- A whale withdrew 5.64 million ai16z tokens, worth $6.37 million, from Gate.io.

- Data from the chain showed that the number of active ai16z wallet addresses increased by 12% in the past week, reflecting growing user engagement.

The cryptocurrency market recently witnessed a major transaction involving ai16z, drawing attention to the token’s growing prominence.

A whaling entity withdrew 5.64 million ai16z [AI16Z] tokens, worth $6.37 million, from Gate.io, increasing their total holdings to 15.95 million ai16z, worth $17.86 million.

This large-scale withdrawal underlines potential strategic moves, which may reflect investor confidence in the long-term value of the token or intentions to use the assets in alternative investments.

As market participants analyze these developments, attention shifts to ai16z’s current market performance and technical indicators for further insights.

Current market performance

ai16z has experienced a modest increase in trading volume over the past 24 hours, indicating increased market activity. The token’s price is currently hovering around $1.16 and maintaining a narrow consolidation range.

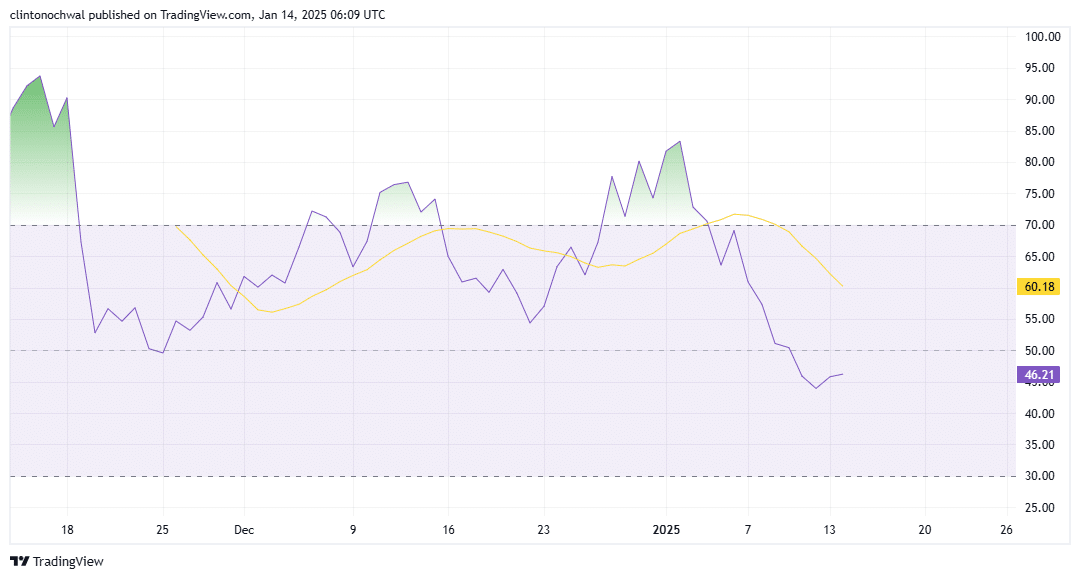

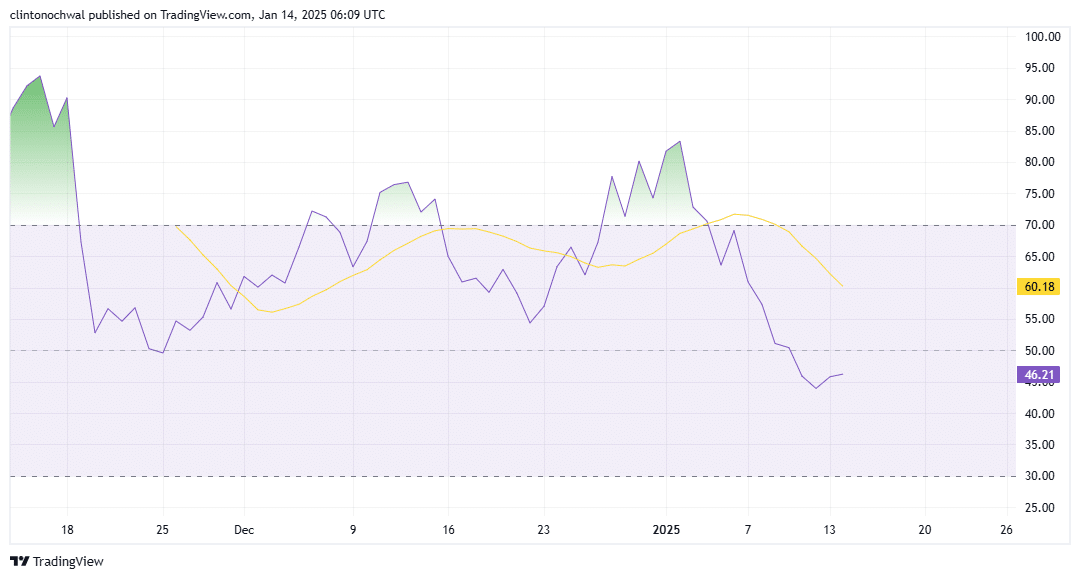

Source: TradingView

Broader market conditions, including Bitcoin price stability and improving altcoin sentiment, have also likely contributed to ai16z’s performance.

However, it is important to note that the AI-focused cryptocurrency sector, including ai16z, has been among the hardest hit in recent weeks, with several tokens seeing sharp declines.

Nevertheless, the recent whale activity could cause volatility as large trades often influence market trends.

ai16z price analysis suggests…

The price of ai16z was trading within a critical range, testing resistance at $1.18 and support at $1.05.

The recent accumulation of whales indicates potential upside, with a breakout above resistance potentially signaling a bullish trend.

However, technical indicators, including the RSI, are currently showing neutral momentum, indicating uncertainty in the market.

Source: TradingView

If the token falls below its support level, it risks entering a bearish phase, potentially reaching $0.95.

