- Despite the price drop, bearish sentiment around AVAX increased.

- In the event of a sustained bull run, AVAX could soon reclaim $32.

Although market conditions remained weak, Avalanche [AVAX] showed promising performance. In fact, AVAX was the best performer in terms of price gains among the top 20 cryptos by market capitalization over the past 24 hours.

Let’s take a closer look at AVAX’s condition to see where it could end up if the bull trend continues.

Avalanche beats Bitcoin and Ethereum

CoinMarketCaps facts revealed that while typos like coins Bitcoin And Ethereum witnessed slight gains, AVAX bulls increased the token’s price by over 6% in the last 24 hours.

At the time of writing, Avalanche was trading at $23.03 with a market cap of over $9.33 billion, making it the 12th largest crypto.

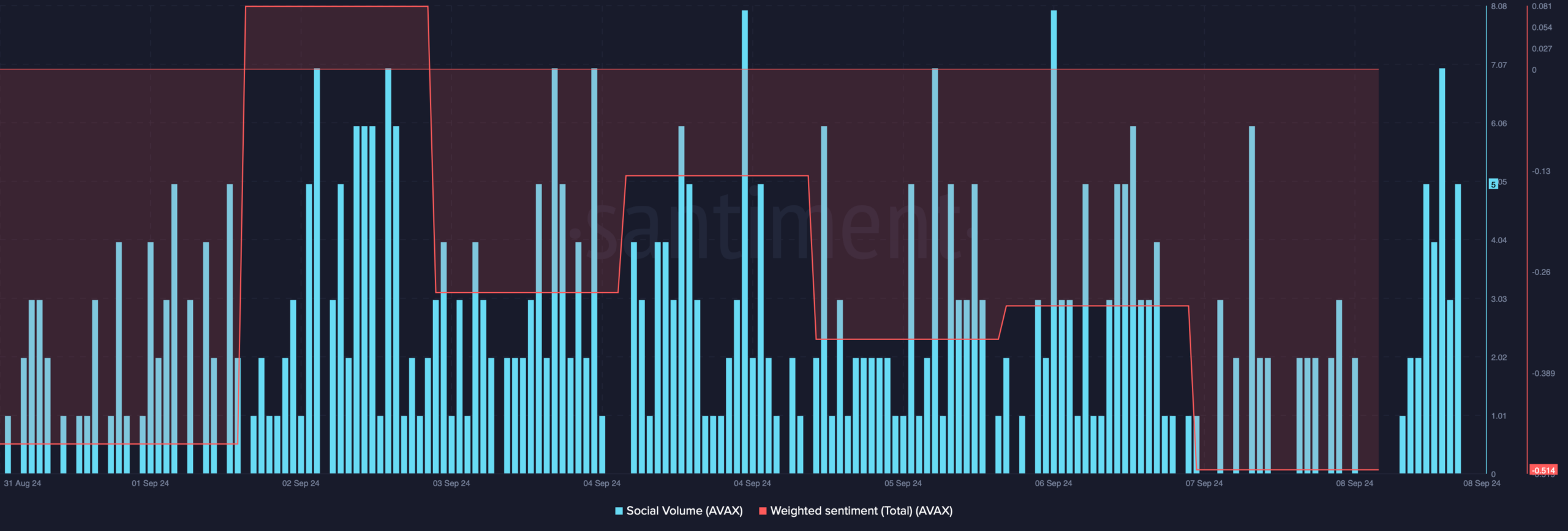

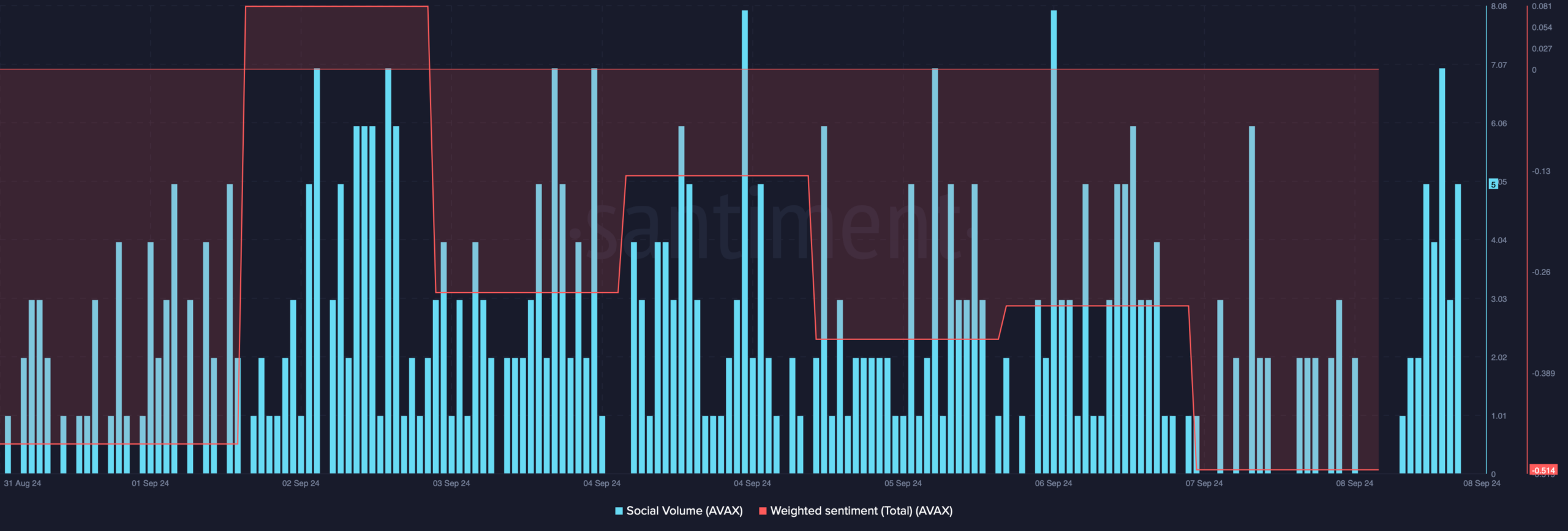

However, it was surprising to see that the price increase failed to fuel bullish sentiment in the market. AMBCrypto’s analysis of Santiment’s data showed that AVAX’s weighted sentiment fell.

This indicated that bearish sentiment around the token was increasing. But social volume remained high, reflecting the token’s popularity in the crypto space.

Source: Santiment

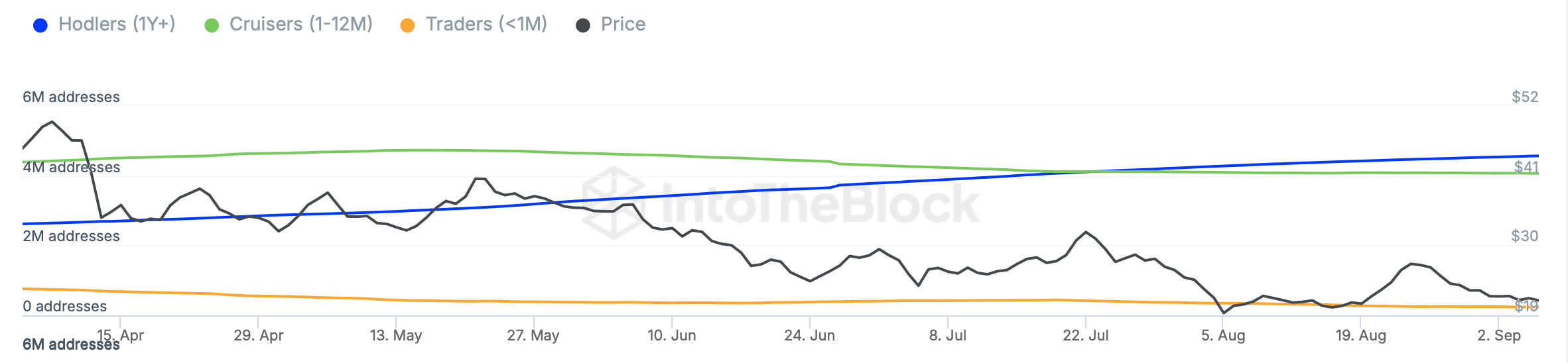

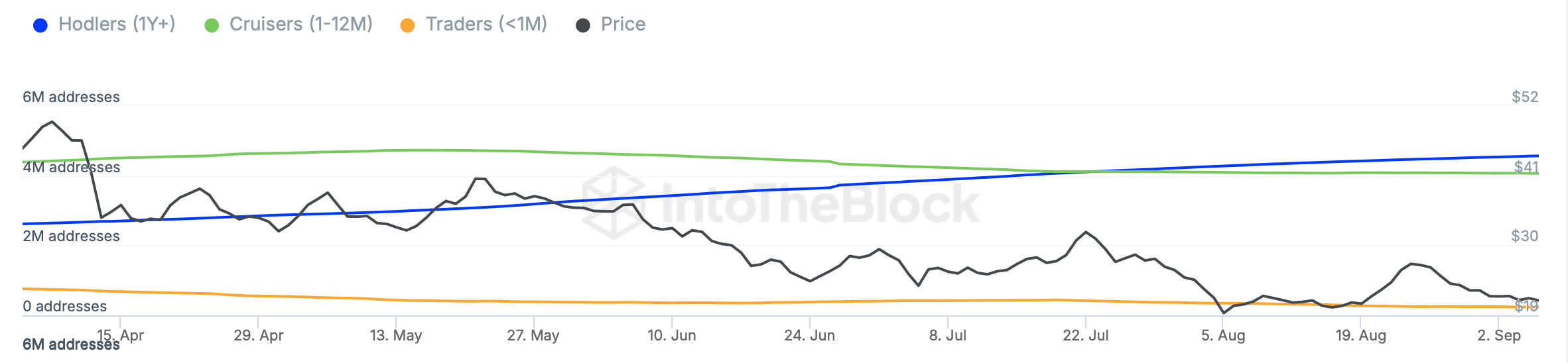

Nevertheless, long-term investor confidence in AVAX has increased in recent weeks.

