- Aptos’ price action shows promise for higher prices.

- The TVL, the number of transactions and the speed of the blockchain testify to the growth.

Aptus [APT] has been on a downward trend since April, with price movements following a downward trend line since May. The APT/USDT pair on the daily chart has reached this trendline four times, each time with rejection.

However, during the fourth touch, the price did not drop to a lower low, indicating a possible weakening of the bearish trend.

Additionally, a head and shoulders pattern has formed, a common signal for price reversals if the neckline is broken and persists above.

For APT to confirm the $4.30 level as a bottom for the current cycle, the price must break and remain above the $7.50 level.

Source: Giray/X

If achieved, it could pave the way for a potential surge to or above $10 by the end of this year or early 2025, as more figures show.

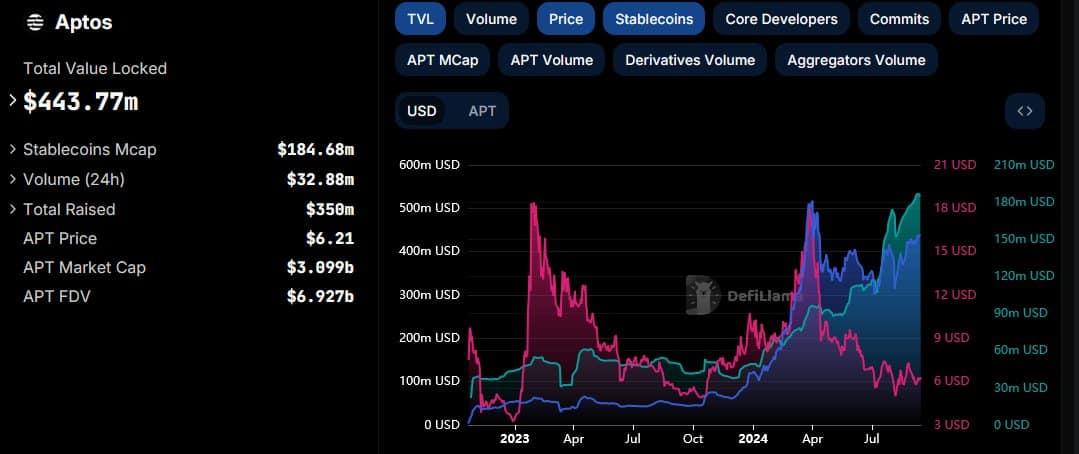

Aptos adoption and TVL

Key metrics for Aptos indicate growing adoption. The Total Value Locked (TVL) in Aptos currently stands at $439 million, ranking it 18th overall and 6th among non-EVM chains.

Despite only launching its mainnet in 2022, Aptos has risen rapidly in the TVL rankings, demonstrating strong market entry.

TVL has remained stable despite price fluctuations, indicating robust asset circulation and increasing confidence in the platform.

Source: DefiLlama

Furthermore, the market capitalization of stablecoins on Aptos has expanded, reinforcing the idea of increasing adoption and trust.

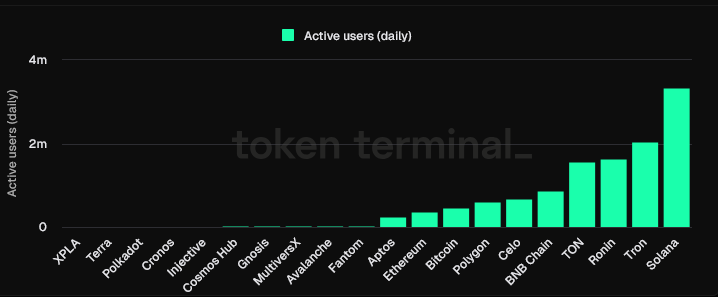

Daily active users and transactions

Aptos shows consistent growth among layer 1 blockchains. Over the past 18 months, the number of active users has steadily increased, with the number exceeding 200,000 daily.

This impressive figure placed it 13th across all blockchains (layer-1 and layer-2). Aptos Explorer reports an average of 1 million user transactions per day.

While interpreting transactions can be complex, the high number of daily active users supports the network’s significant activity levels.

Source: Token terminal

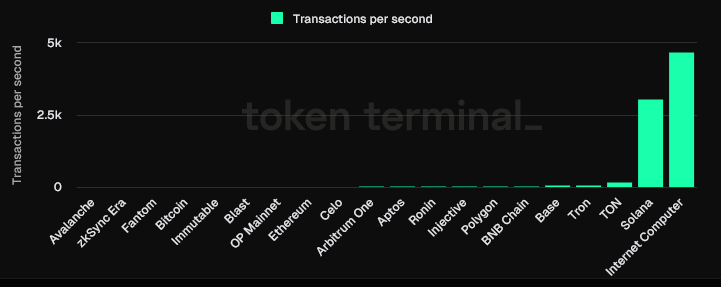

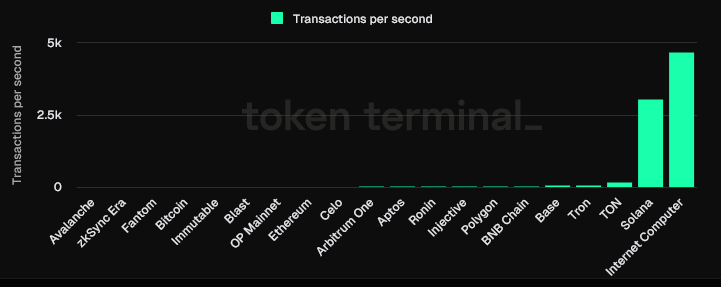

Transaction speed and scalability

Aptos excels in transaction speed, averaging around 25 transactions per second (TPS). Peaks of up to 12,000 TPS have been reached in the past 30 days.

It has demonstrated its scalability with record-breaking transaction volumes. In May, the network processed almost 100 million transactions in one day.

Over four days, it processed 325 million transactions, maintaining over 2,000 TPS for over 24 hours, with peaks approaching 5,000 TPS.

This achievement underlines Aptos’ ability to efficiently handle large transaction volumes.

Source: Token terminal

Read Aptos’ [APT] Price forecast 2024-25

Aptos shows strong potential for higher prices, supported by its adoption metrics, active user base and scalability.

As the price approaches key resistance levels and adoption grows, APT could see significant upside, making it a promising investment in the near future.