Este Artículo También Está Disponible and Español.

In the fourth quarter of 2024, Polygon (formerly Matic) experienced a significant mixed performance in important statistics, mainly driven by the test network launching its interoperability protocol, agglayer.

This new initiative is intended to facilitate cross-chain token transfers and passing messages, the functionality and integration of various to be improved Blockchain network.

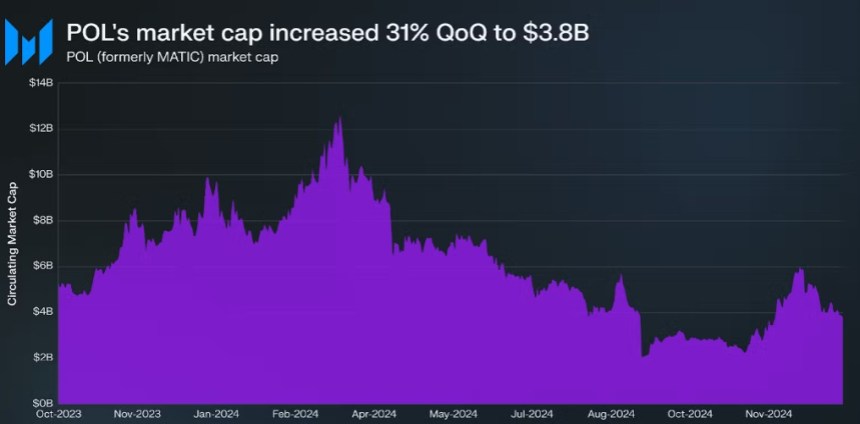

Polygon market capitalization returns to $ 3.8 billion

According to For market lining company Messari, Agglayer promises, by making use of zero-knowledge (ZK) proving, safe communication and asset transfers, which positions itself as an innovative development that is related to the introduction of TCP/IP in the early days of the internet .

Aglayer is designed to unite various blockchain chains by collecting evidence, verify chain states and arranging transactions on Ethereum (ETH). One of the critical characteristics are a uniform bridge for seamless activaconnectivity and a pessimistic proof mechanism That gives priority to safety.

These claims make coordination with low latency and safe interoperability possible, so that developers can concentrate on project design without the burdens of liquidity problems.

Related lecture

Despite these promising developments, the journey of Pol in 2024 was turbulent. After achieving a record high market capitalization From $ 12.9 billion in Q1, the following quarters saw a sharp decrease, with the market hood that fell to $ 2.9 billion towards $ 2.9 billion, which marked a decrease of 47.2% quarterly over-quartaal (QOQ) .

This decline was partly due to the constant transition from Matic to Pol, which temporarily split market capitalization between the two tokens.

However, as market conditions began to stabilize in the first quarter, the migration of Matic tokens – 1.38 billion in total – Pol resulted in a 31% QoQ increase of Pol’s market capitalization, which by the end of the quarter of $ 3, Reached 8 billion.

In particular, 88.1% of the total supply had been transferred to Pol, which strengthened its position as the largest Ethereum Layer-2 token per market hood.

Defi- en NFT – Struggling markets

The determination of EIP-4844 on the Polygon Pos-Main in Q1 2024, which led to a significant change in the cost structure for users. This update resulted in lower transaction costswho fell to just $ 0.01 during Q4.

Despite the lower costs, the total transactions on the Polygon Network, however, fell by 2% QoQ, and active addresses saw a sharp decrease of 39.4%, an average of 523,000 daily users.

The decrease in activity can largely be attributed to a decline in the gaming sector, which had previously been an important engine for user involvement. Average daily gamingactive addresses fell to 54,000, which marked a decrease of 66.7% QOQ.

Related lecture

The Defi landscape of Polygon also faced challenges, with total value locked (TVL) ending Q4 at $ 871.5 million – down 4.9% QoQ and 2.6% yoj. Polygon saw this decline slipping through the tenth largest network TVL Until the twelfth.

In addition, NFT activity on the platform, with an average daily trade volume, fell to $ 822,500, a decrease of 38.4% QOQ. The average daily NFT turnover fell to 21,000, a stunning decrease of 41.5%.

The game sector, formerly the fastest growing area in Polygon, continued to struggle in Q3 and Q4, largely due to a delay in popular titles.

The price of Pol has also confronted with remarkable challenges, with the token registering a significant decrease of 67% to date, because it is currently trading at $ 0.30.

Featured image of Dall-E, graph of TradingView.com