According to IntoTheBlock data, the number of AVAX holders (addresses with 1+ year holdings) exceeded the number of AVAX cruisers (addresses with 1-12 month holdings).

This indicated that long-term holders expected the token’s price to rise further in the coming weeks or months.

Source: IntoTheBlock

Will AVAX maintain its bullish momentum?

AMBCrypto next planned to assess Avalanche’s on-chain metrics to see if they indicate continued price appreciation.

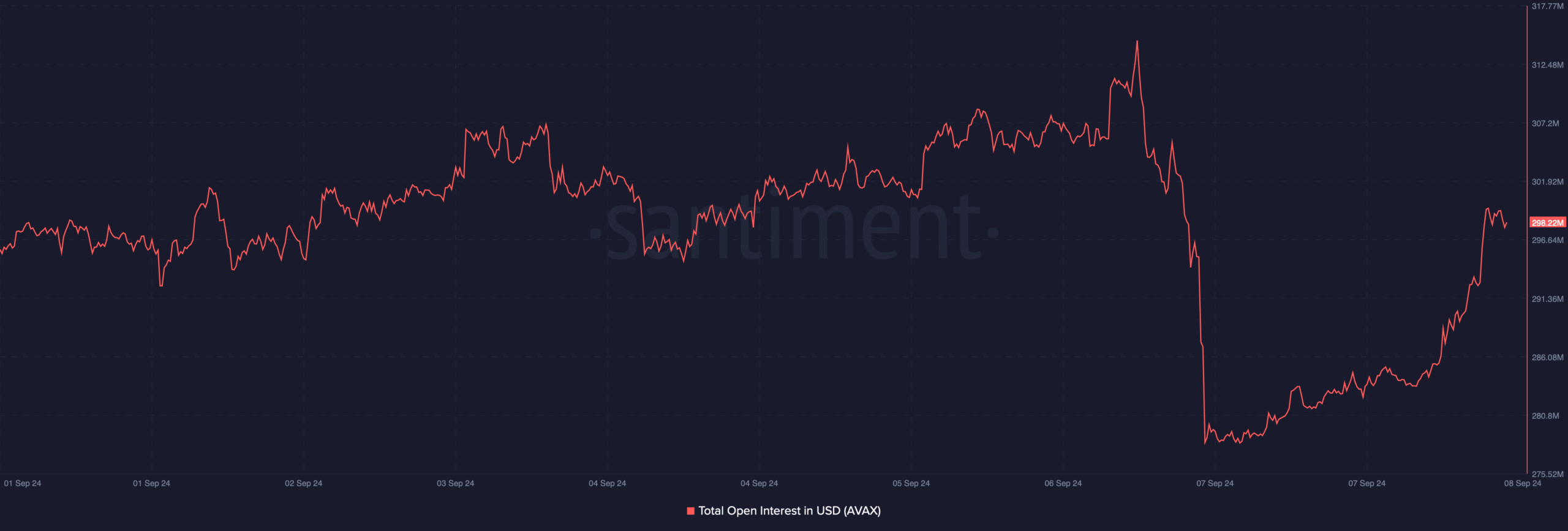

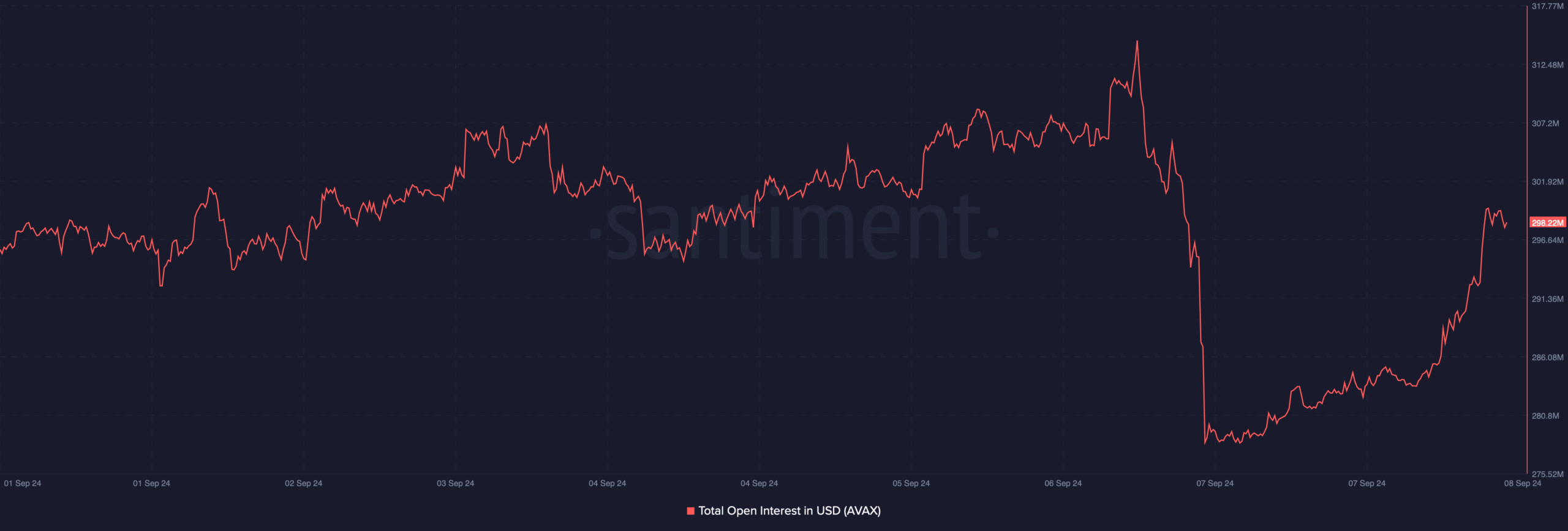

According to our analysis, after declining, AVAX’s open interest started to rise along with the price. This suggested that the chances of the bull rally continuing were high.

