- After falling below the $0.11 baseline, Dogecoin approached a key support range

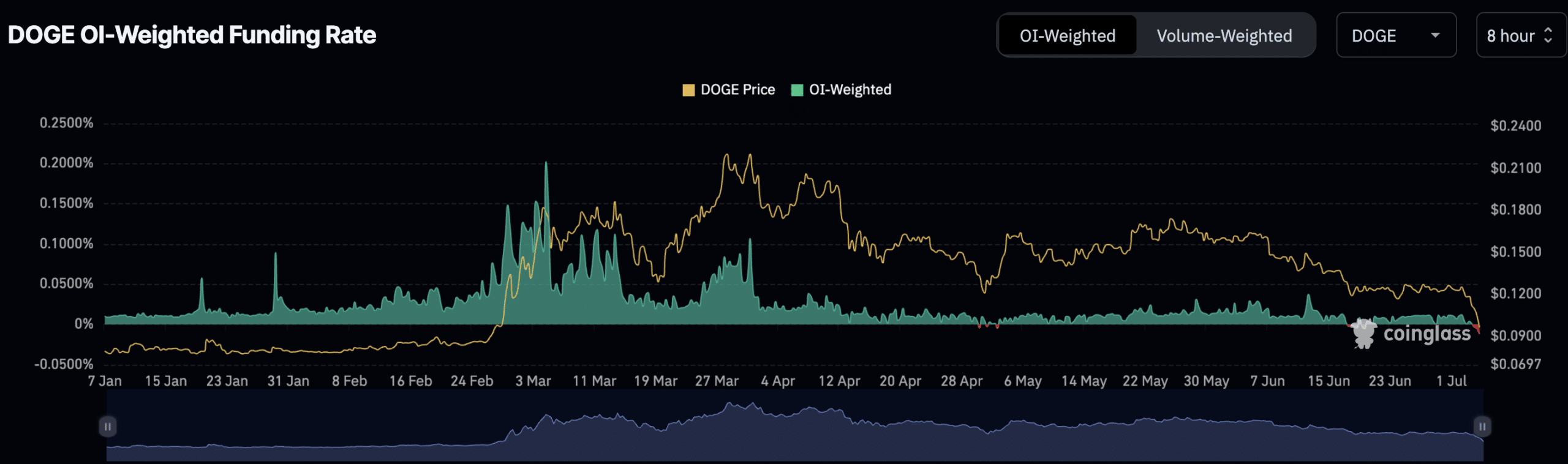

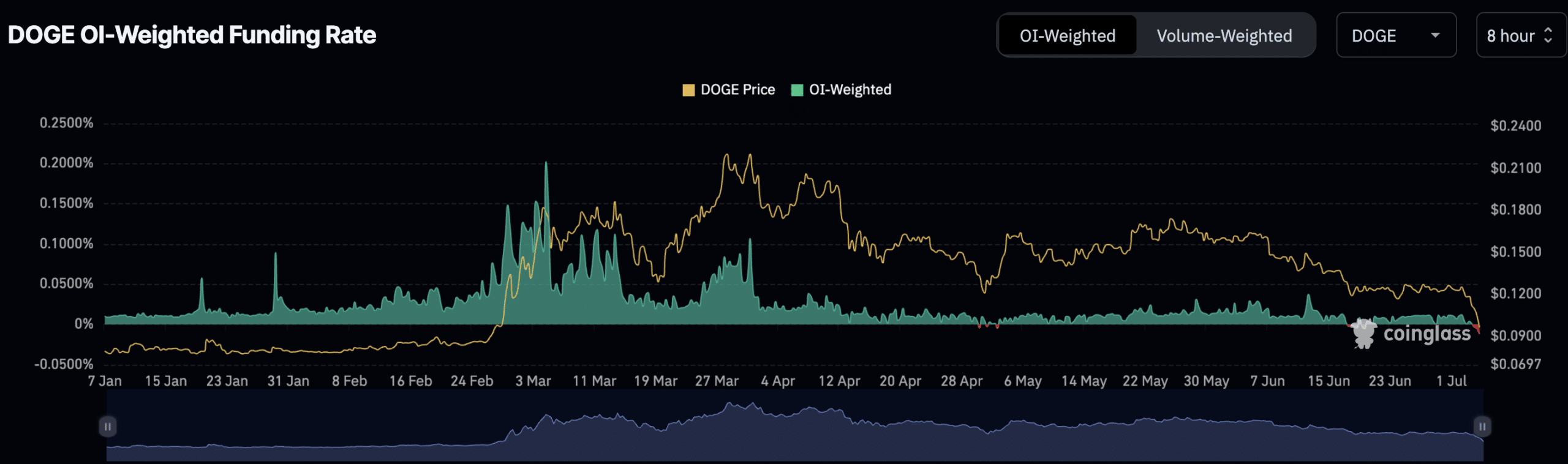

- DOGE’s open interest decline exceeded its daily loss, implying a weakening of bearish momentum

