- Trump’s keynote at the Bitcoin Conference 2024 could impact crypto regulations and market dynamics.

- Bernstein noted BTC’s recent gains and highlighted its significant stock and market positions.

As Donald Trump prepares to deliver the keynote speech at the upcoming Bitcoin Conference 2024, a new analysis from Bernstein Research, led by Gautam Chhugani, highlighted a blind spot in the market.

Bernstein’s analysis

According to Bernstein it is Trump’s potential re-election could bring significant regulatory shifts that could dramatically impact Bitcoin [BTC] and the broader crypto market.

Bernstein elaborated on this, pointing out that Bitcoin markets have recently regained strength, with BTC surging 13% last week to above $67,000.

Source: CoinGecko

Stocks related to cryptocurrencies posted even bigger gains, rising 22% over the same period.

Bernstein’s report categorizes seven major stocks into four groups: hybrid BTC/AI data centers (Core Scientific, Iris Energy), Bitcoin mining consolidators (Riot Platforms, CleanSpark, Marathon Digital Holdings), BTC corporate treasury (MicroStrategy) and crypto broking/exchange . platforms (Robinhood).

“We view major Bitcoin mining consolidators as high-beta Bitcoin proxies, with price action driven by the underlying Bitcoin price and potential cash flows from operating leverage.”

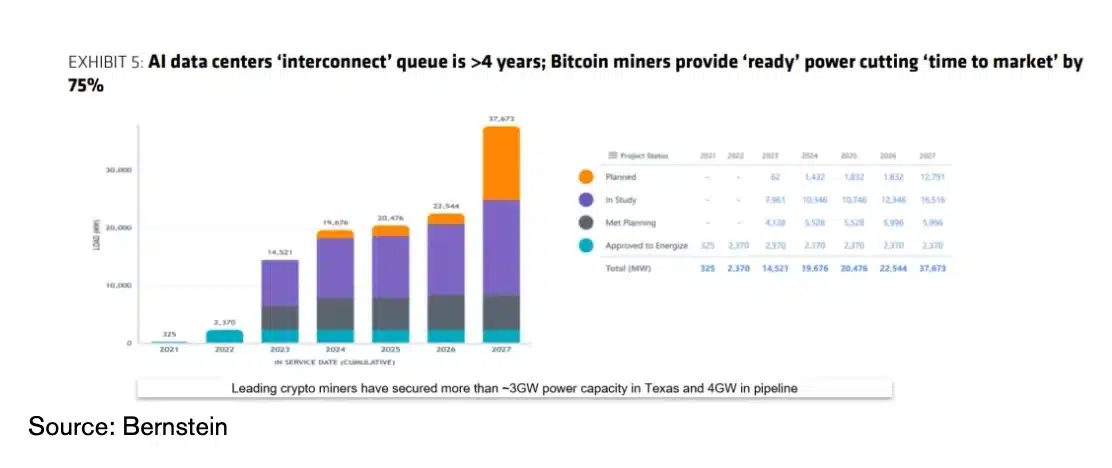

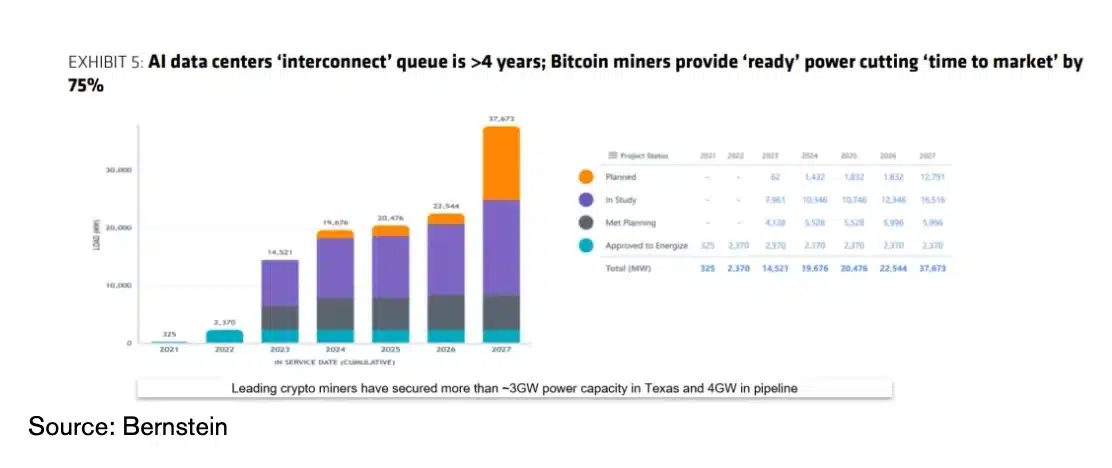

Additionally, BTC’s hybrid mining and AI data center operators were praised for their distinctive market positioning.

“Bitcoin miners are in a unique position, guided by their disproportionate ‘power access’ in a world of limited power.”

Source: Bernstein

The report also discussed the possible effects of the upcoming US elections and Trump’s crypto stance.

Trump and his influence on Bitcoin

Trump’s upcoming speech at the Bitcoin 2024 conference in Nashville has generated significant interest, fueled by his recent advocacy for cryptocurrency and the eye-watering ticket price of $844,600, equivalent to 13 BTC.

Analysts are warning traders about the risks of shorting Bitcoin ahead of Trump’s speech, amid rumors he could declare Bitcoin as a strategic reserve for the US.

This move could significantly impact the value and market dynamics of BTC.

At the time of writing, Bitcoin was trading at $67,000, reflecting a downturn on the daily charts. CoinMarketCap.

However, with the Relative Strength Index (RSI) at 62, the market is showing strong bullish sentiment, suggesting that the recent decline could just be a short-term fluctuation.

Source: TradingView