Binance, known for its dominance in the crypto exchange market since its inception, has recently seen a significant decline in its trading activity. The stock exchange experienced a 20% drop in trading volume in September compared to the previous month. This decline comes amid increasing competition from platforms like Crypto.com, which saw a 40% increase in trading volumes over the same period.

Binance’s dominance reaches 2020 lows

According to According to a report from CCData, Binance’s trading volume fell 21% in September to $1.25 trillion, the lowest level since October 2023. This drop brought Binance’s share of the derivatives market down to 40.7%, the lowest since September 2020 .

Spot trading was also hit hard, falling 22.9% to $344 billion, the lowest since November 2023. This dropped Binance’s spot market share to 27%, the lowest since January 2021.

Overall, Binance’s combined spot and derivatives market share fell to 36.6%, the lowest since September 2020.

Despite these declines, Binance remains the leading platform for spot trading on centralized exchanges by volume.

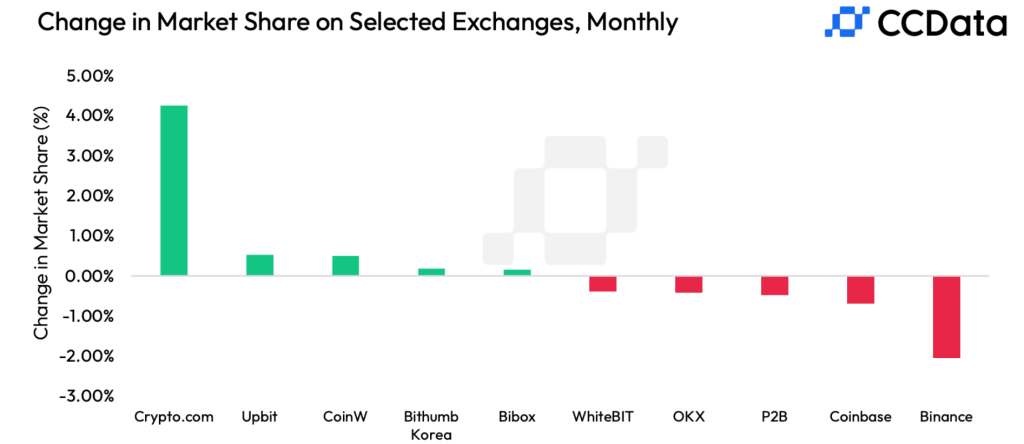

Meanwhile, Crypto.com is making notable gains among centralized exchanges. Spot and derivatives trading volumes rose 40.2% and 42.8% in September, reaching $134 billion and $149 billion respectively. With a combined market share of 11% for the month, Crypto.com has become the fourth largest exchange by volume.

Also read: Binance founder CZ’s wealth doubles during prison sentence, says Forbes

Despite Crypto.com’s growth, overall trading activity on centralized exchanges followed Binance’s decline. Total combined spot and derivatives volume fell 17% to $4.34 trillion, marking the lowest monthly volume since June.

CCData noted that this decline follows typical seasonal trends, with trading activity tending to slow in late summer. Spot market trading volumes fell 17.2% to $1.27 trillion, while derivatives trading fell 16.9% to $3.07 trillion.

Analysts expect trading activity to pick up in the coming months as the US Federal Reserve increases interest rate cuts, which will likely improve liquidity and bring more capital into cryptocurrencies.

Binance’s decline is related to increasing regulatory pressure

Last month, the US Securities and Exchange Commission (SEC) filed an amended complaint against Binance, investigating the exchange’s token listing practices. This came after the SEC’s lawsuit in June 2023, which accused Binance of operating as an unregistered broker, clearinghouse and trading platform, and for offering unregistered securities. To resolve these issues, Binance agreed to pay $4.3 billion in fines to various US regulators.

Also Read: Binance Aims for a Trillion-Dollar Future Under New Leadership; An IPO soon?

Founder and former CEO Changpeng “CZ” Zhao pleaded guilty to violating the Bank Secrecy Act (BSA) due to inadequate know-your-customer (KYC) systems. However, he was sentenced to four months in prison and was released last week.

These events have affected Binance’s operational stability and tarnished its reputation among users and investors.

As a result of these challenges, competitors like Coinbase and Bybit have seized the opportunity to chip away at the dominance that Binance once had.

As these rivals continue to grow and potentially take advantage of Binance’s regulatory woes, the exchange’s dominance could decline even further.