History suggests that the current Bitcoin (BTC) correction could be the last fakeout to the downside before the crypto king explodes on another macro bull run, an analyst said.

The pseudonymous analyst known as TechDev tells are 417,000 X followers that if past cycles are an indicator of things to come, Bitcoin’s recent crash to the $25,000 level could act as a spring for another expansion.

“Either the coming months will surprise the market again, or this time it will be really different.”

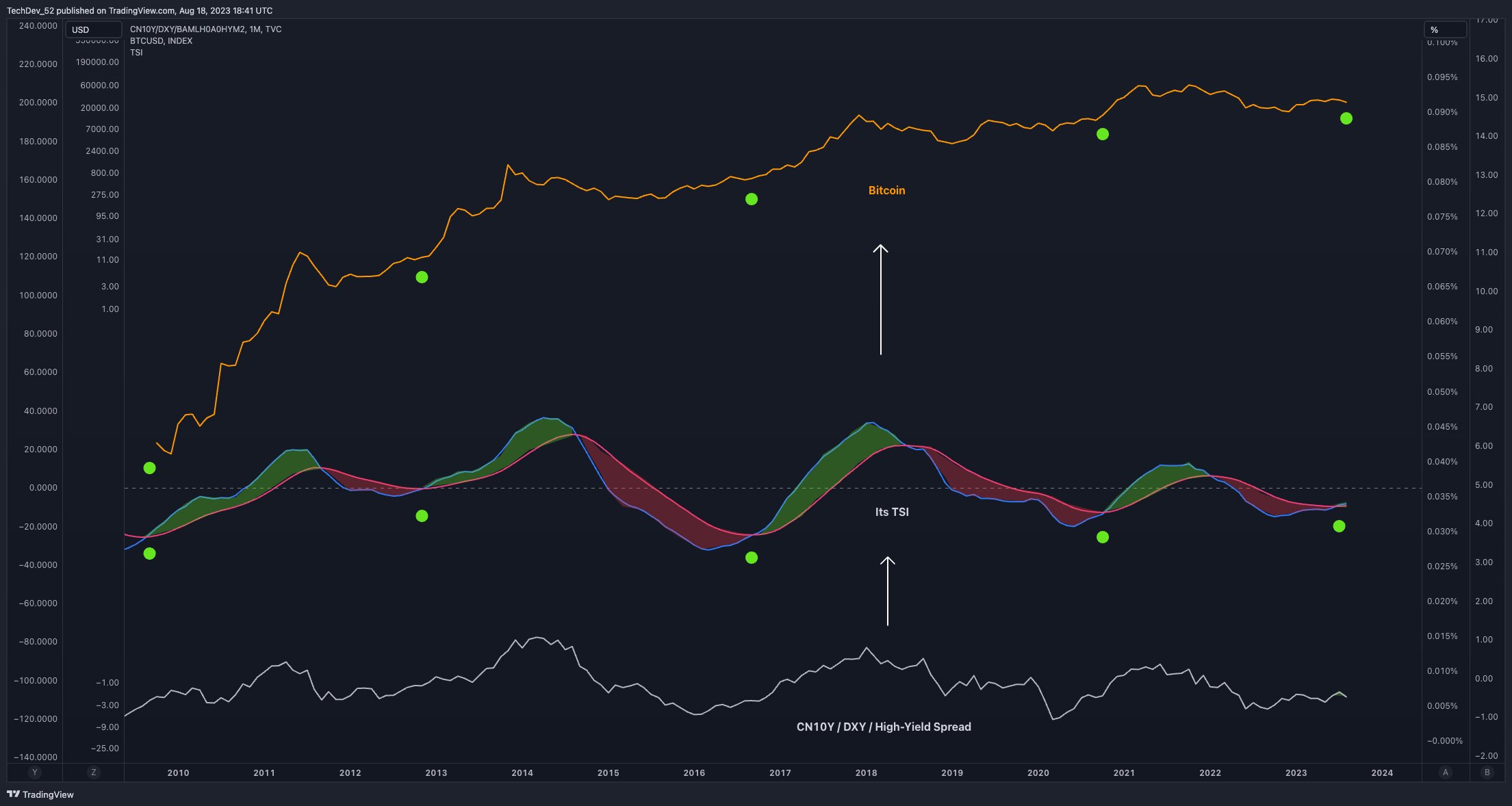

The trader is known to monitor global liquidity cycles, which he depicts by comparing China’s 10-year bonds (CN10Y) against the US dollar index (DXY). TechDev’s chart appears to use the True Strength Indicator (TSI) to measure the momentum of the CN10Y versus the DXY.

TechDev’s chart suggests that the TSI is showing a bullish cross, a technical value also present at the start of previous Bitcoin bull markets.

