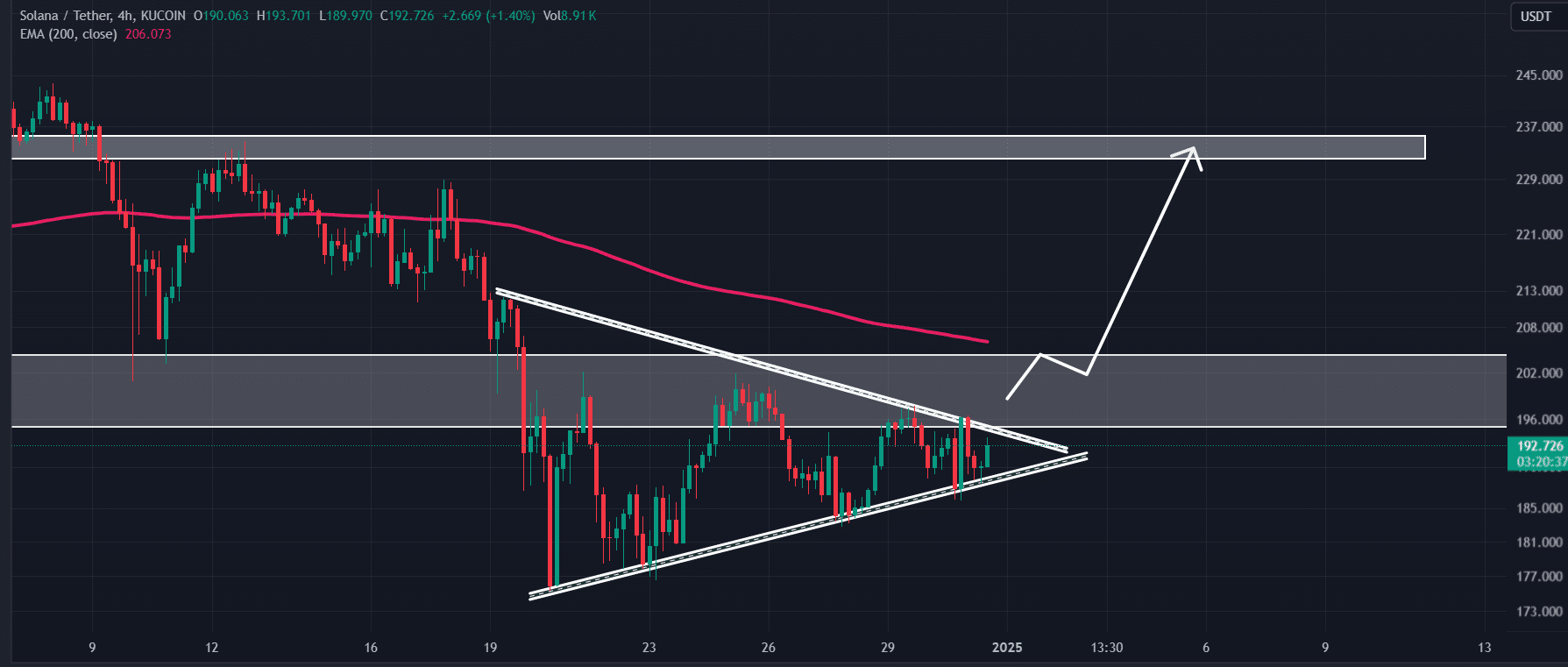

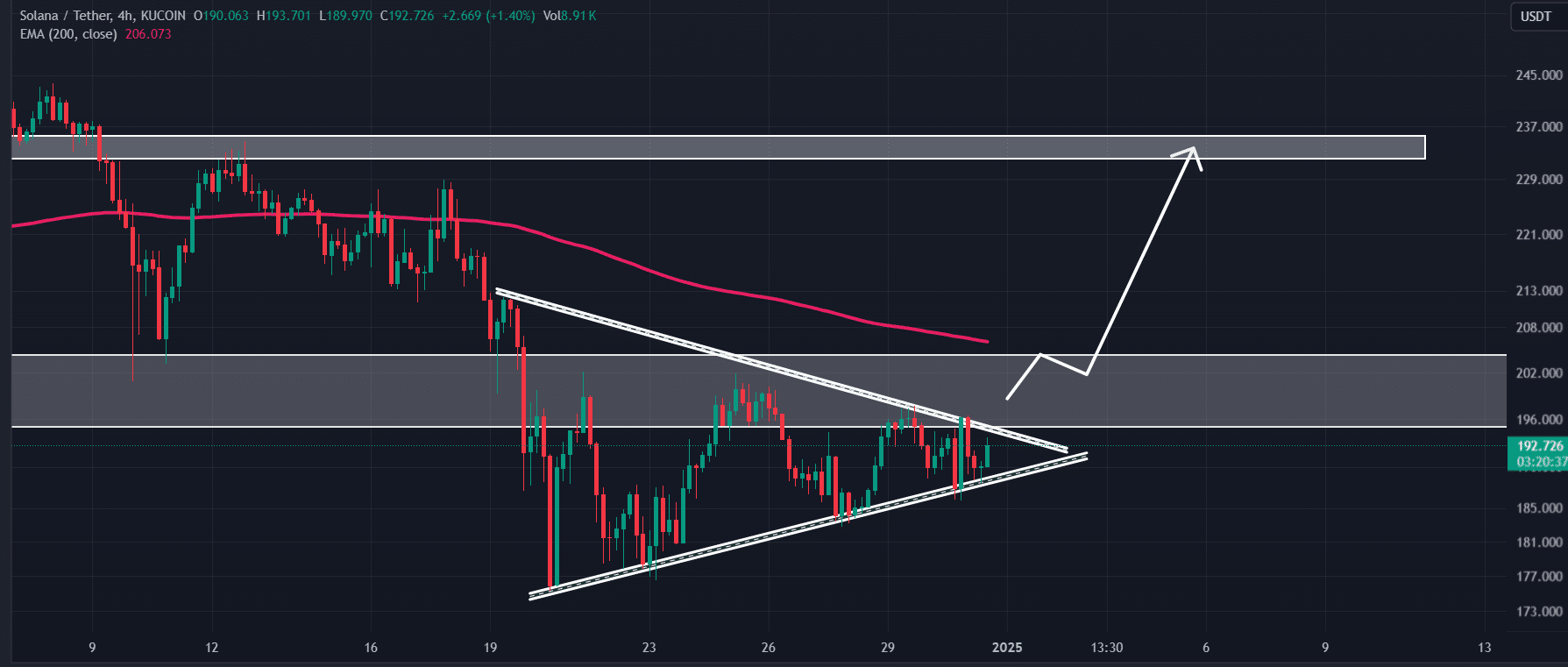

- Solana’s symmetrical triangle pattern suggested that a breakout above $196 could