- The large size of the options’ expiration on August 16 was preceded by a volatility spike in prices

- Price trends could stabilize from here on out, but the bears still have the upper hand

Data about Bitcoin [BTC] and ether [ETH] The expiration of the options on Friday, August 16 is illuminating. On Wednesday, August 14, BTC prices dropped from $61.8k to $57.9k in just one day.

As a result of the options expiring, market price developments can be seen to stabilize somewhat. Still, technical indicators and liquidity charts showed that a move south could be likely.

Market outlook based on options expiration data

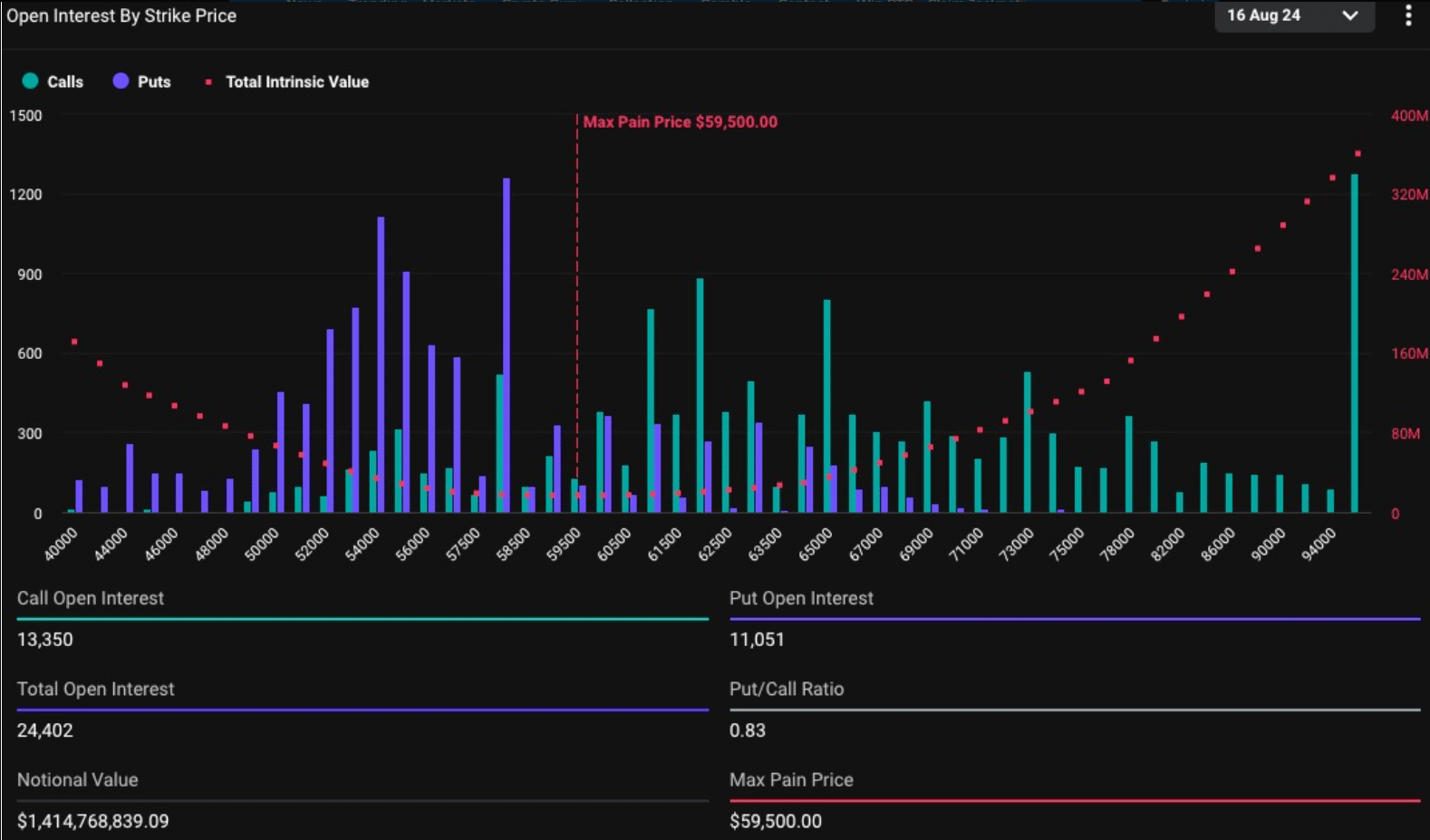

Data from Deribit (via Coingape) showed that the market outlook for both Bitcoin and Ethereum favored the bearish side. For BTC, the notional value of the total Open Interest was $1.414 billion before expiration on Friday.

