Non-fungible tokens (NFTs) saw a huge surge in popularity in 2021, accompanied by skyrocketing prices, but the market has since come crashing back down to earth and it’s unclear if there will be a revival.

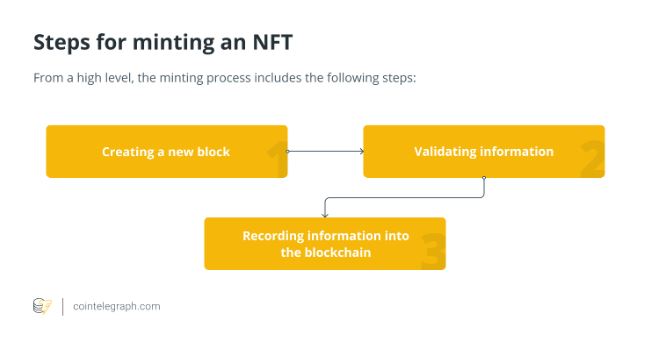

NFTs are unique digital tokens recorded on a blockchain to certify ownership and authenticity. They cannot be copied or replaced, but they can be transferred and sold by the owner.

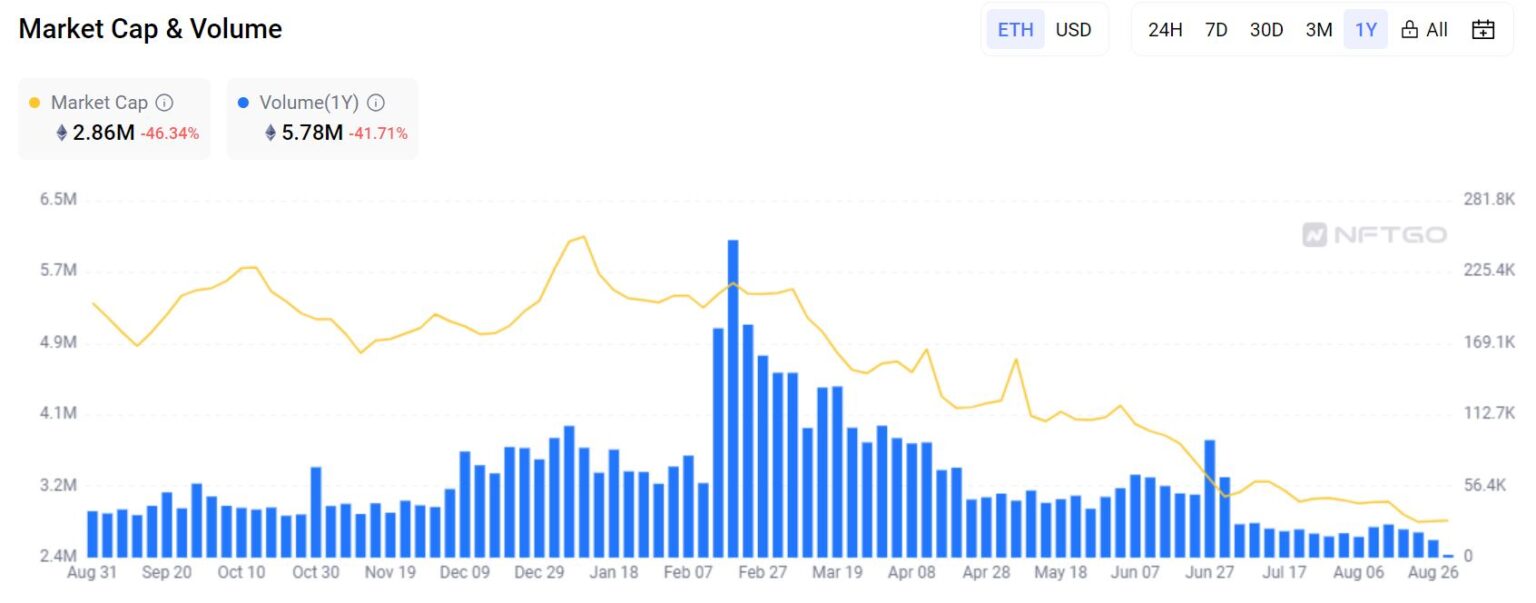

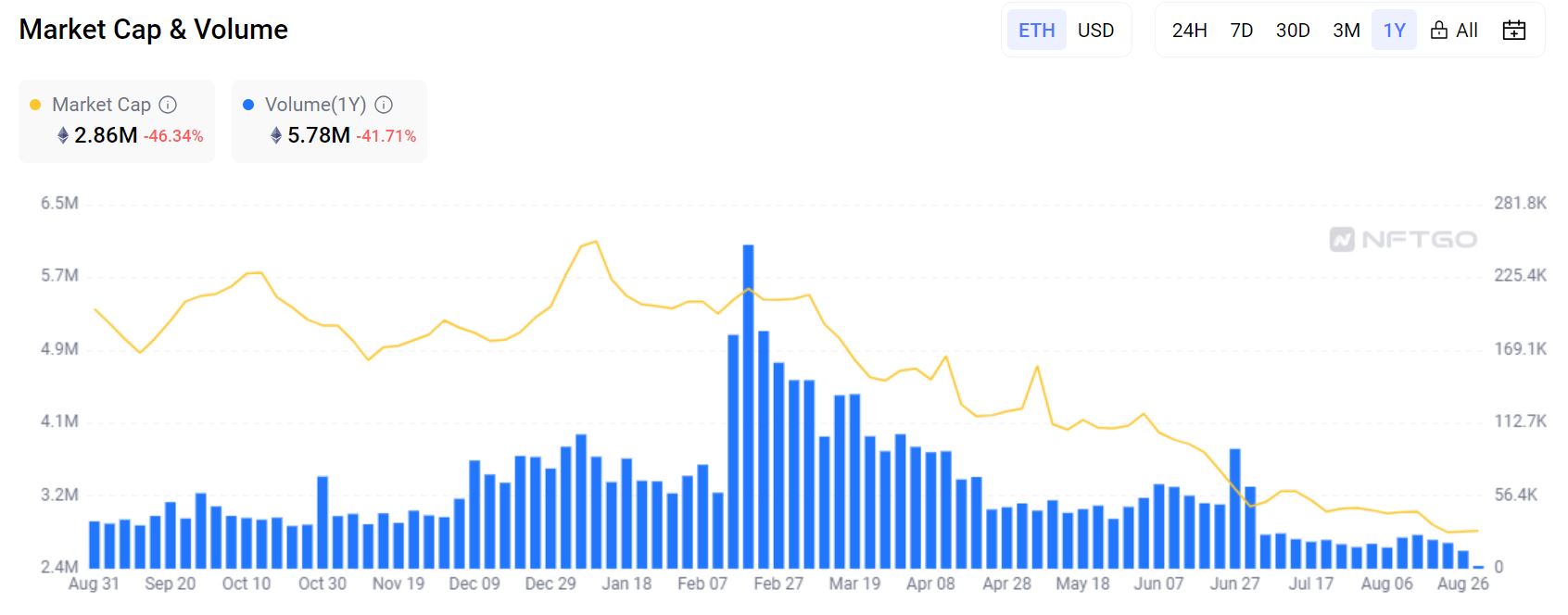

According to analytics platform NFTGo, at the time of writing, the NFT market capitalization valued in Ether (ETH) has fallen 40.59% over the past year, while trading volume fell 40.81%.

Market capitalization in US dollars is down 41.16% and volume is down 66.77%. At the same time, market sentiment ranks 13 out of 100, with an overall rating of ‘cold’.

The NFT market has fallen even further in the second half of 2023. Source: NFTGo

Arno Bauer, senior solutions architect at BNB Chain, told Cointelegraph that NFT projects are adding more and more value from a utility perspective and that this growth in functionality is likely the future of NFTs.

Bauer said the NFT market is showing “promising signs of innovation and creativity,” offering great potential for the growth and evolution of the technology.

Related: Crypto lawyer on SEC: ‘Problematic to imply that all NFTs are securities’

“Market sentiment, cultural shifts towards digital ownership and the potential for NFTs to be integrated into various aspects of our lives are also contributing to a positive outlook on the future of NFTs,” he said.

“While current market conditions may seem subdued, the continued innovation and potential for integration with both the digital and physical worlds suggests that NFTs have not yet had their day and that their continued relevance and growth is highly likely,” Bauer added .

