Cobie, a prominent figure in crypto trading circles known for his insightful and often accurate predictions, made one after on August 23, 2023, which depicted the spot Bitcoin ETF scenario with frightening accuracy.

Cobie’s post, in which he delved into the intricacies of Bitcoin (BTC) and the expected approval of a Bitcoin ETF, showed his deep knowledge of market dynamics.

His prediction of a significant increase in the price of BTC, potentially reaching $50,000 by the end of the year, along with a detailed analysis of the potential impact of the ETF approval, reflects a level of analysis that few in the field can match .

Foresight

The trader also predicted when the SEC would approve the ETFs, saying at the time that it was basically “free” to long Bitcoin until then, and recommending selling as soon as the approval came in, or shortly before.

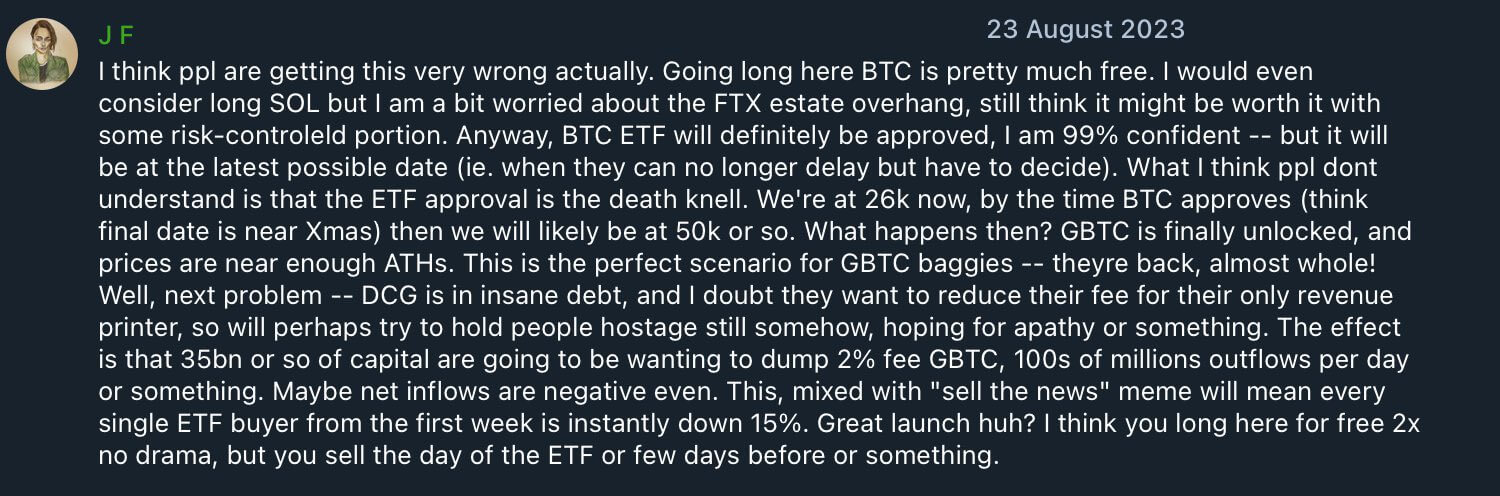

Cobie wrote:

“Anyway, BTC ETF will definitely be approved. I am 99% confident, but it will be at the last possible date (i.e. when they can no longer postpone but have to decide).”

He added that once the ETFs are approved, it would be a “death knell” that would likely send the price tumbling due to high selling pressure from Grayscale’s GBTC holders, who have been waiting for an opportunity to sell once they are sold . almost whole again.

Given the price action, following that advice would have been the best move in hindsight. This has received widespread admiration from crypto Twitter. However, Cobie finds the admiration unnecessary.

Cobie’s reflective response

In a candid response In response to the unrest on social media, Cobie emphasized the dynamic and often uncertain nature of financial forecasts.

“I can’t even remember, man,” he began, emphasizing the challenge of keeping up with ever-changing market views. He pointed out how easy it is to find past predictions that seem accurate in retrospect, given the frequent shifts in opinions and market conditions.

He warned against overreliance on isolated predictions, stating:

“The screenshot itself ‘looks cool’ but doesn’t actually mean much, you know, and is actually missing half a year’s worth of shit and other factors that pollute the thinking.”

His comments are a modest reminder of the ephemeral nature of market analysis. Despite his analysis, he said he did not stick to that position in subsequent months. Cobie added:

“The reality (at least for me) is that it’s quite easy for me to discard my own opinions three weeks later, come up with new ideas that I think go against them, etc., so it’s just a whole mess of doubt and indecision and things along the way.”

This perspective resonates deeply in the cryptocurrency community, where rapid change and volatility are the norm. Cobie’s reflection on the process of forming and reshaping opinions in response to new information and market shifts highlights the complex, non-linear nature of financial forecasting.

Cobie’s full message can be read below: