- Analysts predict a possible rise in BTC after a record increase in the US money supply.

- However, short positions against BTC have risen sharply, raising fears of a price correction.

Bitcoin [BTC] has been in a price consolidation range between $60,000 and $70,000 for weeks, a boring setup for speculators who thrive on volatility.

This sideways movement continued after the April halving and the apparent ‘stagnant’ demand from US spot BTC ETFs.

But there is a new development story for the King coin: an upswing in the US money supply.

Bitcoin’s path forward

According to X user (formerly Twitter) TechDev_52an entrepreneur and crypto analyst, BTC could be tipped for a ‘blowoff’ after BTC versus M1 liquidity hit an all-time high.

“$BTC had no business reaching new highs in 2021. M1 rose to record highs, but #bitcoin couldn’t set a record. Now that the trend has broken above its 2M supertrend, we are likely headed for that breakdown move that is always being signaled.”

Source: X/TechDev_52

The analyst blamed the “COVID panic M1 liquidity” for the lack of a “blowoff” in 2021, when BTC pushed a similar breakout against the money supply.

For those unfamiliar, M1 liquidity tracks the most liquid part of the money supply. It includes currency and any asset that can be quickly converted into cash. For M2, the scope extends further to some ‘not so liquid parts’ of the money supply, such as savings deposits.

Interestingly enough, M2 has that too extensive by 0.7%, according to another analyst, Willy Woo. In previous cycles, the increase in the money supply led to an increase in the value of BTC in USD.

It remains to be seen whether BTC’s breakout against M1 liquidity and M2 expansion will push it above the range.