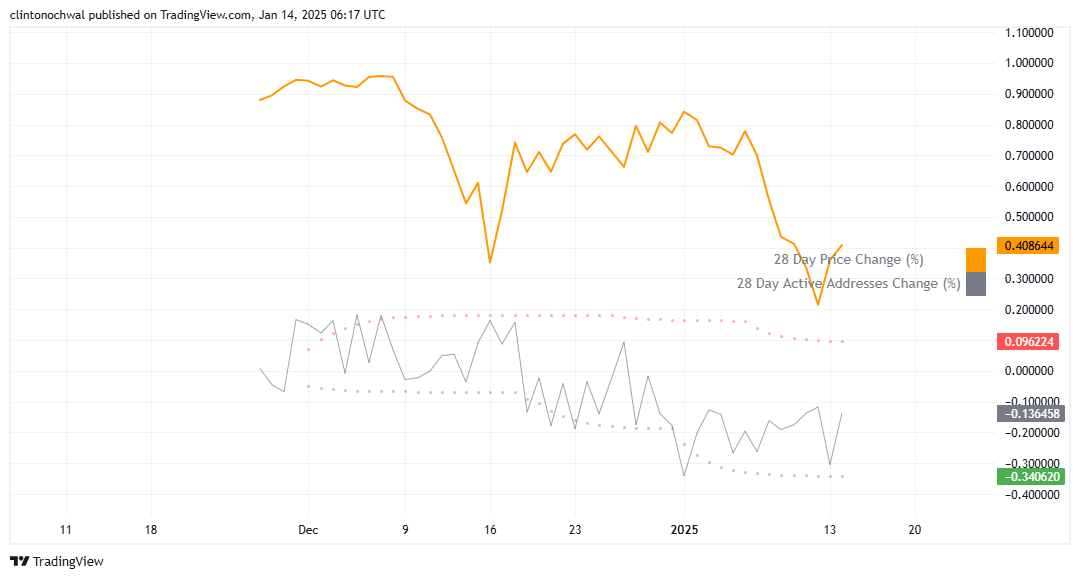

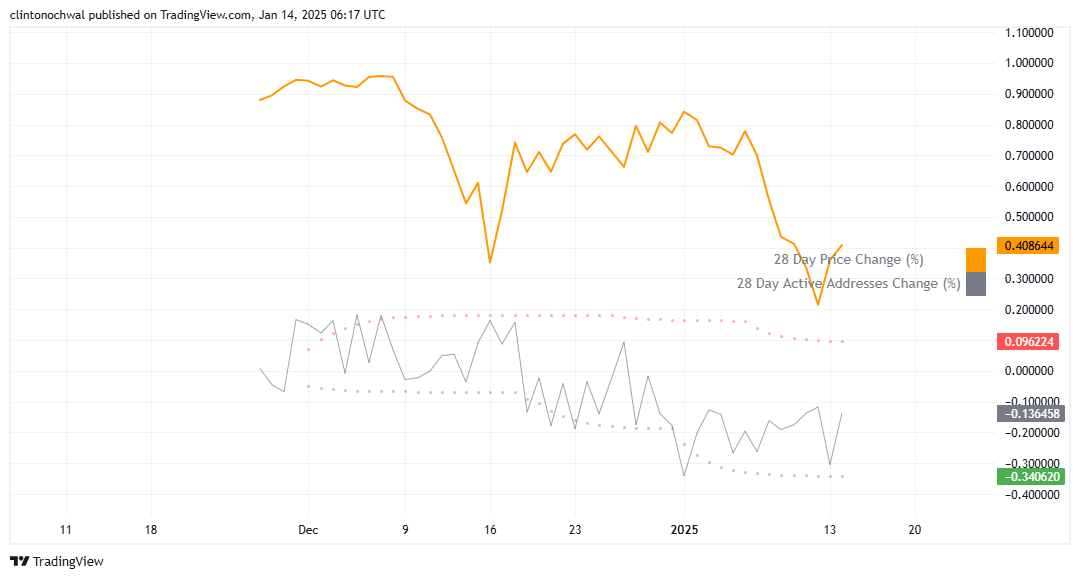

Active address analysis

Data from the chain shows that the number of active ai16z wallet addresses increased by 12% in the past week, reflecting growing user engagement.

This increase in activity is often associated with increased speculative interest, as traders position themselves in anticipation of significant price movements.

Source: TradingView

If active address growth continues, it could support bullish sentiment and improved liquidity. Conversely, a decline in activity can indicate reduced interest, potentially leading to stagnation or price declines.

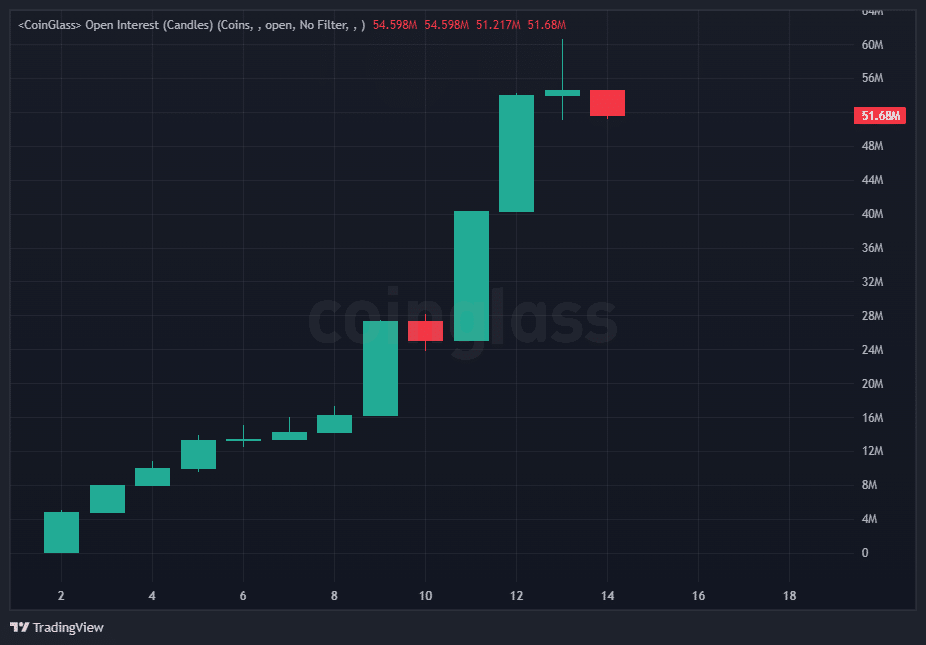

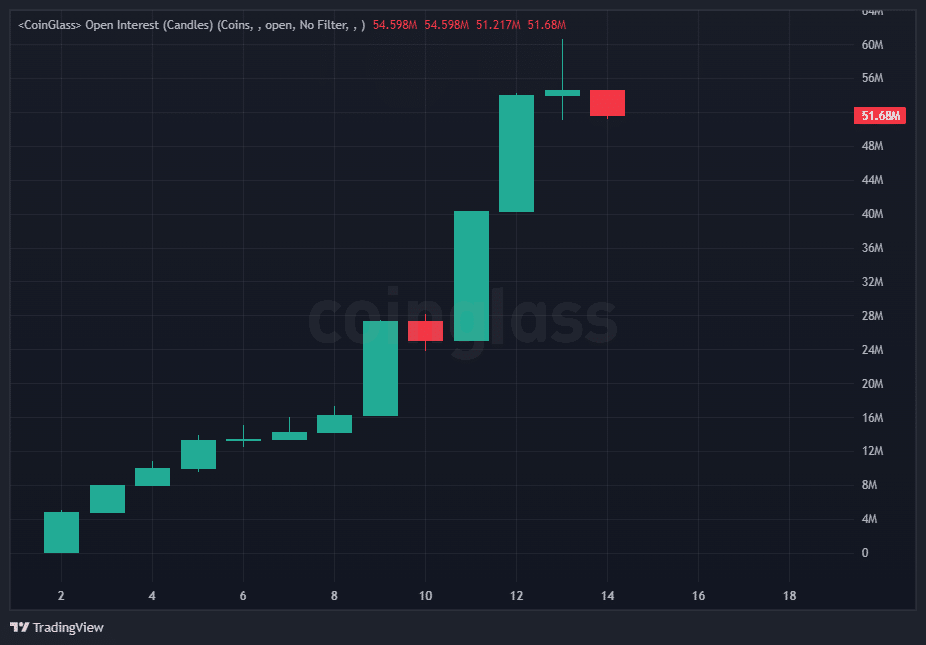

Open interest analysis from ai16z

Open interest (OI) in ai16z futures contracts has risen 20% in recent days, indicating growing speculative activity. Long positions in particular dominate the market, reflecting optimism among traders.

Source: CoinGlass

If ai16z maintains its current price levels or breaks through resistance, the OI could rise further, fueling a potential rally.

Conversely, the inability to maintain support could result in liquidations, amplifying downward pressure.

Neutral funding rates currently indicate balanced sentiment, but traders should watch for shifts that could indicate changes in market positioning.

