- Bitcoin’s price drop affected miners, with revenue falling and hashrate rising.

- Retail interest in Bitcoin remained strong amid market swings.

The price of Bitcoin has increased in recent days [BTC] fell significantly, affecting the overall condition of the market. One key area affected by this correction was the Bitcoin mining sector.

Read Bitcoin [BTC] Price forecast 2023-2024

Miner income takes a hit

According to data collected by Glassnode, the miner’s revenue stat plummeted to a 1-month low, dropping to just $169,708.61 at the time of writing. This downward spiral prompted miners to contemplate a crucial decision: keep their BTC holdings or sell them to preserve their profit margins amid this downward price trend.

Such actions, if miners choose to sell, have the potential to put downward pressure on Bitcoin’s value, exacerbating the ongoing market correction.

📉 #Bitcoin $BTC Miner earnings just hit a 1-month low of $169,708.61

The previous 1-month low of $179,351.54 was observed on August 17, 2023

View statistics:https://t.co/UYhnd9eeZH pic.twitter.com/hXbbDPERHl

— glassnode alerts (@glassnodealerts) August 22, 2023

Amidst this evolving scenario, it is imperative to recognize that despite the drop in miner revenue, the overall miner hash rate has been on a steady rise.

While increased hashrate increases network security, it also increases power consumption, and growing competition among miners could potentially consolidate power in the hands of a few prominent mining entities.

Retail remains interested

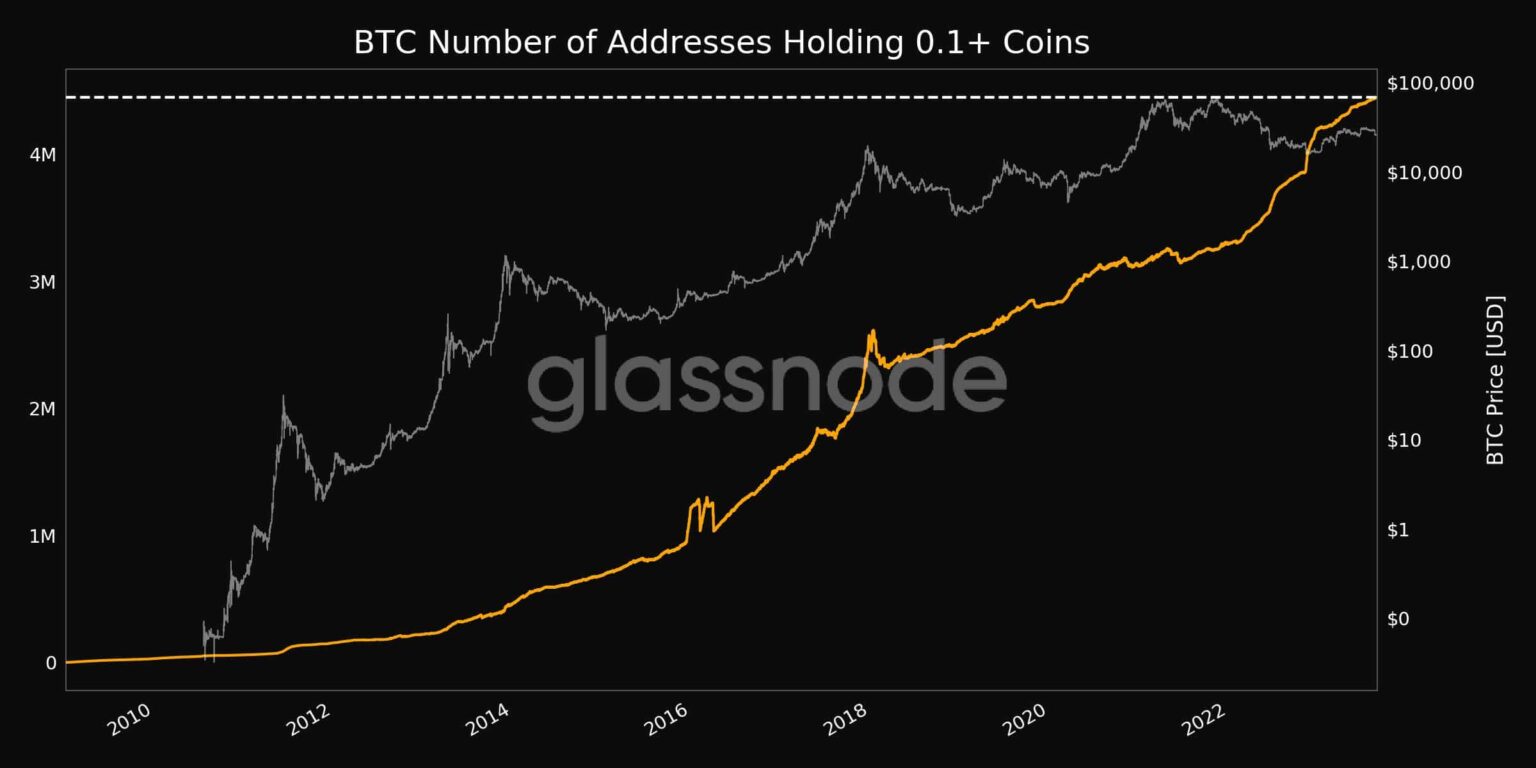

In the midst of this miner dynamic, an intriguing trend persisted. Retail interest in Bitcoin continued to rise. At the time of writing, an important milestone has been reached. A record high of 4,448,542 addresses contained at least 0.1 BTC.

This escalating retail involvement underscored Bitcoin’s enduring appeal as a long-term investment, even amid market volatility.

Source: Glassnode

At the time of writing, Bitcoin was exchanging hands at a price of $26,083.72 and its trading volume has been subdued in recent weeks.

Adding another layer of perspective, Bitcoin’s rate, which denotes the frequency of its transfers, experienced a decline, indicating a reduced frequency of transactions during this period.

Is your wallet green? Check out the Bitcoin Profit Calculator

This could mean that participants are adopting a wait-and-see attitude in light of recent market swings.

Source: Sentiment

Trade sentiment also remained bearish during this period. Short positions accounted for a whopping 51.82% of total Bitcoin transactions. This sentiment emphasized the cautious stance of many traders, who were gearing up for further price declines.

Source: Coinglass