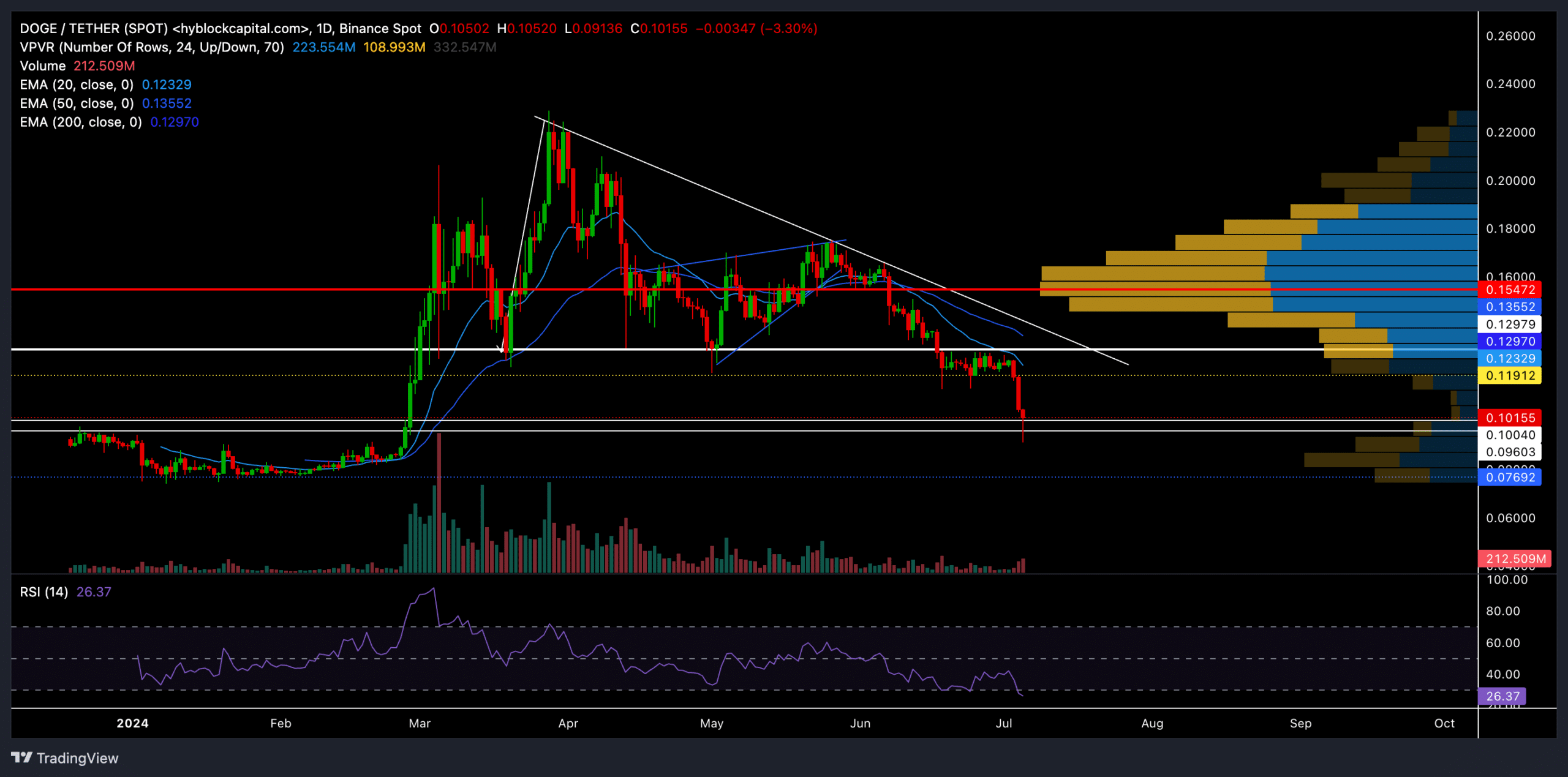

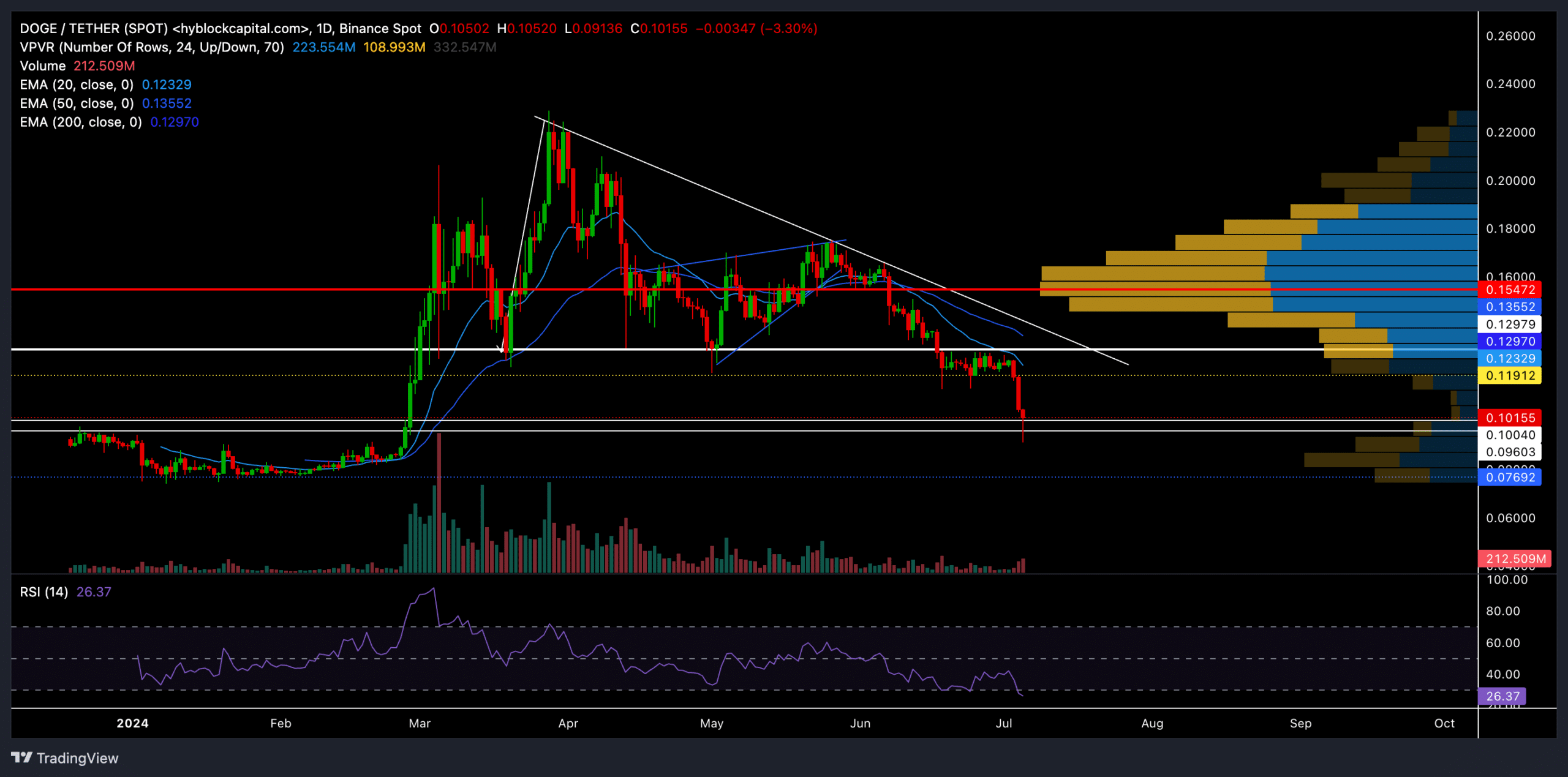

Dogecoins [DOGE] The reversal from the $0.22 resistance level in May this year paved the way for the bears to dominate the market. They set off a series of red candles as the memecoin fell below the 20- and 50-day EMA during this bear run.

As predicted in our previous articleDOGE succumbed further to bearish pressure and fell below the crucial support level of $0.12. A possible reversal of the immediate support range of $0.096-0.01 could stem the bleeding as bulls look to stage a comeback.

At the time of writing, DOGE was trading around $0.101.

Will Dogecoin bears continue put down Busy?

Source: TradingView, DOGE/USDT

The bearish pressure has been quite dominant since the price action returned from the $0.22 resistance point. The memecoin has lost more than 54% of its value over the past three months under this bearish pressure.

During this downturn, the memecoin drew a classic descending triangle structure on the daily chart. After testing the $0.129 level for more than three months, the bears finally triggered a series of red candles below that baseline and confirmed a breakout of a bearish pattern.

The bulls retested this level shortly after this breakout, but the 20 EMA resisted this rally as the altcoin continued its downtrend and approached the crucial $0.01-$0.096 support range at the time of writing.

In the future, this range will be crucial for stopping immediate bleeding. An analysis of the visible volume profile showed that the prevailing price was at the edge of a relatively high liquidity zone. This would mean that bears would likely encounter resistance from bulls for further declines.

As a result, any reversal from the current support range could help the bulls retest the $0.11-$0.12 range. Should the price find a rally above the 20 EMA, it will likely enter a low volatility zone.

On the other hand, any decline below the immediate support range could expose the memecoin to a fairly extended decline towards the $0.08 zone.

The Relative Strength Index (RSI) continued to hover in oversold territory at the time of writing. Any likely reversal from the press time position will confirm the bullish reversal bias.

Open interest fell

Source: Coinglass

According to Coinglass data, DOGE’s open interest has fallen nearly 12% in the past 24 hours. However, price action fell by around 4% during this period, implying a lack of conviction or uncertainty among traders.

Such a scenario often points to a potential reversal or consolidation phase: a phase in which the market could stabilize before taking the next step.