- ADA is down 8.77% in the last 24 hours.

- Market fundamentals show a strong bearish outlook, with one analyst predicting a post-correction rally.

Since making $1.3, Cardano [ADA] is struggling to maintain upward momentum. As such, the country has experienced strong downward pressure, which has increased over the past week. During this period, the ADA has fallen to a low of $0.77.

At the time of writing, Cardano was trading as high as $0.9013. This represented a decline of 8.77% over the past day. Likewise, it has fallen 14.45% on the weekly charts.

The recent decline has prompted the Cardano community to engage with some analysts who showed optimism. Popular crypto analyst Ali Martinez has suggested a potential rally to $6, citing previous cycles.

Market sentiment

In his analysis states Martinez stated that Cardano follows a similar pattern to its previous cycles.

Source:

According to him, in 2020 the first major correction after a bull rally started at the same time as today. After this correction, the market will become sufficiently stronger for a new rally.

In context, during the 2020 rally, the ADA rose from $0.088 to $0.190. After this uptrend, the altcoin returned to a low of $0.12. However, after the market correction, Cardano rose from a low of $0.12 on December 20, 2020 to $1.02 through February 2024, marking a rally of as much as 750%.

So, if we are to follow history, Cardano could see a huge rally after the current correction.

What ADA Charts Indicate

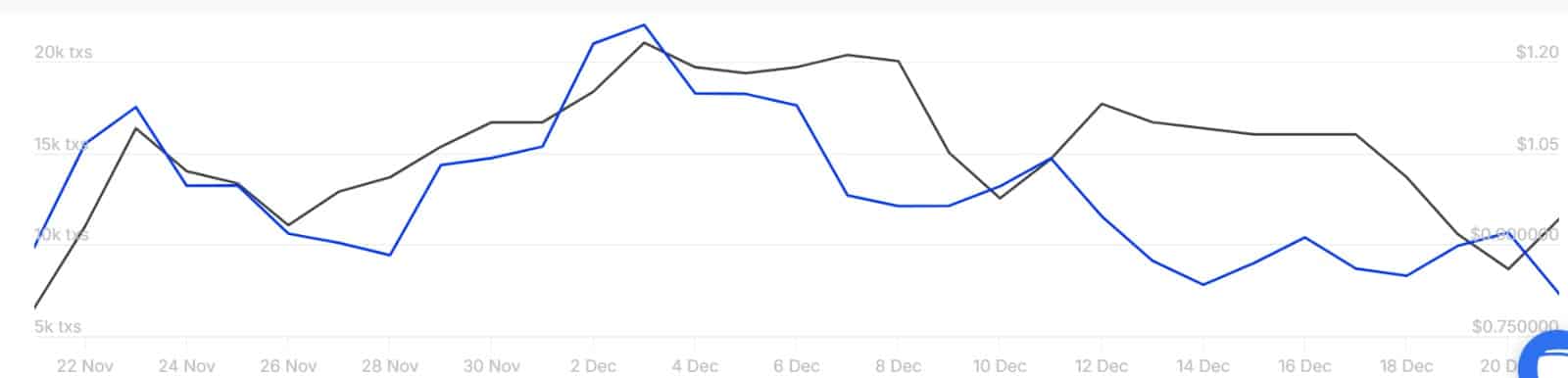

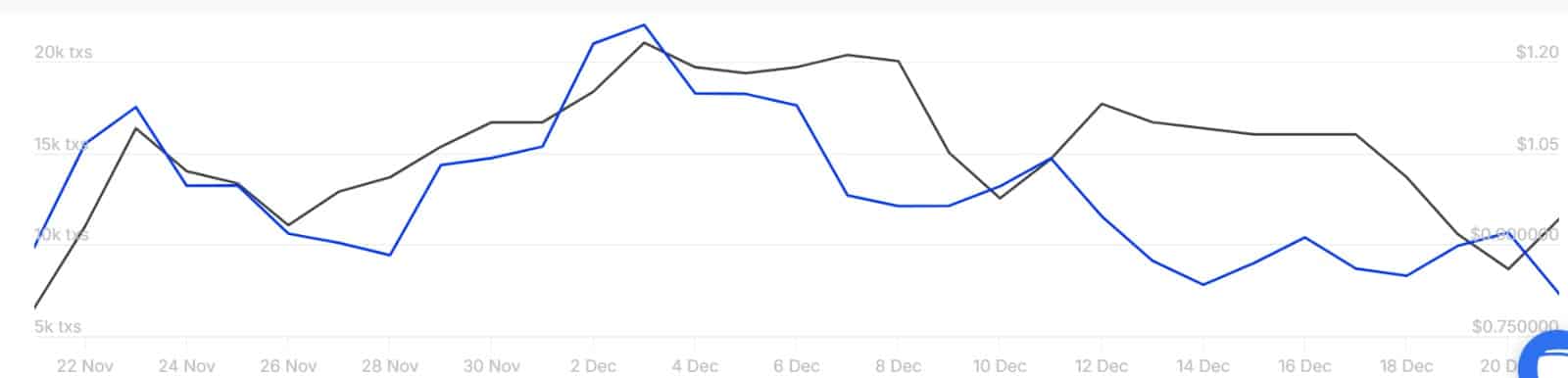

While Martinez’s historical cycle offers a promising outlook, other market indicators tell a different story. This is mainly because Cardano’s on-chain business has fallen to recent lows.

Source: Santiment

For starters, Cardano’s price-DAA divergence has remained negative over the past week. If this remains negative for a long period of time, it means that the current ADA price and market valuation are not supported by the growth of the on-chain business.

Source: IntoTheBlock

We mainly see this phenomenon among large farmers. As such, large transactions have fallen to a monthly low.

