Monax Labs, a studio that builds tools to address legal loopholes related to NFTshas entered the corporate milieu with solutions to the trend of declining royalties for NFT makers – with a range of products that can help makers enforce payments.

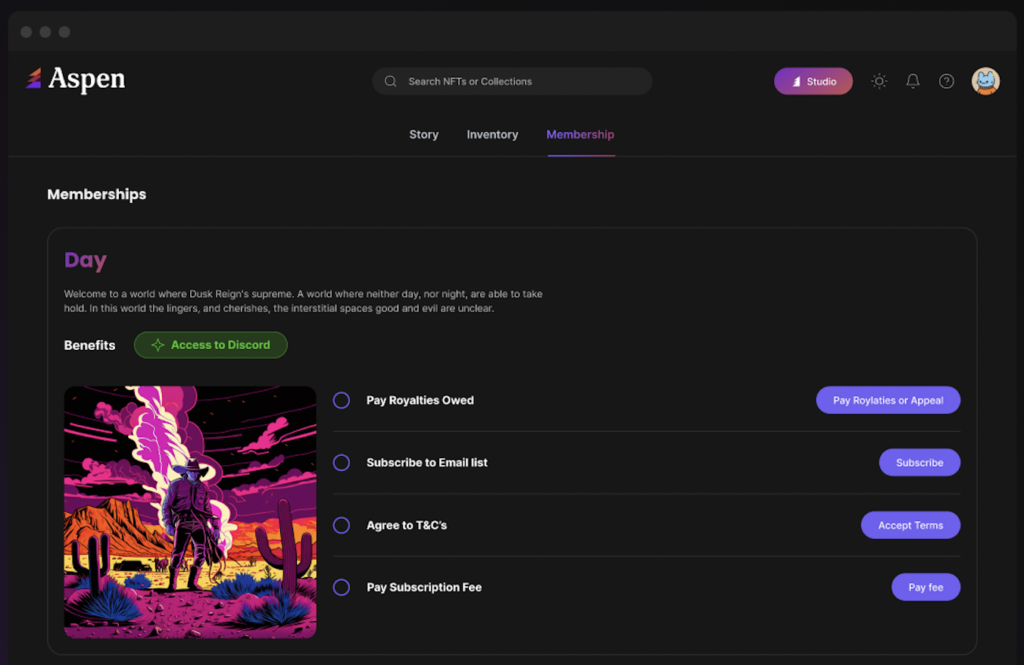

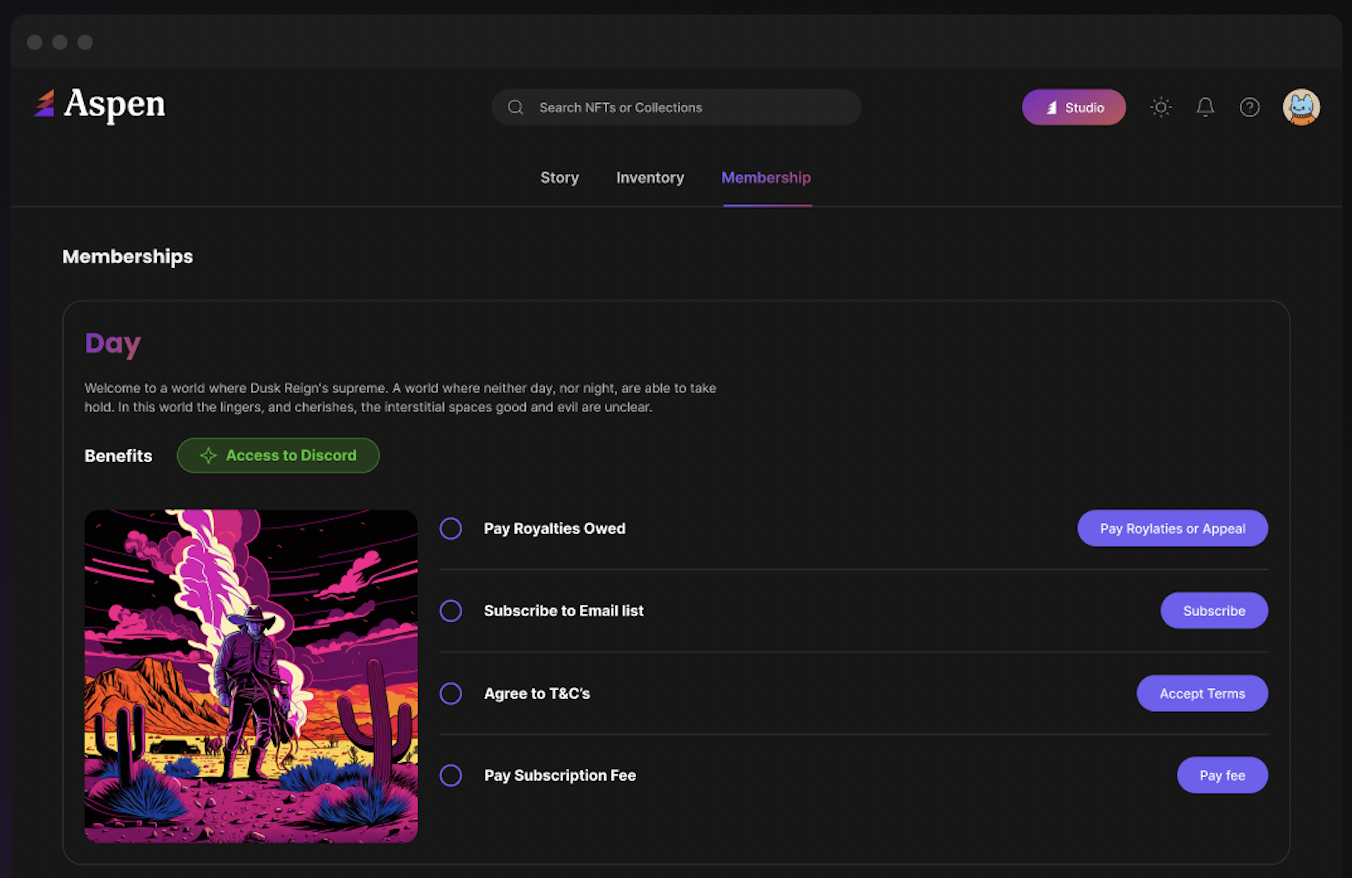

The new membership platform, Esp, provides project creators with a suite of tools for managing royalties, minting, subscriptions, and access to utilities. Aspen is available to the public today after a soft launch period of six months, with tools currently compatible Ethereum NFTs and those on Ethereum scale networks Polygon And Palm.

While Monax admits that it’s technically next to impossible to force an on-chain royalty payment, these new products aim to give project creators control over who can access additional benefits and utilities associated with NFTs, on based on whether buyers in the secondary market have paid maker royalties.

Aspen 🤝 Royalties

Is there a platform where you can allow members of your community to easily pay their royalties no matter where they collect your NFT? https://t.co/yGDvL2ybjD pic.twitter.com/hiF3pNtzCW— Aspen | Web3 Membership Platform (@aspenft) Aug 17, 2023

Royalties were once touted as one of the golden eggs in NFT technology, as creators saw the potential for continued compensation from sales of their work. But while these payments — typically a 2.5% to 10% fee on the secondary sale price — were considered a social norm among NFT collectorsthey could eventually be bypassed.

Many marketplaces no longer enforce royalties. Last month, big marketplace Open sea made paying creator fees optional — the latest step in what some are calling a “race to the bottom” to attract customers. It followed decisions made by marketplaces such as Fade And Magical Eden the past year to no longer strictly enforce royalty fees.

OpenSea makes maker royalties optional for NFT transactions

Aspen’s approach to this problem is to treat royalties as one of the eligibility requirements for access to an NFT’s utility, such as a membership program.

