The Solana blockchain has revealed a sobering story, adding to the turbulence in the vibrant world of memecoins, such as BEER. The coin rose to prominence in recent weeks, experiencing a dramatic price swing and raising concerns about the inherent volatility and risks associated with these internet-driven tokens.

Related reading

Whales and carpet pullers: a recipe for disaster

BEER’s wild ride started with a classic memecoin scenario: a rise in popularity fueled by online hype and community buzz. However, this exuberance masked a lurking danger: the outsized influence of large token holders, often nicknamed “whales.”

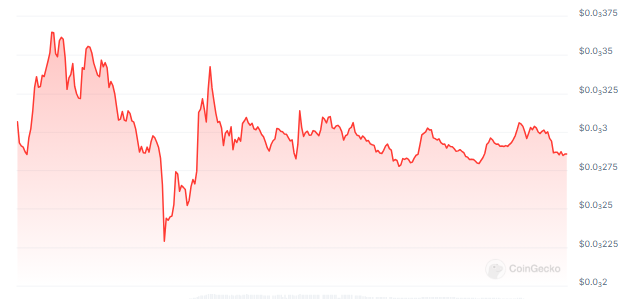

When several whales decided to cash out, their huge sell orders caused a domino effect. The price of BEER plummeted by as much as 70% within hours, causing the token’s price to drop from approximately $0.0003 to $0.0001.

Fears of a “back pull” – a scenario in which developers create a memecoin, drive up its price through marketing, and then disappear with investor funds – are running rampant. Although the BEER team vehemently denied any wrongdoing, the incident highlighted the vulnerability of memecoins to manipulation by large holders.

🚨 LATEST: Someone sold $10 million worth of Solana Memecoin $BEER (@biermuntmeme), causing the price to drop by 70%. pic.twitter.com/22H5cM5wFq

— SolanaFloor (@SolanaFloor) June 13, 2024

Unlike established cryptocurrencies with diverse ownership structures, memecoins often have a high concentration of tokens owned by a small group of individuals. This creates an environment where a few whales can significantly influence the price, leading to extreme volatility.

BEER is weathering the storm, but questions remain

Fortunately for some BEER holders, the token price partially recovered after the initial sell-off. However, the damage was done. The incident served as a stark reminder of the inherent risks associated with memecoin trading.

BEER is currently almost 40% lower than its pre-crash price, which it is currently trading at $$0.00026, while a cloud of uncertainty hangs over the horizon. The question of who caused the sell-off remains unanswered, with the BEER team pointing fingers at pre-sale investors.

BEERUSDT is trading at $0.00028 on the daily chart: TradingView.com

Solana’s Memecoin Boom: a double-edged sword

The BEER episode also sheds light on the double-edged sword of Solana’s burgeoning memecoin scene. Known for its faster transaction speeds compared to Ethereum, Solana has become a breeding ground for memecoin developers.

Related reading

The ease with which tokens can be launched on Solana has attracted a wave of new projects, but has also led to a potential oversaturation of the market. This, coupled with the lack of inherent utility for many memecoins, creates a speculative frenzy where price movements are driven more by hype than actual value.

Featured image from Pixabay, chart from TradingView