Source: Santiment

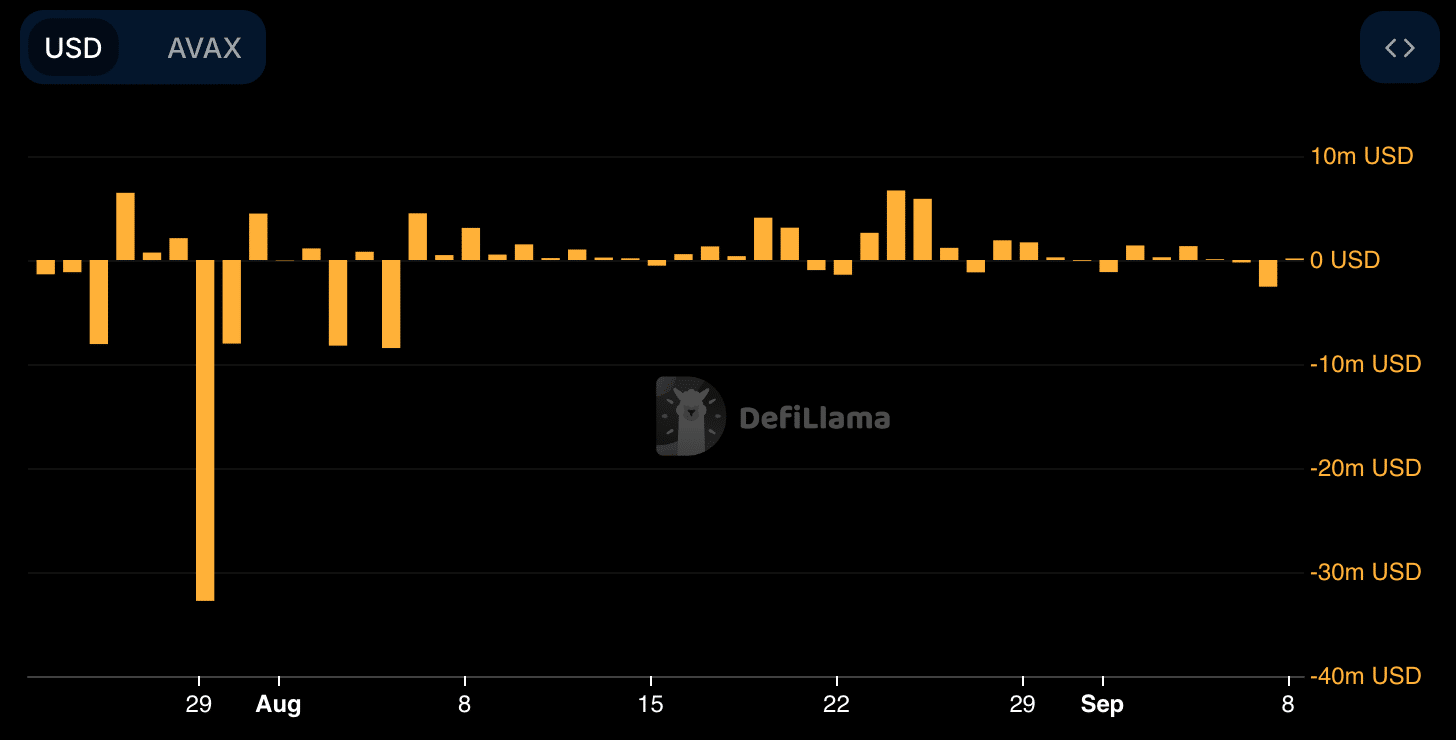

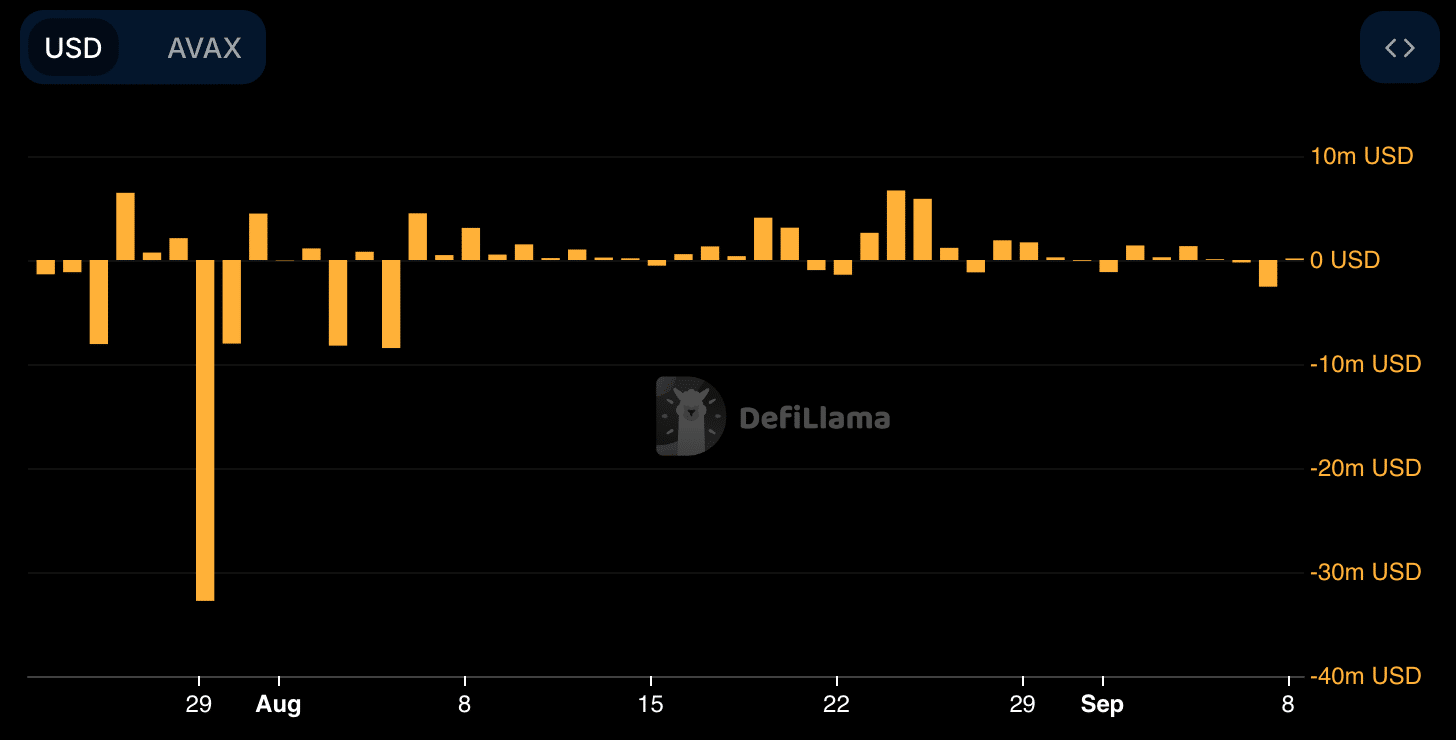

Apart from that, we also found that selling pressure on the token decreased. According to our look at DeFiLlama data, AVAX’s net flow fell to -$2.47 million on September 7.

To begin with, a negative new flow indicates a rise in buying pressure, which can be considered a bullish signal.

