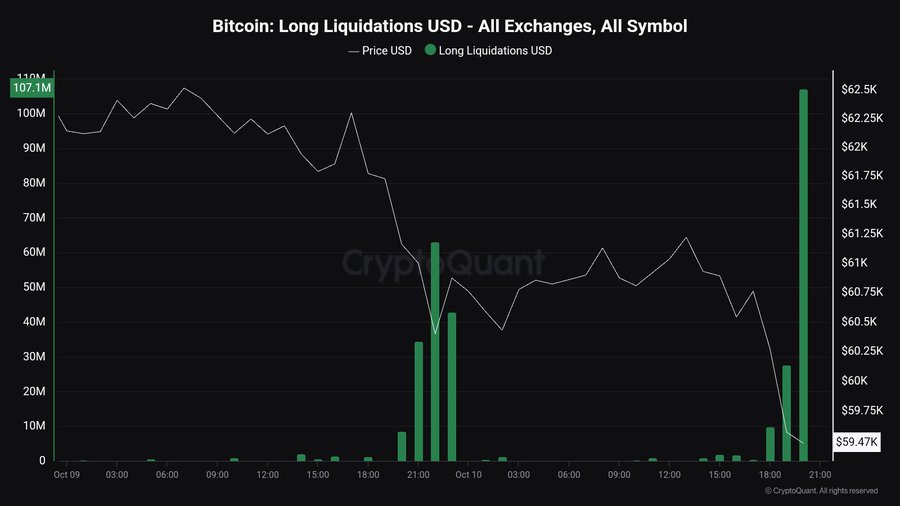

- BTC’s recent volatility resulted in total liquidations worth $107 million

- Analysts consider $60,600 to be the critical level that will determine BTC’s trajectory

Since early October, Bitcoin has experienced increased price fluctuations. During this period, BTC has reached a high of $66,500 and a low of $58,800, the latter being a price level reached less than 24 hours ago.

This drop below $60,000 had a huge impact on BTC holders, with many being forcibly liquidated. In fact, more than $107 million has been liquidated.

Source:

This increase in volatility, which comes with current market conditions, raises questions about BTC’s future trajectory. This is why popular crypto analysts like Rekt Capital have suggested that BTC must remain above $60,600 for any potential upside.

What does the market sentiment say?

In its analysis, RektCapital stated that Bitcoin is retesting the weekly reaccumulation range of $60,600 for the second consecutive week as support.

Source:

According to this analysis, BTC will register an uptrend if it closes above this level on the weekly charts. Therefore, for any potential upside in the near future, BTC must maintain this range, which will position the price for further gains.

However, the analyst also noted that if the crypto loses support here, he will see another downward drift period.

What do the graphs say?

At the time of writing, BTC was trading at $60,573. This marked a decline of 0.58% on the daily charts, with an extension of this bearish trend with a dip of 1.01% on the weekly charts.

Therefore, RektCapital’s aforementioned analysis, based on the latest price action, could be worrying as it portends potential downsides.

Therefore, it is essential to determine what other market fundamentals suggest.

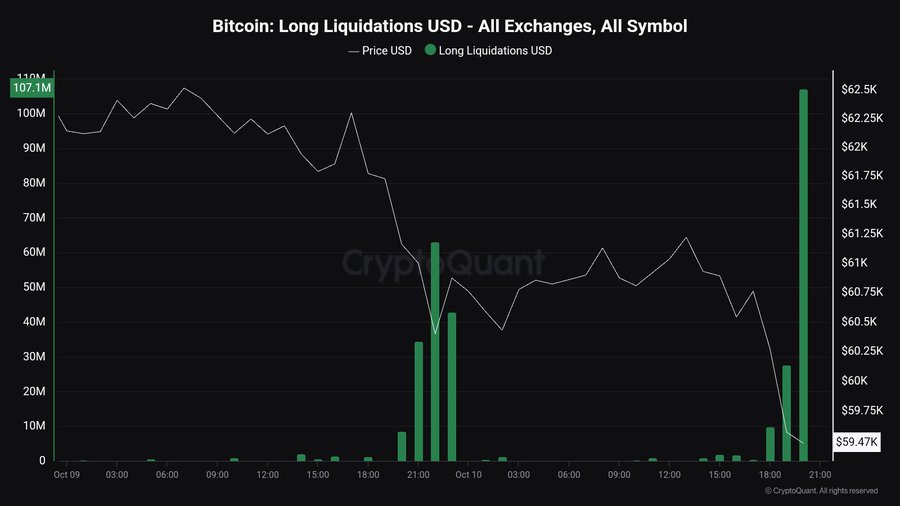

Source: IntoTheBlock

For starters, inflows from Bitcoin major holders spiked from 560.95 to 8.59k in recent days. A spike in the number of large holders means investors buy the dip and take long positions.

Such market behavior is also a sign that large farmers expect prices to rise in the near future.

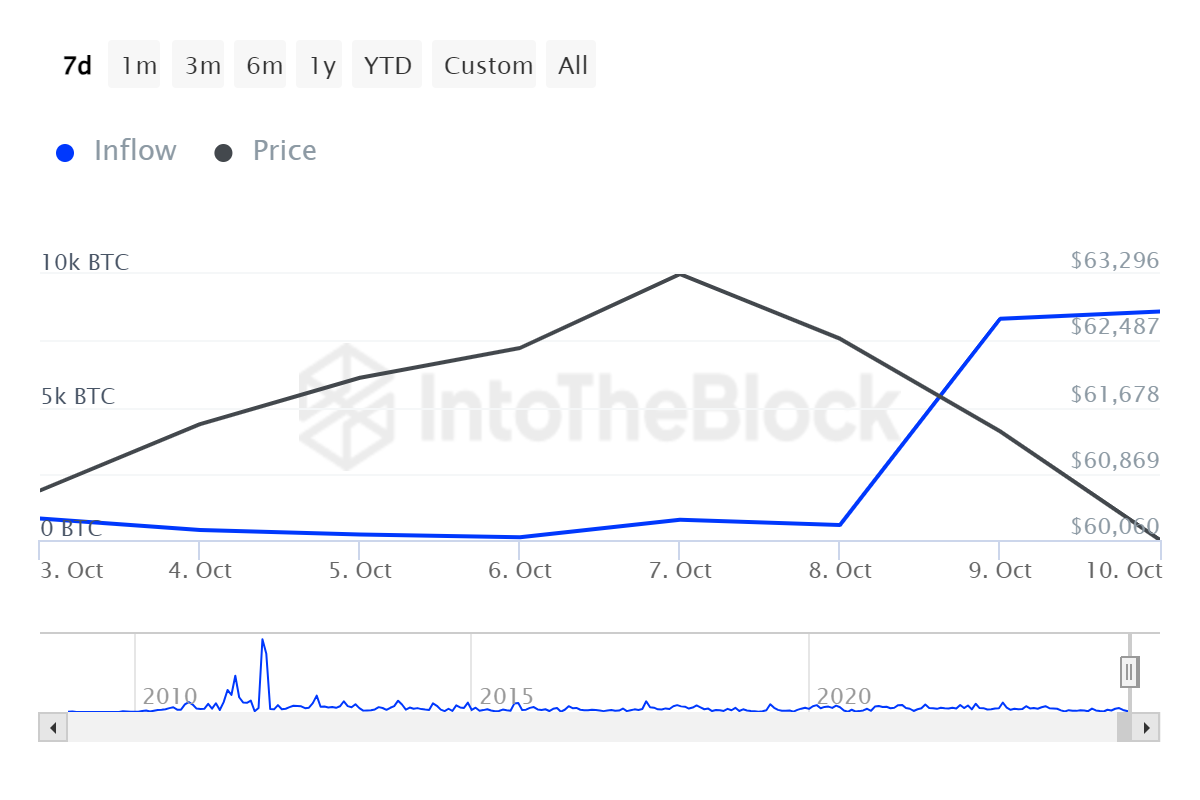

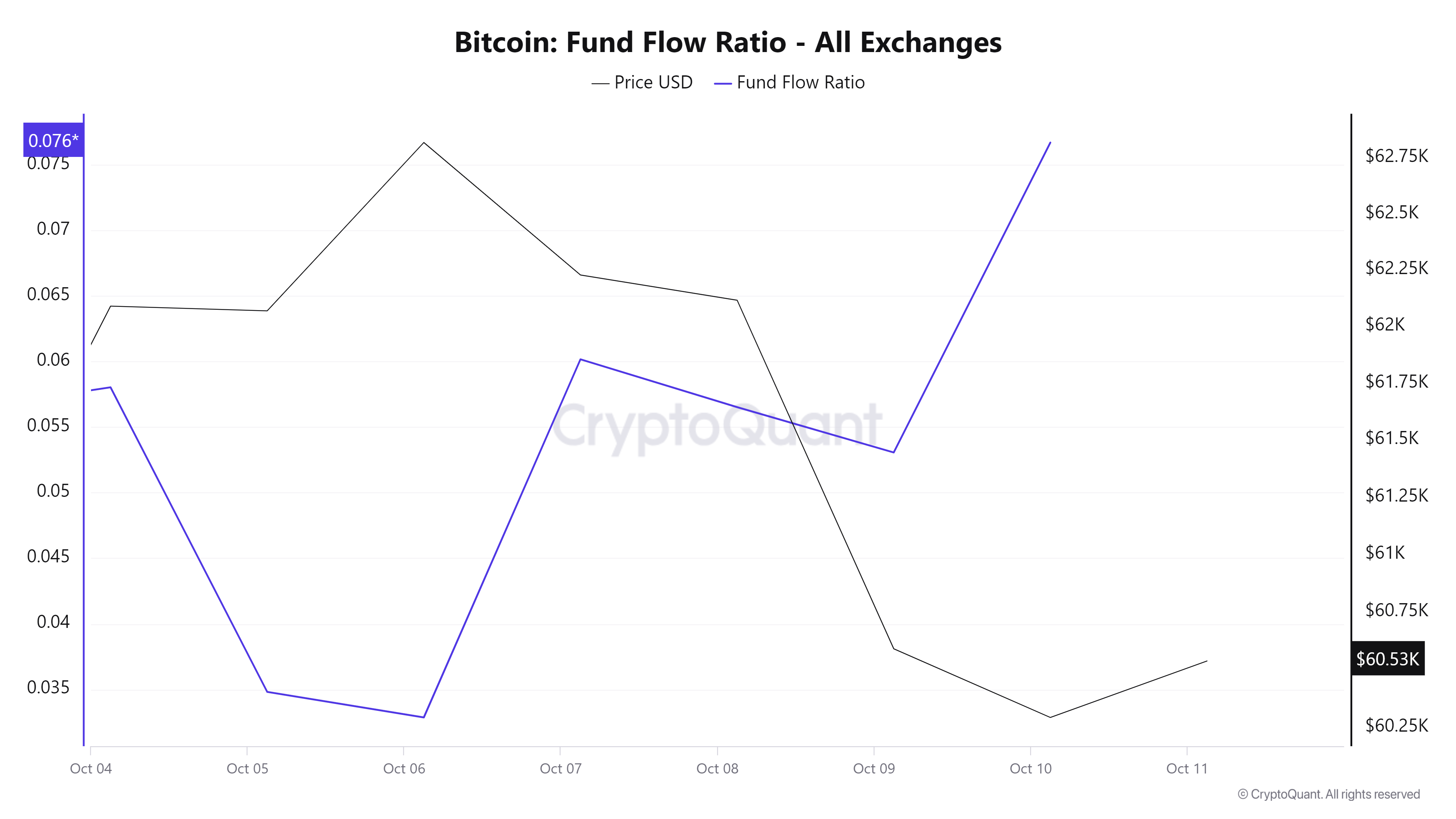

Source: Cryptoquant

Additionally, Bitcoin’s fund flow ratio rose from a low of 0.032 to 0.077, indicating higher buying pressure as investors pour in to buy BTC.

Such behavior is generally associated with bullish market sentiment.

