- Trump’s executive command introduces a federal task force to regulate and promote innovation in cryptocurrency markets

- Bitcoin responded with volatile price movements and reflected optimism and uncertainty about the impact of the order

President Donald Trump went up by signing various executive orders during his first three days in office. On January 23, after much expectation, President Trump finally signed an executive order about cryptocurrency. Needless to say, this step has led to speculation about what the next one can be for the activa class.

Most important highlights of the executive order on cryptocurrency

Trump’s executive order about cryptocurrency, dubbed “Strengthening American leadership in digital financial technology”is a milestone decision that lays the foundation for a more structured approach to the acceptance of digital assets. Under his primary objectives, seek the order,

- Set up a federal task force to supervise cryptocurrency regulations, whereby consumer protection is guaranteed and at the same time innovation is encouraged.

- Promote the development of Stablecoins supported by the US dollar as a counterweight for other digital assets, indicating the intention of the country to maintain dominance on global financial markets.

- Prohibition The introduction of a digital currency of the US Central Bank (CBDC), with reference to risks for monetary sovereignty.

- Explore a reserve system for cryptocurrencies obtained through enforcement actions, indicating an openness for integrating digital assets in government financial systems.

These provisions emphasize a nuanced approach, which combines support for innovation with a careful eye on risks such as fraud and market volatility.

How the market responded to the executive order on cryptocurrency

The executive order on cryptocurrency generated a mix of excitement and caution between markets. Bitcoin (BTC), the largest cryptocurrency through market capitalization, saw volatility immediately after the announcement. While some investors considered the movement as a positive step towards the clarity of the regulations, others hesitated because of persistent uncertainties about the implementation.