Source: DeFiLlama

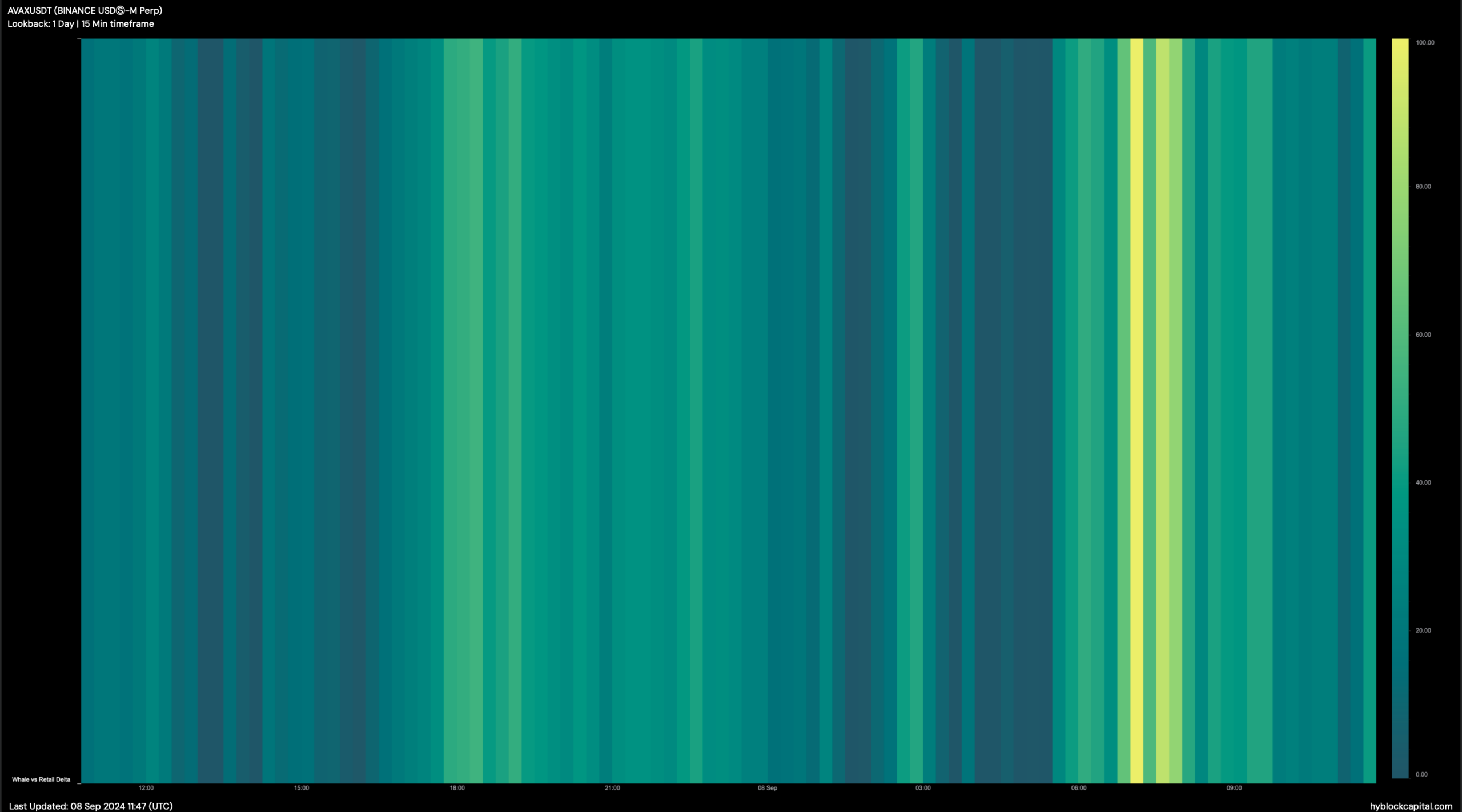

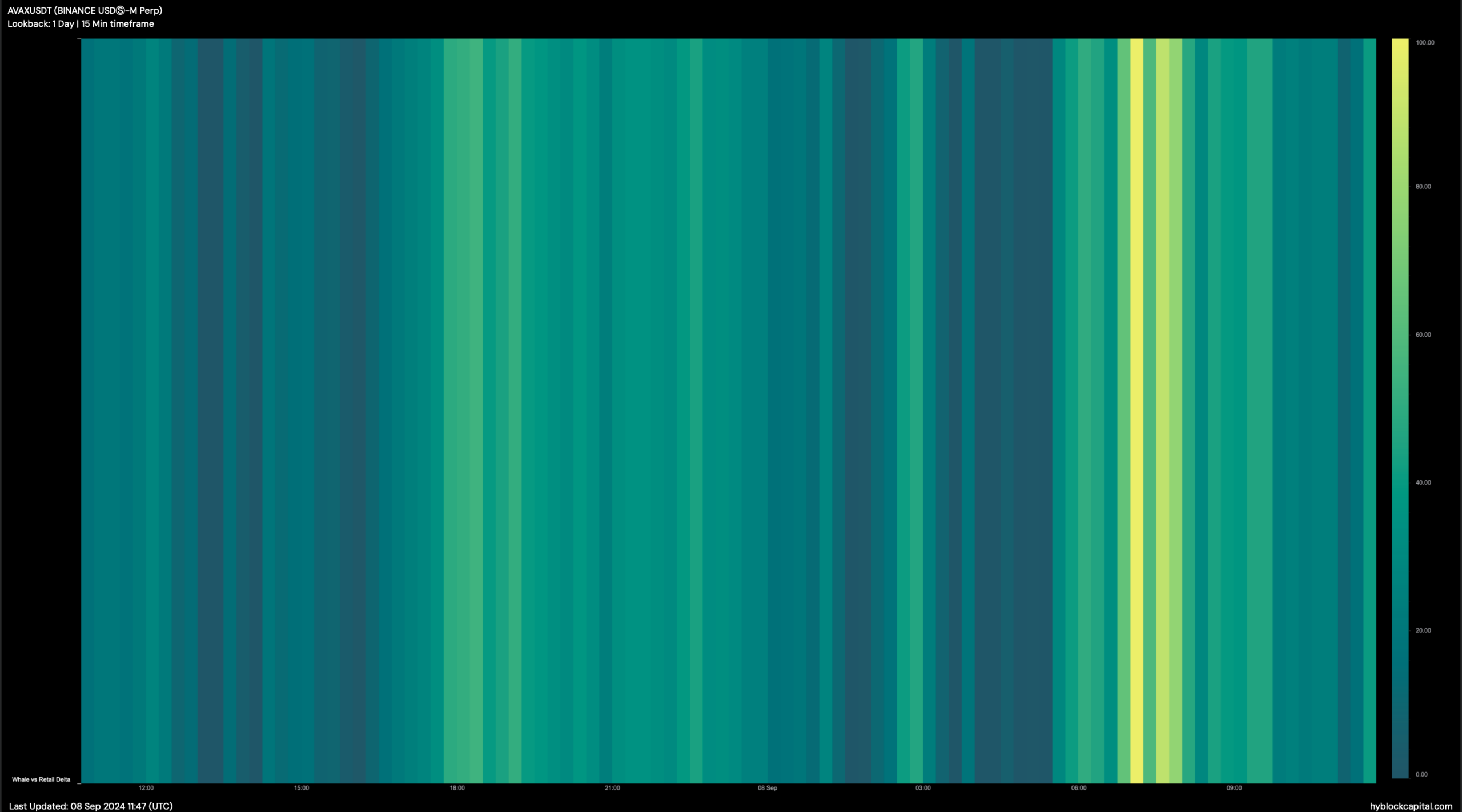

However, the whales were not very active in the past few hours as the price of AVAX rose. A look at Hyblock Capital’s data revealed that Avalanche’s whale vs. retail delta fell from over 60 to 44.

A drop in the benchmark meant that retail investors had more exposure to the market than whales.