The put/call ratio of 0.83 showed that market sentiment was somewhat bullish, but trending towards a balanced market sentiment. The maximum pain point was at $59.5k, which underlines the place where most options would expire worthless.

Thursday’s price drop to below $58.5k was not reversed.

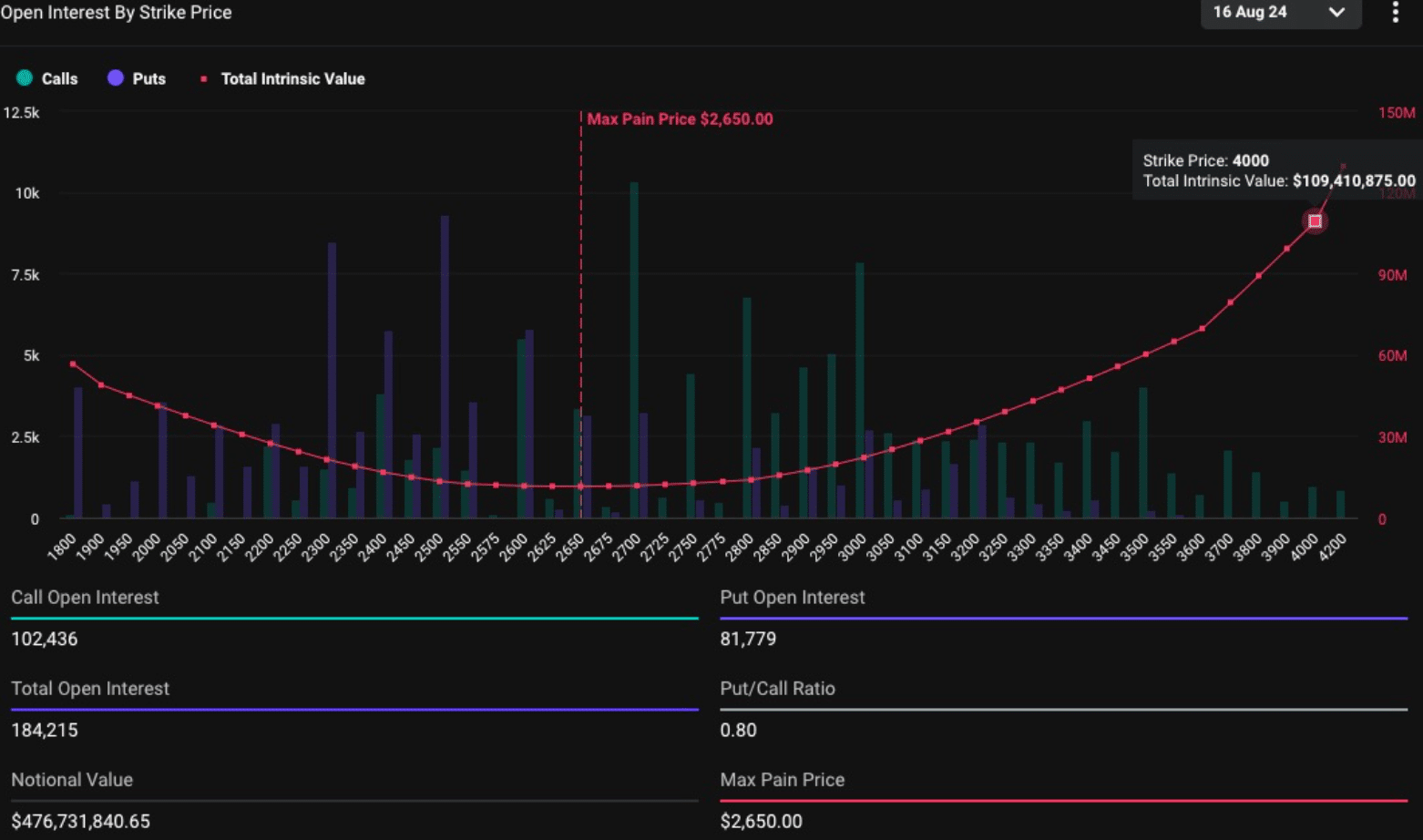

Ethereum options expiration was $476.7 million, and the similar put/call ratio to BTC meant the market was only mildly bullish. ETH remained below $2610, with the maximum pain point at $2650.

