- APE’s trading volume was dominated by sharks, which flipped whales for the first time.

- Social sentiment remained low in the second quarter, but some on-chain metrics were upbeat in the third quarter.

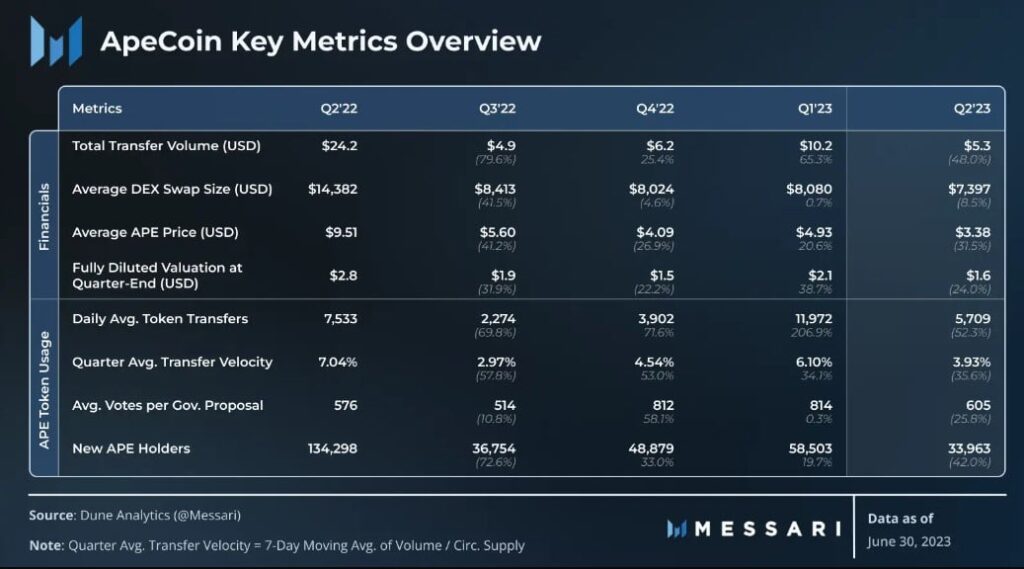

Like most cryptos, ApeCoin [APE] also had a difficult quarter as the price plummeted significantly during that period. In its latest quarterly report, Messari highlighted APE’s performance on multiple fronts and gave a broader picture of the situation in the second quarter of 2023.

Read ApeCoins [APE] Price prediction 2023-24

A closer look at the state of ApeCoin in Q2

According to Messaris reportAPE’s average price fell from nearly $4.9 to $3.38 in the second quarter of 2023. Transfer volume also dropped significantly, from over $10 to $5.3 in the second quarter.

The report also revealed that APE’s trading volume in the last quarter was dominated by sharks, which turned over whales (more than $10 million in daily trade) for the first time since APE’s launch.

Source: Messari

Mentioning token unlocks in the last quarter, during Q2’23 approximately 25 million APEs were unlocked for non-DAO entities and nearly 26 million MONKEY were claimed by Yuga ecosystem assets and APE holders. The unlock for non-DAO entities represents 5% of the circulating supply.

According to the report, this level of selling pressure may have contributed to the quarterly price decline, with the average price falling 32% and the fully diluted valuation falling 24% at the end of the quarter.

ApeCoin’s fully diluted valuation bottomed out at $2 billion at the end of Q2’23, down 91% from its all-time high in Q2’22. Apart from that, the token also witnessed an increase in the number of holders.

In Q2’23 an average of 373 new MONKEY holders joined the ecosystem every day. During the quarter, 34,000 new holders were added, despite the second quarter lagging the previous five quarters. Despite new holders joining the ecosystem, the popularity of the blockchain has remained relatively low.

This was evident from the graph of the social volume, which only peaked on June 7. APE’s weighted sentiment also revealed that the market was dominated by negative sentiment, thanks to the bearish price action.

Source: Sentiment

Will APE’s Q3 be different?

Like many other cryptos, APE’s past week has been in the interest of investors as its price surged. From CoinMarketCap, APE is up nearly 7% in the past seven days. At the time of writing, it was trading at $2.08 with a market cap of over $768 million.

How many Worth 1.10.100 APEs today?

Thanks to the uptrend APEs The MVRV ratio has also improved. Apart from that, the outstanding interest went up as the price rose. An increase in the metric means that the current price trend could continue.

Despite the recent upswing, investor confidence in the token has plummeted, as evidenced by the drop in supply of top addresses.

Source: Sentiment