- Base’s TVL has been steadily declining in recent weeks.

- The chain has seen an overall decline in user activity.

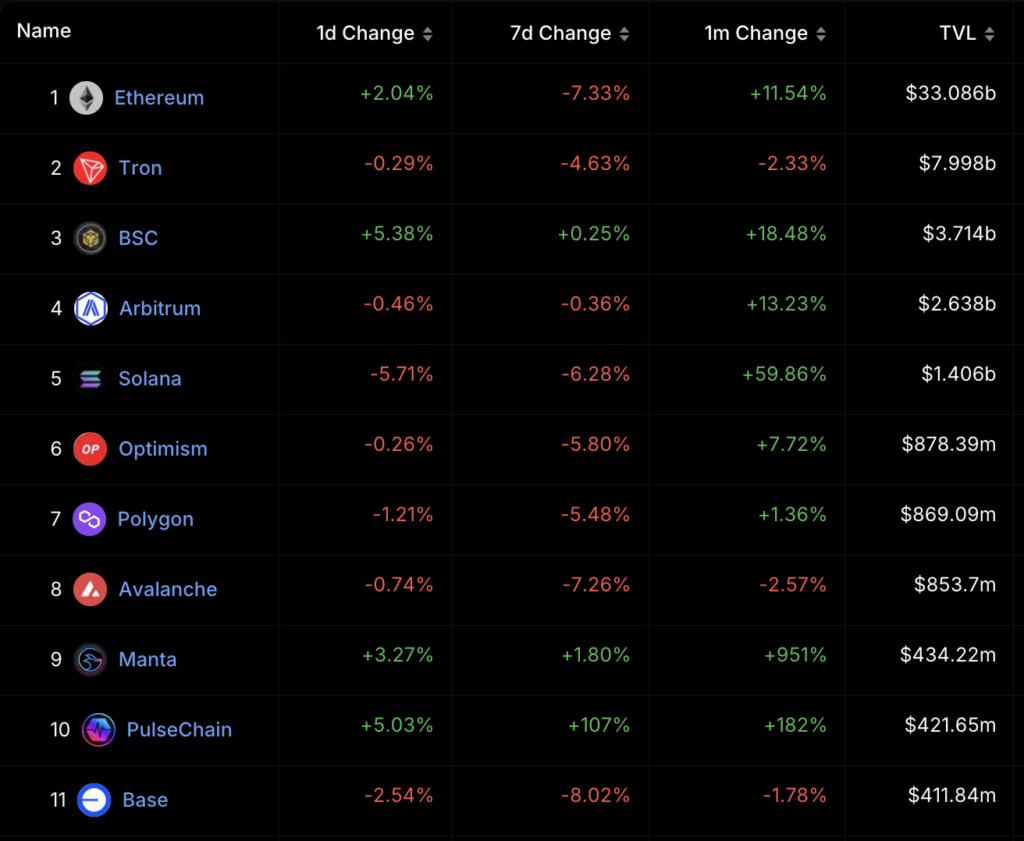

After a steady decline in decentralized finance (DeFi) total value locked (TVL), Layer 2 (L2) blockchain Base has lost its spot among TVL’s top 10 chains, according to data from DefiLlama.

Source: DefiLlama

At the time of writing, L2’s TVL was $412 million, making it the 11th chain with the most DeFi TVL. So far this year, Base has witnessed a consistent decline in DeFi activity, resulting in a decline in TVL.

According to data from, for example Artemisthe total volume of daily trades executed via the decentralized exchanges (DEXs) within Base has fallen by 28% since January 2.

For context, as of January 17, Base’s DEX transaction volume totaled $23.34 million. On January 2, the network recorded DEX volume of $33.21 million.

User activity on Base

Aside from the decline in the DeFi vertical, the entire Base ecosystem has experienced a decline in user activity, according to data from Artemis.

First, the daily number of unique wallet addresses sending on-chain transactions on the network has fallen 19% since December 23.

Due to the decline in the number of users, daily transactions completed during the same period have also decreased. AMBCrypto found that this has fallen by 29% since December 23.

Source: Artemis

It is widely known that the increased adoption base recorded after its launch in August 2023 was fueled by activity on the decentralized social network friend.tech.

For the uninitiated, friend.tech allows users to buy and sell tokenized shares of crypto personalities.

However, a severe decline in friend.tech usage has impacted Base’s network activity. According to data from Dune Analyticsthe number of daily transactions on Base involving a friend.tech transaction has fallen significantly since September 2023.

Source: Dune Analytics

Due to the waning hype surrounding the social network, the daily number of addresses purchasing other users’ keys has fallen by 99% since October 22, 2023.

Source: Dune Analytics

As the number of daily users and transactions on Base declined, so did network costs and revenue. AMBCrypto found that on January 1, network fees on Base fell to a two-month low of $40,000.

As for network revenues, they have been on a downward trend since the beginning of the year. According to Artemis data, Base posted sales of $7,000 on January 17, a decline of 33% since January 1.