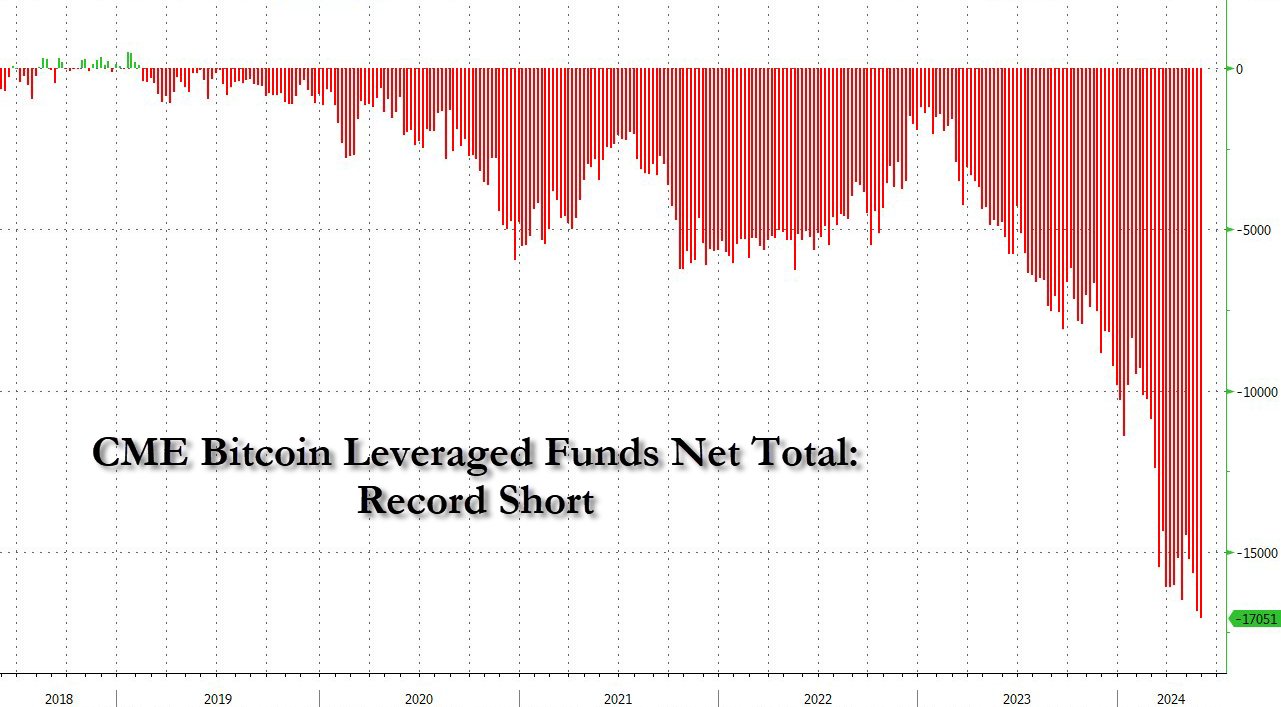

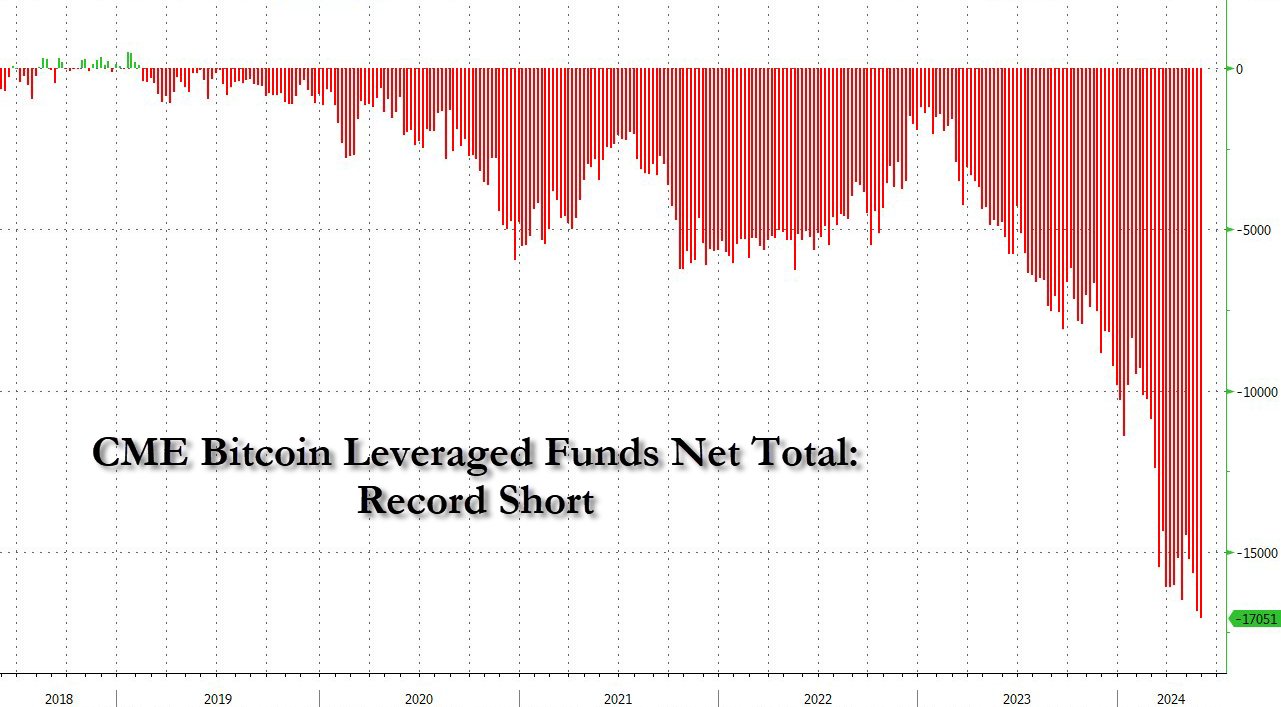

However, recent data shows that hedge funds hit BTC’s all-time high short positions. This could be a hedge against a possible drop in BTC or price correction bets.

