- Aave’s statistics show that the network has experienced increased activity and growth.

- AAVE’s price action was heading towards a retest of support, after cooling off since early October.

Maintaining growth during the crypto winter has been a tall order for many projects. Aaf [AAVE] is one of the few protocols that has somehow achieved remarkable growth in a number of key areas, especially in total value (TVL).

Is your portfolio green? View the AAVE Profit Calculator

According to a recent Ben GCrypto rankings, Aave was the leading protocol within the Polygon [MATIC] ecosystem in terms of TVL. This means that it performs better than other protocols, such as Uniswap [UNI] and Balancer, to name a few.

Top 10 Polygon Ecosystem Coins from TVL

Polygon is a decentralized Ethereum scaling platform that allows developers to build scalable, easy-to-use dApps with low transaction fees without sacrificing security.$AAVE $ FAST $PEARL $UNI $TNGBL $BIFI $COMP $BALL $STG $GAMMA pic.twitter.com/9PfbnJMbxT

— Ben GCrypto (@GCryptoBen) October 11, 2023

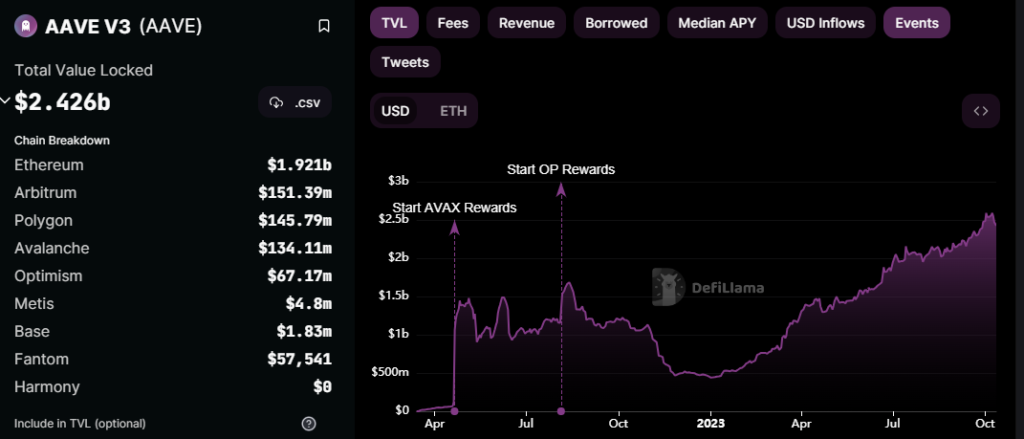

But how much growth has Aave achieved and what does this mean for the future of the protocol? Well, Aave V3 is the ideal representative of that growth, given the positive TVL growth since early 2023. TVL recently peaked at $2.59 billion in early October. For perspective, Aave’s TVL was below $500,000 at its lowest level in January 2023.

Source: DeFiLlama

The TVL growth underlines the robust inflow of liquidity into the Aave ecosystem. While this indicates positive growth for the network, there are a few other metrics that point to Aave’s current trajectory.

For example, the turnover of Aave V3 increased significantly at the beginning of September. This indicated that the network has experienced increased activity over the past four to five weeks.

Source: DeFiLlama

AAVE price action review

The surge in Aave network activity may have boosted investor confidence in the AAVE token given its bullish performance throughout most of September. The rally was short-lived after breaking above the $70 price tag and has been bearish since early October.

AAVE was exchanging hands at $62.45 at the time of writing, following a 14.22% retracement from the current monthly high. This latest bearish outcome has now pushed the price below the Relative Strength Index (RSI) level of 50%. This means there is now a chance of more downside after failing to secure mid-level demand on the RSI.

Source: TradingView

AAVE traders should watch out for support near the $60 price range. This is because the same price level is a historical support range. So traders should look for signs of accumulation as the price approaches that support zone.

Read more about AAVE’s 2024 price forecast

While expectations for a rally are high, traders should be alert to capitulation opportunities due to external market forces. Growing market concerns could reduce investor confidence, potentially leading to even more negative consequences. Nevertheless, Aave’s growing network activity suggested that its native token could deliver bullish performance in the long term.