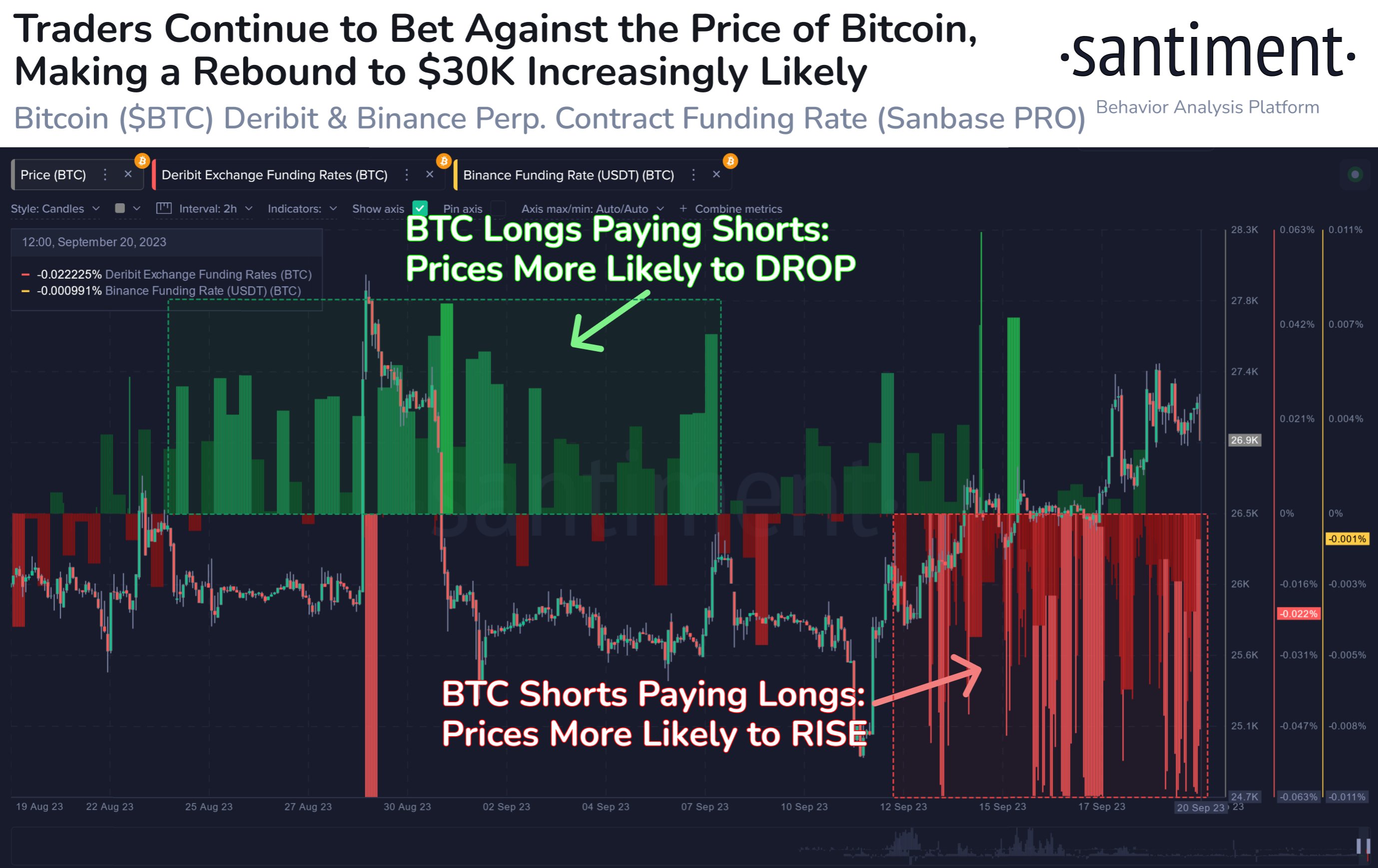

Data shows that Bitcoin shorts have piled up on cryptocurrency exchanges Binance and Deribit in recent days.

Bitcoin funding rates for Binance and Deribit are currently deep red

This is evident from data from the analysis company Santimenttraders in the derivatives market have continued to bet on the cryptocurrency lately. The relevant indicator here is the ‘funding rate’, which tracks the periodic fee that holders of derivative contracts on an exchange currently pay each other.

When this measure has a positive value, it means that the long traders pay a premium to the short traders to hold their positions. Such a trend suggests that majority sentiment on the exchange in question is currently bullish.

On the other hand, the fact that the benchmark is below zero implies that the traders on the platform currently have a bearish mindset as shorts are the dominant force.

Here is a chart showing the trend in Bitcoin funding rates for Binance and Deribit over the past month:

Looks like the value of the metric has been quite red in recent days | Source: Santiment on X

As shown in the chart above, the Bitcoin funding rate for both exchanges was mostly positive during the last third of August and the first third of this month, implying that the majority of traders had been long.

However, these holders’ bets had failed as the price had been on a general downward trend during this period. However, since the recovery earlier this month, market sentiment has turned around as short positions have piled up on both platforms.

