Avalanche (AVAX) has needed help recovering from its losses in this volatile crypto market. Compared to other Layer-1 (L1) blockchains, AVAX consolidation could have been faster, raising concerns about its future performance.

Related reading

Despite this uncertainty, recent price action shows the AVAX consolidation above the $19.80 support and trading at $22.11 at the time of writing, creating positive sentiment among the bulls. Avalanche’s funding ratio has turned positive for the first time since late July, and some analysts are even anticipating a possible turnaround in Avalanche’s fortunes.

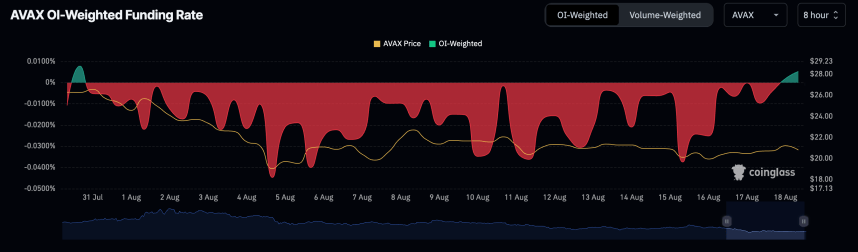

AVAX financing percentage becomes positive

According to Coin glass dataAVAX’s funding rate has moved into positive territory, indicating a possible change in market dynamics.

A positive funding rate in futures trading generally indicates increased demand for long positions as traders are willing to pay a premium to hold them. This bullish pressure suggests that more traders are betting on a rise in AVAX’s price rather than a fall, a notable shift from the bearish sentiment that has dominated the market in recent weeks.

The current positive funding rate for AVAX indicates that bullish sentiment is gaining momentum, which could portend a breakout if bulls can successfully push the price above the crucial $23 level.

October 2023 vs. August 2024: Avalanche at a turning point?

Buyers are hoping a breakout above $22.79 will change the weekly bearish structure, and some investors are looking back to October 2023 for deals.

Analysts like Daghan at X anticipate a turnaround and that has happened compared current market conditions and those of October 2023, just before Avalanche’s price skyrocketed from $8 to this year’s peak of $65 on March 18.

In his comparison, Daghan explains the intensity of AVAX’s uptrends after long and deep corrections, showing how quickly the price moves after moving from bearish to bullish.

Currently trading at $22.11, Avalanche needs to break above this key resistance level to challenge the supply zone around $22.79 and make a new higher high. If the bulls can regain the $23 level, it could signal a broader market recovery for AVAX. However, if the market fails to hold above the August 5 low at $19.53, there is a risk of a downward move, potentially testing demand below $17.50 again, with the next bearish target at $15.

With funding rates signaling a possible shift in market sentiment, the coming days will be critical in determining whether AVAX can break away from the current consolidation and resume its upward trajectory.

Cover image from Unsplash, chart from Tradingview