- Approximately 85% of the company’s reserves were held in cash, cash equivalents and other short-term deposits.

- USDT’s circulating supply was up 24% year-over-year.

Leading issuer of stablecoin Tether [USDT] reported net income of $1.48 billion in the first quarter of 2023, a whopping 110% quarter-over-quarter (QoQ) growth, according to the latest certificate report.

Realistic or not, here is USDT’s market cap in terms of BTC

The company behind the world’s largest stablecoin by market capitalization also added that its excess USDT reserves hit an all-time high of $2.44 billion, up $1.48 billion from Q4 2022.

Unbound’

The report, prepared by accounting firm BDO Italia, detailed Tether’s assets as of March 31, 2023.

Tether’s consolidated total assets at the end of the first quarter of 2023 were worth $81.83 billion. And total liabilities amounted to $79.39 billion. Simply put, excess reserve is the difference between total assets and total liabilities

The majority of the company’s reserves were held in cash, cash equivalents and other short-term deposits. This included a higher percentage of allocation to US Treasury Bils, while Gold and Bitcoin [BTC] represented 4% and 2% of total reserves, respectively.

In addition, Tether also stated that it intends to use the Repo market instead of relying solely on conventional bank deposits to fund its operations.

USDT is a fiat-backed stablecoin that holds a reserve of USD as collateral to secure the value of the stablecoin.

USDT’s dominance is growing

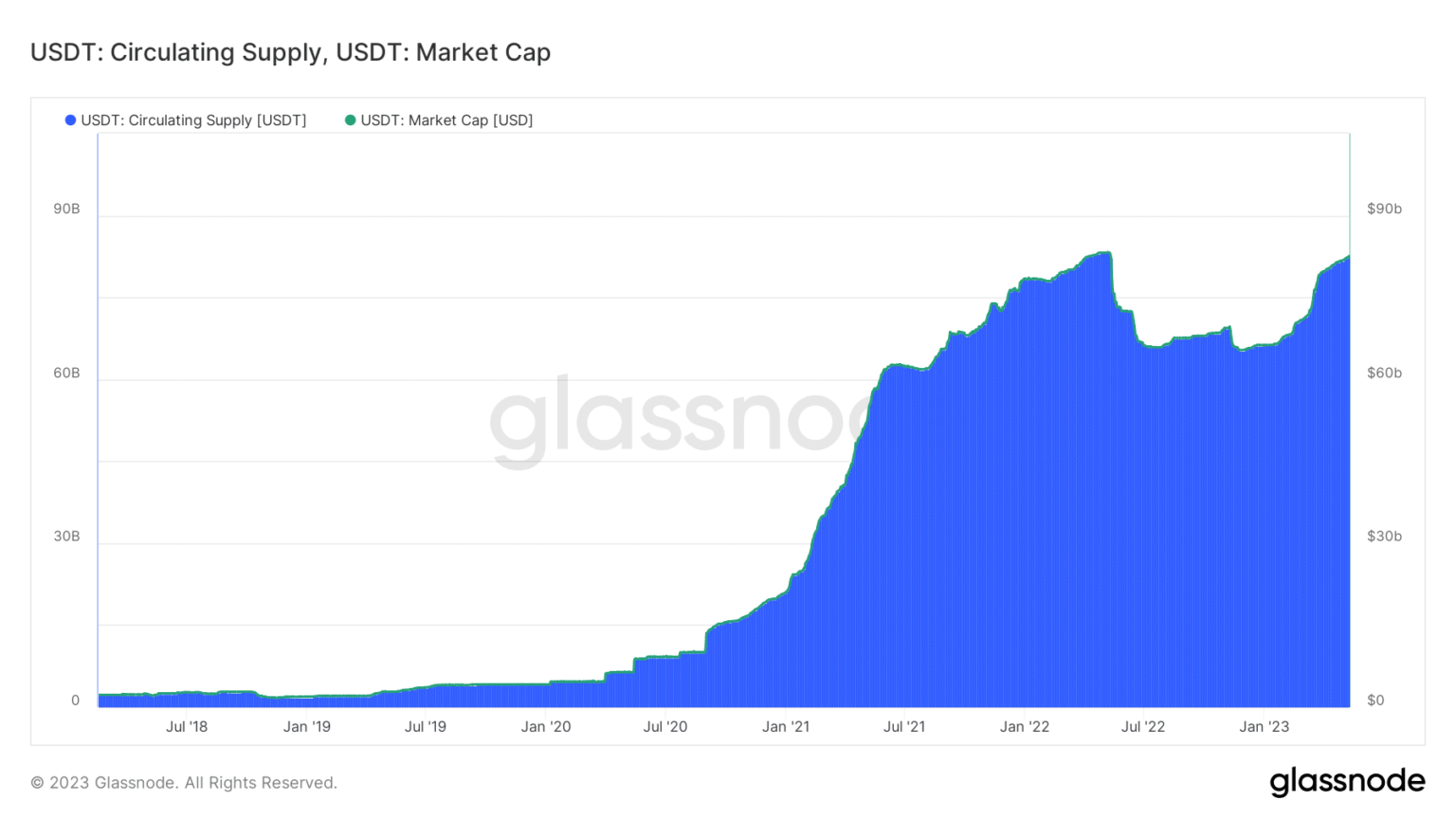

USDT experienced a blockbuster in 2023 with a sharp increase in circulating supply over the past three months. According to Glassnode, there were over 82 billion USDTs in circulation at the time of writing. This reflected a 24% year-over-year gain.

In addition, the increase in supply increased the market value of the stablecoin, as it was the third highest ranked cryptocurrency by market capitalization. CoinMarketCap.

USDT was the most traded cryptocurrency in the market at the time of writing with a 24-hour trading volume of over $32 billion.

Source: Glassnode

Much of the USDT’s success was due to the demise of popular stablecoins such as USD Coin [USDC] caused by the collapse of Silicon Valley Bank (SVB) in March. USDT saw huge trading volumes as people migrated from USDC.

Therefore, USDC’s market cap fell from $43 billion to $30 billion at the time of writing, down 31%.

Source: Glassnode