- Bera’s price and liquidity flow movement in opposite directions, which increases concern about the market among investors.

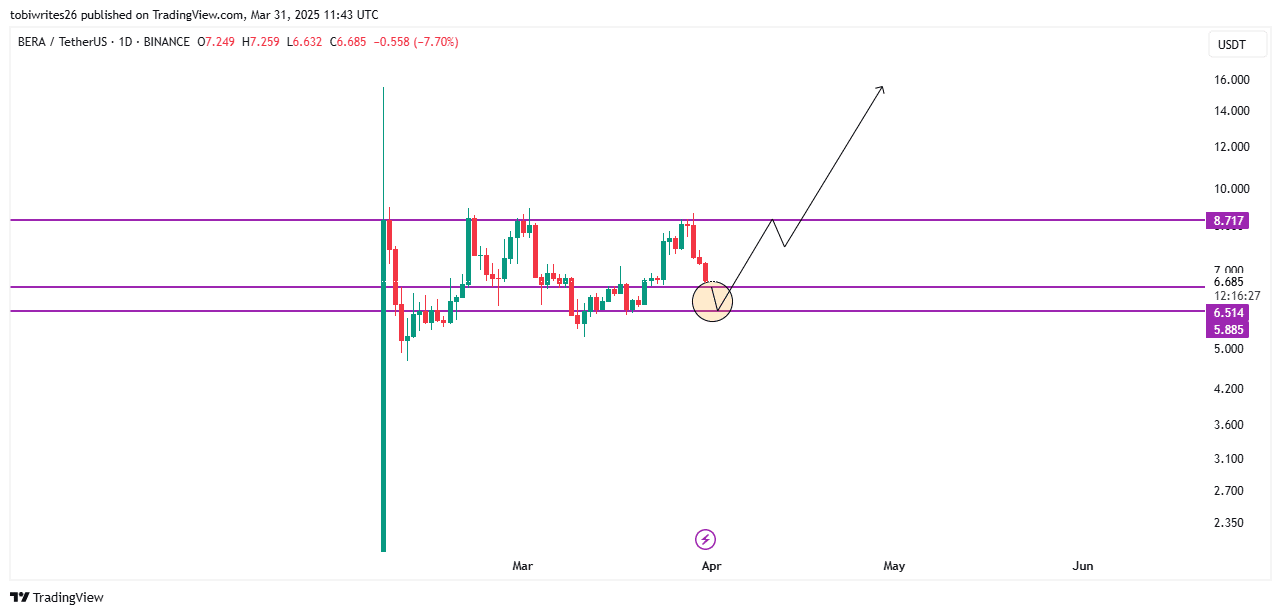

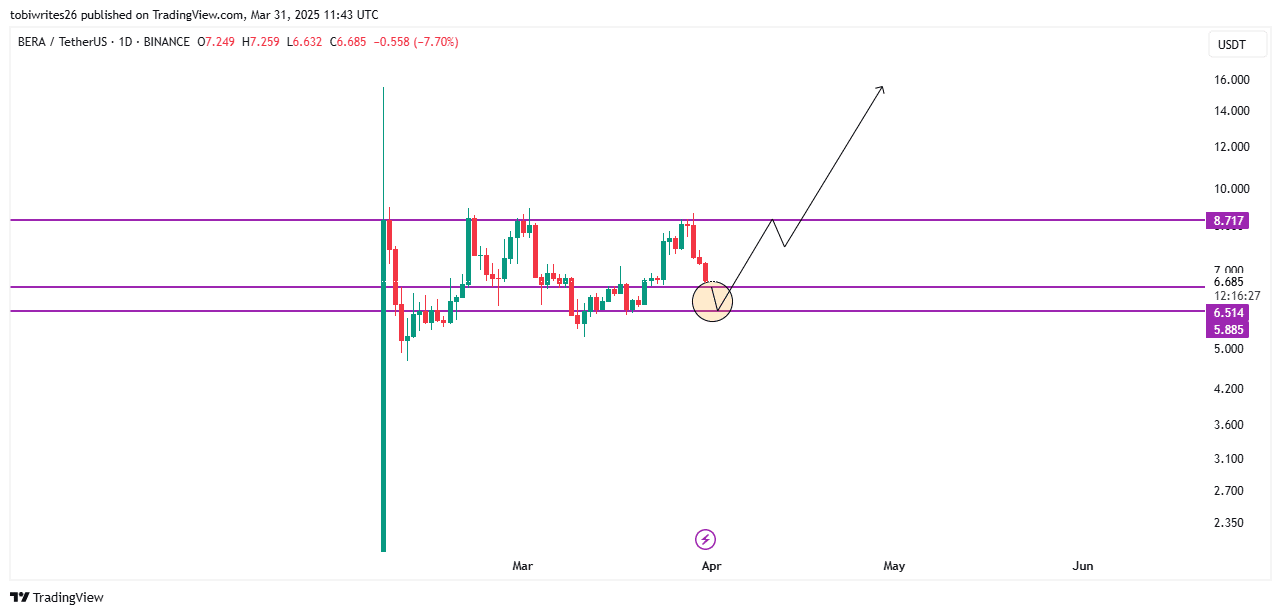

- On the graph there is still a possibility for a large market movement, because Bera approached an important demand zone known for historical rallies.