These short traders have also not been successful so far, as the value of the cryptocurrency has seen net growth since they appeared. Historically, the market has been more likely to move against majority expectations, so this pattern could be consistent with that.

The reason why the assets would move against the expectations of these contract holders is that massive liquidation events, called squeezes, become more likely the more lopsided the sector is.

A large number of long liquidations can amplify crashes, while short liquidations can fuel upside waves. Since Bitcoin continues to face aggressive short positions, this could be a positive sign for the cryptocurrency’s current price rise as a potential short squeeze could extend the price further.

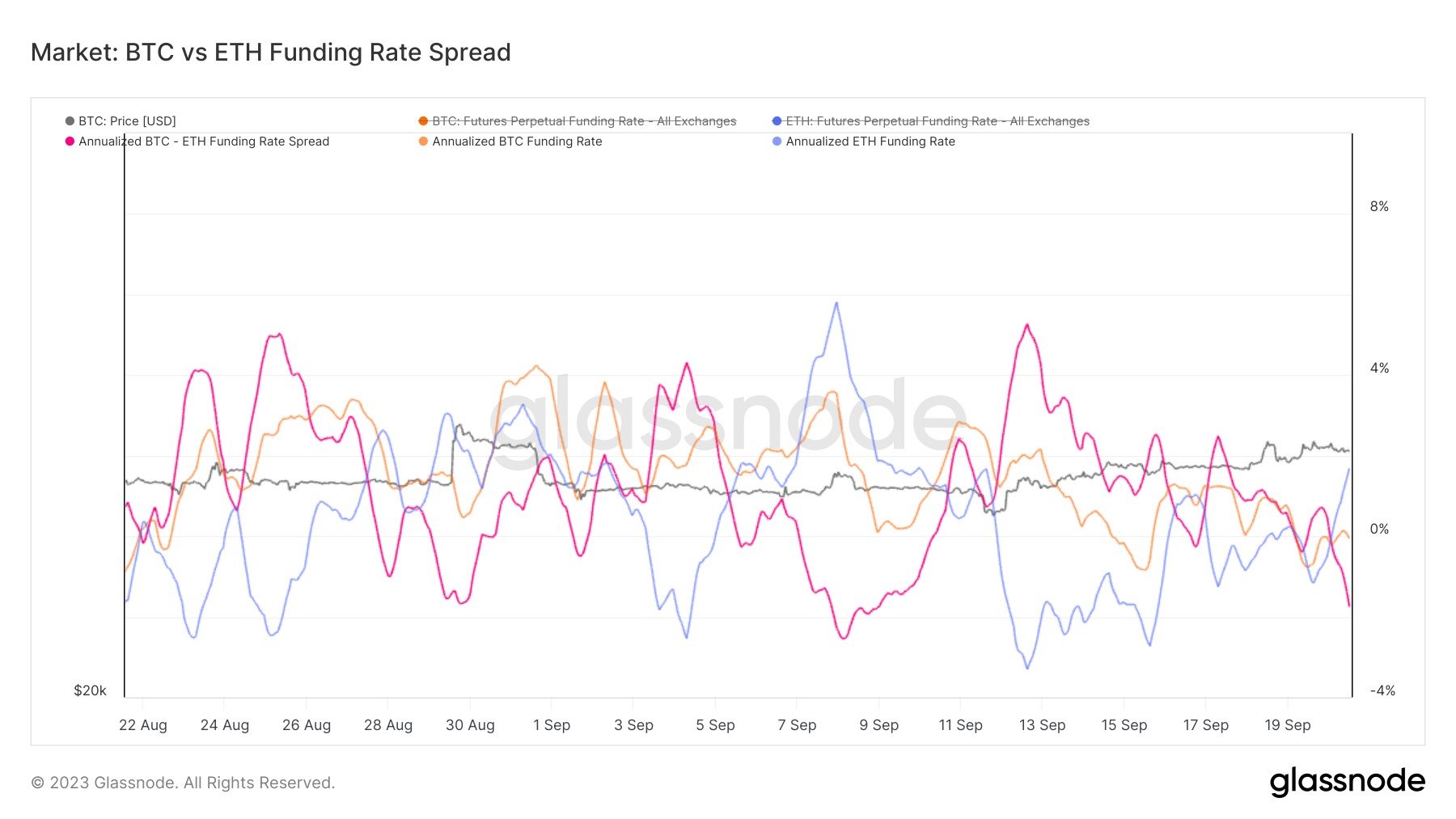

Interestingly, while there are currently bets against Bitcoin, Ethereum funding rates are positive, as noted by analyst James V. Straten in an article. after on X.

The two metrics have diverged recently | Source: @jimmyvs24 on X

The graph shows that the financing rates of the two largest assets in the sector have become inverse in recent times. This means that while BTC could potentially build an uptrend based on the shorts, ETH could experience the opposite effect if the longs are eventually liquidated.

BTC price

Bitcoin has seen a decline of around 1.5% today as the price of the asset has now fallen to the $26,700 level.

BTC is still overall up in the past week | Source: BTCUSD on TradingView

Featured image by Yiğit Ali Atasoy on Unsplash.com, charts from TradingView.com, Glassnode.com