Driven by a mix of positive elements, Solana (SOL) is seeing a spike in trading activity. This includes large buying orders, the smart purchasing approach of institutional investors and the expected release of SOL-based exchange-traded funds (ETFs).

Related reading

Whales Consolidate SOL discreetly

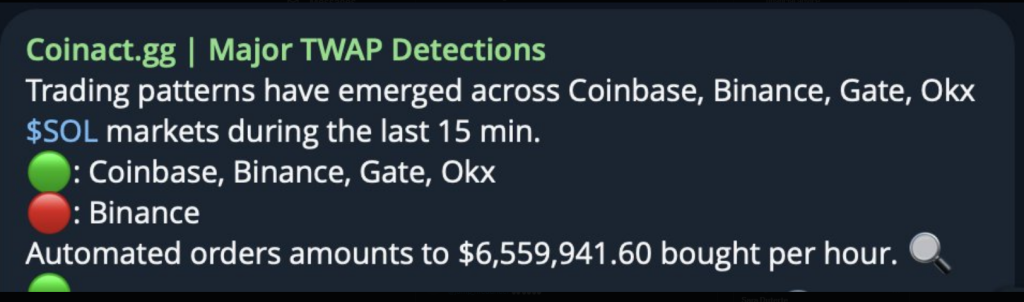

Trading data shows a notable increase in trading volume across major exchanges including Binance, Coinbase, Gate.io and OKX. However, a more in-depth analysis by Coinact.gg, a real-time trading research program, points to a pattern that is very intriguing: a ‘Major TWAP’ signal for SOL.

Important TWAP detection warning enabled $SOL. Bigger buyers are piling in $SOL #Solana.

Trade patterns have emerged everywhere @muntbasis , @binance , @gate_io , @okx $SOL markets during the last 15 minutes.

🟢️: Coinbase, Binance, Gate, Okx

🔴️: Binance

Automated orders amount to… pic.twitter.com/TXpnfprQPn— MartyParty (@martypartymusic) July 10, 2024

Large investors, especially financial institutions, typically employ a strategy known as Time-Weighted Average Price, or TWAP for short. It is common to spread a large buy order over a period of time to reduce its impact on the market price.

The implication of this is that institutional players accumulate deliberately SOL without causing major price movements, which is a classic indication of a positive long-term outlook.

ETF hype fuels investor interest

Moreover, the announcement shows that this is likely SOL-oriented exchange-traded funds (ETFs) could appear on the market in mid-March 2025, arouses curiosity among investors. As a result of the Chicago Board Options Exchange’s (CBOE) recent filing of proposals to list exchange-traded funds (ETFs) offered by VanEck and 21Shares, the bitcoin community is filled with excitement and speculation.

Solana price forecast

A number of analysts predict a continued rise in the SOL price; others estimate a 17% gain by August 10th under an underlying cautious optimism. In addition, technical indicators show a positive trend.

Related reading

As a measure of the general market mood, the Fear & Greed Index comes out as ‘Fear’ (29). This implies that while investors are largely hopeful about SOL’s potential, certain fundamental problems remain present in the larger crypto industry.

The disparity in Binance’s trading statistics compared to other exchanges raises some questions. More research is needed to find the cause of this varying behavior, as it could indicate clear market dynamics affecting Binance in particular.

ETFs’ promise of easily available, regulated SOL investment choices is attracting a new generation of investors, especially those previously reluctant to negotiate the complexities of cryptocurrency exchanges. The continued 8% price increase for SOL in the weekly time frame reflects this higher demand, allowing the network to pedal its way back into the $142 field.

Fueled by a combination of favorable circumstances, Solana’s future looks bright. A positive outlook is presented by the interest of institutional investors, the possibility of regulated ETFs and the recent price increases.

Featured image from Pexels, chart from TradingView