Bitcoin proponents have reason to be cheerful as the alpha coin has gracefully ascended to a promising coin valuation of almost $38,000 as of late Wednesday, the country has reclaimed its throne with the highest value in the past twelve months.

Bitcoin bounced back strongly from the previous day’s blow, coming within striking distance of a new 18-month high, just below its vaunted price target.

A drop in federal interest rates, expectations that Sam Bankman-Fried’s apology for his actions at FTX will be a fresh start for the ailing sector, and the SEC’s approval of a bitcoin exchange-traded fund (ETF) are among the things that caused prices to rise.

ETFs are a type of investment product that tracks an index or commodity. Bitcoin ETFs would allow investors to benefit from the rising value of bitcoin without actually owning any bitcoin.

ByteTree pointed out that Bitcoin is far outperforming standard assets such as gold and US stock indices, which are also rising.

Reports say a decision could create $600 billion in additional demand. An ETF approval will increase Bitcoin’s market cap by $1 trillion, according to CryptoQuant experts.

Bitcoin is up 117% this year

As this has developed, Bitcoin has seen a significant increase in value of over 117% over the course of this year. The anticipation of the halving in 2024 has also contributed to increased market optimism.

The price of Bitcoin (BTC) is rising as people try to make up all the ground they lost during the recent crash, which wiped out up to $90 million in open interest.

At $34,572, the 25-day Exponential Moving Average (EMA) comes into view. BTC is trying to get back above the important support level at $36,788.

BTCUSD trading at $37,379 on the daily chart: TradingView.com

Despite a series of economic challenges, BTC continues to rise, gaining 126% since the start of the year, and options market data points to speculators. towards the $40,000 level.

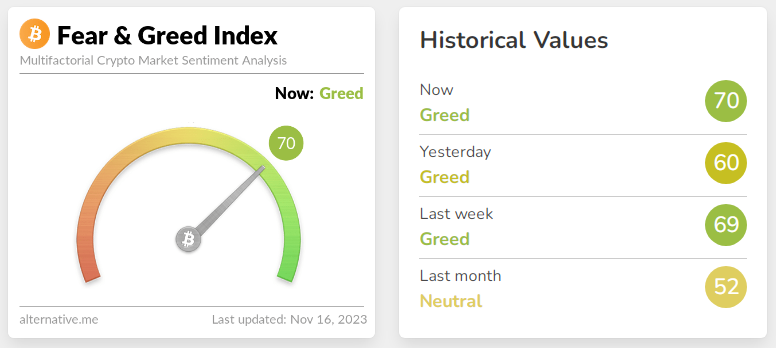

With the recent price increase, the Crypto Fear and Greed index has moved straight into the ‘Greed’ category, indicating that the market’s mood has improved.

Source: Alternative.me

In an environment characterized by an optimistic and positive outlook, Bitcoin’s momentum could strengthen and reach the psychological turning point of $40,000.

This would be a big 10% increase from where it is now. It is strengthening as the Relative Strength Index (RSI) tilts north, showing a rise in momentum.

Is the bear market behind us?

According to Zach Pandl, head of research at crypto fund provider Grayscale Investments LLC:

“The recovery in crypto valuations could continue as real interest rates peak and we continue to see progress toward spot ETF approvals in the U.S. market.”

“Bitcoin is now going mainstream and the bear is behind us,” Charlie Morris, founder of investment advisory firm ByteTree, said in a market report on Wednesday.

“The good times are here,” he said.

Source: CoinShares

Meanwhile, institutional investors have already started deploying capital into Bitcoin and cryptocurrencies, while retail investors may be waiting for additional liquidity from approved ETFs.

Over the past year, institutional investors poured more than $1 billion into cryptocurrency, according to CoinShares data (chart above).

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image by Cottonbro Studio/Pexels