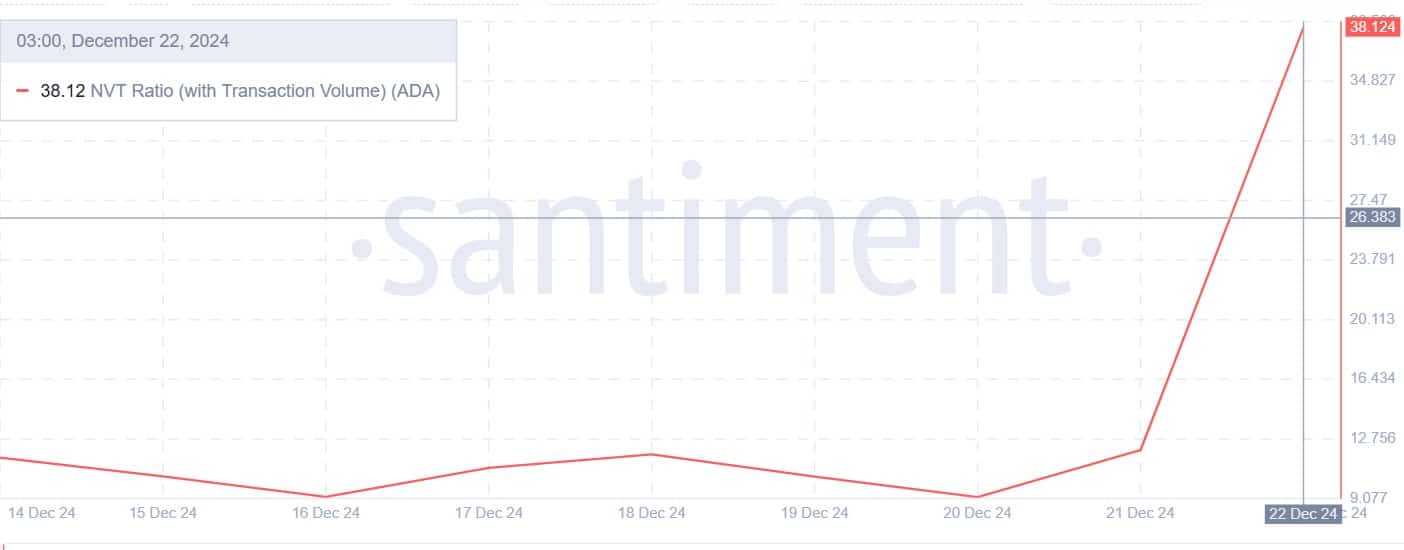

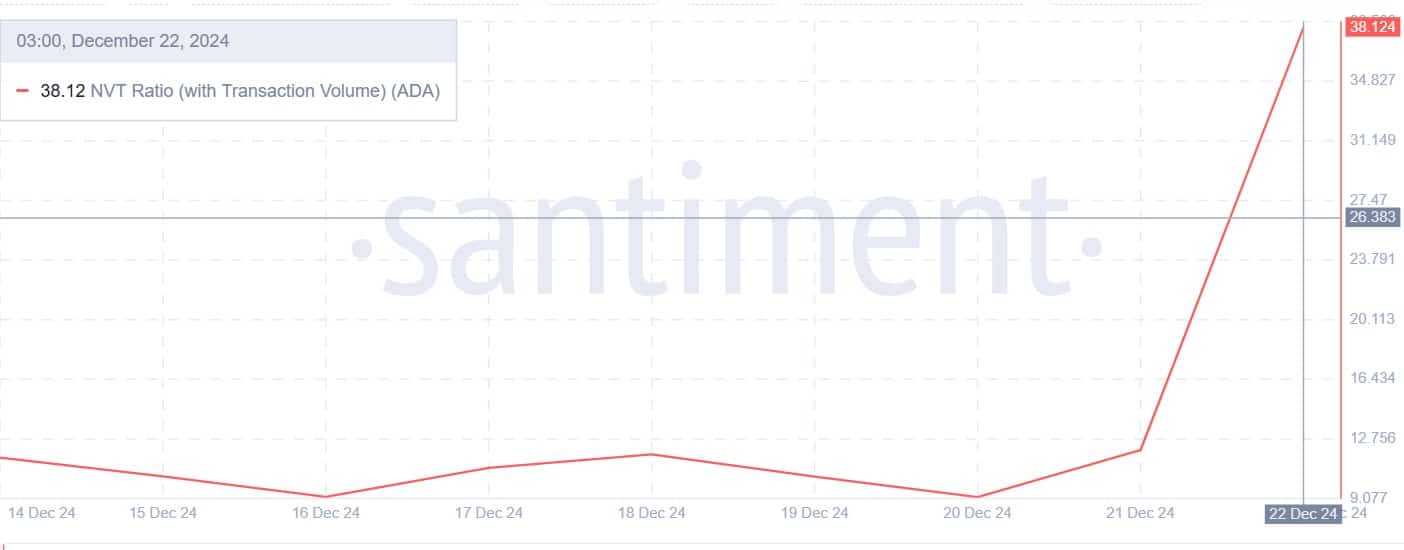

Source: Santiment

Furthermore, Cardano’s NVT ratio with transaction volume has increased from 9.17 to 38.12 at the time of writing.

This implies that despite the recent decline, ADA’s market value is still growing faster than the on-chain transaction. Such a trend suggests that speculation is driving price growth rather than increased usage, and prices are still high.

For sustainable price growth, Cardano must therefore see a relative increase in active addresses, transactions, and overall on-chain activity.

Read Cardanos [ADA] Price forecast 2024-25

As such, given the prevailing circumstances, it appears that ADA’s corrective phase is not yet over. As such, before a trend reversal, the ADA could fall to $0.85 in the near term.

Subsequently, Cardano will regain the resistance at $1.0 through a trend reversal. The $6 is currently far-fetched as the altcoin needs to break the resistance levels of $1.2, $1.6, $1.8 and $2.4.