Source: Hyblock Capital

Is your portfolio green? Check the Avalanche Profit Calculator

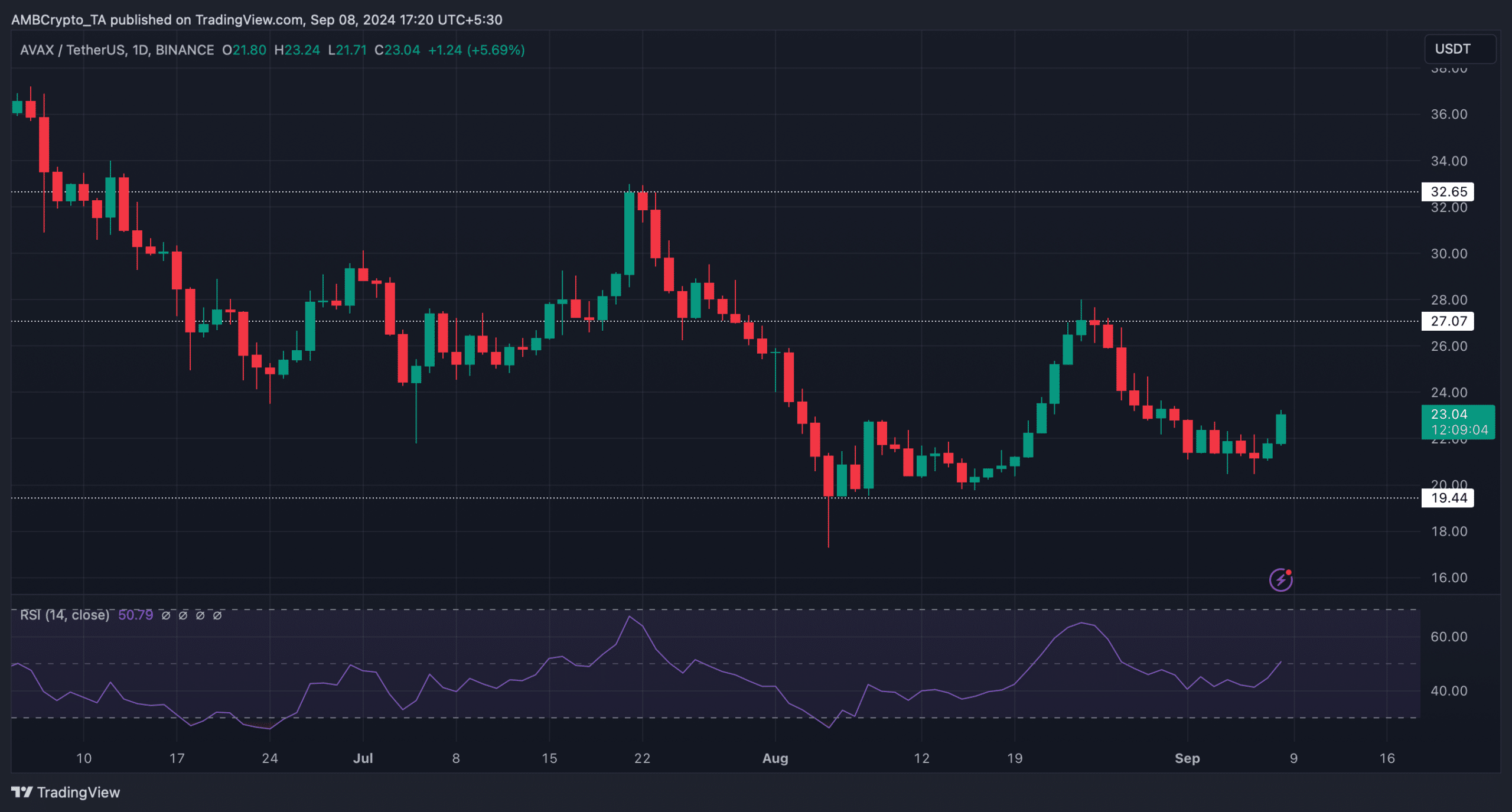

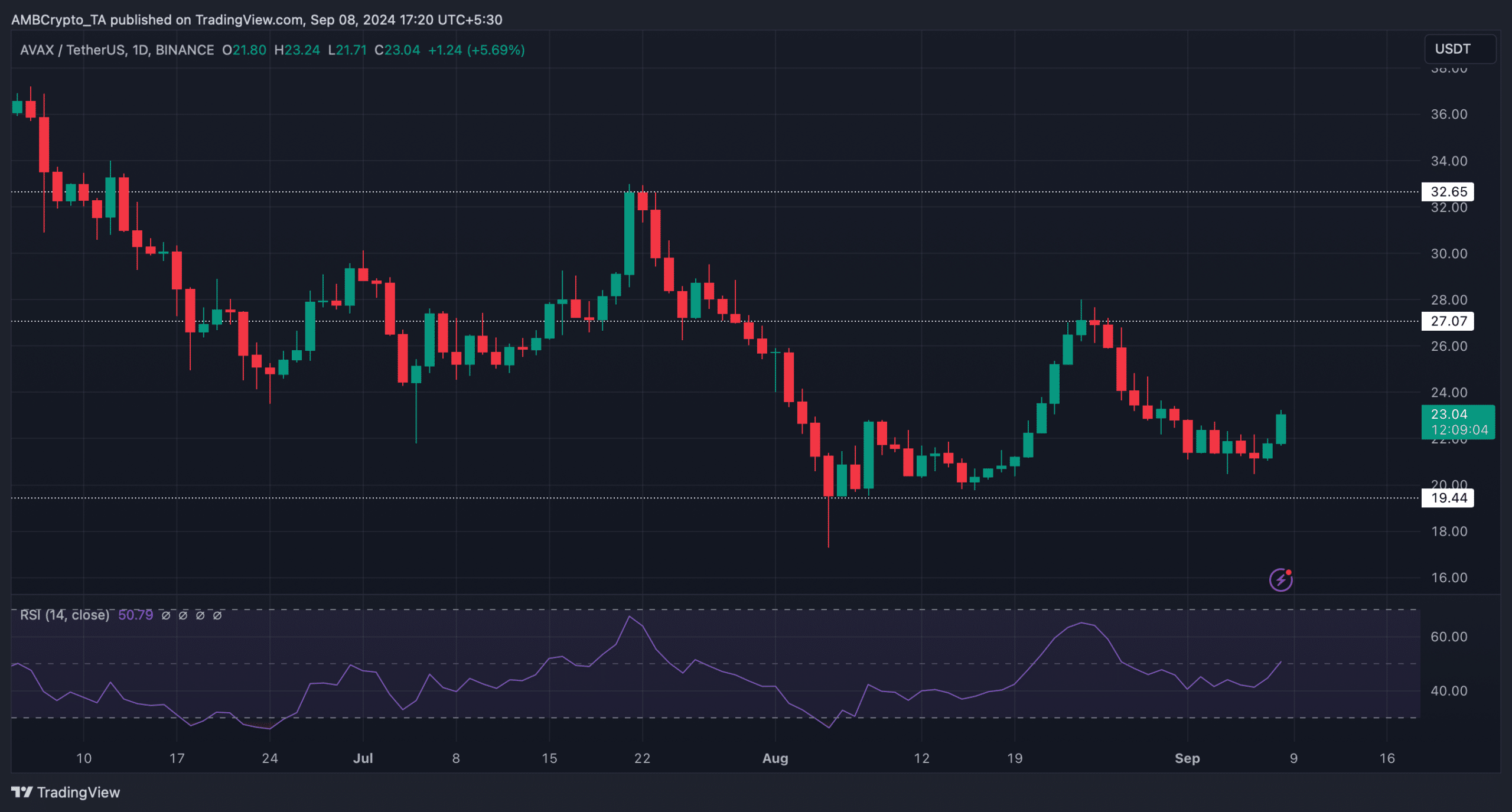

Nevertheless, the technical indicator the Relative Strength Index (RSI) registered an increase. This indicated that AVAX bulls could maintain the upward momentum and push the token’s price further higher.

If that happens, AVAX may target $27 before targeting $32. But in the event of a bearish trend reversal, AVAX could fall to $19.4.

Source: TradingView