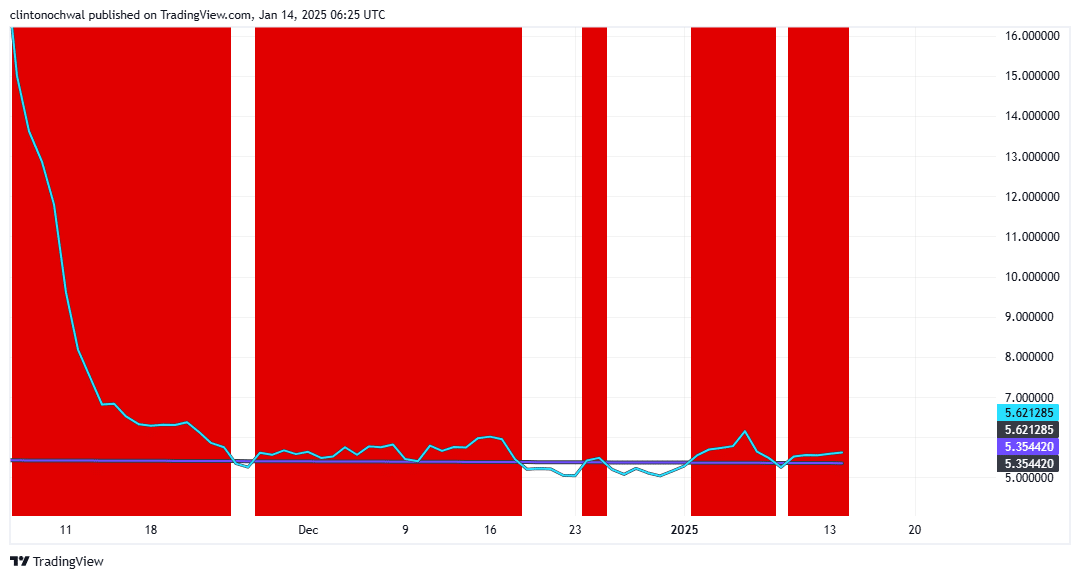

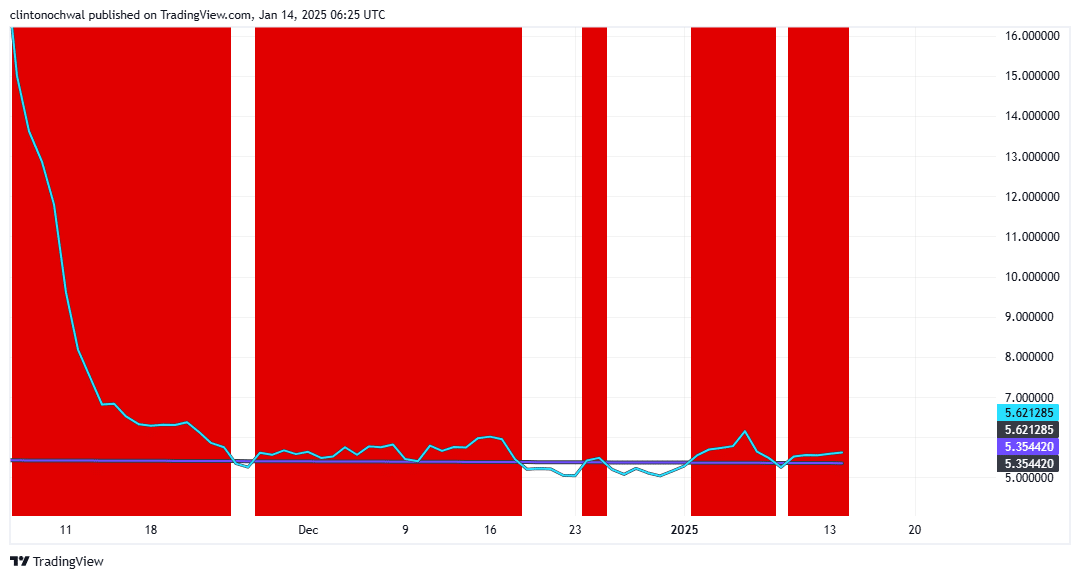

Reduced selling pressure from investors

The MVRV ratio for ai16z highlights a difference between short-term and long-term holders. Short-term holders suffer small losses, while long-term holders remain profitable, indicating that selling pressure from committed investors is easing.

Source: CoinGlass

If the MVRV ratio turns positive in the short term, it could be a sign of renewed buying interest, potentially pushing prices higher. However, a sharp market correction could increase losses for short-term traders, leading to broader uncertainty.

This metric remains an essential tool for assessing the market health of $ai16z.

Read ai16z [AI16Z] Price prediction 2025-2026

ai16z’s market position is at a pivotal point, with whale activity, active addresses and increasing open interest indicating greater market engagement.

Although technical indicators show potential for both upward and downward movement, traders should take a cautious approach, keeping a close eye on key levels and broader market trends.

Continued support in critical price zones will be essential for ai16z to maintain its momentum and attract continued interest from the trading community.