In a recent report analyzing the performance of the Layer 1 (L1) blockchain Algorand (ALGO) in the second quarter (Q2), data analytics firm Messari highlighted several notable milestones achieved by the network during the period, with a record transactions is one of the most important. most striking.

Rapid network growth

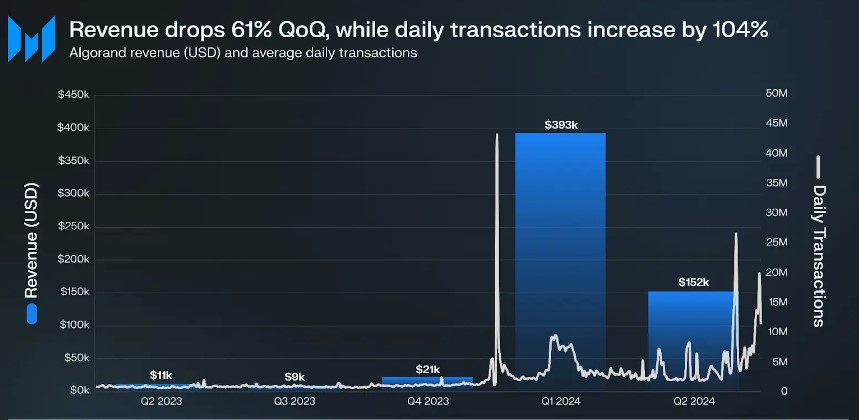

One of the most important metrics What stood out was the increase in Algorand’s average daily transactions, which shot up 104% to 4.7 million. Total transactions showed a more modest 6% quarter-on-quarter (QoQ) increase to 425 million.

Despite this increased transaction volume, Algorand took a hit, falling 61% to $152,000. The report attributes this to a 46% depreciation of ALGO against the US dollar compared to the previous quarter. Although the average transaction compensation increased 44%, total dollar revenues still decreased.

Related reading

The 61% decline in quarterly revenue also reflected a correction following ALGO’s 1,747% rise in the first quarter, driven by a one-day spike of 43 million transactions tied to the ORA memecoin project.

However, on an annualized basis (yearly basis), Algorand’s gain saw a substantial increase of 1,241%, from $11,000 to $152,000.

On the plus side, Algorand reached a major milestone of 2 billion transactions during the quarter, demonstrating the growth and adoption of the network. Remarkably, it took the network four years to achieve its first billion transactions, while the second billion was achieved in just one year.

Algorand Staking falls to lowest level in a year

In the second quarter of 2024, the amount of ALGO deployed on the Algorand network fell 38% year-on-year and 6% quarter-on-quarter, reaching a one-year low of 1.6 billion ALGO. Messari believes this may be due to the diminishing rewards awarded per board term.

The percentage of Algorand’s eligible supply deployed fell by 4.7% quarter on quarter and now stands at 20.2%. Meanwhile, Algorand’s circulating supply rose 1.2% to 8.2 billion ALGO.

Finally, data shows that the market cap for stablecoins on Algorand increased 15% quarter-over-quarter, from $73 million to $85 million, mainly due to a 32% increase in Circle’s USDC stablecoin market cap, which now represents 78% of the total stablecoin market. market cap on Algorand.

Conversely, Tether’s USDT market cap fell by 22%, representing 21% of Algorand’s market cap. market share of stablecoins. EURD’s market capitalization remained at 1% of Algorand’s stablecoin market capitalization.

ALGO Price faces a make-or-break moment

The ALGO token has seen significant price gains in recent weeks after a challenging second quarter for the price and the broader market. Coin gecko facts shows that the token has seen a 14% price increase in the last two weeks and 12% in the last seven days alone.

This has resulted in ALGO trading at $0.1357, just below the 200-day exponential moving average (EMA), marked by the yellow line on the ALGO/USDT daily chart below, which is currently acting as a wall of resistance for the sign.

Related reading

It will be essential to overcome this hurdle for a possible continuation of the upward trend of the price in the coming days and realize the same short-term support in the event of a correction.

Featured image of DALL-E, chart from TradingView.com