- Bearish sentiment is looming as the Ethereum options market signals caution.

- Declining interest in whales and network activity were potential headwinds for ETH.

In a surprising turn of events amid a generally bullish cryptocurrency market, Ethereum[ETH] facing bearish pressure.

Realistic or not, here is the market cap of ETH in terms of BTC

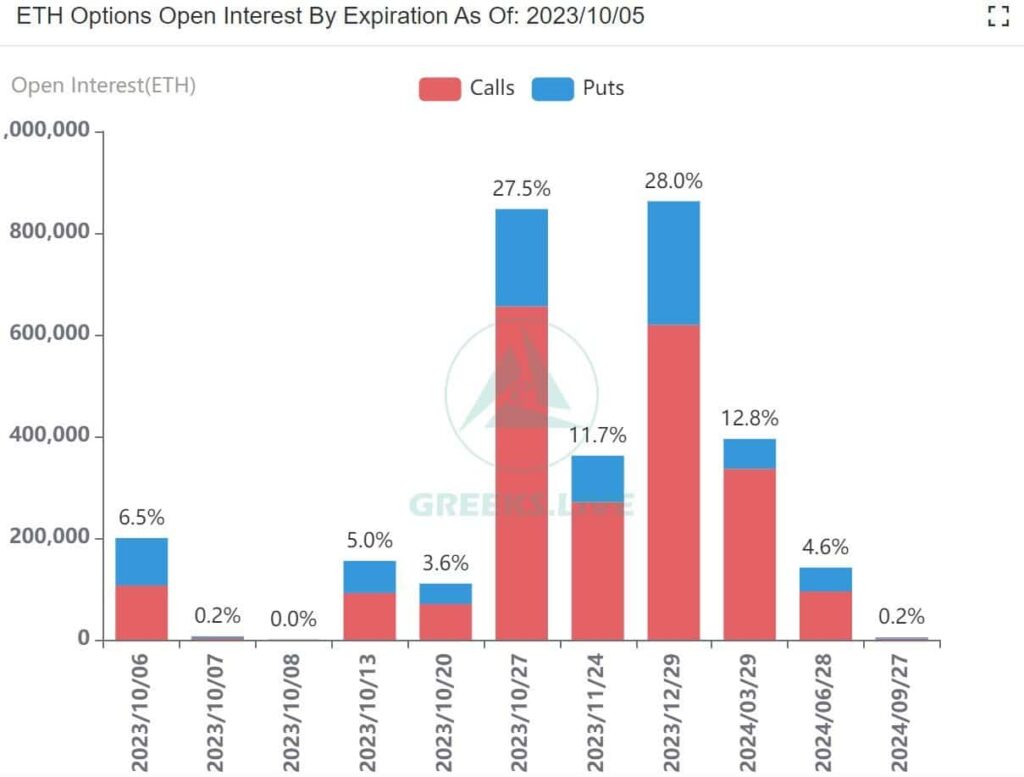

Data sourced from Greeks.Live showed that approximately 200,000 ETH options were about to expire, with a Put Call Ratio of 0.87, a telltale sign of bearish sentiment. In addition, the maximum pain level was set at $1,650, with a total face value of $330 million.

Source: Greeks.live

This increasing bearish sentiment became even more evident when we observed declining Open Interest across all exchanges. This indicated a decline in interest in Ethereum options and futures.

Implied volatility, which serves as a benchmark for expected price movements, also fell. This could imply that the market expects the price of ETH to remain relatively stable in the short term, indicating a lack of substantial buying interest.

Source: Greeks.live

Additionally, Ethereum’s 25 Delta Skew, a metric used to assess sentiment in the options market, also saw a downturn. This shift indicated a trend toward more bearish sentiment among options traders. This may reflect a lack of confidence in ETH’s near-term price prospects.

Source: Velo

Interestingly, contrary to these bearish indicators, there have been no substantial liquidations for either long or short positions in the ETH market. This suggested that traders approach ETH with caution and refrain from heavy bets for or against the cryptocurrency.

Is your portfolio green? Check out the Ethereum profit calculator

Whales aren’t that interested

In addition to the options market data, there were indications of declining whale interest in Ethereum. Glassnode’s data showed that the number of addresses holding 1,000 or more ETH fell to a five-year low, with a total of 6,010 addresses.

This suggested that major holders are reducing their positions or transferring their ETH elsewhere, which could cast a negative shadow on Ethereum’s price.

📉 #Ethereum $ETH The number of addresses holding more than 1,000 coins just reached a five-year low of 6,010

View statistics:https://t.co/iDNXAbbLRt pic.twitter.com/FWsRMgyHFR

— Glassnode Alerts (@glassnodealerts) October 5, 2023

Furthermore, Ethereum’s network showed signs of slowing down. Network growth, which measures the number of new addresses interacting with ETH, has been declining. Additionally, the speed of ETH transfers decreased, indicating that ETH is being moved between addresses less frequently. These statistics collectively indicated that the new interest in Ethereum was waning.

Finally, Ethereum has a relatively high market value to realized value ratio (MVRV). This ratio compares the market price to the realized price of ETH. A high MVRV ratio could indicate impending selling pressure from profit takers, which could put downward pressure on the price of ETH.

Source: Santiment