In the last 24 hours, Berachain [BERA] Printed with 10.72%, at the time of writing, and placed it under the top market losers during this time frame, despite the fact that the potential has shown before a large rally.

Despite this decline, a large rally is still possible, because various sentiment indicators – in particular liquidity Netflow and graphics patterns – draw up a bullish directional bias.

However, a further decrease may first be necessary.

Liquidity flow at the price

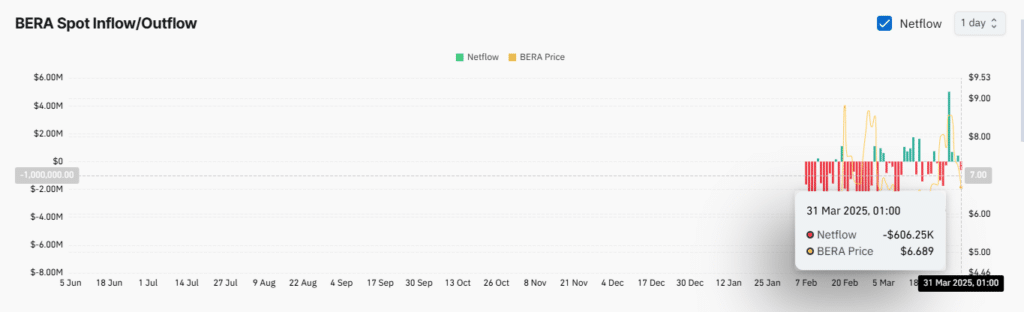

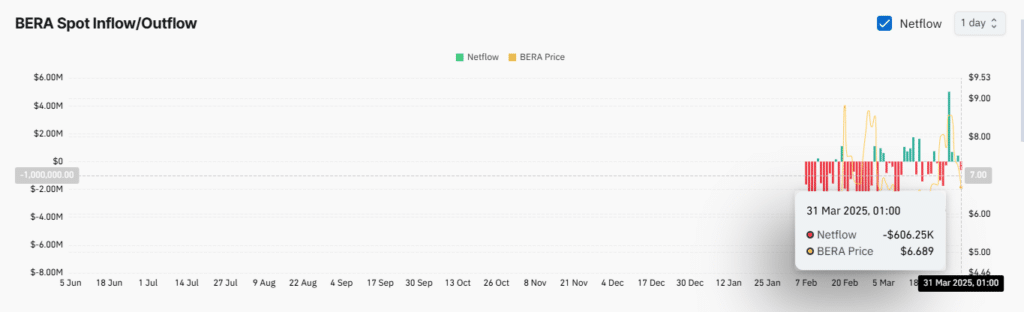

The decrease in the last 24 hours, which Bera brought to $ 6.69 at the time of the press, is a movement against the liquidity flow in his chain.

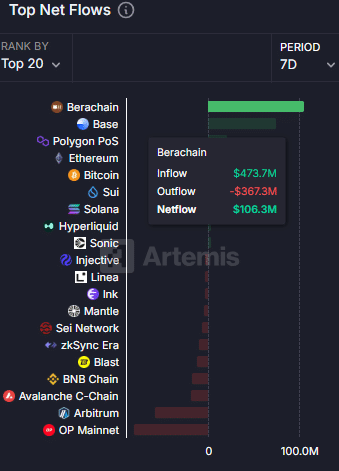

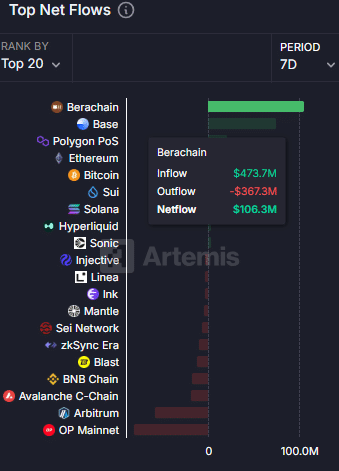

In the past week, Berachain registered the highest inflow of liquidity, which exceeded Ethereum, Solana and other top chains, with $ 106.3 million to his network.

