- Avalanche witnessed growth in terms of number of strikers, but TVL fell sharply.

- The price of AVAX is down more than 2% in the last 24 hours.

AVAX Daily recently posted Avalanche [AVAX] weekly status of the subnet, which revealed an interesting development. According to the report, the number of daily active users of Avalanche has increased significantly in recent days. However, other than active addresses, the token’s key metrics seemed to have declined.

Read Avalanche [AVAX] Price prediction 2023-24

A look at Avalanche’s subnet stats

According to the tweet, there was a surge in AVAX’s daily active addresses, which is positive as it indicates increased adoption of the blockchain. In addition, the total number of Avalanche subnets reached 59, while the number of validators reached 1281.

In the past seven days, the sign also processed more than 14 million transactions. Thanks to the transactions, Avalanche’s gas consumption reached 6.39 trillion last week.

Avalanche subnet weekly statistics

Total number of subnets: 59

Total number of blockchains: 45

Total number of validators: 1281

Total bet amount: 249.09 million AVAXOverview🧵👇#AVAX #Avalanche $AVAX pic.twitter.com/FioxzZAGpz

— AVAX Daily 🔺 (@AVAXDaily) May 18, 2023

AVAX is on the rise

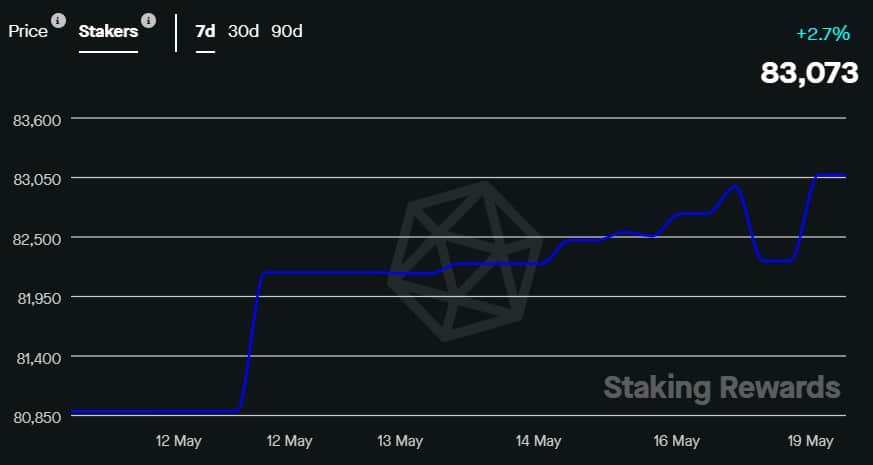

Not only in terms of daily active addresses, strikes also recorded growth. At the time of writing, AVAX’s market cap was $3,735,172,558, with a 59% stake ratio, according to Turn off rewards.

Source: Staking Rewards

Not everything was perfect, however, as Avalanche also saw a decline in quite a few areas. The map of Artemis, for example, pointed to that from AVAX TVL has fallen sharply in the past month.

A decrease in TVL means that the total value of crypto assets deposited in DeFi protocols has sunk. A similar trend of decline was also noted in terms of Avalanche’s DEX volume.

Source: Artemis

On-chain performance remained reasonable

Although TVL and DEX volumes declined, Avalanche’s development activity increased strongly. This was the result of the Avalanche X-Chain Explorer, which allows users to analyze all X-Chain activity, including transactions, assets, UTXOs, blocks, and more.

Introducing the new Avalanche X-Chain Explorer!

With this major upgrade, you can analyze all X-Chain activity, including transactions, assets, UTXOs, blocks, and more.https://t.co/DSonrBNu8f pic.twitter.com/Dbr5bdqClN

— Avalanche 🔺 (@avax) May 18, 2023

In addition to development work, AVAXBinance’s funding rate was relatively high, reflecting demand in the derivatives market. AVAX’s weighted sentiment also improved significantly over the past week.

Source: Sentiment

Avalanche’s price action was tricky

From CoinMarketCap, the price of AVAX has fallen slightly over the past week. However, in the past 24 hours alone, the price of AVAX fell by more than 2%. At the time of writing, it was trading at $14.68, with a market cap of over $4.8 billion.

However, a look at AVAX’s daily chart revealed quite a few bearish indicators.

Realistic or not, here it is AVAX market cap in terms of BTC

The Exponential Moving Average (EMA) ribbon revealed that the 20-day EMA was below the 55-day EMA. The Chaikin Money Flow (CMF) followed a sideways path. AVAX’s Relative Strength Index (RSI) was also substantially low, looking bearish.

Nevertheless, Avalanche’s MACD showed the possibility of a bullish crossover, which could turn things around AVAXfavor in the short term.

Source: TradingView