- Sticking to PoW allowed UNI, AAVE and CRV to enjoy a period of institutional acceptance.

- Token prices skyrocketed; same as the TVL.

The prices of Uniswap [UNI], Aaf [AAVE]And Crooked finances [CRV] significantly increased in the past 24 hours. According to CoinGecko, AAVE’s value with cryptocurrency increased 27.2%. UNI was up 10.9% while CRV was up 8.7%.

How many Worth 1,10,100 AAVEs today?

The price spike may be related to the complex interplay of factors in the market. Some of these include institutional outreach and regulatory actions. Recently, the US SEC listed several tokens as unregistered securities.

Escape drives profit

Most of these labeled assets fall under the Proof-of-Stake (PoS) consensus mechanism. The regulator also considered them to be relatively centralized. Resulting in institutional acceptance, which has since increased Bitcoin [BTC] ETFs approval, also looked at the DeFi sector.

So since these tokens had not yet migrated to PoS despite being linked to them Ethereum [ETH]invaded institutional funds.

For AAVE, Lookonchain reported that a particular whale speculated to be an institution netted $13.2 million on June 25. This move was instrumental in sending the award up the charts.

This shift in investor sentiment highlights the growing interest in Decentralized Finance (DeFi) projects amid unclear regulation from the SEC.

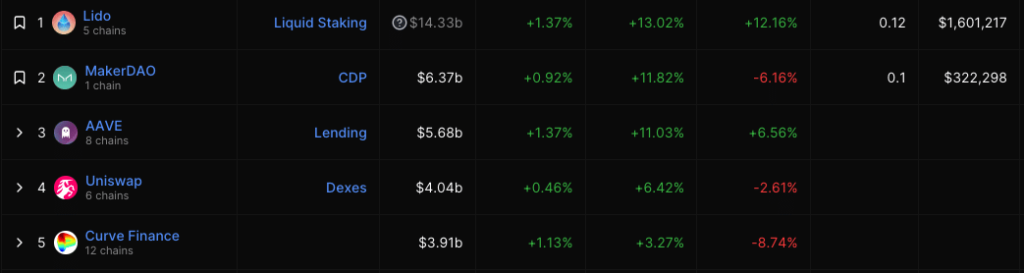

As for their respective Total Value Locked (TVL), DefiLlama showed that Aave, Uniswap, and Curve are aligned in descending order.

At press time, AAVE’s TVL was $5.68 billion – up 11.03% over the past seven days. Curve’s TVL was $3.91 billion, while Uniswap’s was $4.04 billion.

The rise in the TVL suggests that investor confidence in the project had improved. And in practice, deposits in smart contracts that work under each protocol increased.

Source: DefiLlama

Rising volumes for everyone

AAVEs volume, which has been in an unimpressive state for some time, rose to 431.61 million. UNI also increased to 135.49 million and CRV volume increased slightly to 57.73 million.

The rising volume indicated that transactions with the token were increasing. It also indicates increased enthusiasm among buyers.

If this continues without significant selling pressure, then the token’s prices could get stronger. This could therefore lead to another price increase.

Source: Sentiment

Realistic or not, here it is CRV’s market capitalization in terms of UNI

As prominent DeFi tokens, AAVE, UNI and CRV, it is unusual to be typically associated with traditional financial systems.

In addition, their respective ability to provide decentralized loans, loans and yield farming has made them attract attention. These activities, which take place without relying on traditional intermediaries, could also have played a role in increasing investment interest.