push the price towards $233.

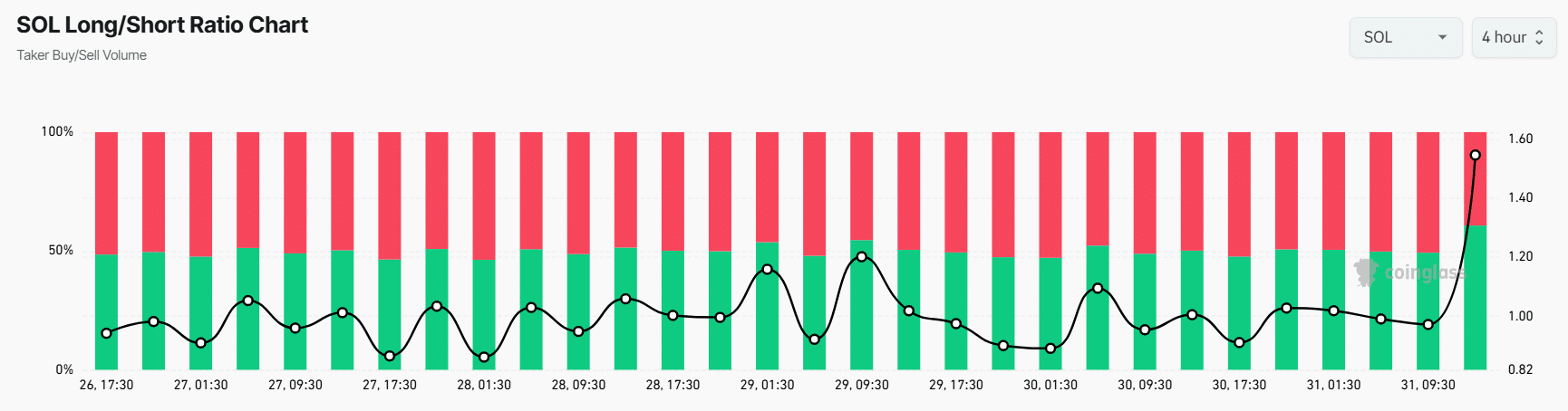

- Currently, 60.71% of top traders have long positions, while 39.29% have short positions.