It works by giving makers the tools to track these payments and limiting access to NFT holders who have not paid royalties on a secondary market purchase. But it also allows NFT holders to pay to regain access if they had not initially paid the royalties when buying from a marketplace.

Christina Giannakou, Creative Director at Monax Labs, compares it to a Spotify or Netflix subscription model, although it puts the responsibility on the artist or NFT creator to make sure they offer value in return. Aspen monetizes the tool by charging a commission when creators make money.

An example of the Aspen membership portal. Image: Monax Labs

‘We can see [who has paid]and we’re actually compiling a list of people who either paid royalties on another platform — or came to Aspen and then paid royalties — to access membership and utilities,” Giannakou said.

Monax keeps up with his work Consortium key as one of Aspen’s success stories during the soft launch phase. Consortium Key leverages Ethereum NFTs to unlock tools to maximize crypto market trading efficiency – and sets the creator royalty fee at 7.5% of each secondary sale price. The NFTs are currently starting at a price of 1.5 ETH (approximately $2,450) on OpenSea.

When the companies began working together, Monax Labs claims that Consortium Key’s revenues dropped by 95% due to declining enforcement of NFT royalties. Within the first month of implementing the new program, Consortium Key reached its original revenue target, more than doubling subscriptions. Monax said 90% of Consortium Key holders have now paid their set creator royalties, up from 10% in April.

While Aspen’s model puts utility first rather than art, Giannakou argues that this shouldn’t stop artists from thinking about what other useful utility they can offer their owners. Such benefits may prompt buyers to hold on to their NFTs – or alternatively, potential holders to consider buying in the secondary market.

“In fact, any project can create continuous utility,” she said. “Is there something that you can charge a small amount of money for on an ongoing basis to generate income? I think that ultimately comes down to the project, the individual artist and their brand.”

“The creators are the innovators,” added Giannakou, “and I think if the innovators don’t get paid to innovate, the whole Web3 ecosystem is fundamentally in trouble.”