- ALGO’s recent performances have attracted a lot of attention lately

- Analysis of active addresses revealed increasing network activity – a sign of growing interest among merchants

Algorand (ALGO) is in the news among cryptocurrency traders these days after showing strong signs of bullish potential on the charts. Thanks to its innovative governance structure, DeFi reward systems and strengthening technical indicators, the blockchain has now positioned itself as a major player in the market.

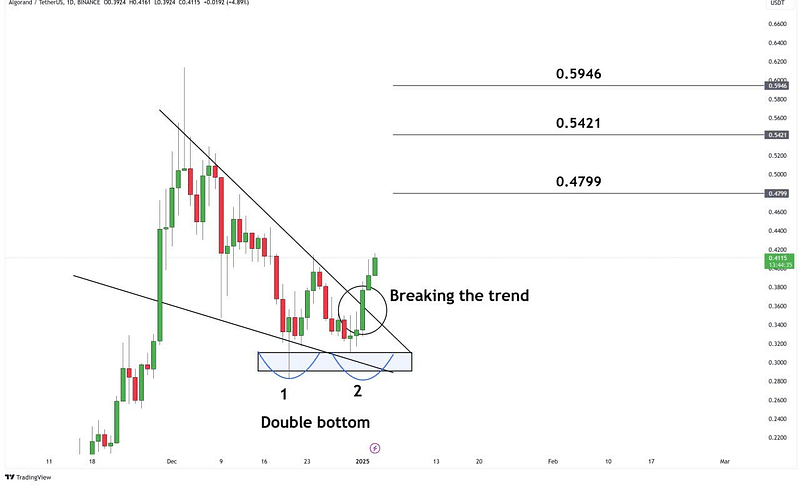

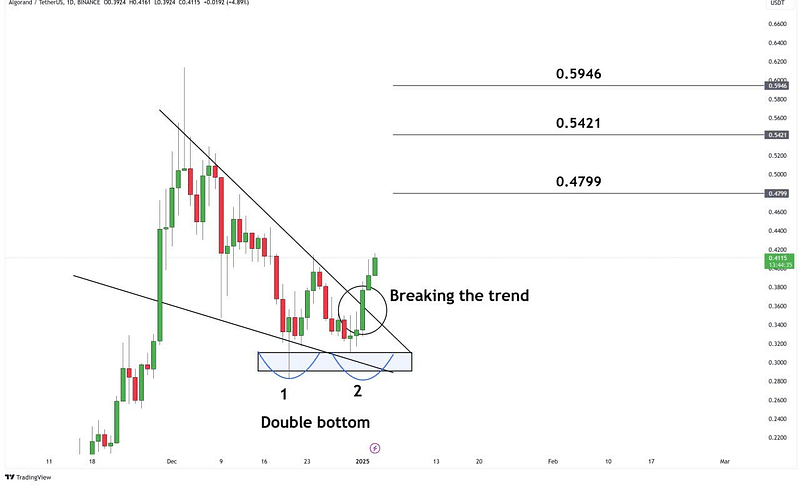

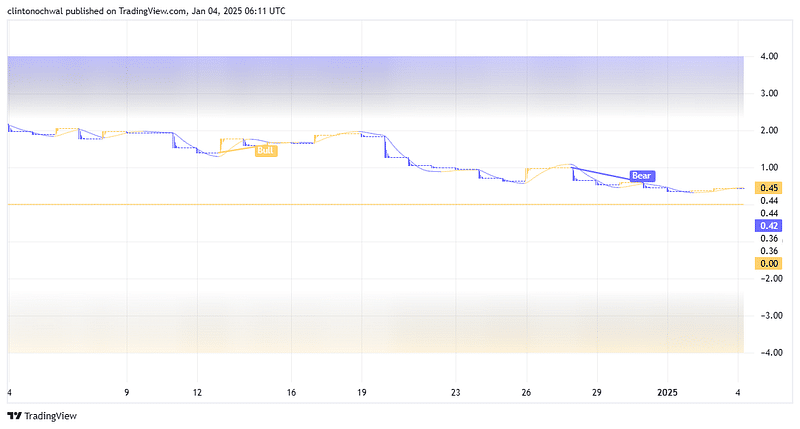

A double bottom pattern!

Recently, ALGO formed a double bottom pattern on the charts, with the same pattern marking a strong bullish reversal. This pattern, characterized by two consecutive dips at a similar price level followed by a breakout above the neckline, is a widely recognized technical indicator.

Source: TradingView

In the case of ALGO, the double bottom occurred at the $0.34 price level, providing a robust support base. Following this, ALGO broke through the descending trendline, confirming its bullish breakout. The breakout was accompanied by a notable increase in price momentum, indicating growing buying interest among traders.