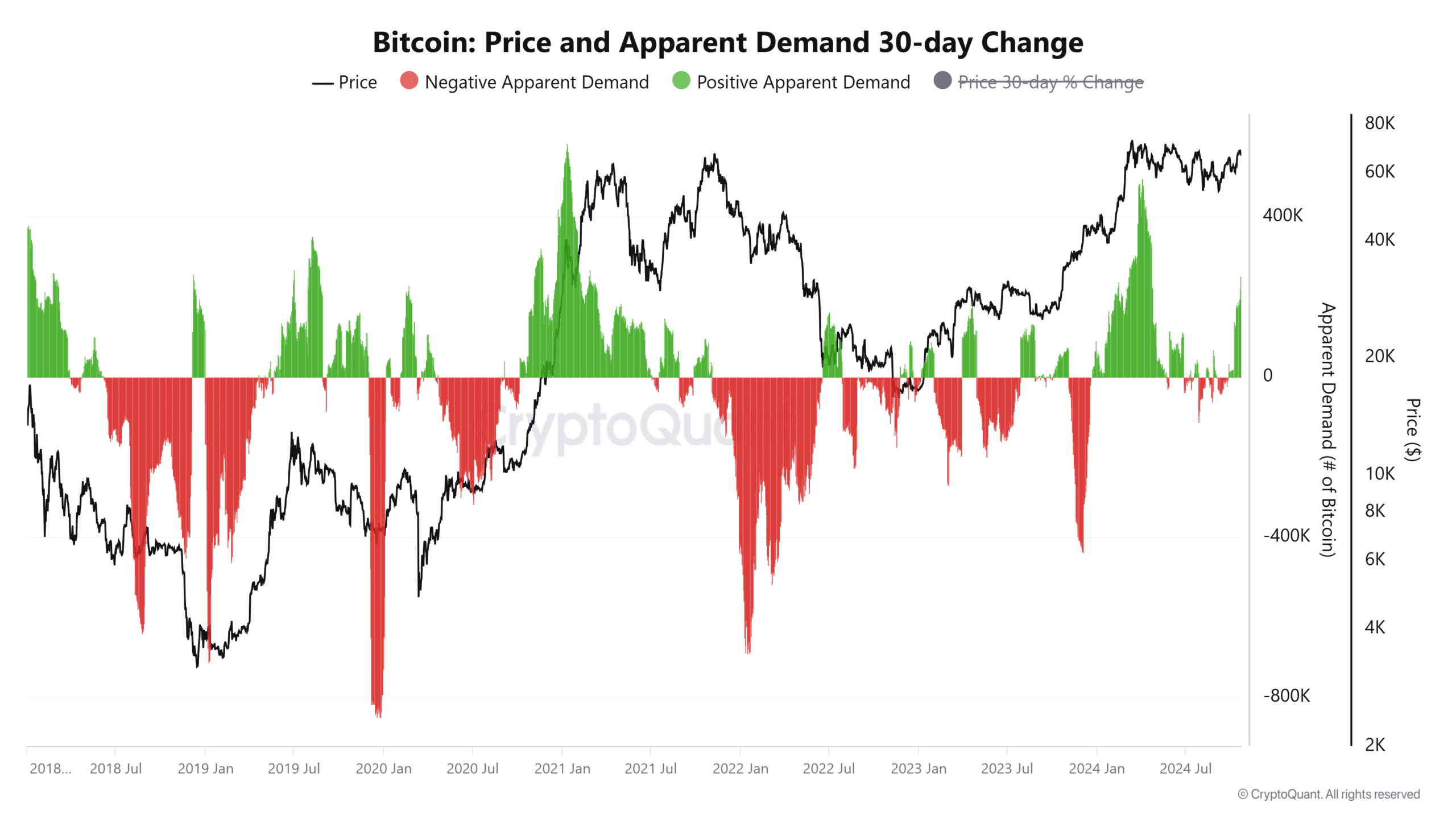

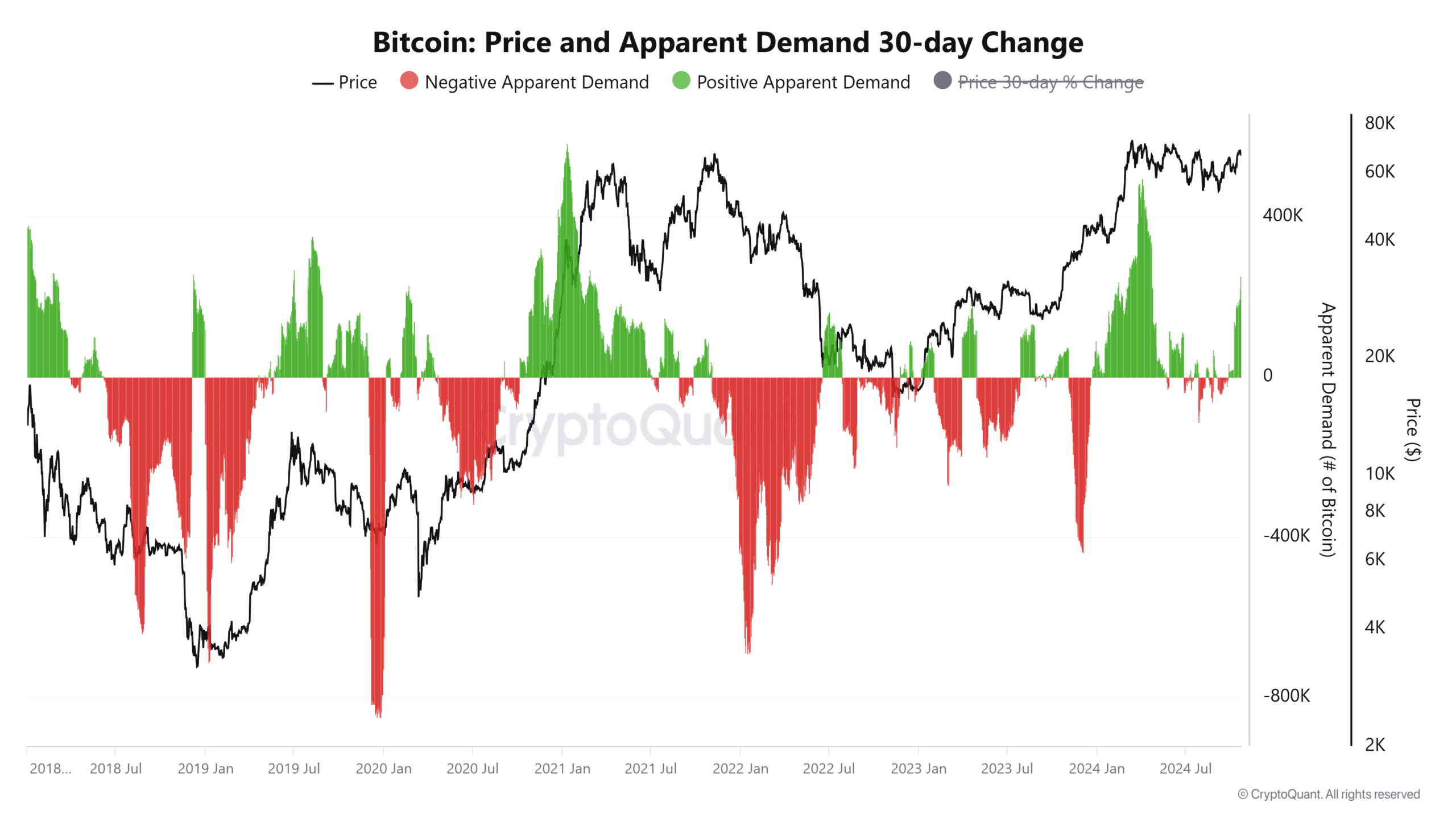

Ambcrypto analyzed the price of Bitcoin and the apparent demand changes to better understand the market reaction, as visualized in the corresponding graph.

Bitcoin’s price and apparent question: a detailed look

The graphic Bitcoin’s price process illustrated in addition to 30-day changes in the apparent demand. During the days around the executive order, the price of Bitcoin saw an increased volatility.

The first announcement led to a slight increase in market optimism. However, the price was withdrawn when traders showed the long -term implications of potentially legal supervision.

Source: Cryptuquant

At the same time, a sharp walk fell in a positive apparent question together with the release of the order. This trend hinted at an increased purchase interest rate, probably powered by renewed confidence among investors that clearer regulations can attract institutional capital.

The graph, however, also revealed periods of negative apparent question, which reflects profit and uncertainty among retail investors. These fluctuations emphasized the delicate balance between optimism for the clarity of the regulations and the fear of stricter checks.

Implications for the Cryptocurrency ecosystem

Trump’s executive order about cryptocurrency could mark a crucial shift for industry. By giving priority to the development of stabile and opposite CBDCs, the order aims to protect US economic interests and at the same time allow blockchain innovation. However, the mixed reactions of the market signal the need for more detailed implementation plans to tackle concerns about investors.

For Bitcoin, the executive order strengthens its role as a barometer of market sentiment. The price movements and demand dynamics underlined the sensitivity of the cryptocurrency to policy changes, which underlines the importance of the predictability of regulations for promoting long -term growth.