Amid ongoing market uncertainty, the continued price decline in Solana [SOL] appears to be on the verge of a reversal as experts make bold predictions.

Recently, Nate Geraci, president of the ETF Store, posted on X (formerly Twitter) that Solana ETFs are expected to be approved in 2025.

Source: X (formerly Twitter)

Will SOL ETF be live in 2025?

The possible reason for this prediction is the crypto-friendly government and the resignation of Gary Gensler, chairman of the US Securities and Exchange Commission (SEC).

Since pro-crypto Donald Trump won the presidential election, the overall cryptocurrency market has experienced significant upward momentum but is currently undergoing a price correction.

During this rally, Solana, Bitcoin [BTC]Pepe [PEPE]and many others reached all-time highs even as Trump has yet to assume the presidency.

With continued support from Trump, the crypto market could witness several ETF approvals, including the Solana ETF.

Will ETF Approval Affect SOL Price?

Based on Bitcoin’s performance after ETF adoption, experts and analysts expect a similar rally in 2025.

ETF approval opens the door for traditional investors and retail traders to participate in crypto through their respective stock exchanges, potentially resulting in skyrocketing demand and price for assets.

If a spot Solana ETF is approved, significant upside momentum is likely. However, SOL price seems to be struggling at the moment.

Solana technical analysis and key level

According to AMBCrypto’s technical analysis, SOL appears bullish and poised for an upward rally. Within a four-hour time frame, SOL has formed a symmetrical triangle price action pattern that is primed for a breakout.

Source: TradingView

Based on the recent price action, there is a high probability that the asset could rise by 18% to 20% and reach the $233 mark in the near future if it breaks this pattern and closes a daily candle above $196.

Despite this bullish outlook, investors appear uncertain, as evidenced by analytics firm Coinglass.

$9.50 million worth of SOL inflows

SOL spot inflow/outflow data shows that the exchanges witnessed an inflow of $9.50 million in SOL in the last 24 hours.

These substantial inflows into the stock markets indicate that long-term holders may be selling off their holdings, potentially creating selling pressure and leading to further price declines.

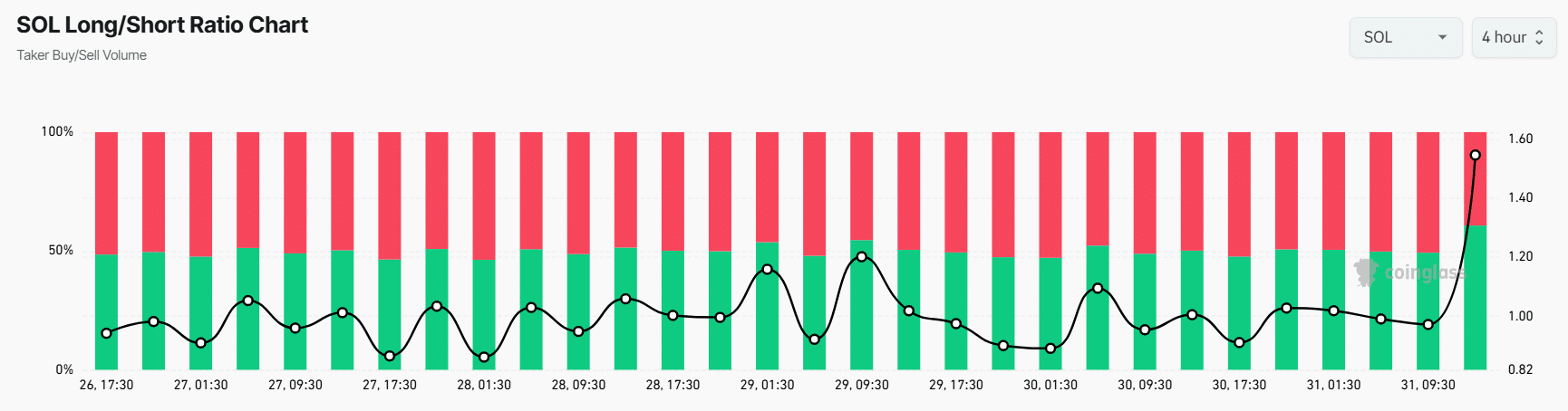

61% of traders hold long positions

In addition to the potential selling by long-term holders, intraday traders appear to be showing interest in SOL.

Read Solana’s [SOL] Price forecast 2025–2026

According to Coinglass, the SOL Long/Short Ratio at the time of writing was 1.545, indicating strong bullish sentiment among traders.

Source: Coinglass

The data shows that 60.71% of top traders currently hold long positions, while 39.29% hold short positions.