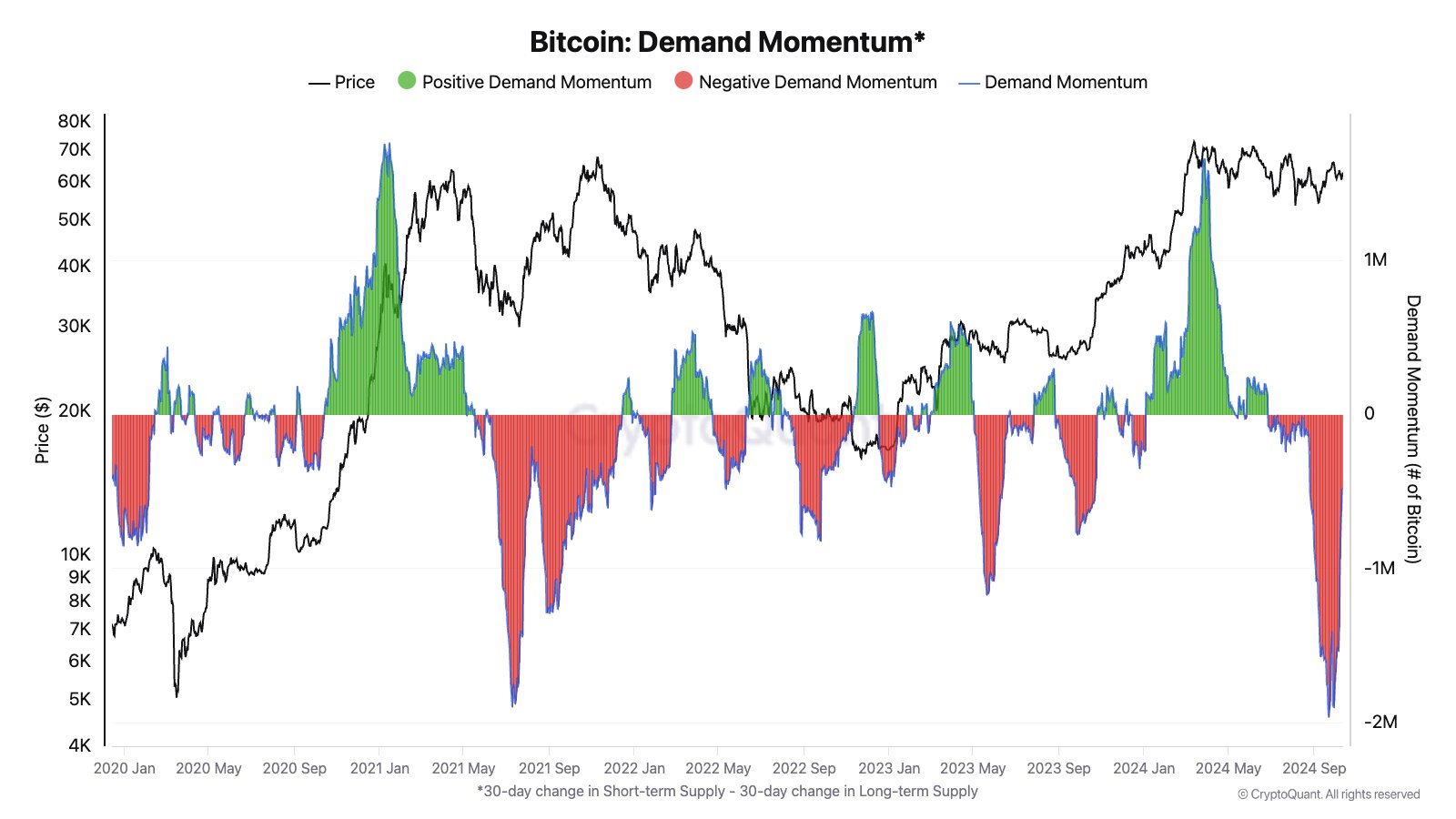

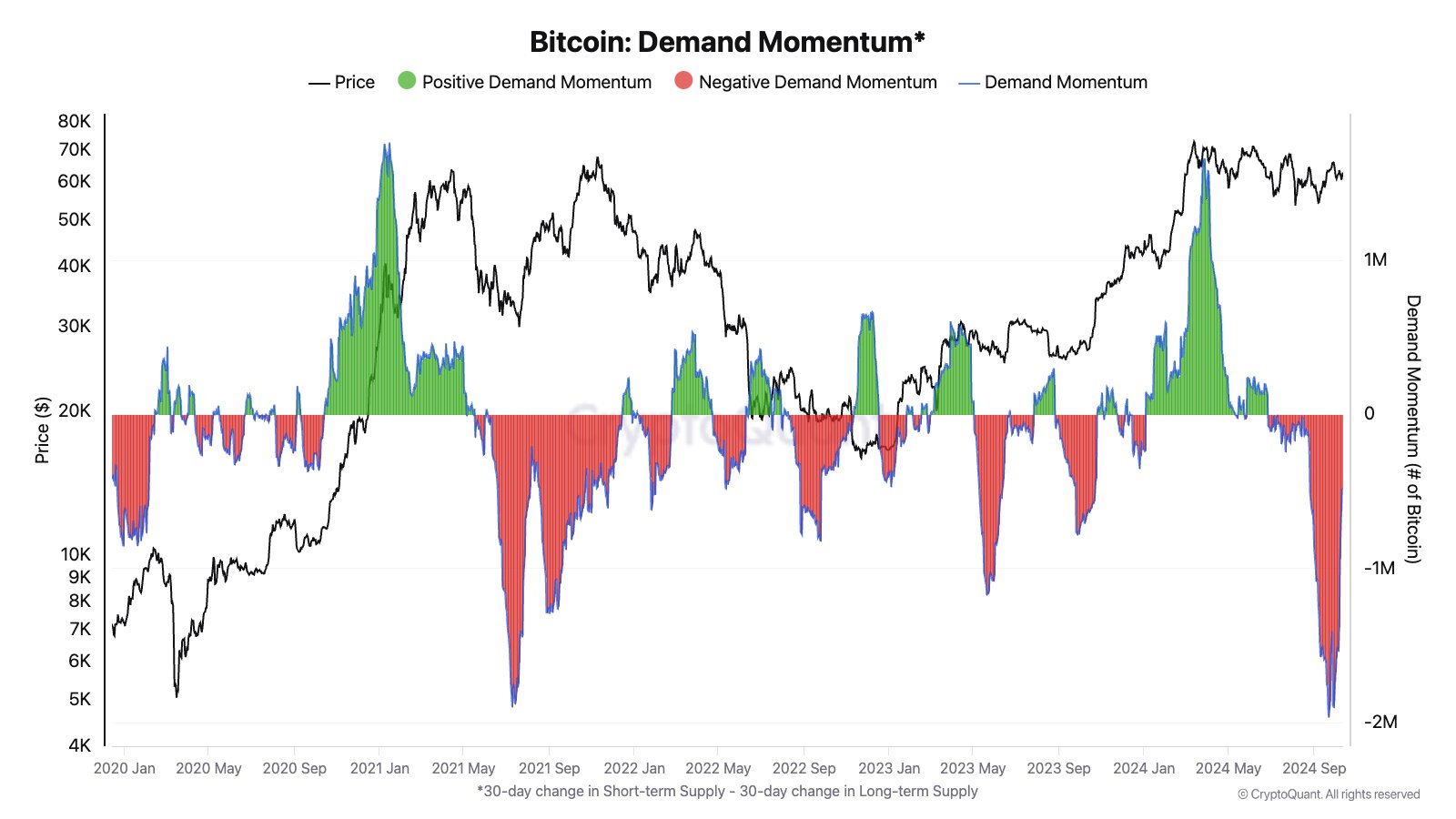

In perspective, BTC demand has been negative since May, with sales outpacing purchases. However, CryptoQuant noted that the pace of imbalance has slowed.

