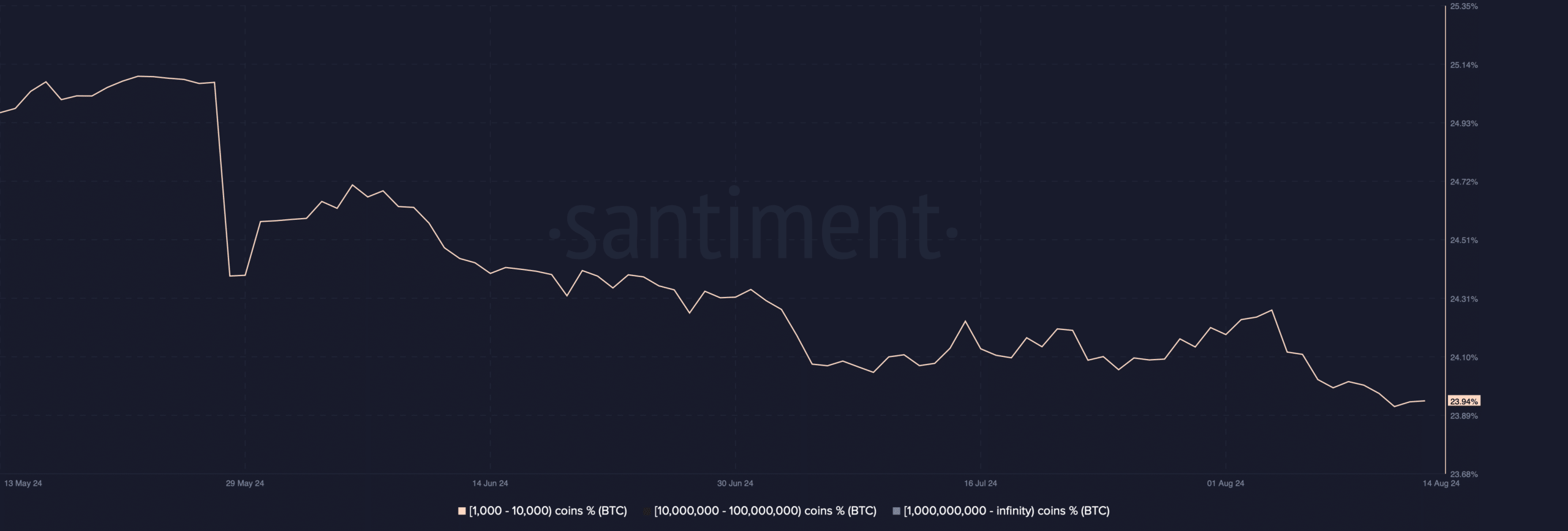

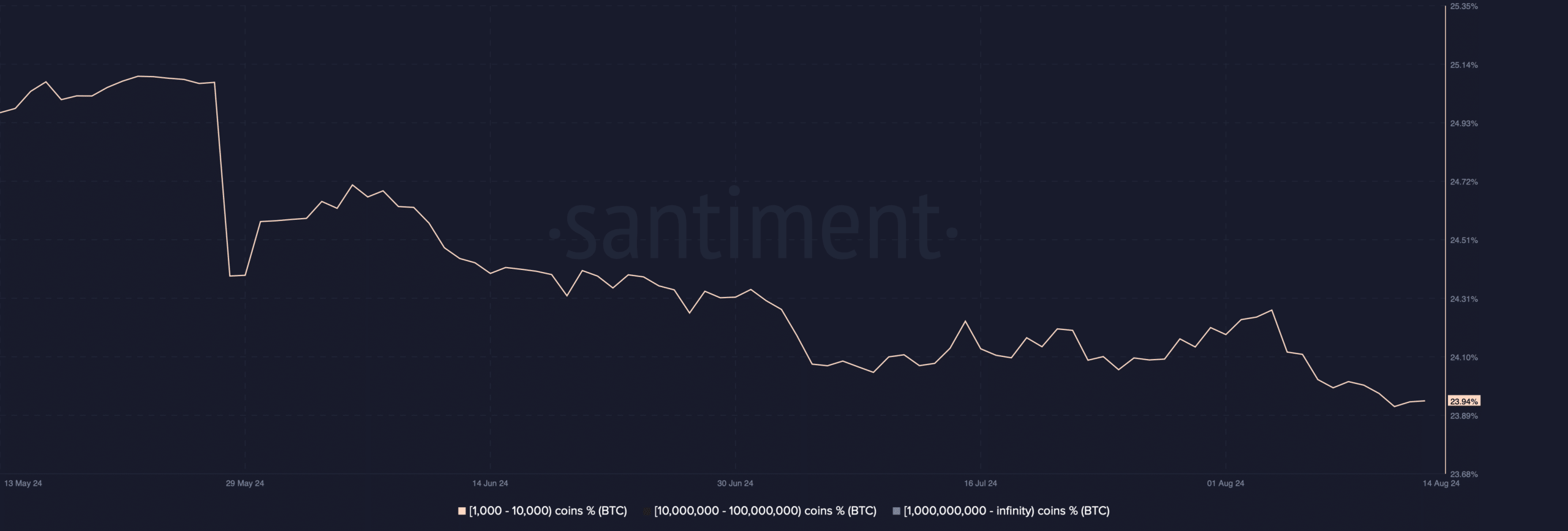

- The number of BTC addresses holding 1k-10k BTC has decreased over the past three months.

- Market indicators and benchmarks remained bullish, indicating continued price appreciation.

Bitcoin [BTC] Bulls have remained dominant in the market over the past seven days. However, as BTC’s price gained momentum, the whales chose to sell a substantial portion of their holdings.

Does this mean that BTC will soon fall victim to a price correction?

Bitcoin whales are being sold

CoinMarketCaps facts revealed that the price of BTC has risen by more than 6% in the past seven days. In the last 24 hours alone, the king of cryptos witnessed an increase in value of over 4%.

At the time of writing, BTC was trading at $61,298.02 with a market cap of over $1.2 trillion.

AMBCrypto found that as the price of BTC rose, deep-pocketed players in the crypto space opted to sell their BTC holdings.

Our analysis of Santiment’s data showed that the number of BTC addresses holding 1k-10k BTC has fallen dramatically over the past three months.

Source: Santiment

Ali, a popular crypto analyst, recently posted one tweet highlighting the same story.

According to the tweet, some of the biggest Bitcoin whales have sold more than 10,000 BTC in the past week, worth about $600 million.

This suggested that BTC whales did not have confidence in the coin and expected the price to drop in the coming days.

Will the price of BTC be affected?

Although whales were sold, buying sentiment was generally dominant in the market. AMBCrypto reported previously that Bitcoin’s foreign exchange reserves were as low as they were in 2018.

This indicated that buying pressure on the currency was increasing. Our look at CryptoQuant’s data revealed quite a few bullish statistics.

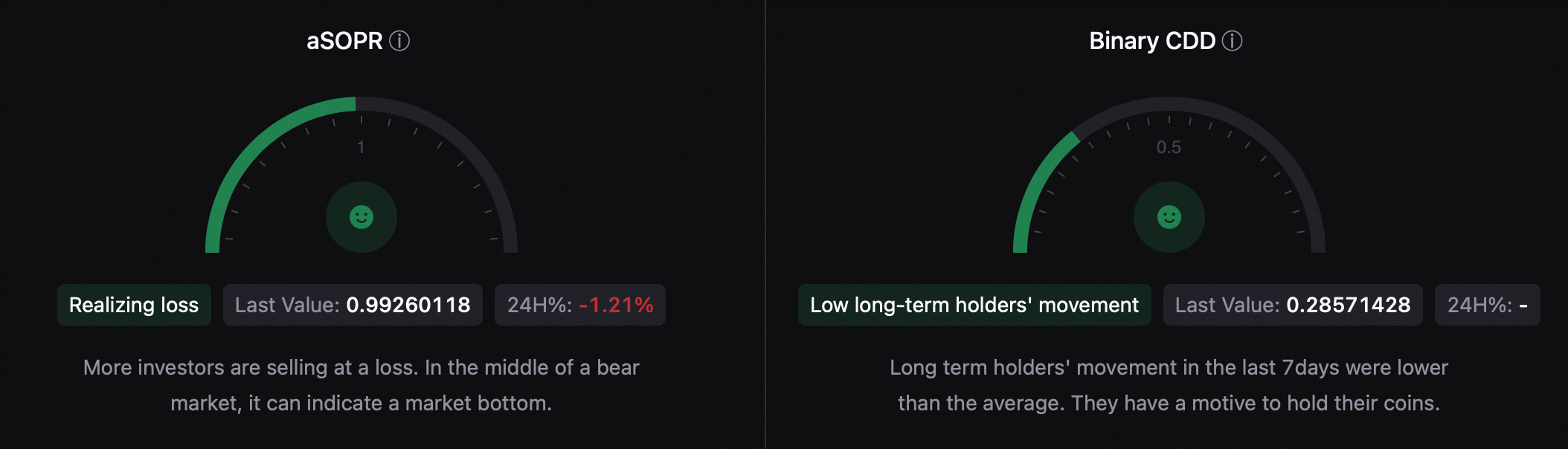

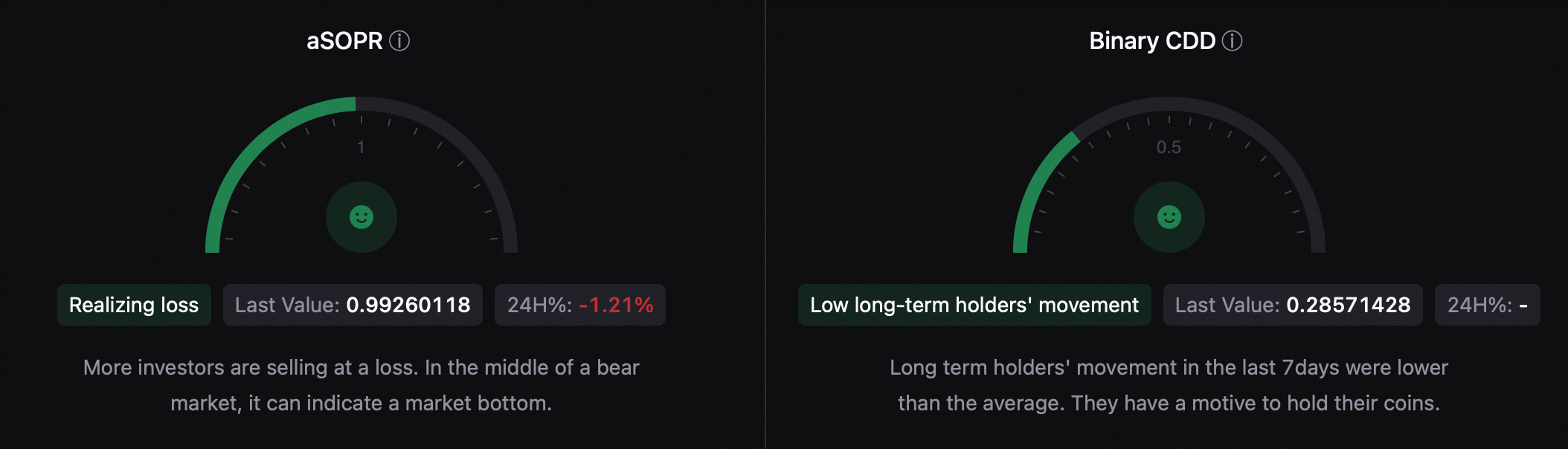

For example, BTC’s aSORP was green, meaning more investors were selling at a loss. In the middle of a bear market, this could indicate a market bottom.

Also, the Binary CDD suggested that the movement of long-term holders over the past seven days was lower than the average. Both indicators suggested that BTC could continue its upward price movement.

Source: CryptoQuant

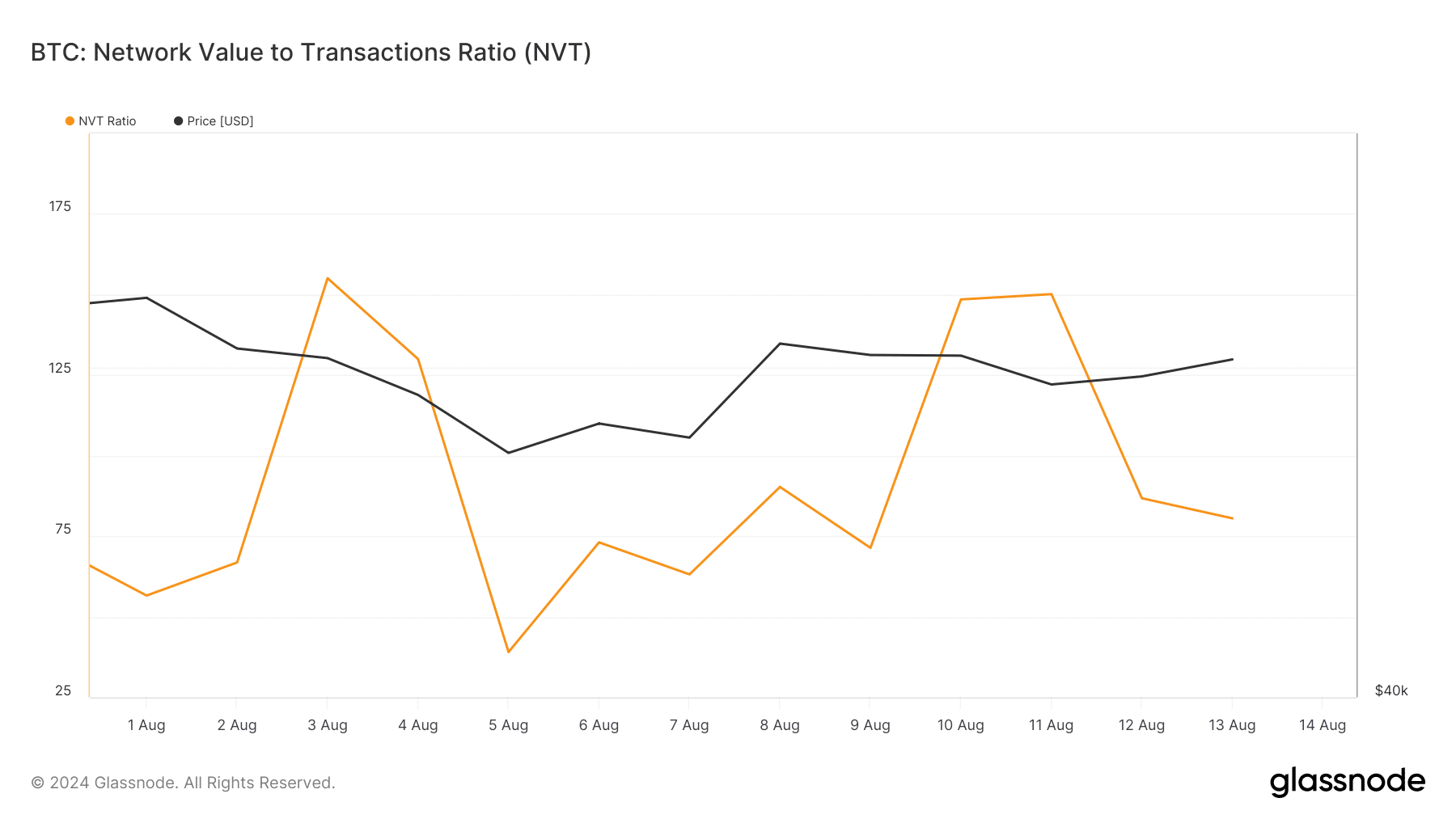

Apart from this, upon checking Glassnode’s data, AMBCrypto found that BTC’s NVT ratio had also fallen. In general, a decline in the benchmark means an asset is undervalued, signaling a soon rise in price.

Source: Glassnode

Is your portfolio green? View the BTC profit calculator

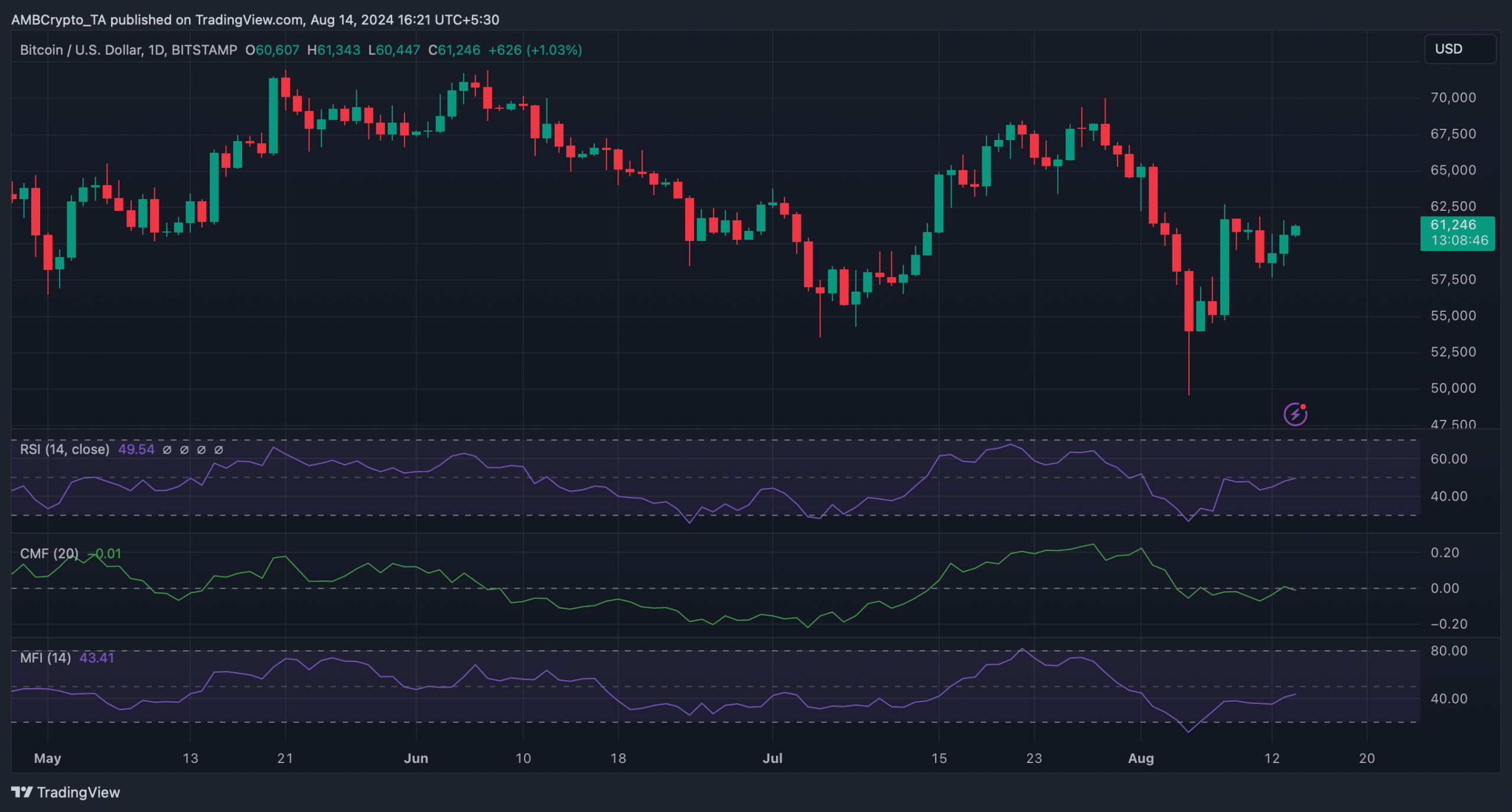

We then reviewed Bitcoin’s daily chart to better understand which direction BTC was planning to go. The technical indicator Relative Strength Index (RSI) gained momentum.

Similarly, the Money Flow Index (MFI) also registered an upswing, indicating continued price appreciation. Nevertheless, the Chaikin Money Flow (CMF) turned bearish as it fell slightly.

Source: TradingView