- The Bitcoin 2024 conference brought BTC close to $70,000 again.

- The whales seem to have come to a standstill as the bulls wait with bated breath for BTC’s next moves.

Bitcoins [BTC] Its dominance increased as King Coin started the week with a strong bullish bid targeting $70,000.

This bullish performance builds on the Bitcoin 2024 conference hype and politically charged excitement that prevailed over the weekend.

The Bitcoin 2024 conference had a huge impact on demand, and especially on Bitcoin’s dominance.

The latter has been on the rise since mid-July, reaching a peak of 56.76%, just a few points away from hitting a new three-year high.

Bitcoin’s dominance peaked at 57.03% in April 2024. The last time it was this high was in April 2021.

Source: Tradingview

Will the FED’s upcoming announcement further Bitcoin’s dominance?

A major announcement from the Federal Reserve is just days away, another factor that could push Bitcoin’s dominance to new highs in 2024. The FED will announce this next interest rate decision on July 31.

Market sentiment showed that 96% of analysts expected interest rates to remain unchanged in August.

Source: Tradingeconomics.com

Risky assets like Bitcoin would experience strong demand if the FED were to announce a rate cut. If rates remain unchained, the Fed’s announcement may not have much impact on asset prices.

Market sentiment is largely in favor of a 25 basis point rate cut in September.

More market confidence?

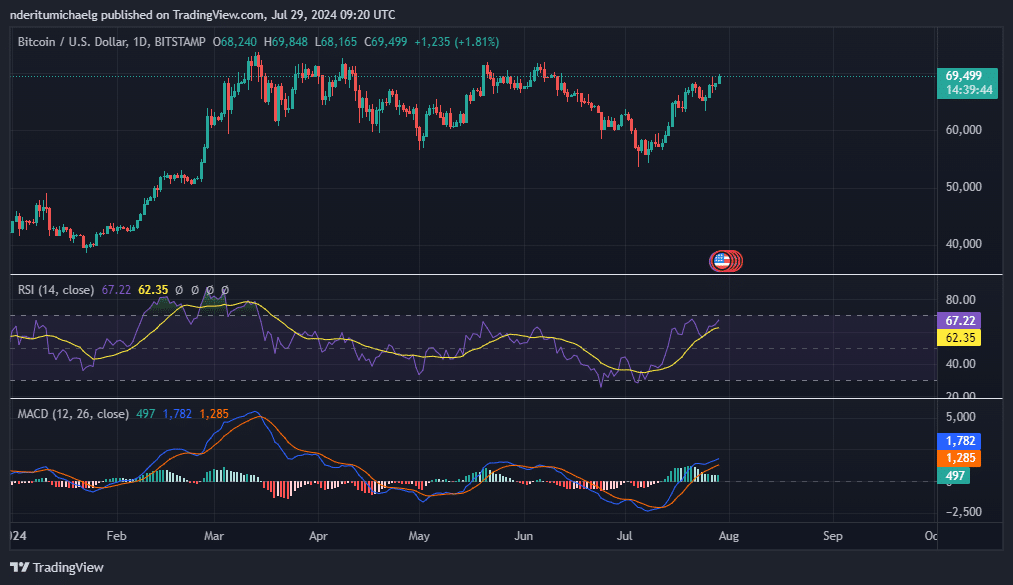

Bitcoin was trading at $69,503 at the time of writing, after rallying 1.81% in the past 24 hours. AMBCrypto is eager to see if it can generate enough bullish confidence to break above $70,000.

This is an important price point as BTC has been experiencing resistance and a resurgence of selling pressure above this zone since March.

Source: Tradingview

On the technical side, a rise above $70,000 will also subject BTC to overbought conditions, according to the RSI. The MACD was already suggesting that bullish momentum was slowing as of press time.

These observations, along with the emerging resistance zone, pointed to the potential for a pullback fueled by short-term profit-taking.

However, the long-term outlook remained bullish, especially after the Bitcoin conference. The excitement surrounding the event has created more confidence in other markets.