Source: Cryptoquant

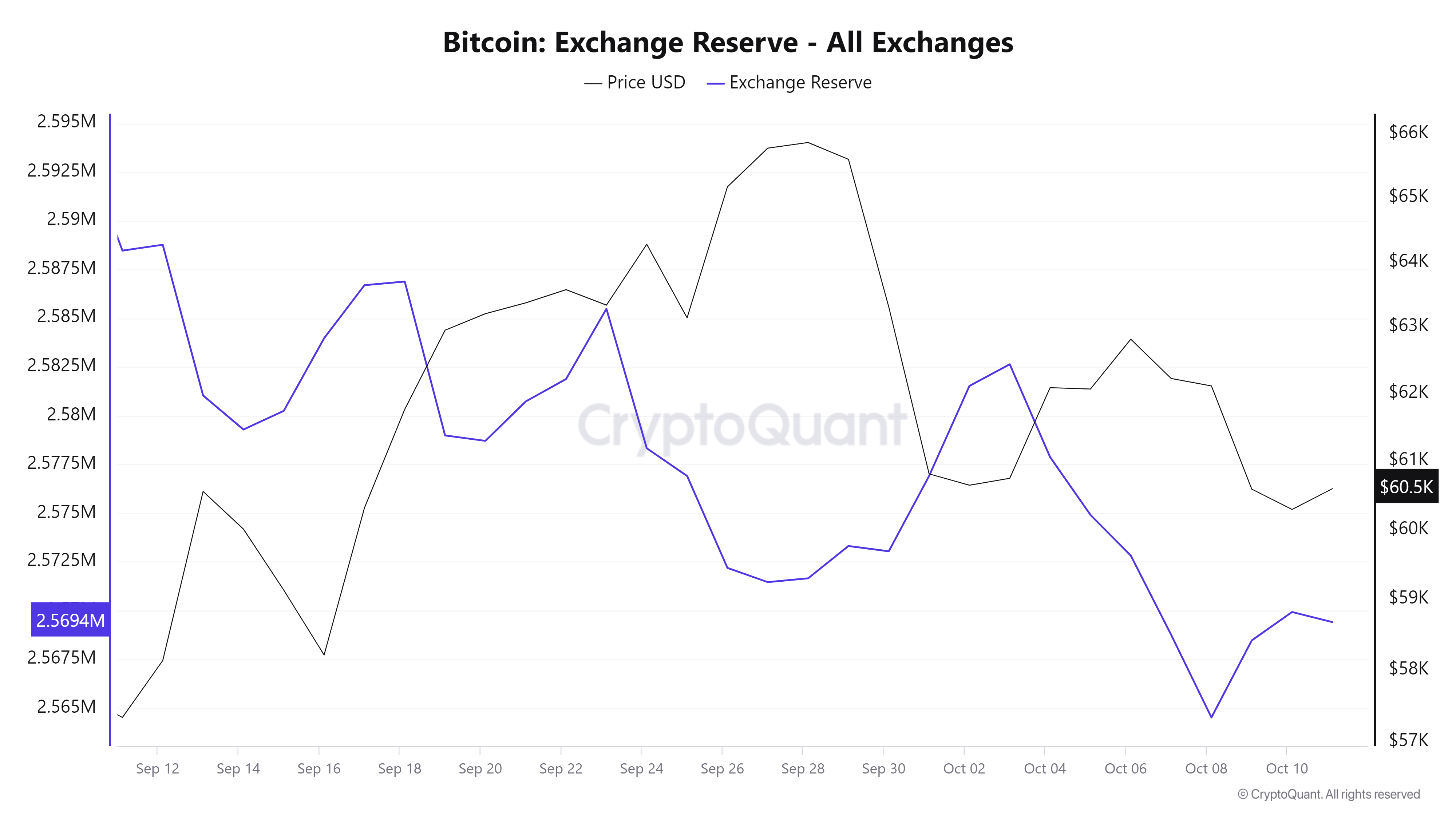

Finally, the Bitcoin reserve also registered a sustained decline over the past month. This refers to a long-term strategy, as investors are less likely to sell their BTC in the short term. Usually this is a bullish signal, as supply on the exchanges decreases, reducing potential selling pressure.

Simply put, the recent downtrend has lost momentum and BTC could be well positioned for further gains. If positive market sentiment continues, BTC will regain the resistance level at $61,875. If this level is not maintained, Bitcoin will fall to $58,272.