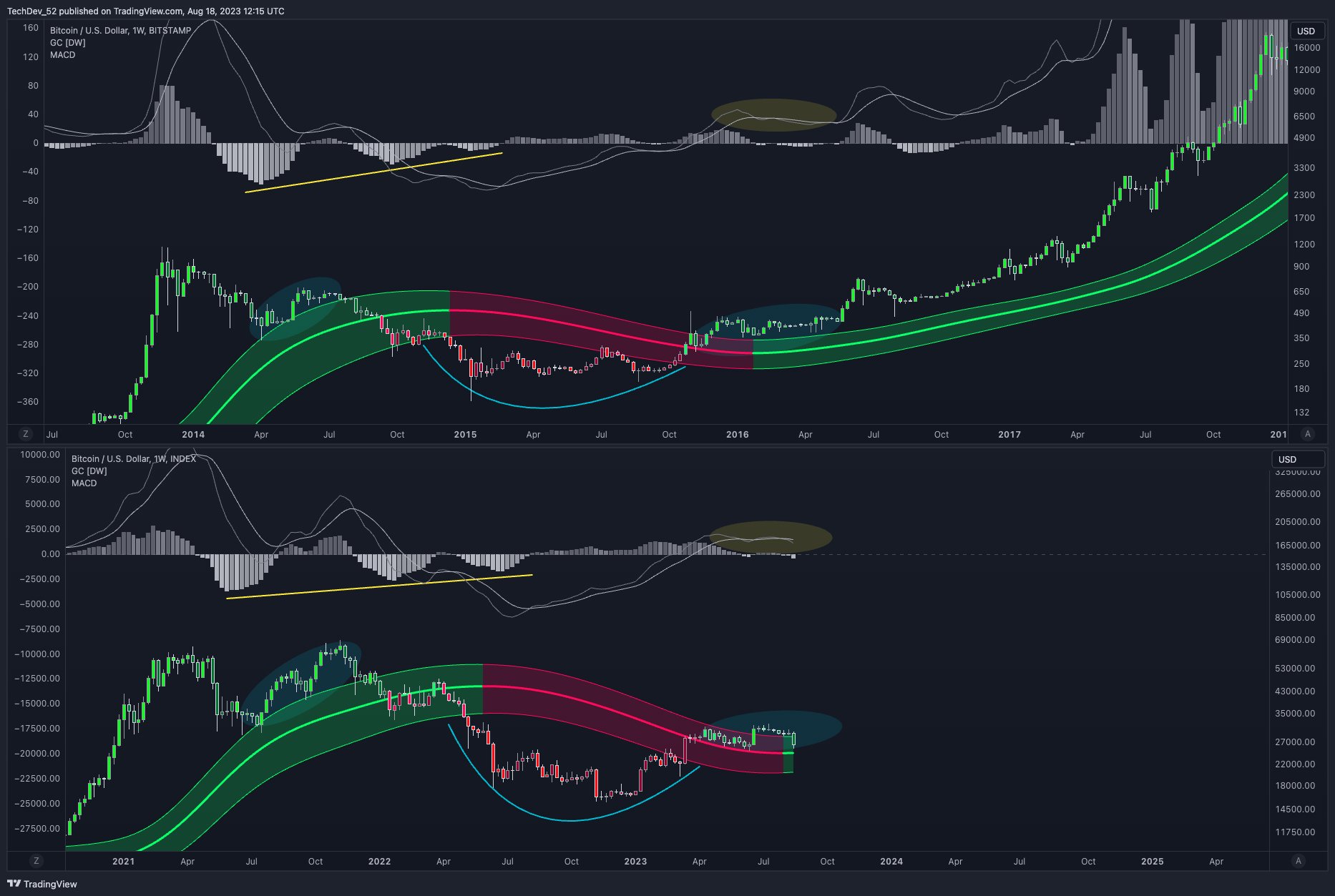

TechDev also bases its analysis on the supertrend indicator, which generates bull and bear signals based on whether the price breaks previous open or close levels during a given period.

He says an optimal scenario for Bitcoin would be a run-up to the two-month supertrend level of around $50,000, represented by the red line on the chart, before testing support near $30,000 or so and then launching into a parabola .

According to TechDev, the move will allow Bitcoin’s two-month chart to fall into the support area of the Bollinger Bandwidth Indicator (BBW), a level that heralded the start of the 2017 and 2020 bull markets.

Traders use the BBW indicator to gauge the volatility of an asset.

says TechDev,

“Want to see a move to two-month supertrend + retest to complete two-month compression.”

The analyst also makes a comparison between now and 2016, where BTC spent several months above the Gaussian channel testing it as support as it consolidated before entering a clear uptrend.

Based on the comparison, BTC could repeat its 2016 recovery by consolidating just above the Gaussian Channel for a long period of time before heading to an all-time high.

The Gauss channel is an indicator that attempts to define the trend of an asset.

says TechDev,

“Stay above the center of the Gaussian channel.”

At the time of writing, Bitcoin is worth $26,116.

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey