- A recent report has revealed an interesting link between global inflation and cryptocurrency market capitalization.

- Is the recent ‘dip’ in cryptocurrency market capitalization just a false alarm, or is volatility looming?

A year ago, the crypto market cap was a solid $1.72 trillion. Fast forward to today and it has risen to $3.27 trillion – a staggering 90.11% increase since the start of the year.

Interestingly, half of that growth came in the fourth quarter alone.

Clearly, the “Trump pump” was the main catalyst, fueling a massive influx of new capital into the crypto market.

However, 2024 ended with the market still 11% below its mid-December peak.

Could this widening gap be a sign of things to come as we head into the most volatile first quarter yet?

The crypto market must be prepared for a volatile 2025

Interestingly enough, a recent grayscale report has revealed a striking connection between the crypto and bond markets.

The market capitalization of digital assets has now surpassed that of the US high-yield bond market, more than doubling its size. It is clear that investors are turning to crypto in search of better returns.

Despite this tremendous growth, the recent double-digit dip in the crypto market is not just a fluke.

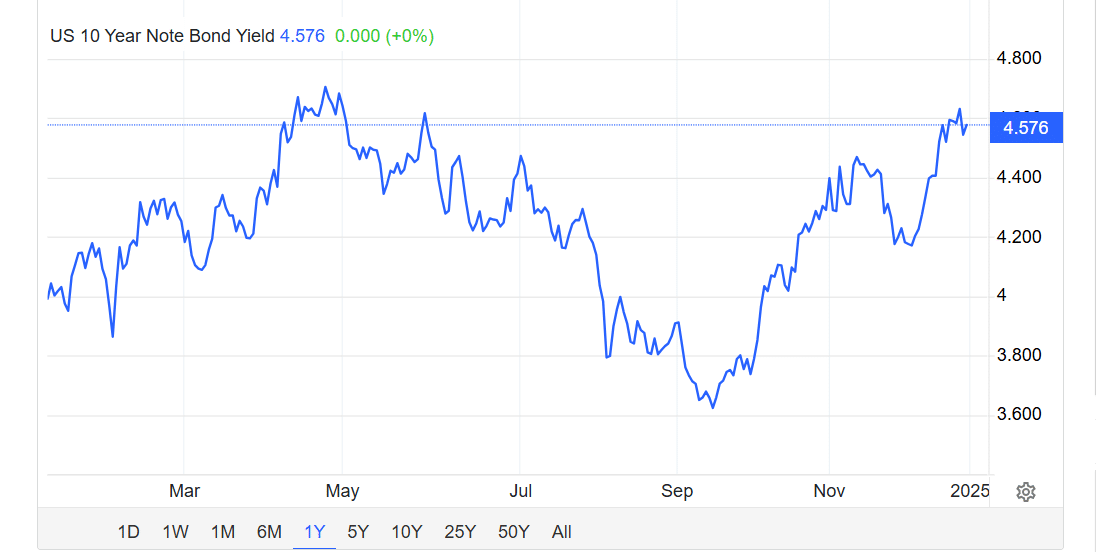

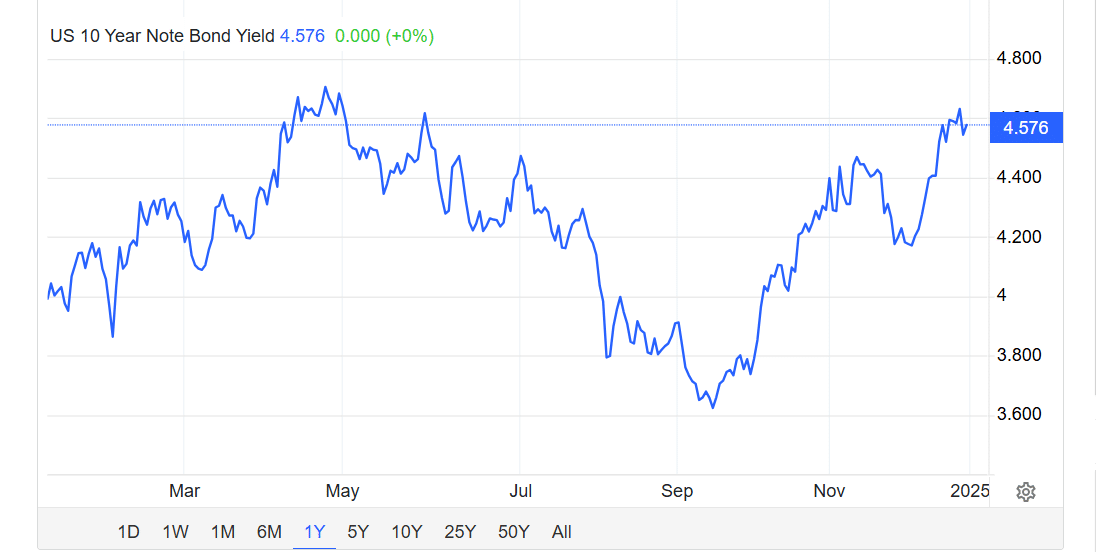

The Fed’s signal for fewer rate cuts in 2025 has created some uncertainty, creating a tricky dynamic for both markets.

Here’s the deal: Typically, bonds become more attractive when interest rates rise. Why? Because returns increase, offering a better deal for investors.

With the Fed leaning toward fewer rate cuts, it’s no surprise that investors are flocking to bonds for their stable yields. This could set the stage for a possible bond market recovery in 2025.

In response, the crypto market, which often moves in the opposite direction to bonds, has taken a hit. Yet this dip may be more about “speculationon interest rate increases than on actual changes in financing costs.

Is the crypto market ready for a turnaround, or are we looking at a longer dip?

The US bond market under the microscope

Technically, bonds play a crucial role in how the U.S. government raises money.

But if interest rates rise, it will come with a hefty price tag – no wonder President-elect Donald Trump pronounced about the Fed’s reluctance to lower borrowing costs.

This could be a pivotal moment for the crypto market. While many expect inflation to rise as a result of Trump’s tough policies, modest core PCE inflation growth in November indicated less price pressure than expected.

To add to the mix, mid-December facts revealed persistent unemployment claims hitting a three-year high, signaling potential economic strains.

Meanwhile, the yield on the 10-year U.S. Treasury note fell to 4.576%, falling further from a recent peak of 4.6%, the highest level since early May.

Source: Trade Economics

These changing dynamics could lead the government to reconsider its approach to borrowing costs, especially given their sheer size debt burden it is confronted.

What does this mean for investors? It could be time to refocus on crypto. Moreover, with a possible economic downturn looming, the idea of Bitcoin [BTC] because a strategic reserve, as proposed by Trump, is gaining ground.

Read Bitcoin’s [BTC] Price forecast 2025-26

2025 promises to be a pivotal year for both the bond and crypto markets. As bonds face increasing challenges, the crypto market presents a profitable opportunity.

But how the government responds to macroeconomic trends, especially around interest rates, remains the key factor to watch in the coming months.