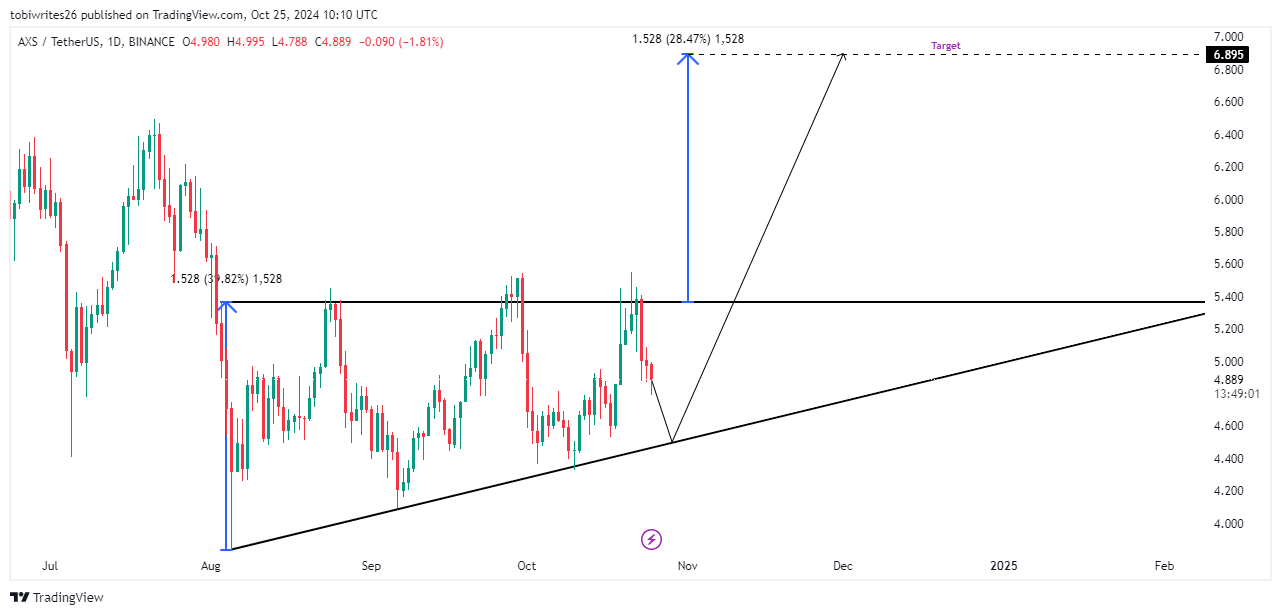

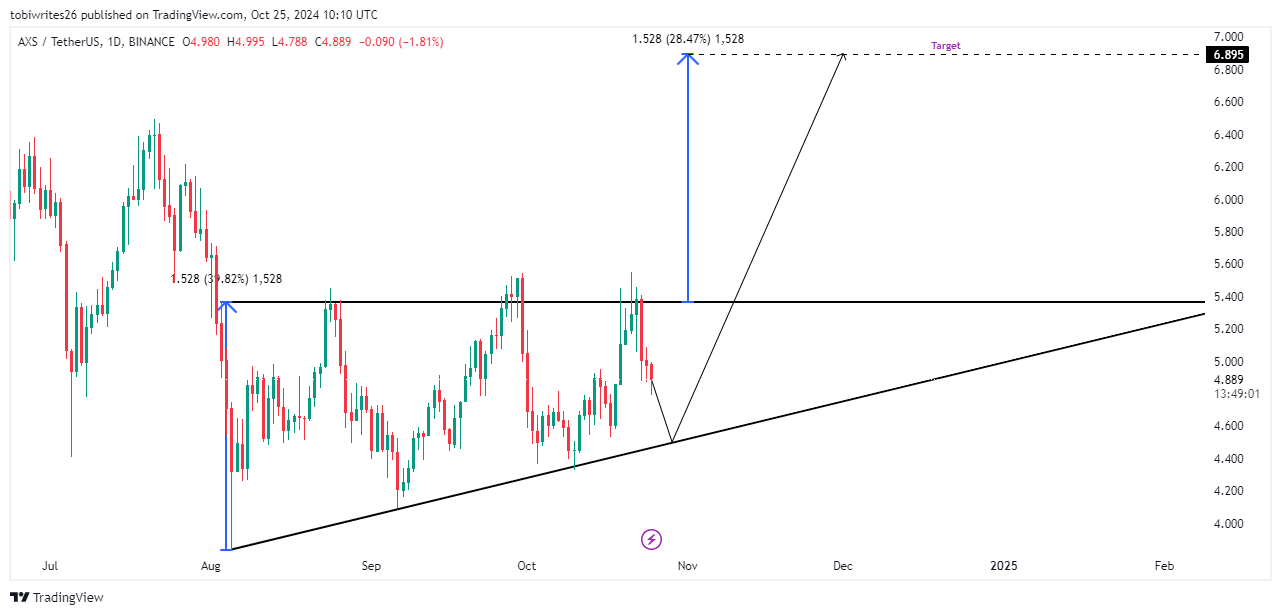

- Currently, AXS is trading within a bullish ascending triangle and approaching a support zone that could trigger a major price rally.

- Downward pressure is expected in the near term as indicators point to temporary weakness.

Axie Infinity [AXS] has underperformed in recent weeks, falling around 5.42% over the past month after reacting to a major resistance level.

As the market remains overshadowed by the prevailing bearish sentiment, it is likely that AXS’s dip will continue as several metrics support this outlook.

A necessary dip for a revival of AXS

After bouncing back from the resistance zone at $5,366 within the ascending triangle pattern, the AXS has fallen, and this downtrend could continue toward the formation’s diagonal support.

If AXS reaches this support level, it could resume its upward momentum, with an initial target in the pattern’s resistance zone.

A successful breakout above this resistance could provide an additional 28.47% upside, taking the AXS to $6,895. This projection is based on the measured distance between the resistance and support levels within the pattern as shown in the chart below.

Source: trading view

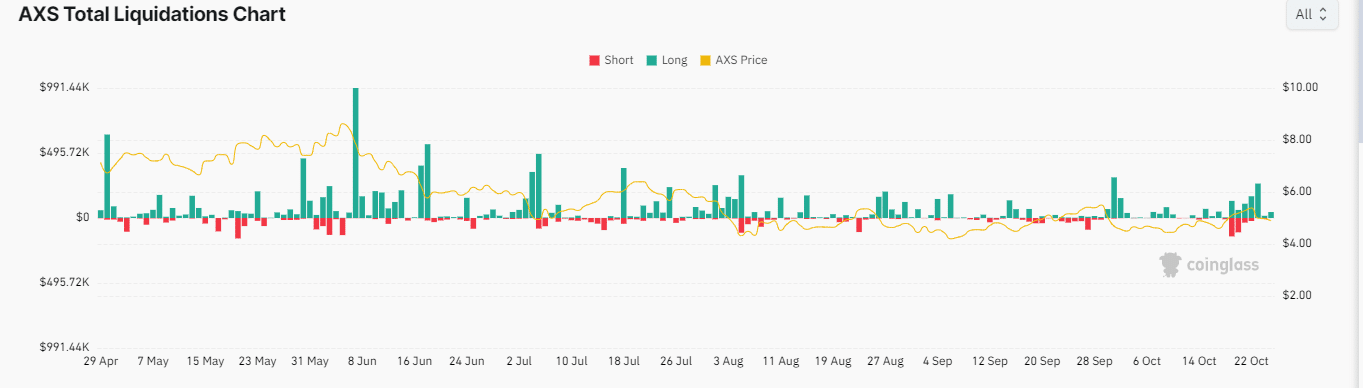

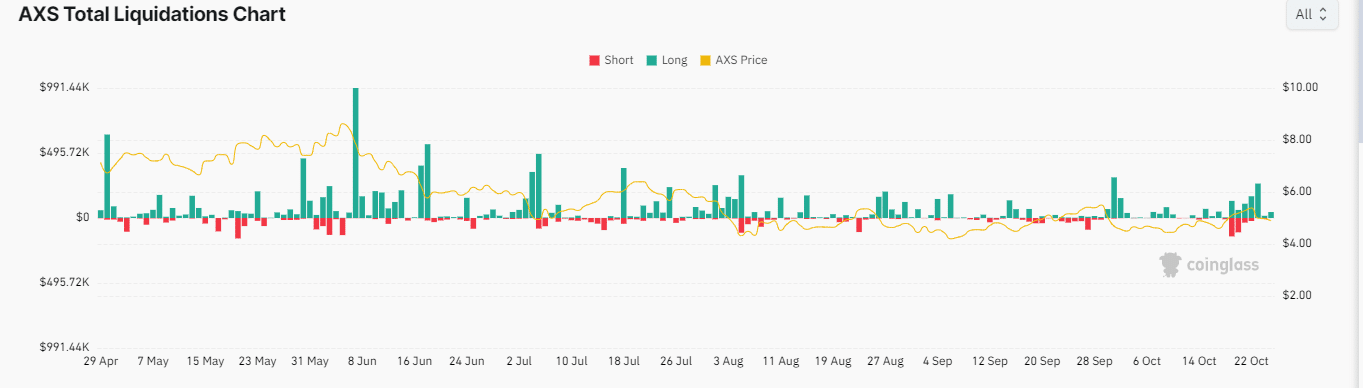

Traders are turning to selling as AXS faces downward pressure

On-chain data from Coinglass, analyzed by AMBCrypto, shows that traders are increasingly selling, indicating potential for further price declines.

Recent liquidation data indicates significant losses for long traders, with $50.56K of the $51.82K liquidated in the last 24 hours, attributed to those betting on an AXS price rise.

This shows that short traders have gained control, successfully betting on an AXS rally and likely driving down prices.

Source: Coinglass

Furthermore, funding rates remain negative at the time of writing, reflecting higher demand for short positions as short traders are willing to pay long traders to hold their short positions, reinforcing downward pressure on AXS.

If these numbers continue, AXS’s decline will likely continue until a shift in market structure occurs, possibly near the pattern’s historical resistance zone.

A supply shortage gradually arises

While AXS derivatives traders are largely short and expecting a price drop, spot market activity is showing a different sentiment as traders prepare for a rally.

Is your portfolio green? View the Axie Infinity Profit Calculator

According to Mint glass$417.88K worth of AXS has been delisted from the exchanges in the last 24 hours, reducing available supply and contributing to a potential supply shortage.

This shift signals that bearish sentiment could be nearing its end, and a turning point is likely on the horizon for AXS as upside momentum builds.