Based on the analysis, the immediate resistance levels for ALGO are now $0.4799, $0.5421, and $0.5946. Breaking through these levels could pave the way for continued upward momentum.

In light of increasing global liquidity and Algorand’s growing ecosystem, the next price target could be $0.5946, depending on sufficient volume and support from the broader market.

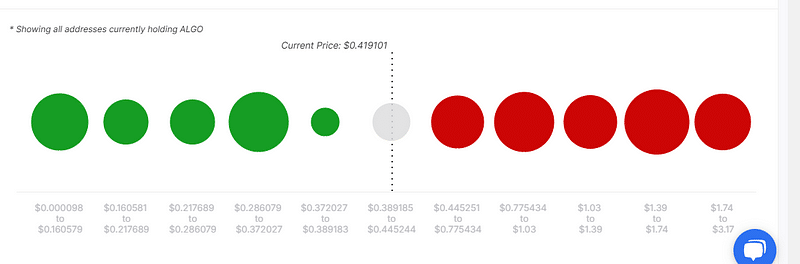

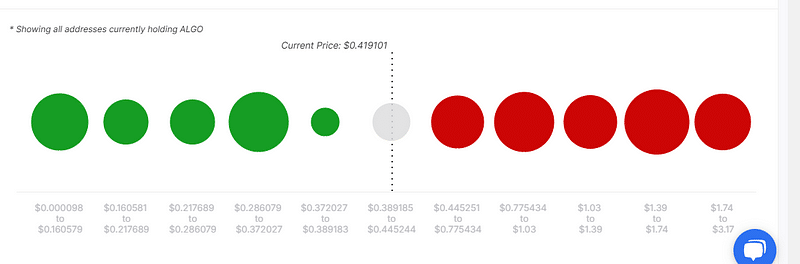

Active addresses and network involvement

In another case, Algorand recorded a notable increase in the number of active addresses in recent weeks, with the increase in line with the altcoin’s price recovery on the charts.

Source: IntoTheBlock

This increase underlined the renewed interest from both traders and investors, which is a sign of higher network demand. Active addresses are typically an early indicator of bullish momentum, as they indicate growing confidence in the asset.

This increase also corresponded with the increase in global liquidity, which has historically led to higher blockchain activity. If active addresses continue to trend upward, this would indicate continued investor confidence.

However, a delay could indicate hesitation or profit-taking among participants. So, traders should keep a close eye on this measure as it often precedes significant price movements on the charts.

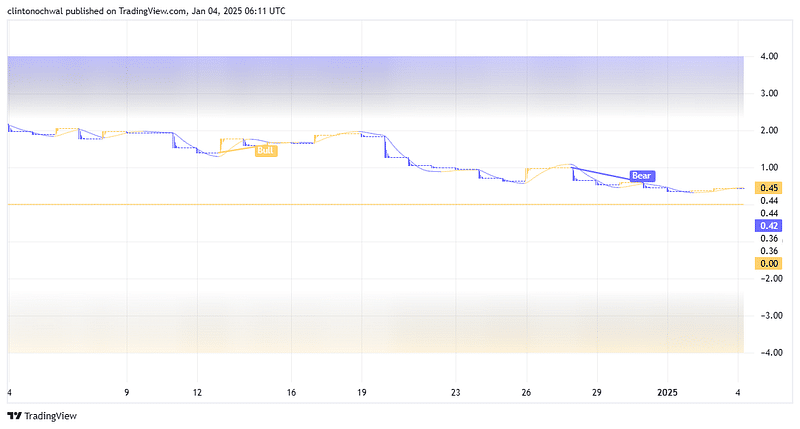

MVRV (market value to realized value)

At a value of 0.45, the MVRV ratio indicated that ALGO is undervalued relative to its historical price performance.

An MVRV of less than 1 means that market participants, on average, hold ALGO at a loss. This has traditionally been an area of accumulation and price reversals.

Source: TradingView

The aforementioned reading seemed to reinforce the idea that ALGO has significant room for upside. In fact, this undervaluation corresponded with the recent breakout of the double bottom pattern – a sign of a strong possibility of bullish continuation.

The low MVRV also indicated minimal risk of excessive selling pressure. Mainly because at this stage it is unlikely that most holders will suffer losses.

If the MVRV ratio starts to approach 1 or higher in the coming weeks, it could indicate that ALGO’s price is catching up to its realized value. This trend would support growing bullish sentiment, especially as DeFi rewards and increasing network activity attract more participants.

However, it is advisable to be cautious if the MVRV rises too quickly as this could indicate possible overextension and profit taking.

This undervalued state of ALGO, combined with rising activity and improving sentiment, makes it an attractive option for traders looking for long-term upside potential.