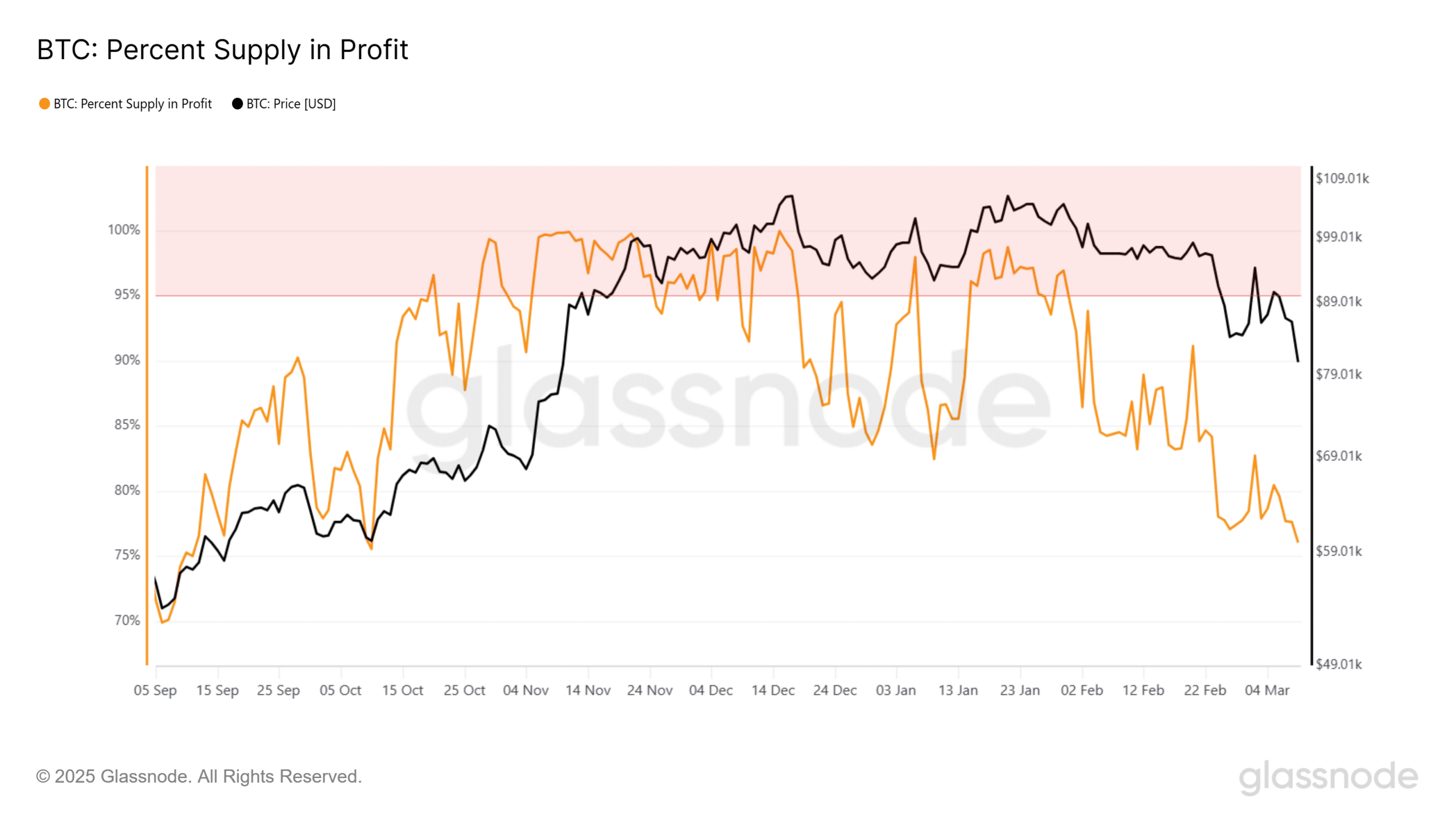

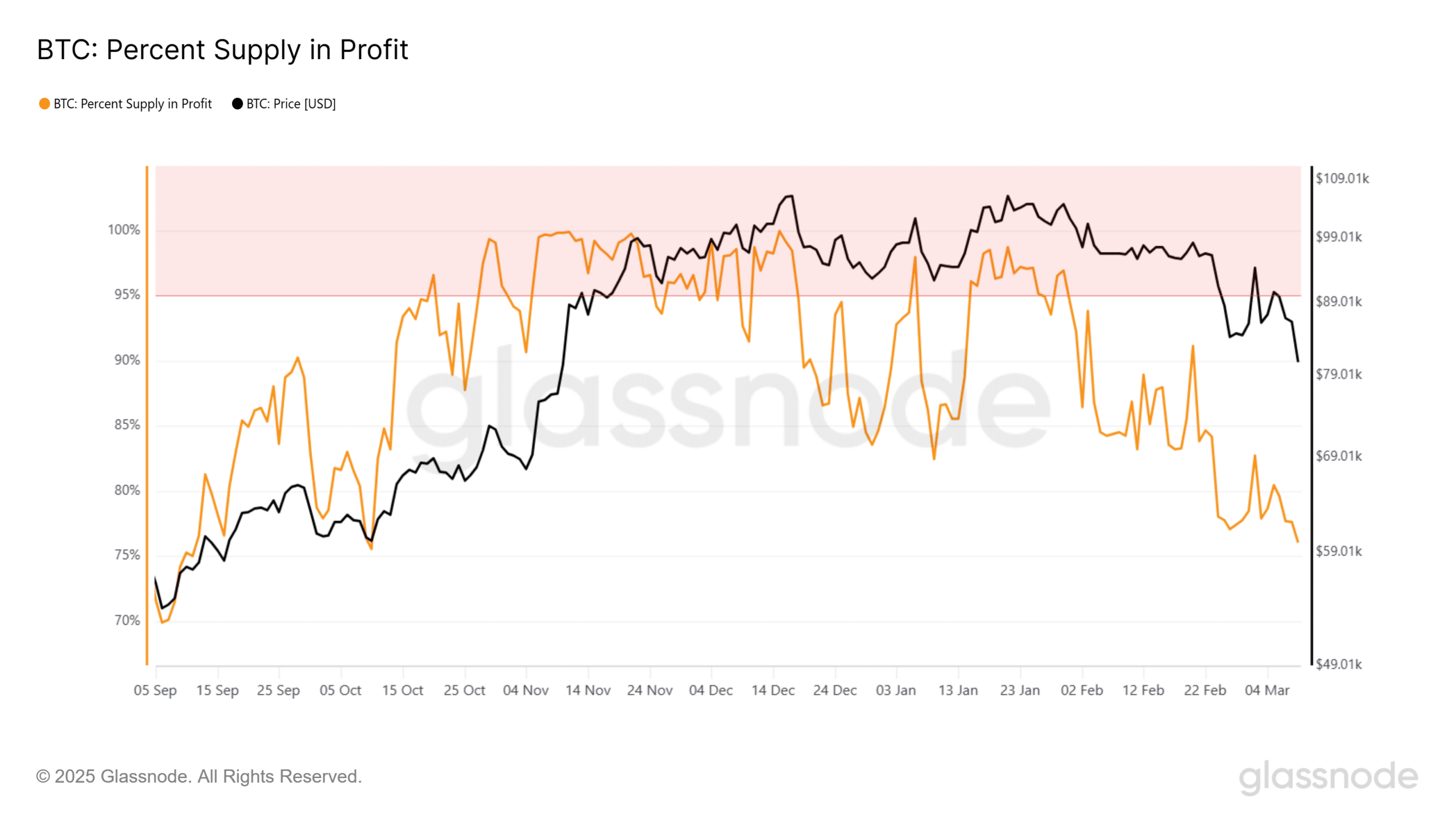

- The range of Bitcoin profit from 99% to 76% means that a significant part of the BTC holders is now in non -realized loss.

- Will this profit phase lead to deeper falls, or is this a healthy consolidation before the next step?

As previously marked by Ambcrypto, Bitcoin [BTC] Faced with a strong resistance at $ 97K, which activated a sharp rejection. The subsequent decrease up to $ 82k at the time of the press suggests another profitable wave.

Despite the pullback, 76.08% of BTC’s range remains in profit – the lowest in six months – which indicates that most Hodlers are still in the green.

However, it leaves 23% of the circulating offer in non -realized loss – around 4.56 million BTC. As more Bitcoin holders go into non -realized loss, some holders can decide to sell to limit further losses.

Source: Glassnode

To overcome this liquidity on the sales side, volume indicators are crucial.

Although the trade volume has increased 178.22% to $ 43.12 billion, net deposits At trade fairs, 3.96%increased, Emphasizing that sale outweighs the number of purchases in large stock exchanges.

By buying pressure from American investors who stay low In the midst of economic uncertainty, it suggests that buyers of Retail do not pop up to absorb sales pressure.

This may indicate the involvement of third parties playersPossibly institutions that influence the next step of the market.

High leverage risk in Bitcoin derivatives trade

In the midst of a weak spot purchase, the estimated lever ratio of Bitcoin (ELR), which recently fallen to a low -point of three months, has risen dramatically.

This indicates that derivatives traders are not de-delivery, but rather increasing leverage to take positions with a higher risk.

Source: Cryptuquant

On March 9, Bitcoin had a decrease from 6.41% to $ 80k, which resulted in $ 195.86 million in liquidated Long positions.

Institutional “Dip-Buying” gains a grip, so that the stage can be set for a short squeeze. This could drive Bitcoin to re -test the $ 85k resistance In the coming days.

However, breaking this resistance remains a challenge. Escalating sale can lead to further liquidations, so that Bitcoin pushes below $ 80k.

In summary, institutional capital absorbs the liquidity on the sales side of traders who break, even after the weekly fall in Bitcoin 17%. Nevertheless, the risks related to “dip-buying” are increased.