BTC and ETH rose 0.8% and 0.4% respectively on Friday, at the time of writing, following the massive options expiration, which caused volatility and a small price drop in the late hours of Thursday.

What next for the crypto markets?

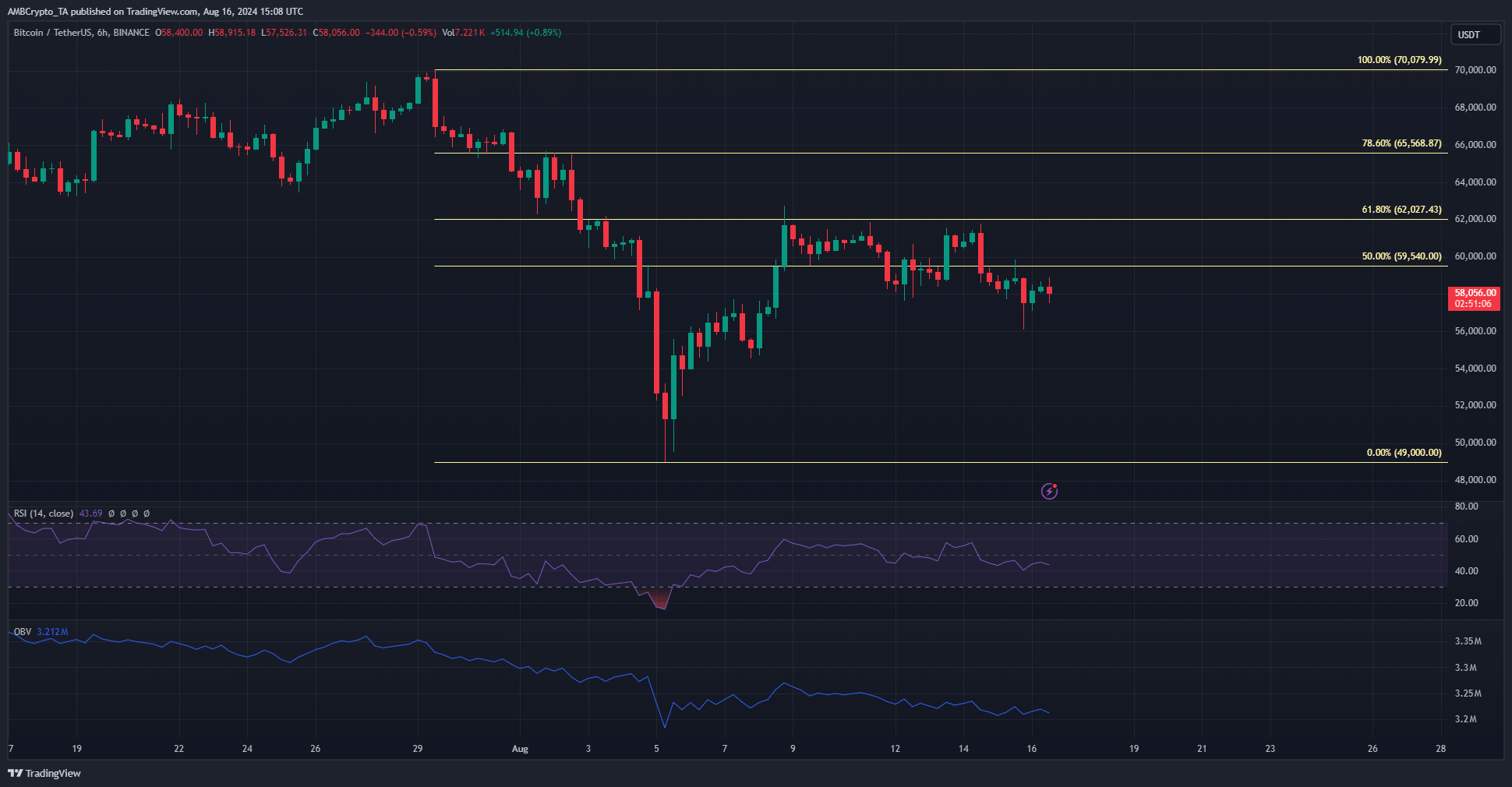

