- One analyst predicted a massive XRP price increase and projected a target of $263 if a full bullish breakout were to occur.

- Increased whale activity and market support levels indicate that XRP may break the seven-year consolidation.

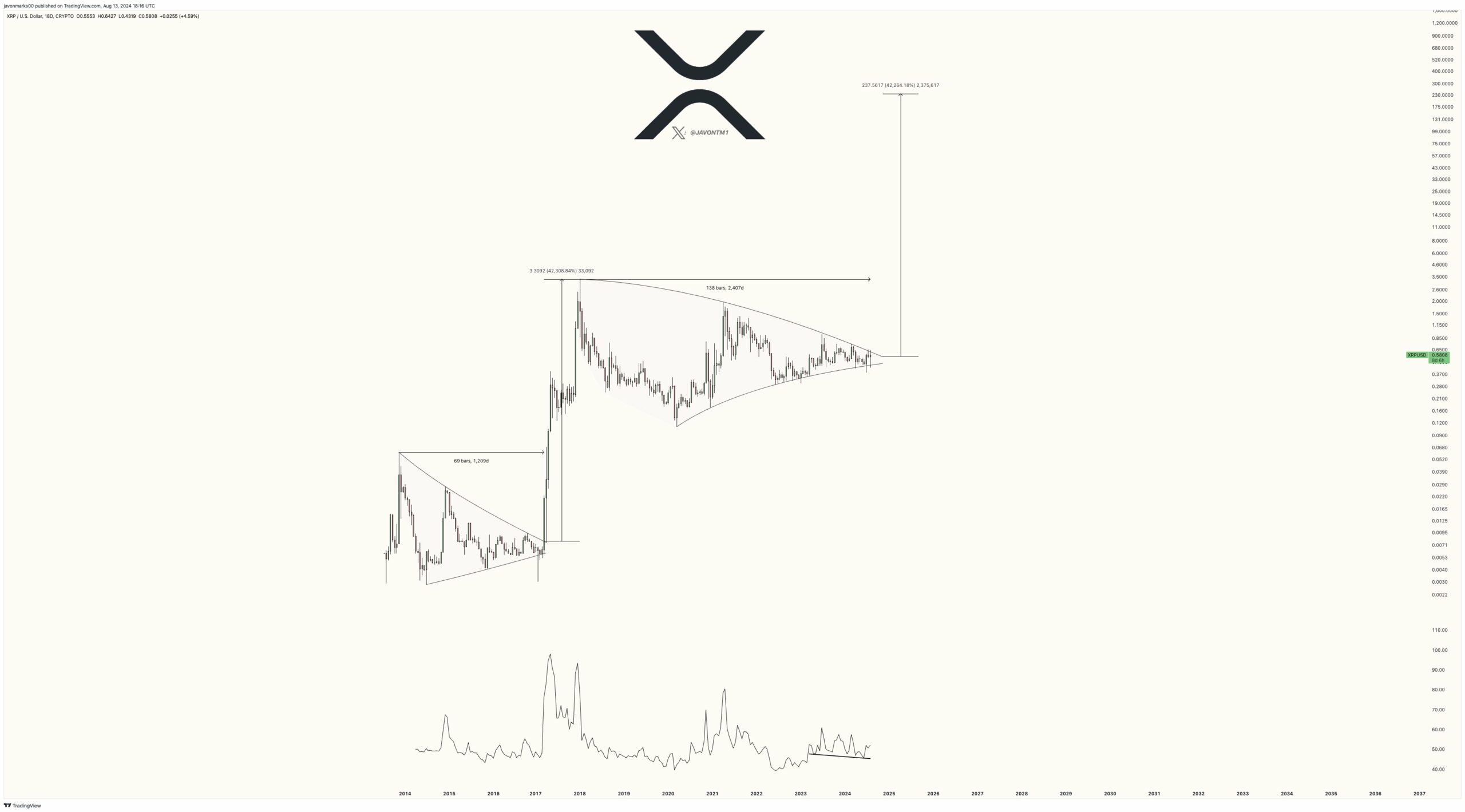

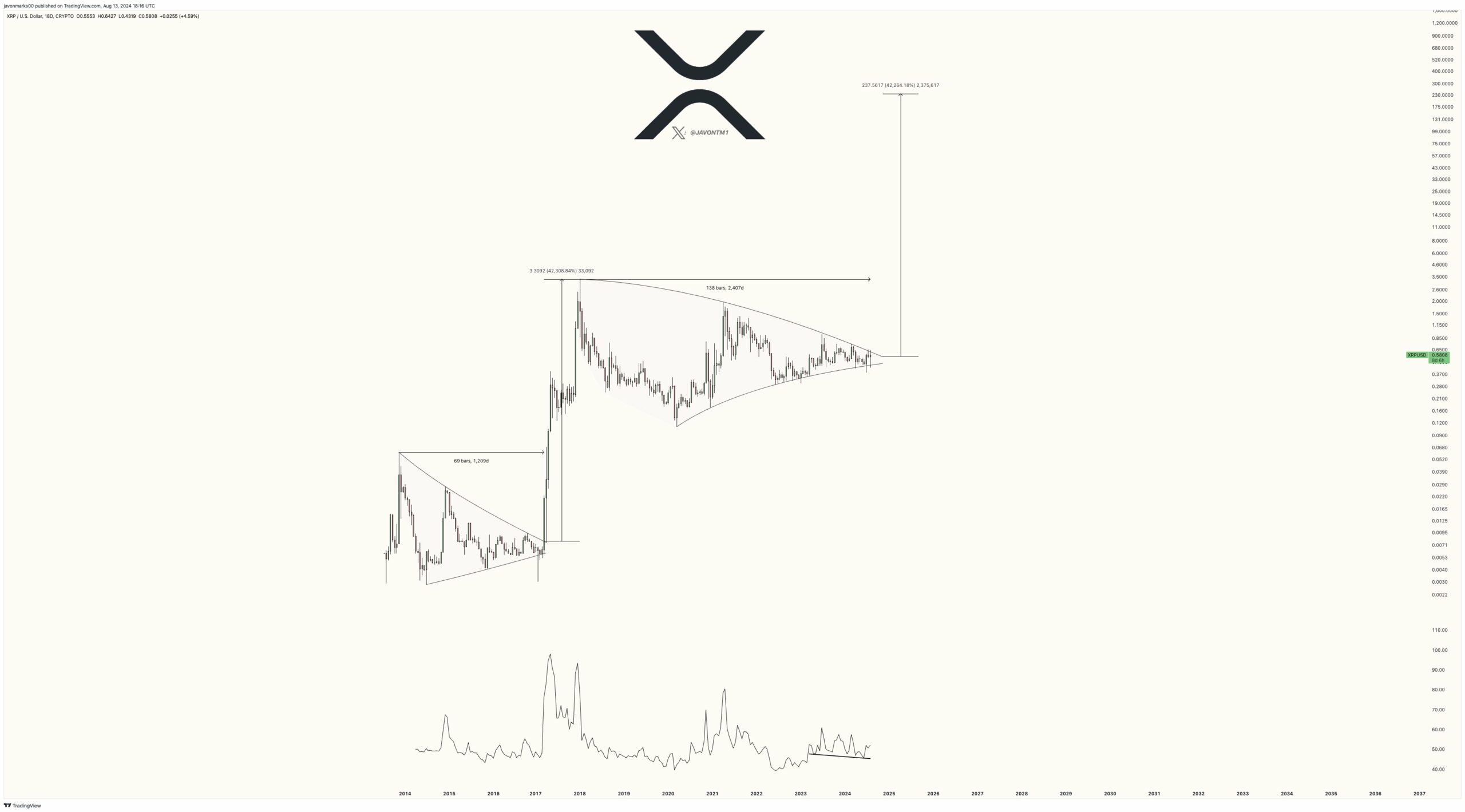

Javon Marks, a crypto analyst, recently did just that outlined a bullish outlook for XRP, indicating that the altcoin could see a significant price increase if a breakout were to occur.

According to Marks, if XRP were to experience a full logarithmic continuation of the current consolidation pattern, the token could reach an ambitious target of $263.

In fact, this would represent an increase of more than 42,000% from current levels, based on historical patterns and market behavior.

Source:

Marks emphasized that XRP was nearing the peak of a nearly seven-year consolidation phase, during which it showed multiple bullish signals.

He believed that these signals, combined with XRP’s resilience during this period, increase the likelihood of a bullish breakout.

Marks has previously said he had tempered his predictions, but now believes it is crucial to focus on XRP’s full potential, which he believes could push the price well above $200 with similar patterns.

Additionally, Brad Garlinghouse, CEO of Ripple, recently made a bold statement statement on Bloomberg TV, in which he claims that,

“XRP is the next Bitcoin.”

This comment has fueled speculation and excitement among XRP followers, who are eager to see if the crypto can live up to such high expectations.

Market performance and technical indicators

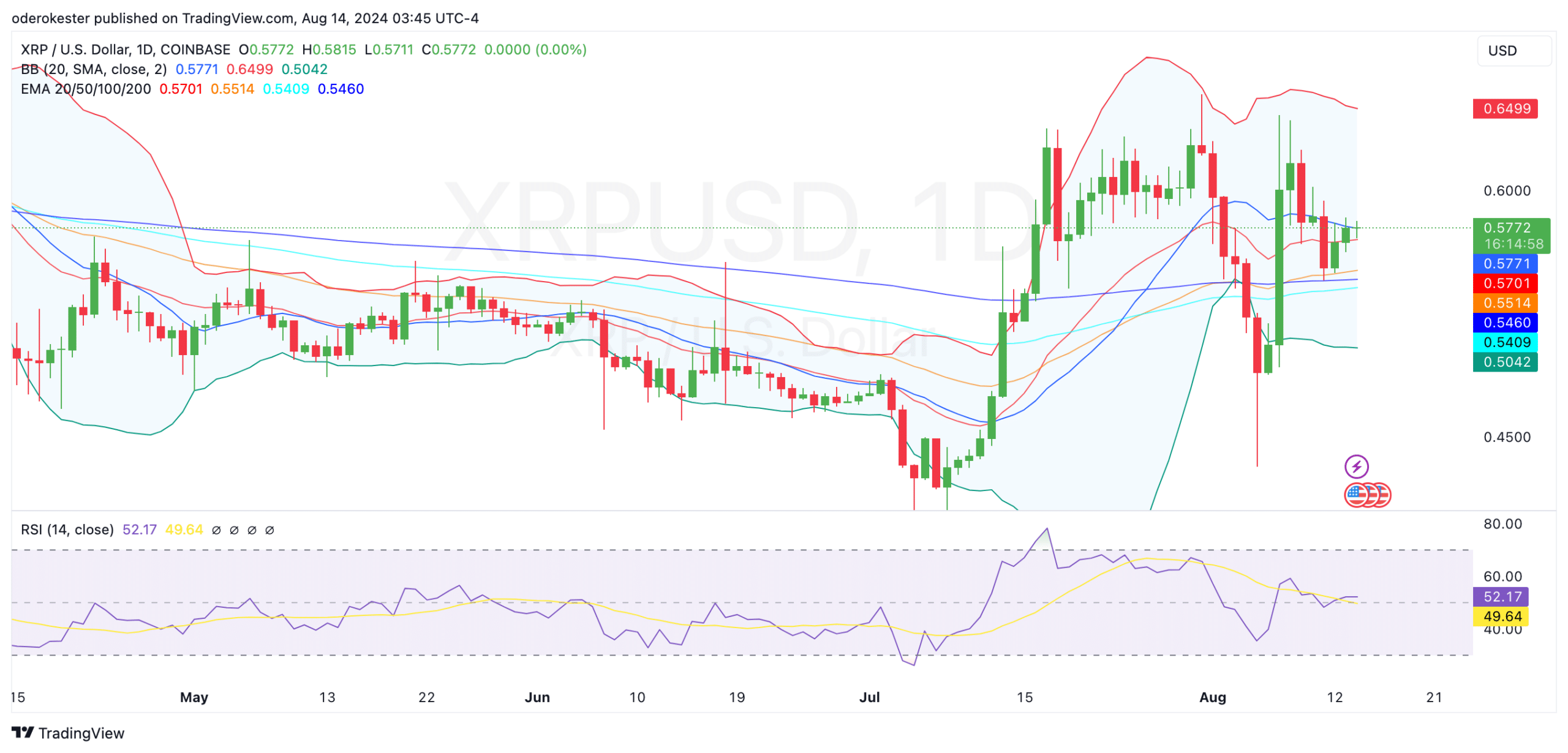

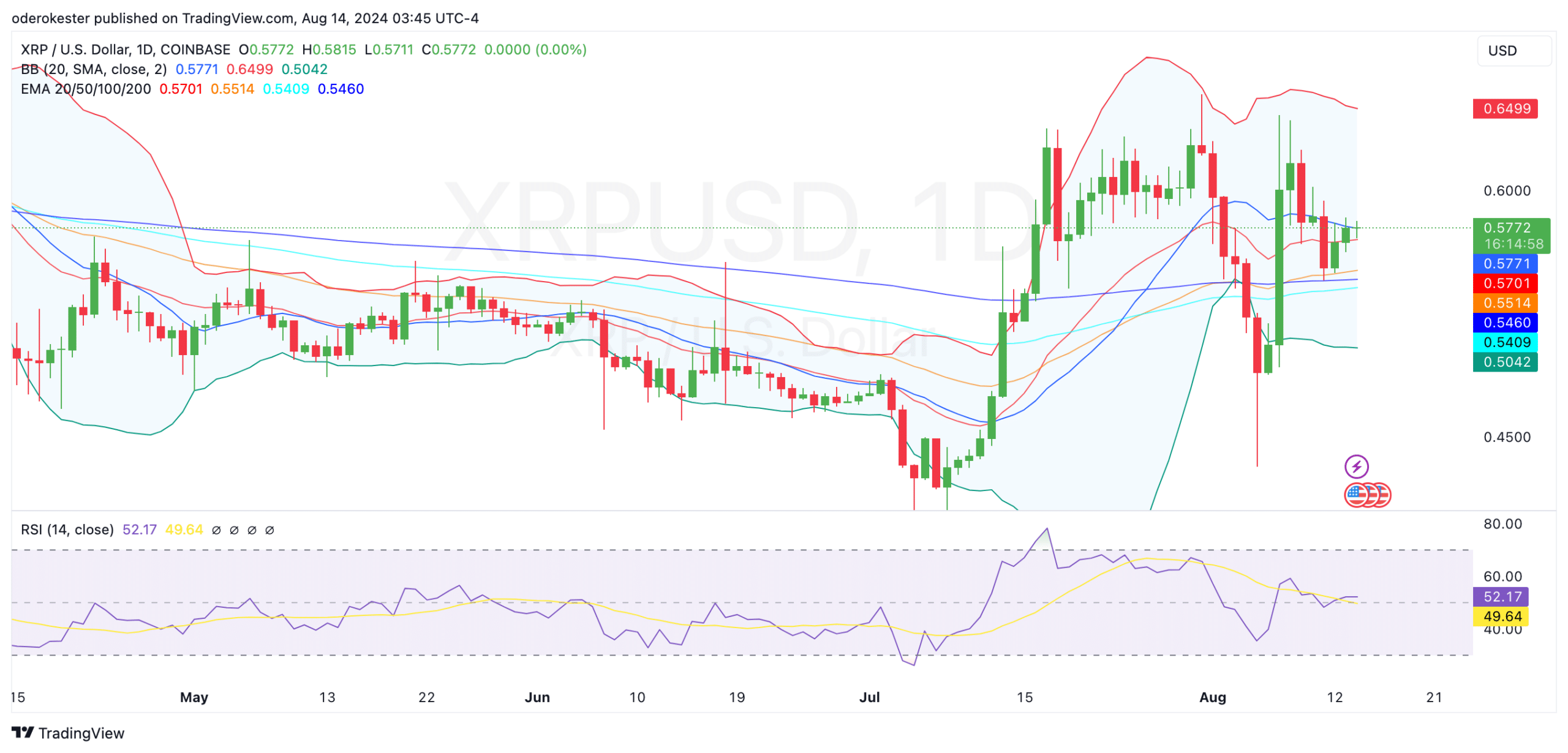

At the time of writing, XRP was trading at $0.5778with a 24-hour trading volume of $1.39 billion. XRP has seen a rise of 1.58% in the last 24 hours and a rise of 12.09% in the last week.

With a circulating supply of 56 billion XRP, the token’s market capitalization was approximately $32.44 billion.

Meanwhile, XRP was slightly above the middle band of the Bollinger Bands, which was relatively narrow, with the upper band at $0.6499 and the lower band at $0.5042.

This indicated reduced volatility and neutral to slightly bullish market sentiment.

Source: TradingView

Moreover, the 50-day EMA of $0.5514, along with the 100-day and 200-day EMAs of $0.5409 and $0.5460, respectively, served as support levels.

This suggested that XRP could have the potential for upside if it sustains these levels.

Whales Are Fueling the XRP Futures Wave?