For example, Japanese company Metaplanet has reportedly purchased Bitcoin worth over 1 billion yen.

Shares of Metaplex are reportedly up more than 1,300% this year. A significant portion of the stock price gains occurred in July, as the company ramped up its Bitcoin purchases in July. At the time of writing, it held 246 BTC.

While this underlines some market confidence, Bitcoin’s ability to rise above its current resistance zone depends on the level of demand it can maintain above these levels.

Read Bitcoin’s [BTC] Price forecast 2024-25

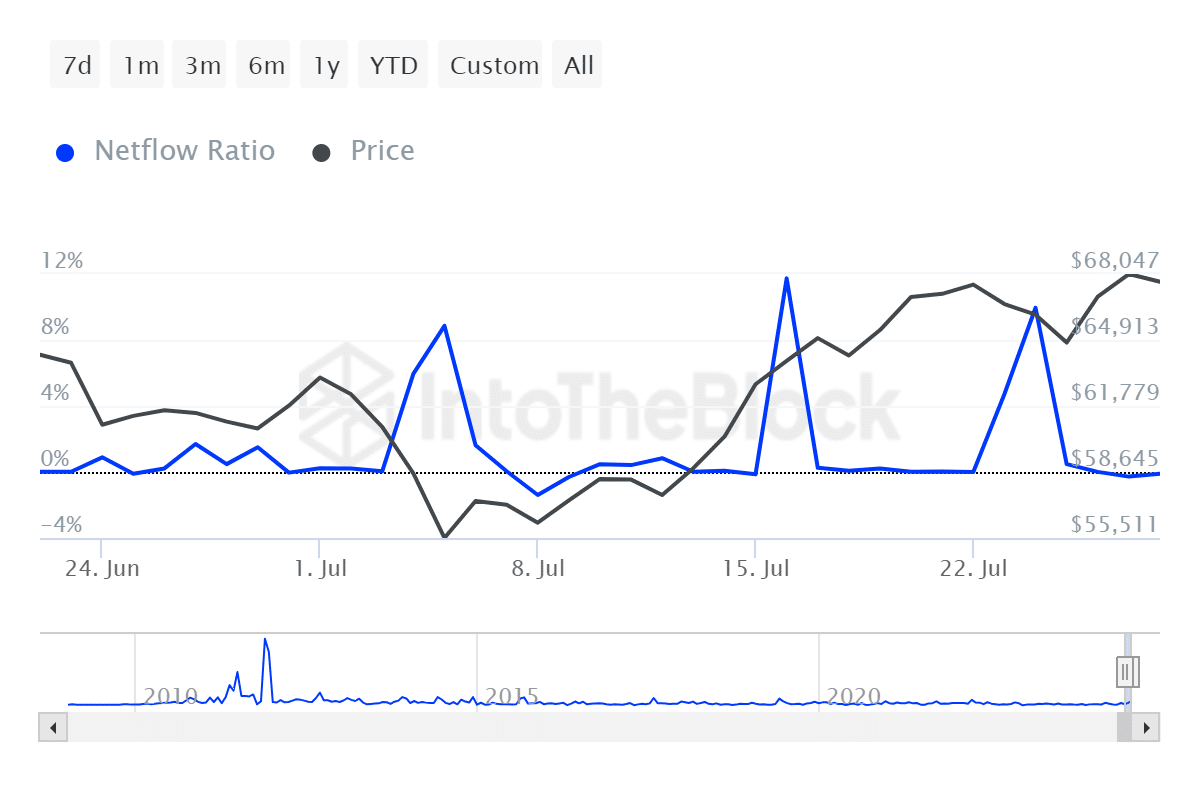

The net to net flow ratio of large holders of Bitcoin indicated that whales may not move much of their money so far.

AMBCrypto will continue to monitor this indicator to assess the potential flows that could influence Bitcoin’s dominance and price in the coming days.

Source: IntoTheBlock