- Critical Buy Zones for Bitcoin are worth watching right now

- Bitcoin Whales Amassed 358,000 BTC in July, Marking an “Unprecedented” Transfer of Wealth

Bitcoin (BTC) has experienced significant price fluctuations recently, dropping from around $67,000 to less than $65,000 in just 24 hours. This volatility has caught the attention of traders and analysts alike.

Zen, a popular crypto trader and analyst, even noted on X that Bitcoin’s downturn mirrored the stock market’s movements. He claimed,

“$BTC followed the stock market and dumped. The nearest interest zone 64.5-65k that I mentioned earlier was skipped in one 1H candle – which is why I wrote that it is not good for blind limit orders and requires monitoring on lower time frames.

He emphasized the need for caution and close monitoring of price movements to avoid premature buying orders.

Zen further identified critical price zones and stated that the first solid buy zone is around $61.4K to $61.8K, with a lower zone potentially covering the CME gap around $58.5K to $60.5K.

Source:

Accumulation by Bitcoin whales

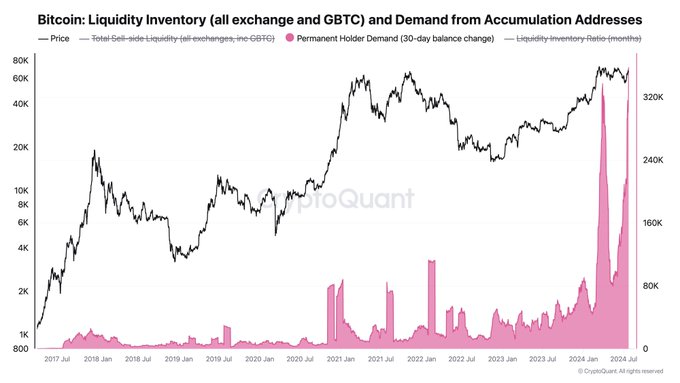

Furthermore, on-chain analytics platform CryptoQuant also observed a notable trend of Bitcoin accumulation by large investors, known as whales. CEO Ki-Young Ju marked this in a recent post, describing the flow of coins to these investors as “unprecedented.”

He stated that 358,000 BTC was moved to permanent holder addresses in the past month. In July alone, there was a global spot ETF inflow of 53,000 BTC.

Although not all BTC is in portfolios, the accumulation phase is clearly visible, with a substantial transfer of wealth within the crypto market.

Source: CryptoQuant

Bitcoin was trading at $64,222 at the time of writing, with a 24-hour trading volume of $37,443,835,918. This underlined a decline of 3.35% over the aforementioned period.

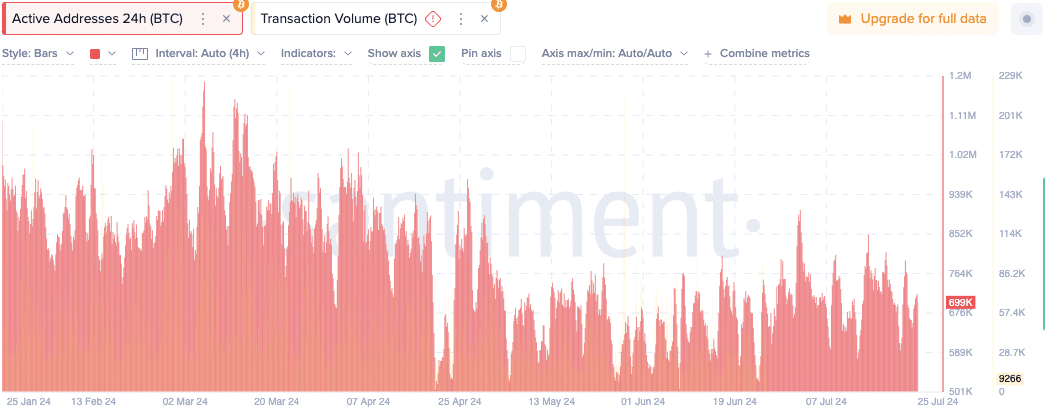

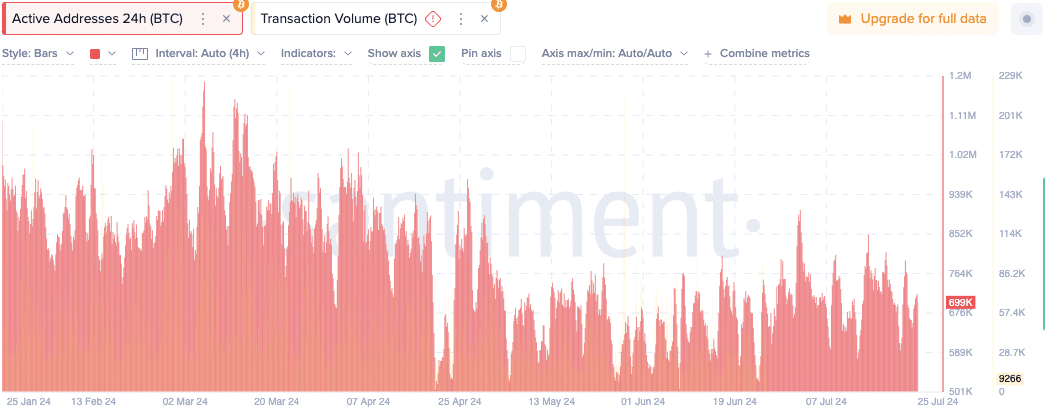

Furthermore, the number of active Bitcoin addresses also shows some variability, ranging from approximately 500,000 to 1.2 million.

For example, at the time of writing, there were 699,000 active addresses, with a transaction volume of 9266 BTC. This is a decrease compared to previous peaks in late February and early June.

Source: Santiment

Additionally, the Total Value Locked (TVL) in Bitcoin was $701.92 million, reflecting continued involvement and investment in the cryptocurrency market.

The dynamics of active addresses and transaction volumes provide valuable insights into market activity and investor behavior.

Impact of possible political developments

The upcoming Bitcoin 2024 conference has generated excitement, especially due to the involvement of 2024 presidential candidate Donald Trump.

Trump has been vocal about his support for Bitcoin and has proposed the addition of BTC as a dollar reserve. This ambitious plan aims to turn Bitcoin into digital gold. The potential impact of Trump’s presidency on Bitcoin’s price is a topic of great interest among crypto enthusiasts.