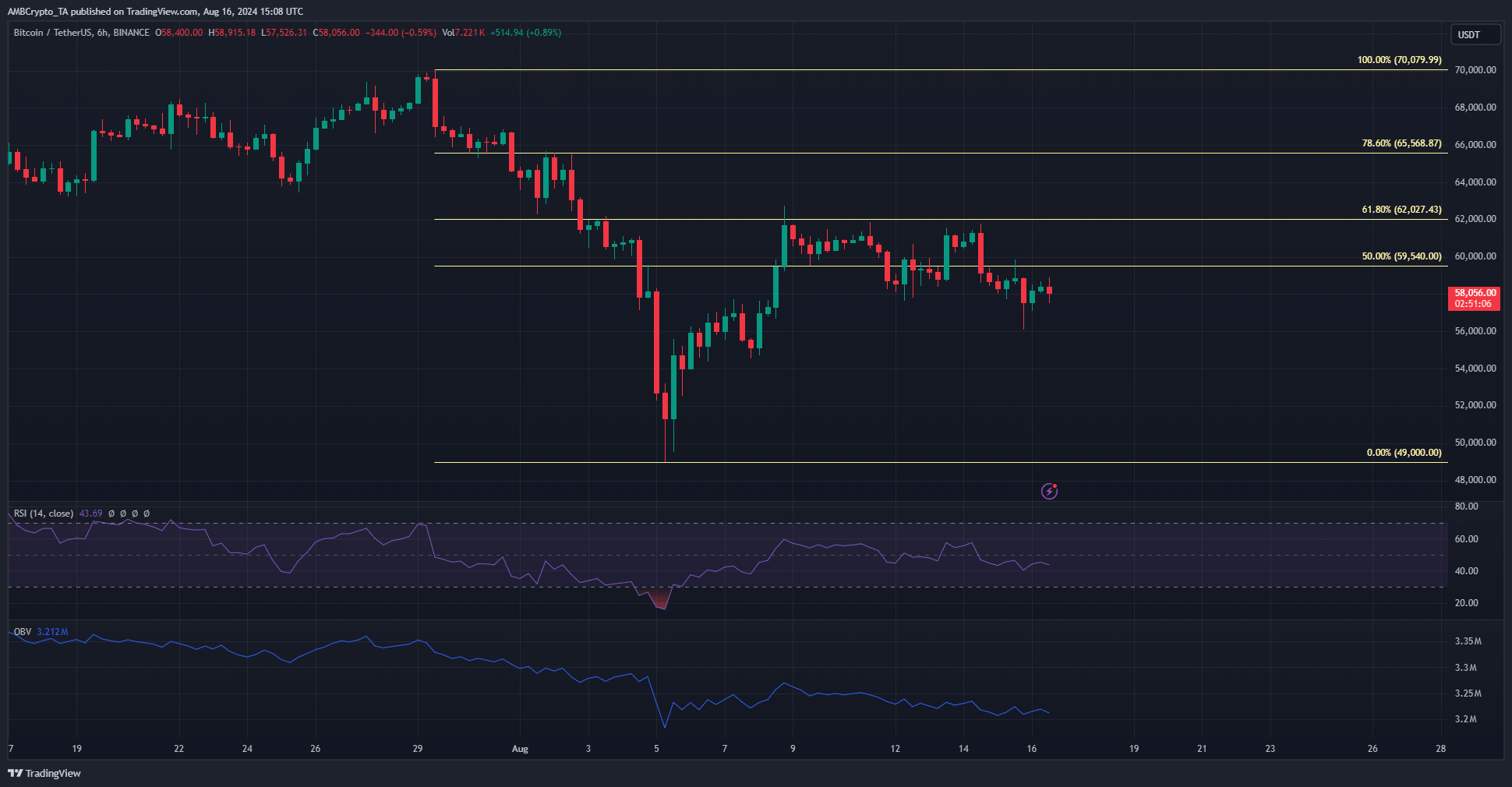

Source: BTC/USDT on TradingView

The next expectation is for volatility to decline, but the trends for both leaders remain bearish. Bitcoin has a bearish market structure and the OBV showed continued selling pressure on the 6-hour chart.

