- The price of BTC has risen slightly over the past 24 hours.

- More than $17 billion in BTC has been accumulated in recent months.

Bitcoin [BTC] has entered a phase of reaccumulation as long-term holders (LTH) have been steadily adding to their holdings recently. This move could impact BTC’s price as it struggles to regain the $60,000 price range.

LTHs back Bitcoin

AMBCrypto’s long term holder chart analysis on Glass junction revealed notable trends in Bitcoin ownership.

By early 2024, long-term holders (LTH) held more than 14 million BTC. However, this figure dropped significantly in the first quarter, falling to around 13.35 million BTC in March 2024.

This decline indicated that long-term holders were distributing or selling their Bitcoin, possibly in response to market conditions or to seize profit opportunities.

Source: Glassnode

In March 2024, the trend changed as long-term holders began steadily increasing their Bitcoin holdings. By August 2024, approximately 300,000 BTC were added to long-term investments, marking a phase of reaccumulation.

This suggested that investors had renewed confidence in Bitcoin’s long-term value as they opted to “HODL” rather than sell.

The trend showed a clear upward movement in long-term investments, reflecting strong belief in Bitcoin’s prospects among seasoned investors despite short-term market fluctuations.

Possible implications for future steps

This long-term upward trend in Bitcoin ownership could significantly impact the price of Bitcoin.

As seasoned investors accumulate, increased confidence in Bitcoin’s future value will likely contribute to greater price stability.

This renewed bullish sentiment, often seen among well-informed investors, could precede a potential price increase, reflecting their anticipation of future increases in value.

Moreover, the steady accumulation by long-term holders indicated tighter supply in the market, which could reduce volatility and create a more stable trading environment.

With fewer BTCs available for short-term trading, less dramatic price swings may occur, paving the way for a more sustainable upward trajectory.

This behavior may indicate that the market has bottomed out, with long-term investors positioning themselves for a recovery phase.

Historically, such accumulation phases have led to significant price increases as the dynamics between supply and demand shift in favor of higher prices.