NFTs in the long run

As for long-term use cases, Bauer said NFTs will “likely evolve” over time and become increasingly tied to real-world assets, such as ownership of real estate or unique physical goods.

Currently, NFTs are the most successful in the art world, with some selling for tens of millions of dollars.

Digital artist Pak sold an NFT project titled “The Merge” for $91.8 million on Nifty Gateway in 2021, while Mike Winkelmann, aka Beeple, sold “Everydays: The First 5000 Days” for $69 the same year .3 million sold through Christie’s auction house.

Blockchain games also use NFTs to represent in-game items such as weapons and armor, and there is speculation that the technology will make the jump to mainstream games. Various types of music items are also sold as unique NFTs.

Bauer thinks NFTs are likely to become more attractive to mainstream markets as more robust technology offers improved use cases and ownership security.

He speculated that NFTs could be linked to financial instruments, representing shares in companies or investment funds, and to social performance, where they could symbolize achievements in various areas.

“Beyond art, the ability to tokenize unique assets and provide verifiable ownership will create countless applications across domains,” Bauer said.

“Collaborations with traditional industries, technological advancements, clear regulatory frameworks and educational efforts can significantly drive the utility and adoption of NFT.”

“Tackling sustainability issues could make them more attractive to a wider audience,” he added.

NFTs have the potential to make a comeback

Jason Bailey, co-founder and CEO of NFT tool and self-management solution ClubNFT, told Cointelegraph that he thinks “NFTs will come back and become mainstream” because crypto and NFTs rebound cyclically, much like previous tech crashes.