Source: CryptoQuant

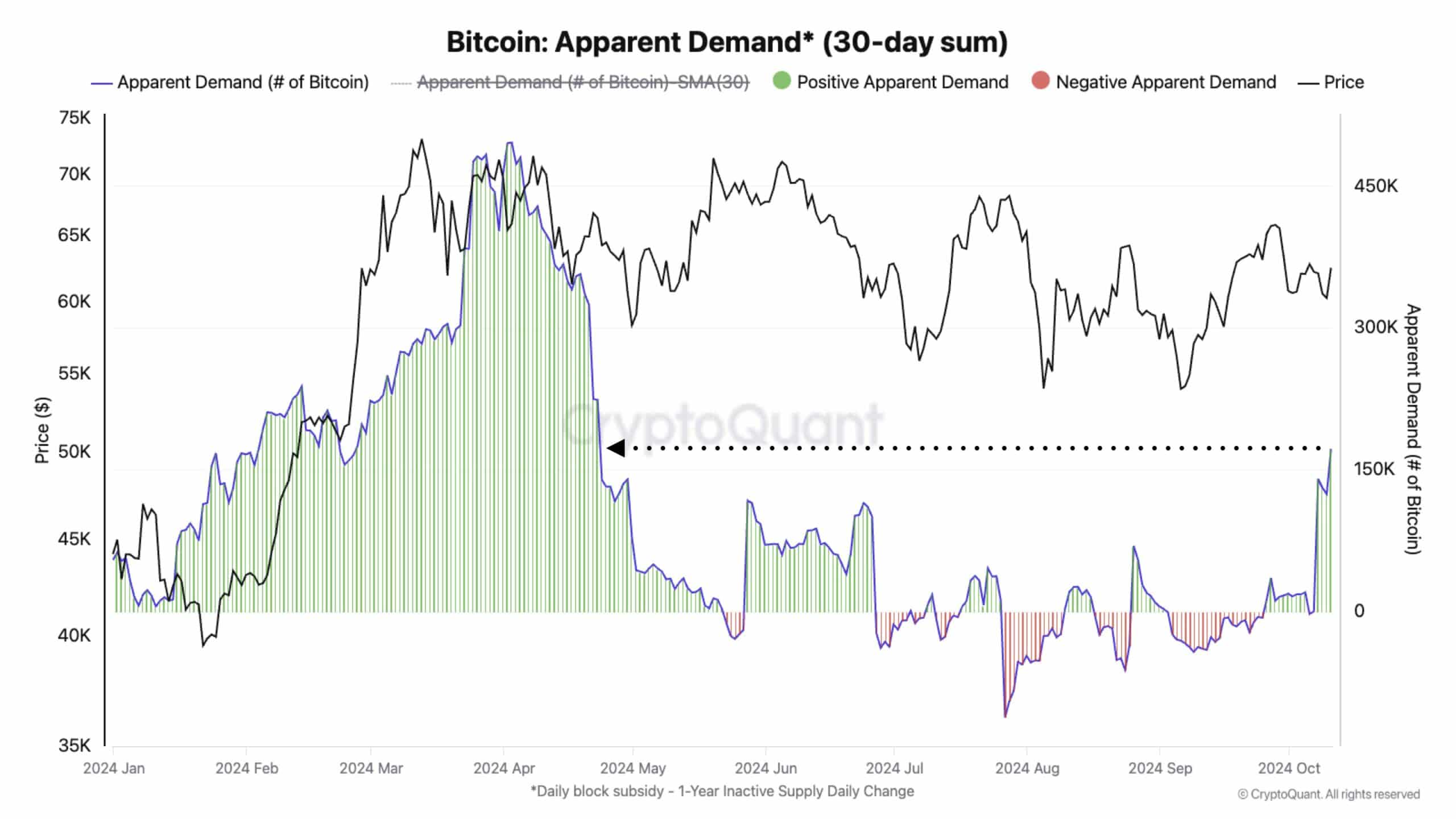

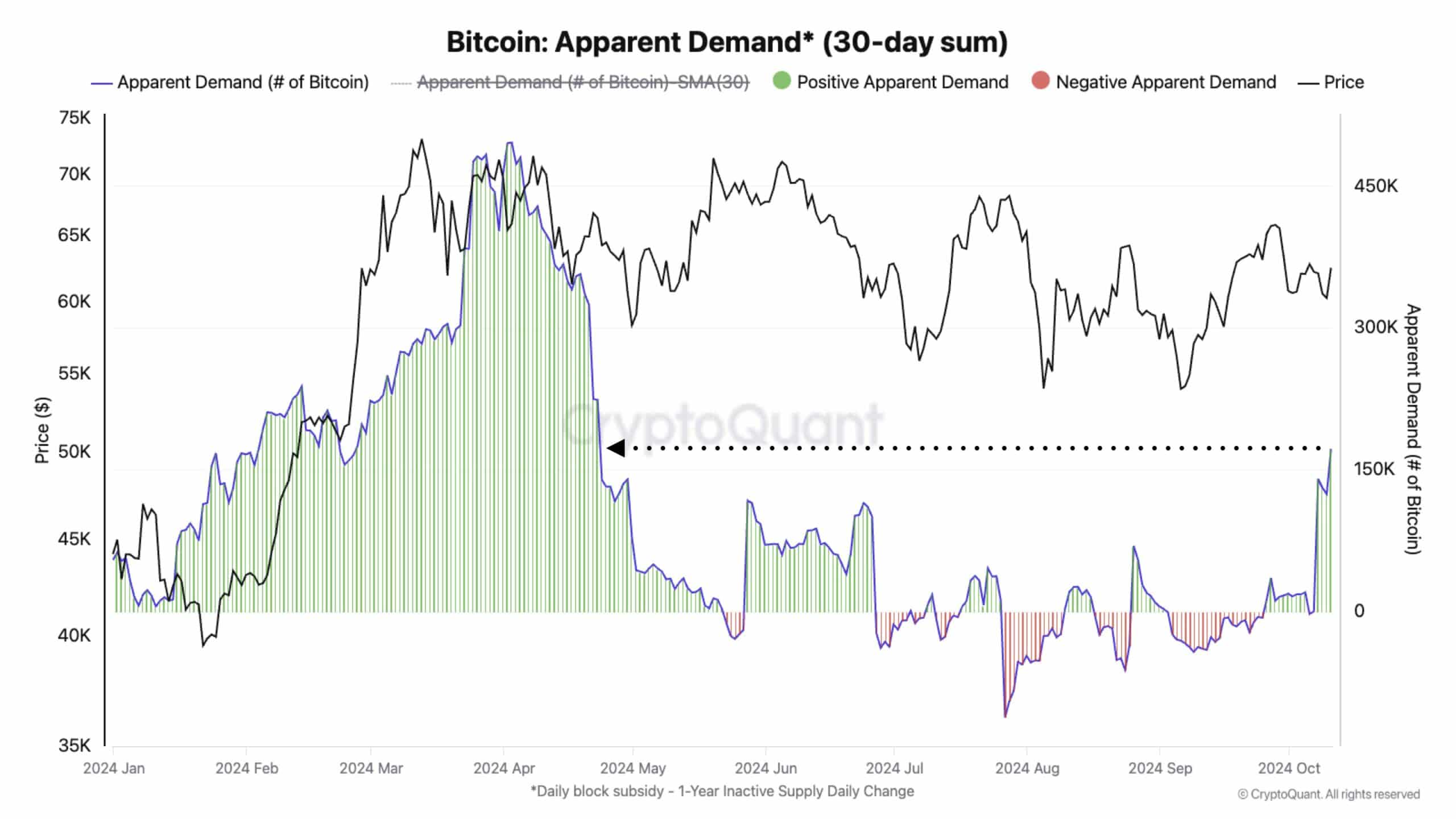

In fact, apparent demand for BTC measured over the past 30 trading days indicated that investor demand was reaching levels last seen in May.

About 150,000 BTC, worth about $9.4 billion, was intercepted by investors between late September and mid-October.

Source: CryptoQuant

If the pattern were to continue over the next two weeks, rising demand could support Stockmoney Lizards’ breakout projection.