Source: Artemis

Price movements after such liquidity inflow usually remain positive, with gradual and consistent profit or stability within a certain range.

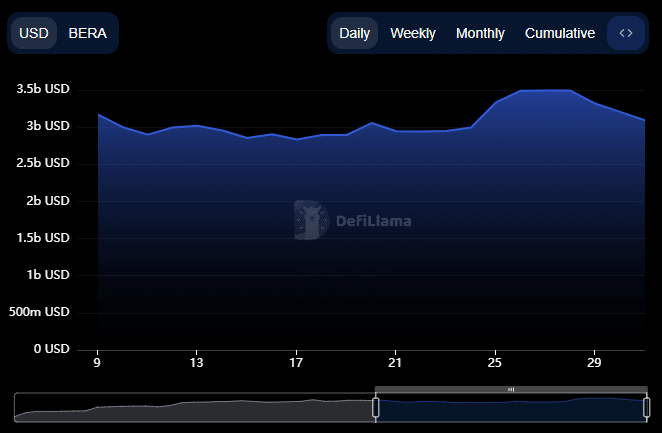

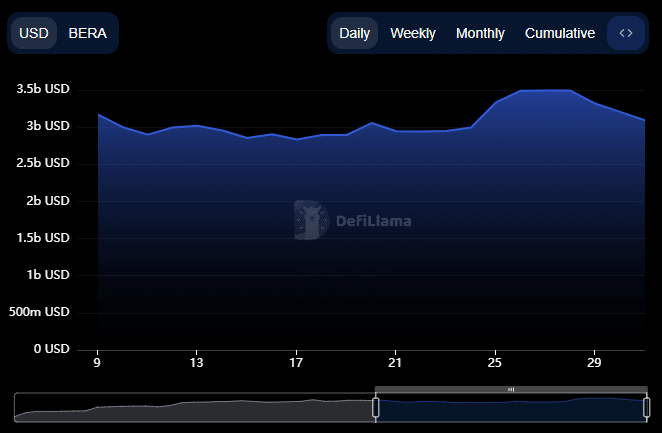

To understand the context behind the price fall, it is essential to analyze the total value (TVL) – an indication that assesses the value of a network based on the assets that has been deposited or locked about its protocols. TVL has seen a continuous decline.

Since March 28, Berachain’s TV has fallen from a highlight of $ 3,493 billion to a current value of $ 3,144 billion, which means that $ 349 million was removed from protocols about his blockchain in three days.

Source: Defillama

This liquidity outflow has contributed to the considerable price decrease in the last 24 hours. However, according to the analysis of Ambcrypto, this decrease could have a positive effect on Bera’s next step.

Bera’s approaches important demand zones

On the graph, Bera is on his way to an important level of support that previously followed as a catalyst for upward price trends.

If downward pressure Bera pushes between $ 6.5 and $ 5.8 in the demand area (circled on the graph), it could gather to at least $ 8.71 and possibly go up to $ 15.

The rally to $ 15 is possible if Bera crosses the $ 8.71 resistance and forms a bullish flag pattern.

Source: TradingView

Adding the bullish sentiment is the renewed purchase activity on the spot market after a few days of consistent sale. In the last 24 hours, a total of $ 627,000 has been purchased from Bera at fairs.

When buying activities, despite a price fall, this indicates healthy market conditions. The decline of Bera is seen as a stimulus for accumulation prior to a potential price increase, especially if it is traded to the marked demand zone.

Source: Coinglass

Market sentiment remains divided

Traders on Binance have been bullish, with a high purchase volume compared to the sales volume. This is clear because the long-to-korter ratio above 1 is crossed at 1,0991.

However, the wider market trend presents an opponent, with the overall long-to-go ratio under 1, which indicates a high sales pressure.

Source: Coinglass

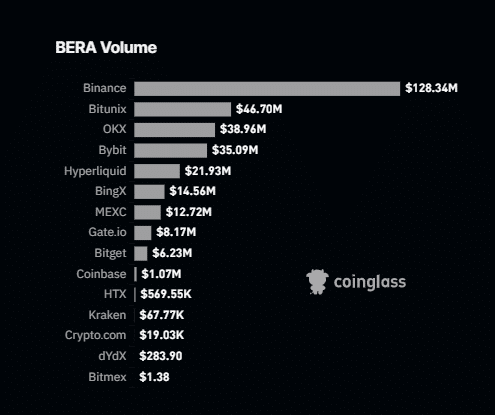

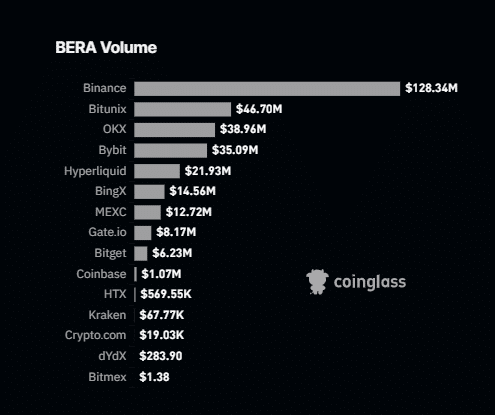

Binance traders who go against the broader market sentiment for a long time can delay Bera’s decline, given that Binance dominates the current trade volume of Bera.

