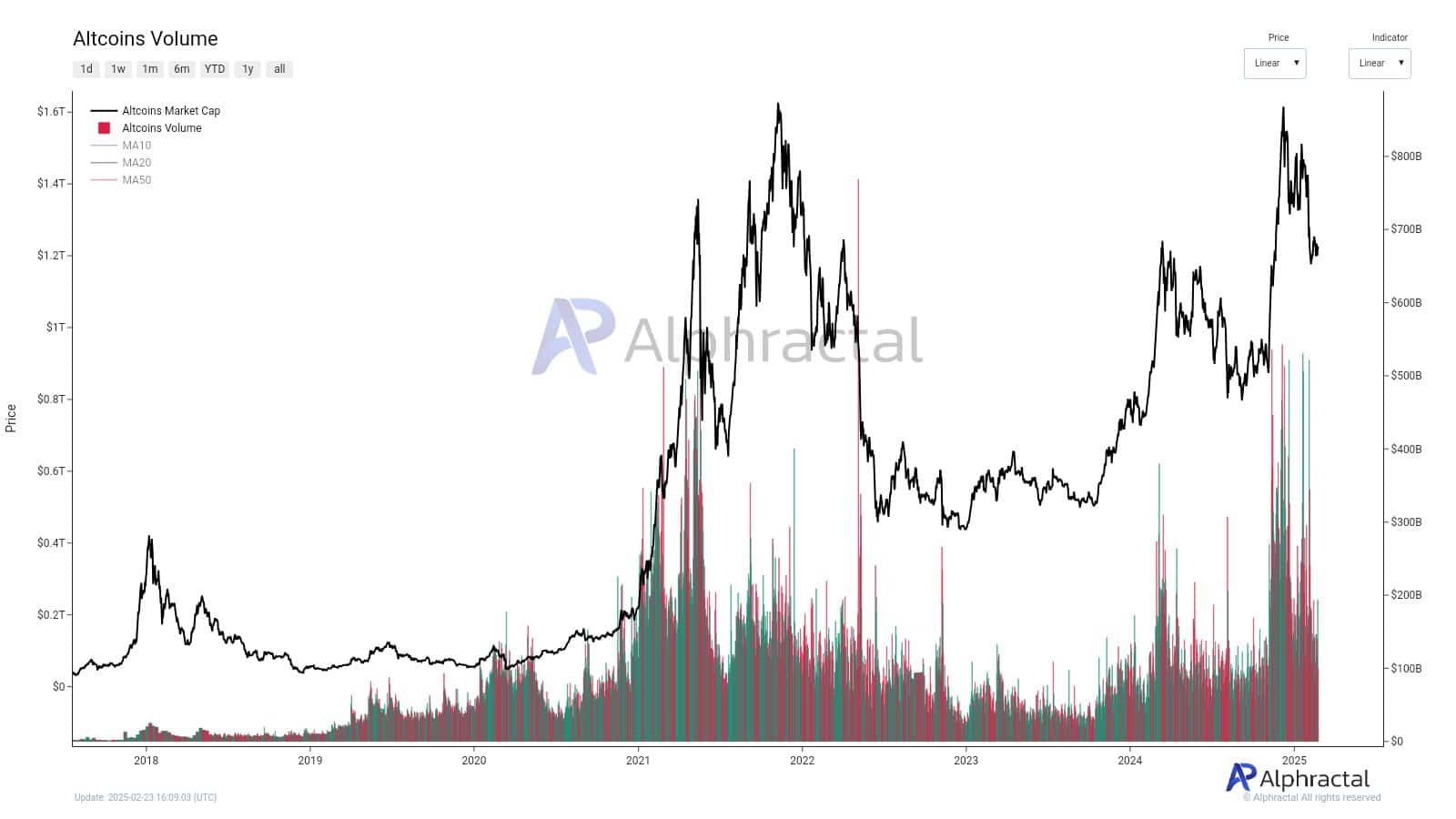

- The trade volumes in the Altcoin market have fallen sharply, so that the leading analysts wondered whether the Bullrun has ended.

- With volume historically linked to price action, this shift indicates a possible change in investor sentiment and market dynamics.

The Altcoin market has reached a critical moment, with trade volumes that have recently fallen to levels that have not been seen since 2021.

This decrease, often seen as a sign of reduced market interests, asks analysts to question the future of altcoins.

Because the trade volume usually correlates with a price promotion, this delay can indicate a shift in enthusiasm from both retail and institutional investors.

While the market is at a intersection, the urgent question is whether we witness the end of one phase and the beginning of another.

Altcoin volume and its meaning

Trade volume is a crucial market indicator that reflects the level of activity and investor interest. In the context of Altcoins, volume has a direct correlation with price action and often confirms bullish or bearish trends.

During periods of a high volume, prices usually experience considerably upward or downward movements. Conversely, the low volume usually signals consolidation or market stagnation.

Observing earlier Altcoin -Cycli, volume peaks in general during bullish periods, so that the strength of markettrallies is confirmed.

The current volume decrease and the implications thereof

Altcoin Trade Volume Has seen a sharp fall in recent weeks, which expressed concern about the momentum of the decreasing market.

Source: Alfractaal

The latest data indicates that trading activity has withdrawn from recent highlights, in accordance with the general market hesitation.

February 2025 has experienced increased volatility, in which ETF flows fluctuate, regulatory uncertainty that influences sentiment and the liquidity provision of risk activa.

This decline in volume suggests a possible shift in the market structure, because investors re -assess their positions in the midst of evolving macro -economic conditions.

Historically, comparable decreases have followed large market peaks. The Cooldown after 2021 saw a steep fall in both altcoin prices and volume, which led to long-term stagnation.

A similar pattern was created in 2022 when the volume collapsed after a euphoric increase. The current question is whether this decline is a temporary withdrawal for a renewed momentum or the start of an extensive decline for Altcoins.