How BTC has developed

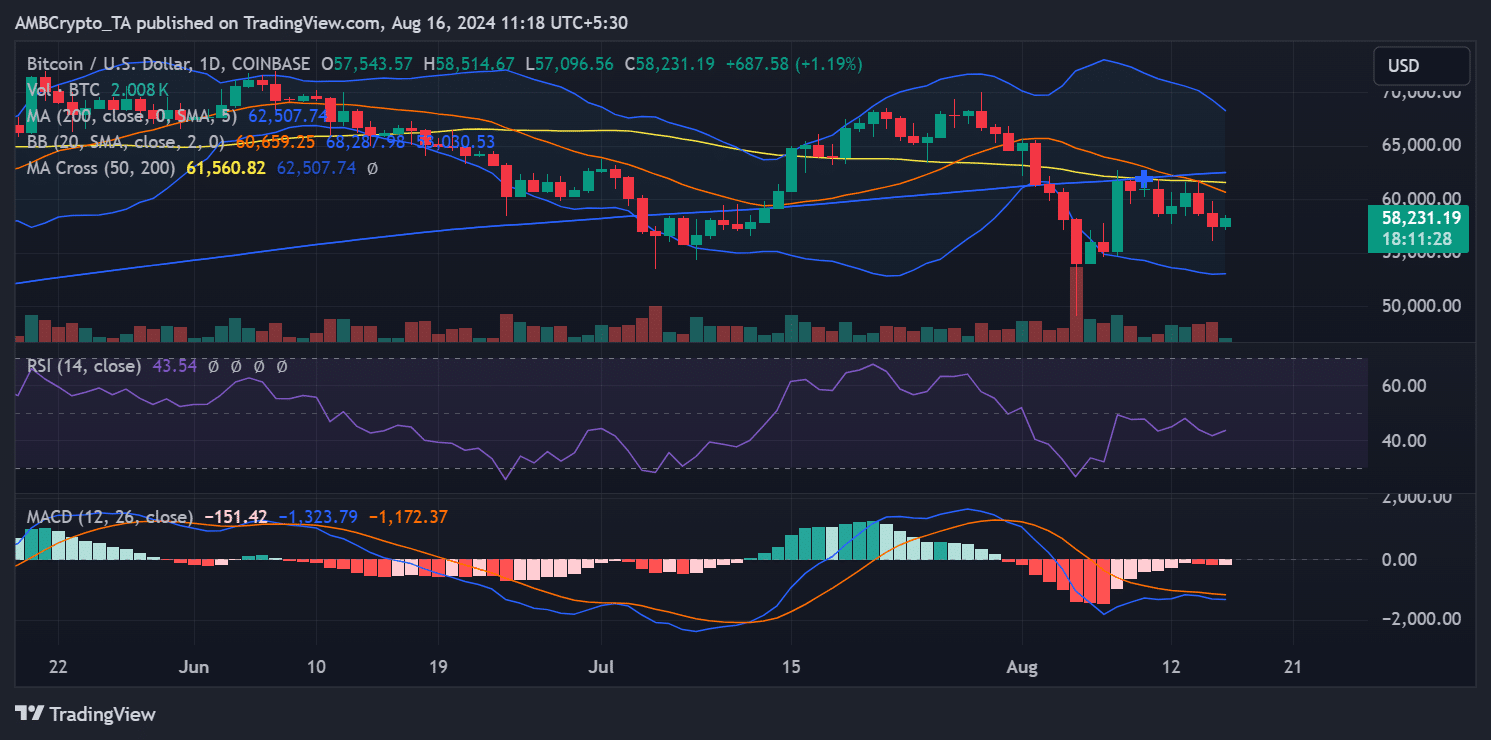

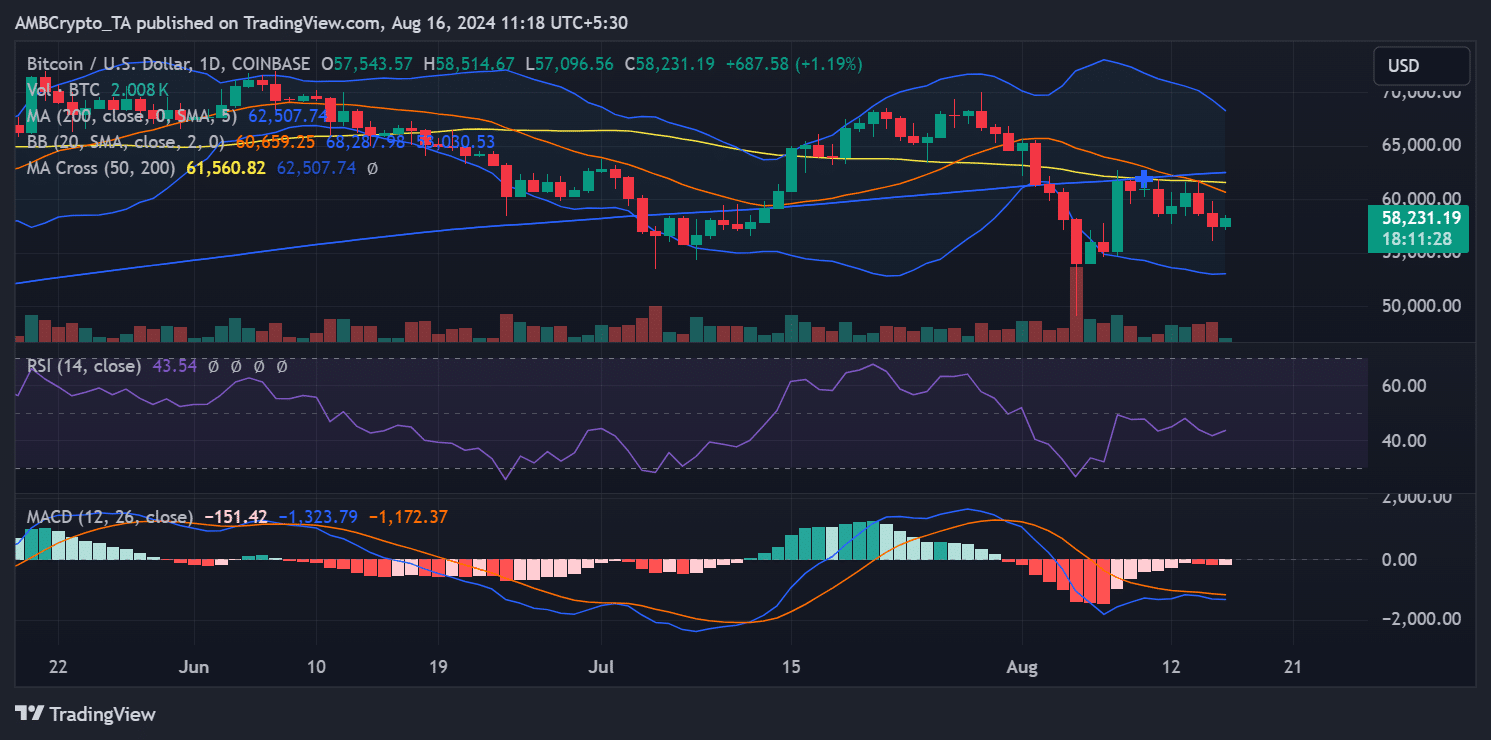

Bitcoin’s press time price was $58,231.19, marking a modest increase of over 1.19% in the last trading session. The Bollinger Bands showed a contraction, indicating reduced market volatility.

At the time of writing, the price was trending towards the mid-band, suggesting the possibility of a sideways move or consolidation. The upper band was $68,287.98, while the lower band was almost $50,030.53.

Furthermore, the Relative Strength Index (RSI) was around 43.54, putting it in the neutral zone but closer to oversold territory.

Is your portfolio green? Check out the BTC profit calculator

THe suggested that Bitcoin may be undervalued, although there is no significant buying momentum yet.

Source: TradingView

Furthermore, the RSI indicated that selling pressure could be nearing exhaustion, with a potential price reversal on the horizon if Bitcoin were to break above the middle Bollinger Band or if trading volume increased.