The lack of upward momentum was consistent with the structure and did not promise a turnaround. Ethereum also seemed to have a similar bearish outlook.

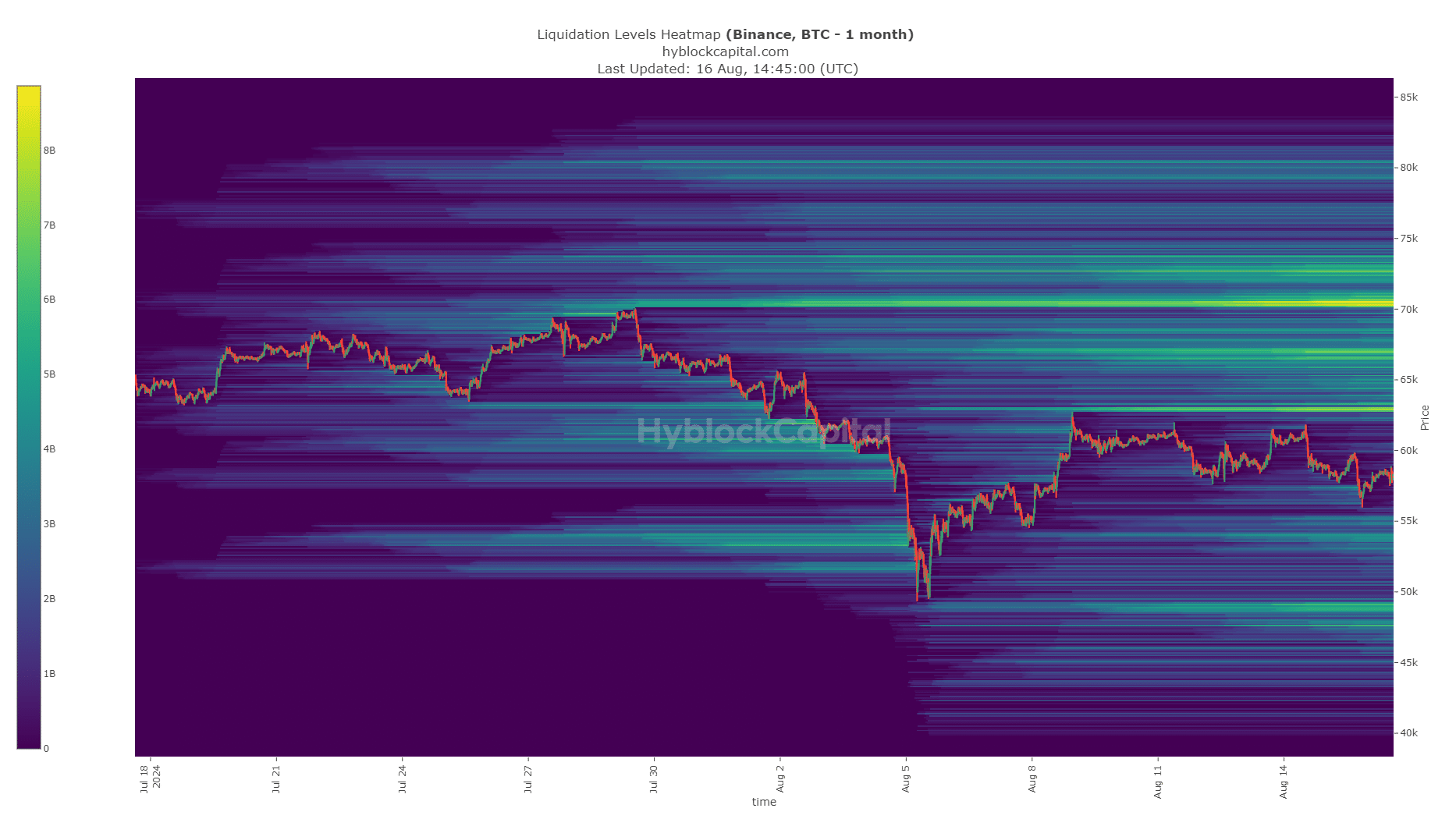

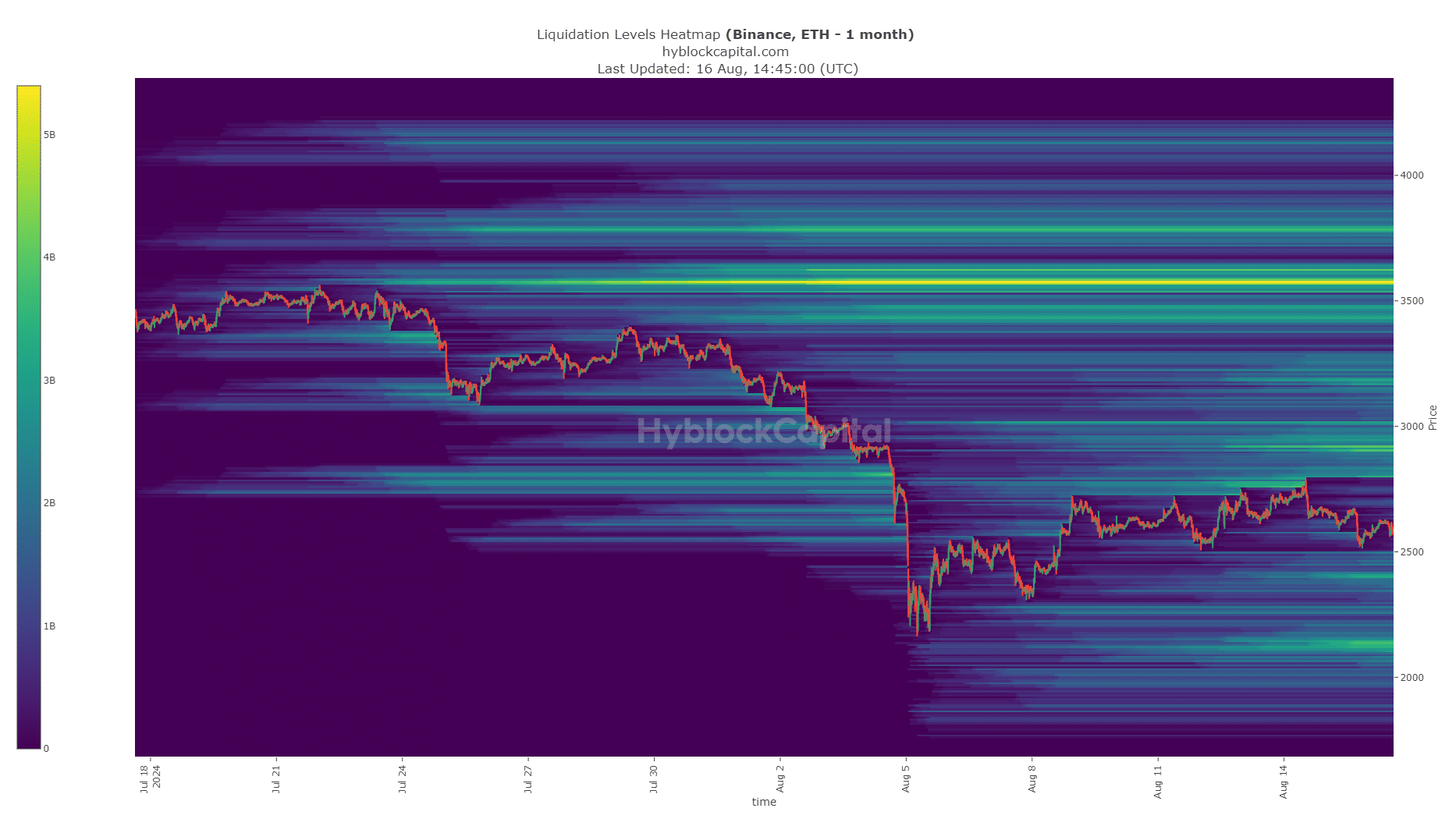

In fact, the liquidation heatmaps showed that the downside targets were closer together, and prices could move there more easily.

For Bitcoin, the nearest liquidity pool was $55.1k, while a similar liquidity pool was also $53.9k. In the North, the $70,000 zone, while full of liquidation levels, may not be reached anytime soon.

For Ethereum, the nearest pocket at the time of writing was $2.4k. The upside target, though less likely, was $2.8k-$2.9k. CPI data showed a 0.2% month-on-month increase in July, but this was in line with market expectations.

Is your portfolio green? Check the Bitcoin [BTC] Price forecast 2024-25

With the odds of a major Fed rate cut lowered, technical, liquidity and macro conditions all appeared to be in the bears’ favor over the next month.