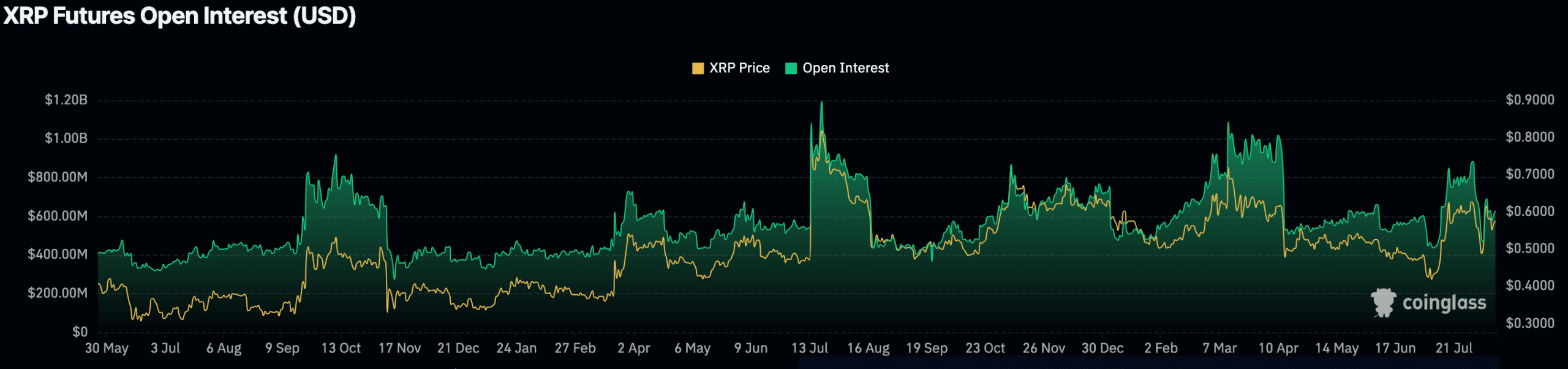

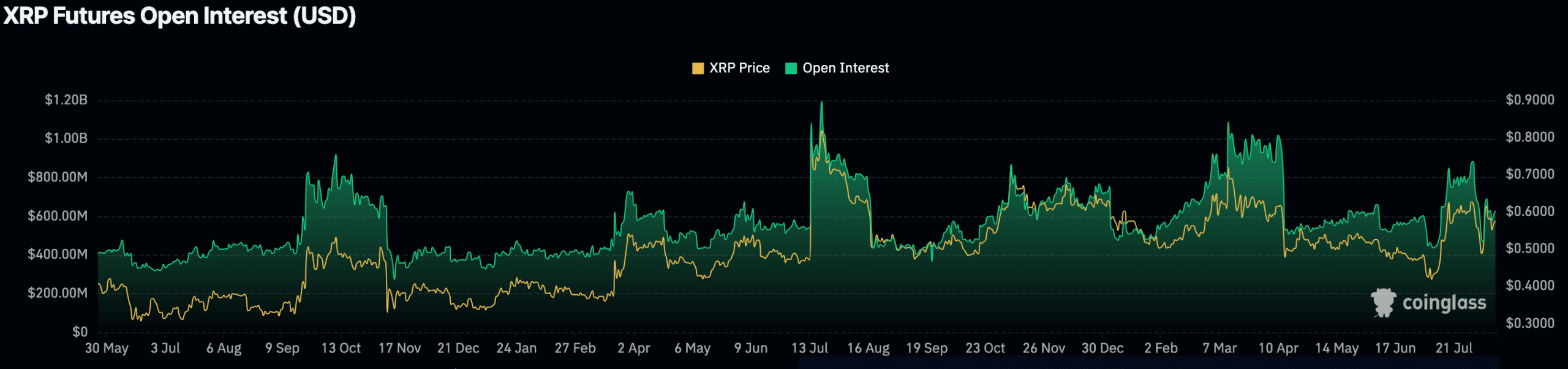

Data from Coinglass revealed that XRP’s Futures Open Interest has shown fluctuations, peaking above $1 billion in mid-July 2023 before stabilizing around $600 million.

At the time of writing, Open Interest is $632.74 million, reflecting an increase of 2.44%, while trading volume is down 20.76% to $1.86 billion.

These figures indicated muted interest in XRP Futures, with trader involvement varying in recent months.

Source: Coinglass

Read Ripple’s [XRP] Price forecast 2024-2025

AMBCrypto recently reported that the whale-to-retail delta was 30.63, indicating increased interest among large XRP holders.

This uptick in whale activity indicated a potential impact on future price movements, especially as the level of market indecision has been broken.