In his latest post, Charles Edwards, CEO of Bitcoin and digital assets hedge fund Capriole, said this marked a key market indicator in the latest edition of the company’s newsletter, Update #51. Edwards points to the activation of the ‘Hash Ribbons’ buy signal, a notable event that has historically indicated excellent buying opportunities for Bitcoin.

Bitcoin Hash Ribbons Flash Buy Signal

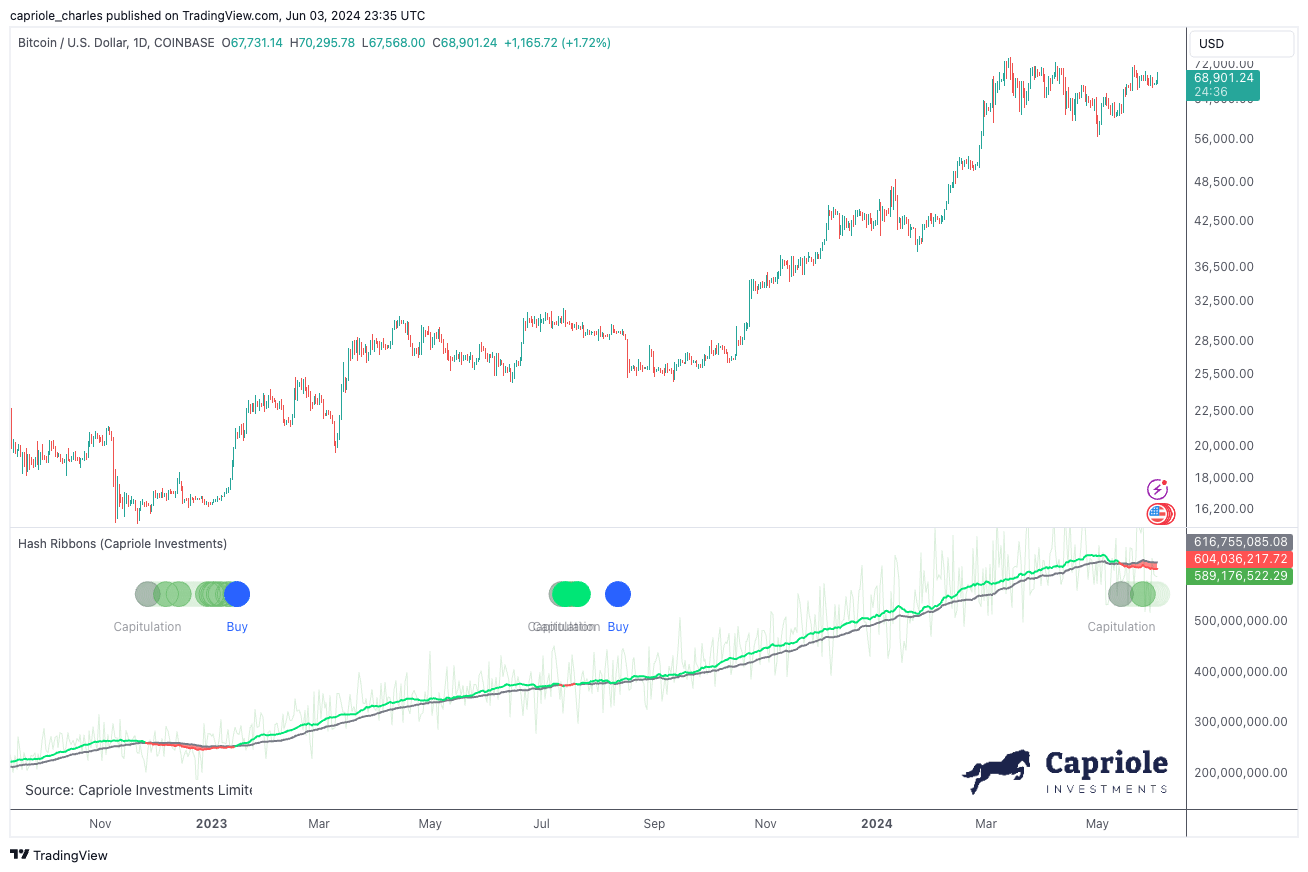

First introduced in 2019, the Hash Ribbons indicator uses mining data to predict long-term buying opportunities based on miners’ economic pressure. The signal comes from the convergence of the short- and long-term moving averages of Bitcoin’s hash rate, specifically when the 30-day moving average falls below the 60-day average. According to Edwards, this event has “in the vast majority of cases been synchronized with broader Bitcoin market weakness, price volatility and significant long-term value opportunities.”

The current miner capitulation, as highlighted by Edwards, started two weeks ago and coincides with post-halving adjustments in the mining sector. This period often leads to closure of operations and even bankruptcies of less efficient miners. Edwards notes: “Just as we see today, these mining rigs will typically be phased out several weeks after the halving, resulting in declining hash rates.”

Despite the historic profitability of miners, especially with higher block costs from new applications such as Ordinals and Runes, Edwards suggests the market should not overlook the current opportunity signaled by the latest miner capitulation. “While this capitulation occurs while miners have generally been profitable, we would be remiss if we did not recognize this rare opportunity,” Edwards said.

Related reading

The Hash Ribbons have not been without their critics, with each event sparking a debate about the signal’s current relevance and accuracy. Edwards responded to this criticism by pointing to last year’s signal, which correlated with Bitcoin trading in the $20,000 range, boosting the predictive power of the indicator. “Every event brings with it some discussion about its relevance today, or why the current signal might not count,” Edwards explains.

Edwards recommends that the safest approach to exploiting the Hash Ribbons is to wait for confirmation from renewed hash rate growth and positive price movement. He concludes: “The safest (lowest volatility opportunity) to assign to the Hash Ribbons strategy is the confirmation of the Hash Ribbon Buy, which is triggered by a renewed Hash Rate growth (30DMA>60DMA) and a positive price trend (such as defined by the 10DMA >20DMA of price).”

Broader market context

Moving from the technical to the contextual, Edwards discusses the changing regulatory landscape that has recently become more favorable to cryptocurrencies. The SEC’s approval of an Ethereum ETF, categorizing ETH as a commodity, marks a significant shift in the regulatory approach to cryptocurrencies and reflects growing institutional adoption.

Related reading

“Ethereum’s reclassification and the approval of its ETF represent a critical shift in the government’s stance on cryptocurrencies,” Edwards notes. “This could lead to greater institutional involvement and potentially greater stability in the crypto markets.”

Additionally, Edwards points to macroeconomic factors that could influence Bitcoin’s value. The expansion of the M2 money supply and the Federal Reserve’s stance on interest rates are intended to stimulate economic activity. However, Edwards warns of the potential long-term consequences of these policies, such as inflation, which could increase Bitcoin’s appeal as a hedge against monetary devaluation.

“Bitcoin was conceptualized as an alternative to traditional financial systems during times of economic stress,” Edwards notes. “Current economic policies reinforce the fundamental reasons for Bitcoin’s existence and could lead to greater adoption.”

On the technical front, Edwards provides an analysis of Bitcoin’s price movements, highlighting its recent breakout and consolidation above critical resistance levels. He sets a conditional medium-term price target of $100,000, contingent on the market maintaining current momentum and the monthly close remaining above a critical threshold of $58,000.

At the time of writing, BTC was trading at $69,008.

Featured image created with DALL·E, chart from TradingView.com