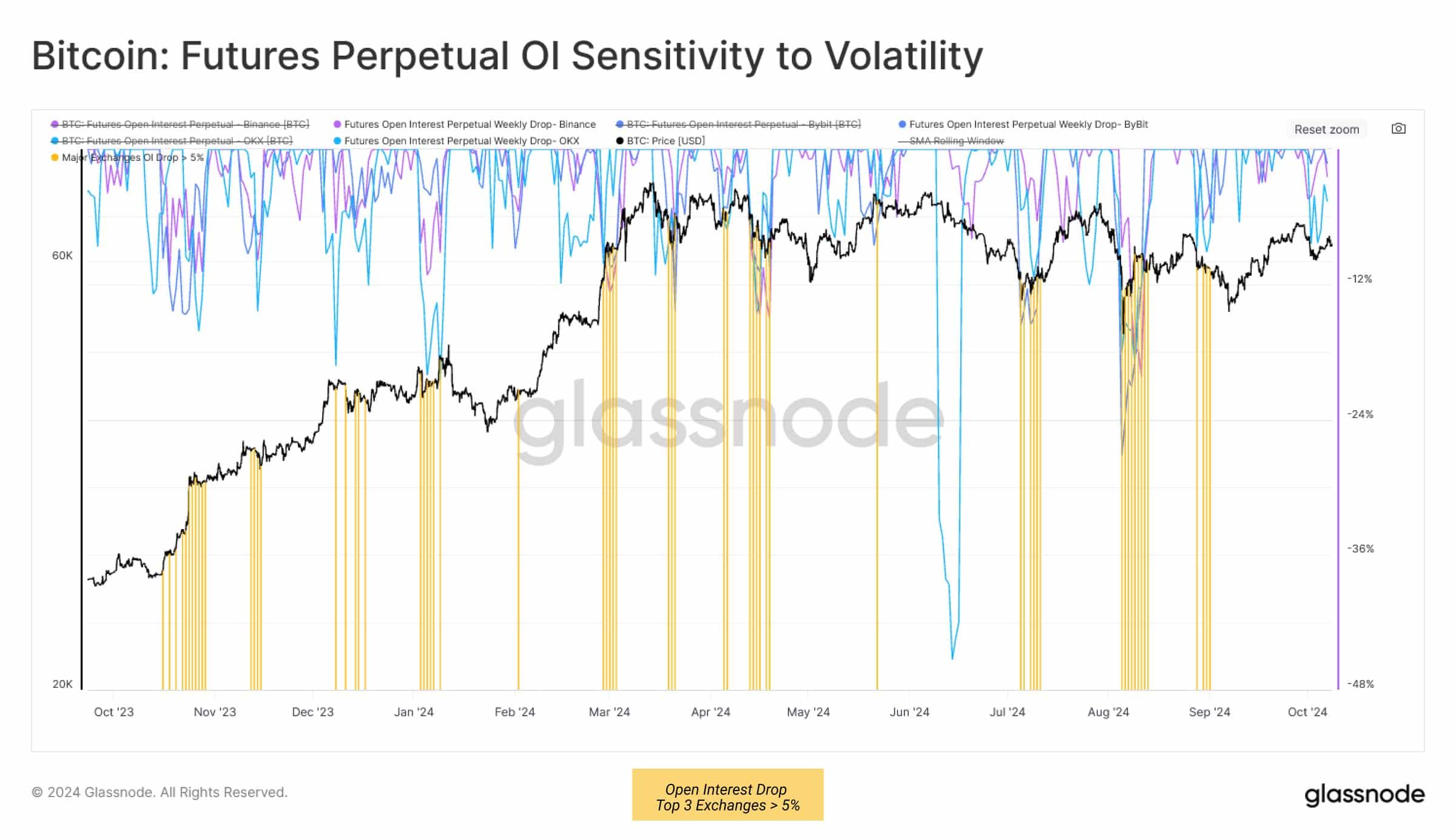

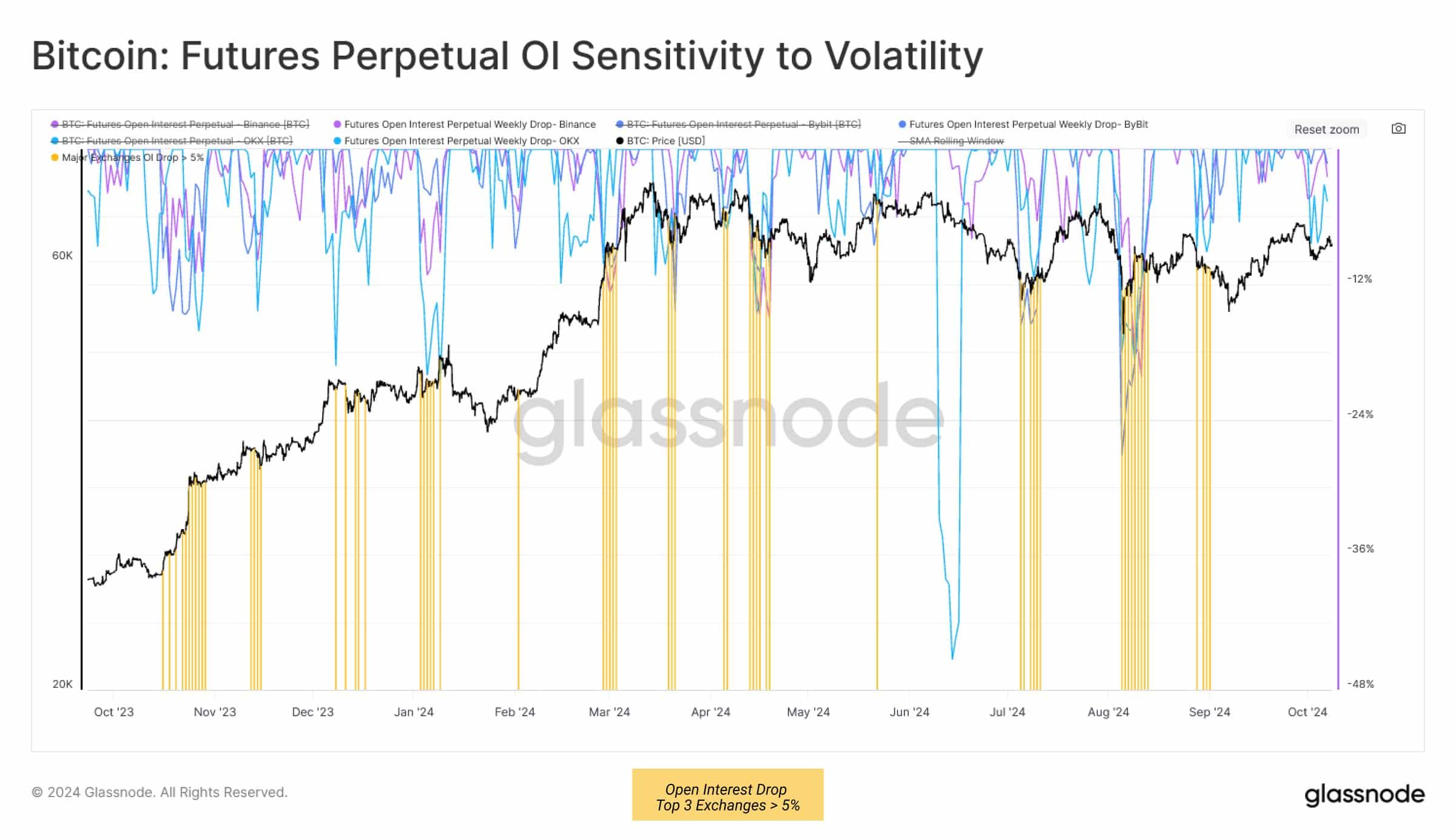

But the rising debt burden, as evidenced by a rise in Open Interest (OI), also posed a looming pitfall to breakthrough expectations.

For those unfamiliar, rising leverage meant that speculators were taking more risk by borrowing money to open BTC positions in the futures markets.

According to Glass junctionThe recent weekend surge from $58.9K to $63.4K has washed away some short sellers ($2.5B in OI).

Source: Glassnode

However, the analytics firm also noted that the OI drop did not exceed 5%, a level that has historically always seen an extended BTC rally when hit.

In short, increased volatility and liquidation risks on either side of the price direction could derail the breakout expectation.

Meanwhile, BTC was valued at $62.8K and consolidated below the 200-day moving average (MA) at the time of writing.