The volume of Binance exceeds that of the following three stock markets – Bitunix, OKX and Bybit – by $ 128.34 million, with their combined volume at $ 120.75 million.

Source: Coinglass

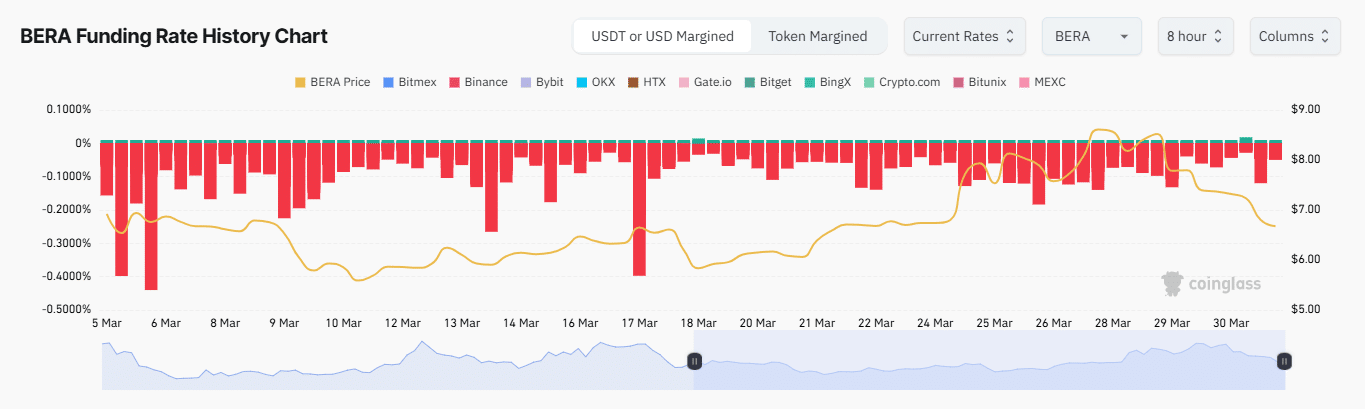

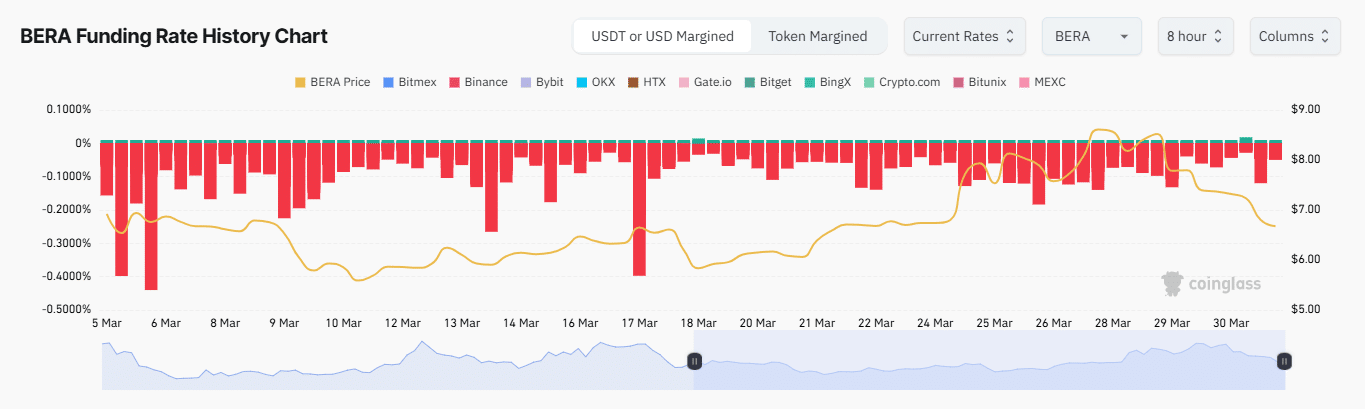

Moreover, the financing percentage of BERA was -0.0415 %, which means that short traders pay to maintain their positions. This very negative percentage suggests a strong bearish conviction among derivatives traders.