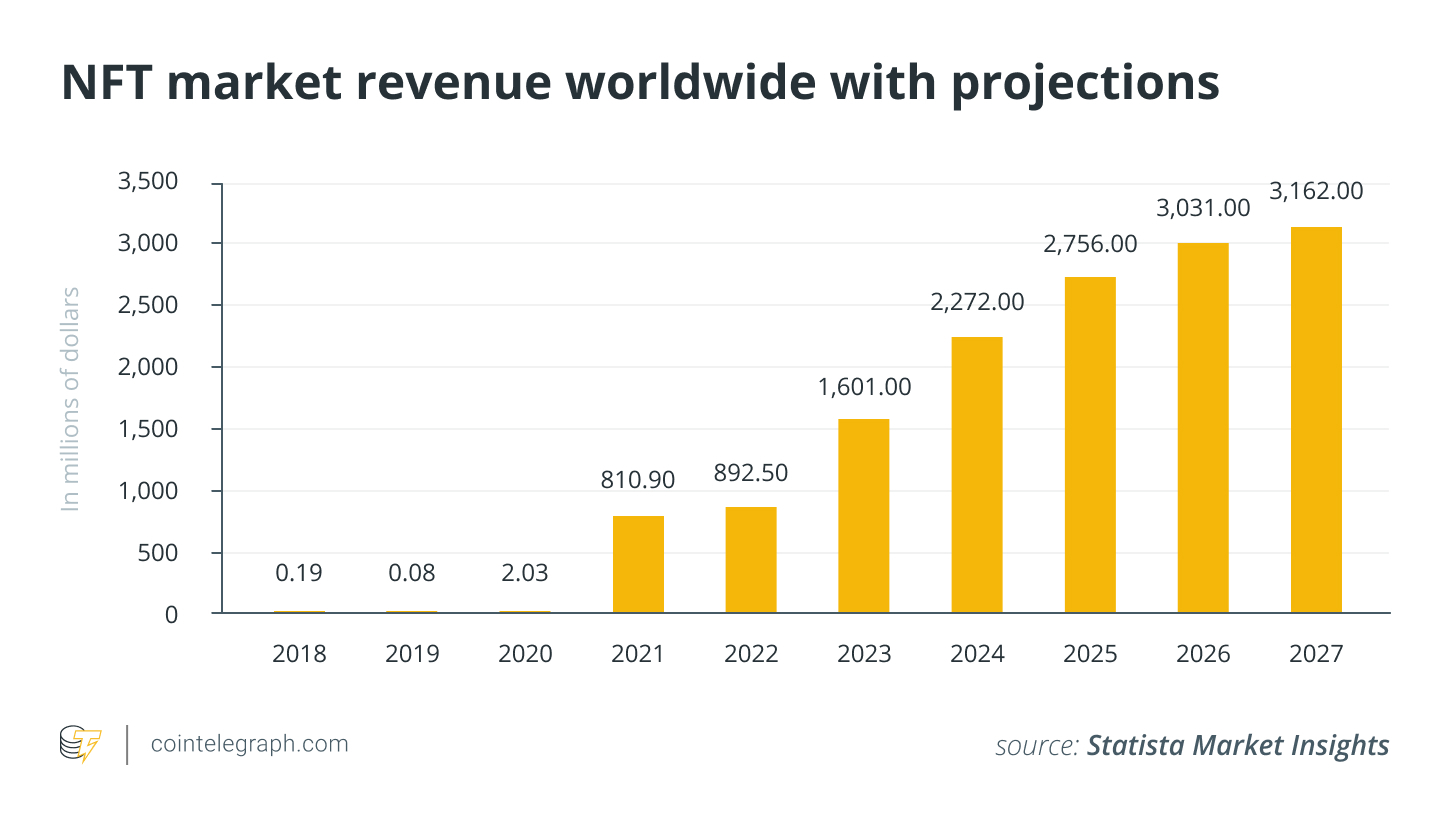

According to data collection platform Statista, the NFT market is expected to continue growing in revenue, users and market capitalization.

In 2023, there will be 13.95 million NFT users, but by 2027, that number is expected to reach 19.31 million.

However, Bailey believes that NFTs currently have a number of problems, most of which have been exacerbated by rampant market speculation, that need to be resolved before NFTs can go mainstream.

He said NFTs and the ecosystem surrounding them are so complex that almost everyone is still vulnerable to many risks they may not even know about.

“Many of us have tried to educate and get people into the space in a thoughtful way so they can be safe, but the truth is that NFTs won’t go mainstream until complexity is replaced with a standard, safe, easy path Bailey said. said.

“For example, the vast majority of people don’t realize that an NFT is almost always at risk in some sense, except for completely on-chain NFTs, which are a very small fraction.”

“The steps required to prevent the art from disappearing and to prevent the NFT from being broken are complicated, time-consuming and error-prone,” he added.

Related: AI-based tools bring security and transparency to the NFT market

Bailey believes that NFTs or similar technology could be invaluable in the long term in validating digital documents such as marriage certificates, diplomas and licenses.

Overall, he believes NFTs solve too many of the current problems associated with digital ownership – including scarcity, authentication, provenance and provable ownership – to ignore.

“We need to build infrastructure now, during the bear market, for smoother onboarding and to protect NFT adopters from malicious actors in the next NFT bull market,” he said.

“Once these issues are resolved, NFTs will absolutely go mainstream because the digital ownership train left the station decades ago, and there’s no stopping it.”

Meaningful projects can be a game changer for NFTs

Speaking to Cointelegraph, Andy Ku, founder and CEO of digital content Web3 ecosystem Altava Group, said he thinks the previous highs in the NFT market were based on a hype cycle, so it will be difficult for an individual NFT to reach such lofty heights. again.

Google asked Bard to write me some tweets about the NFT market now…

mf really went for the throat here… pic.twitter.com/aLjUbwH3gT

— beep (@beeple) August 22, 2023

According to CoinGecko, many of the top NFT collections have seen significant declines in value over the past year.

At the time of writing, Bored Ape Yacht Club is down 67.1%, CryptoPunks is down 33.2%, Mutant Ape Yacht Club is down 59.2%, and Azuki is down 49.3%.

Ku believes that if we can see more meaningful NFT projects in the market that deliver tangible benefits to more people, it is possible for the combined volume to increase the overall market value.

Related: What’s next for NFTs and Web3 in the age of the maker economy?

“NFTs must provide value and utility beyond just a digital art or PFP. The two areas I particularly believe in are asset-backed NFTs and a membership NFT,” he said.

“The core value of NFT, which is to be an immutable representation of something, is a great fit for assets and membership.”

NFTs for subscriptions, membership-based models and loyalty programs are starting to gain traction, with examples in hospitality venues and gyms already in the market.

“In terms of asset-backed NFTs, master artworks, real estate and precious metals like gold are all good examples of assets that people believe in,” Ku said.

“NFTs would be a great proof of ownership for these assets as well as being extremely portable,” he added.