Source: X/ZeroHedge

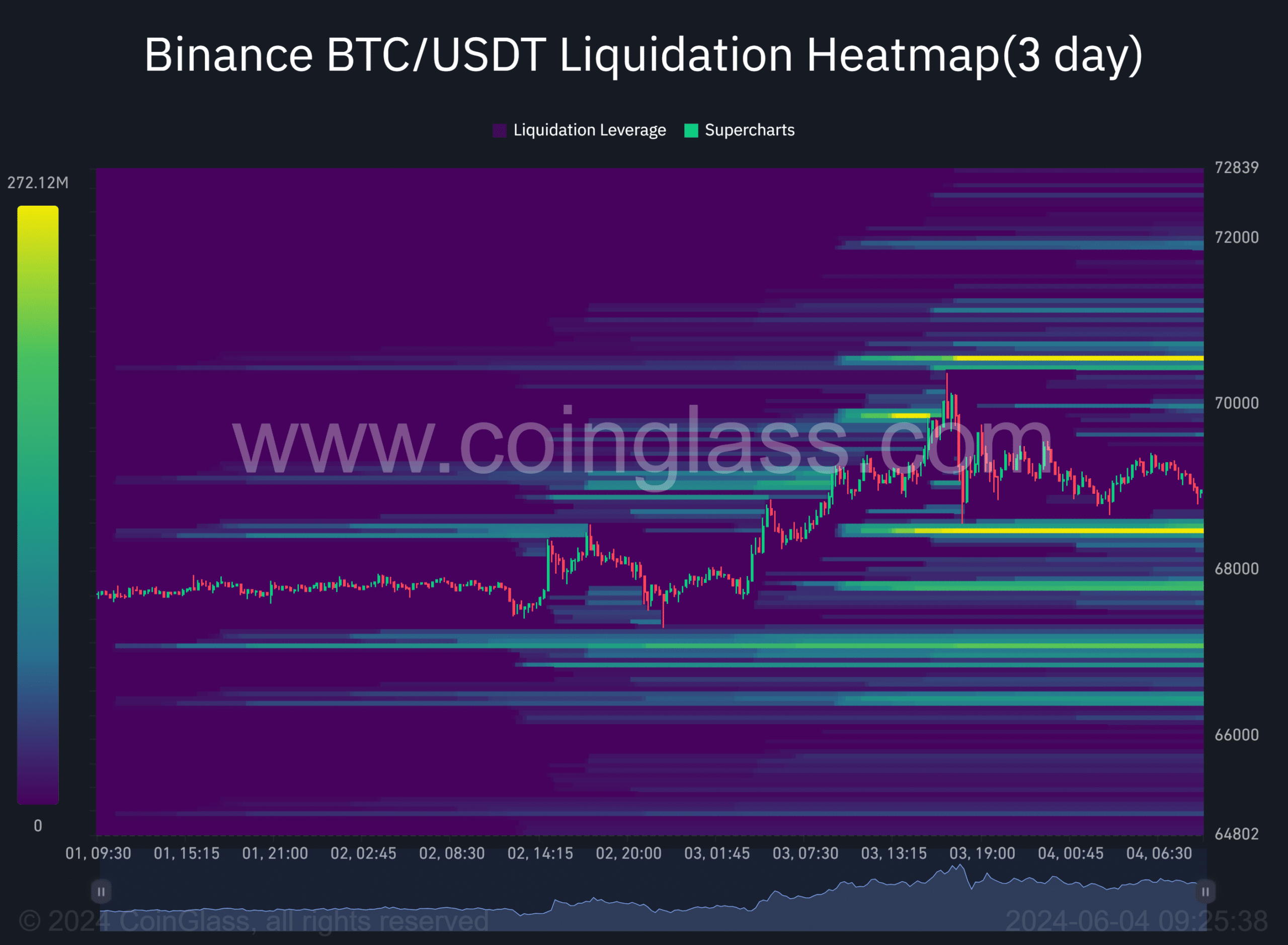

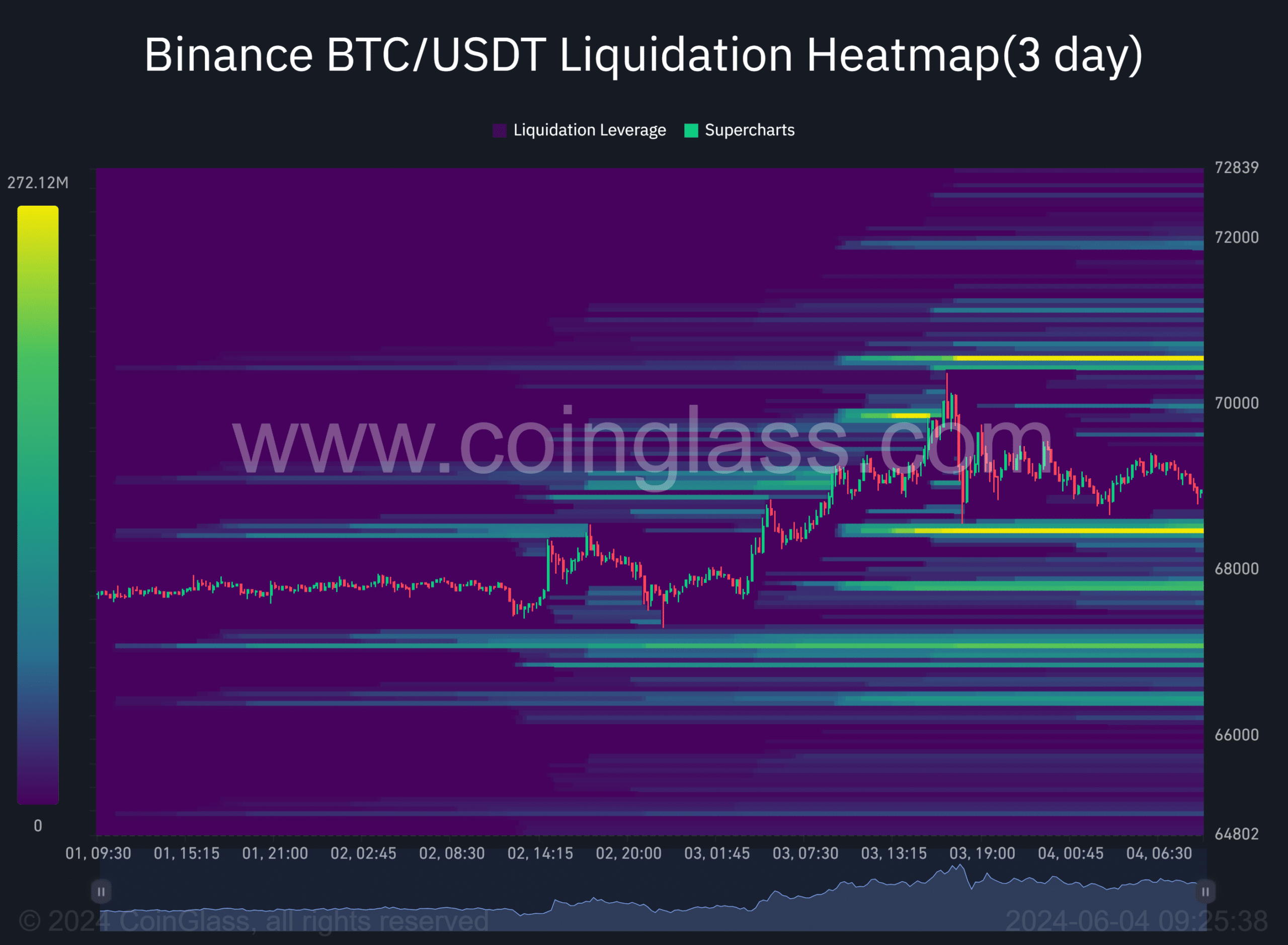

Meanwhile, a near-term move towards $70.5K was more likely after bringing liquidity to $68.4K.

According to Coinglass data, both levels, highlighted in orange, were key liquidity cluster points that could act as magnets for price action.

Source: Coinglass