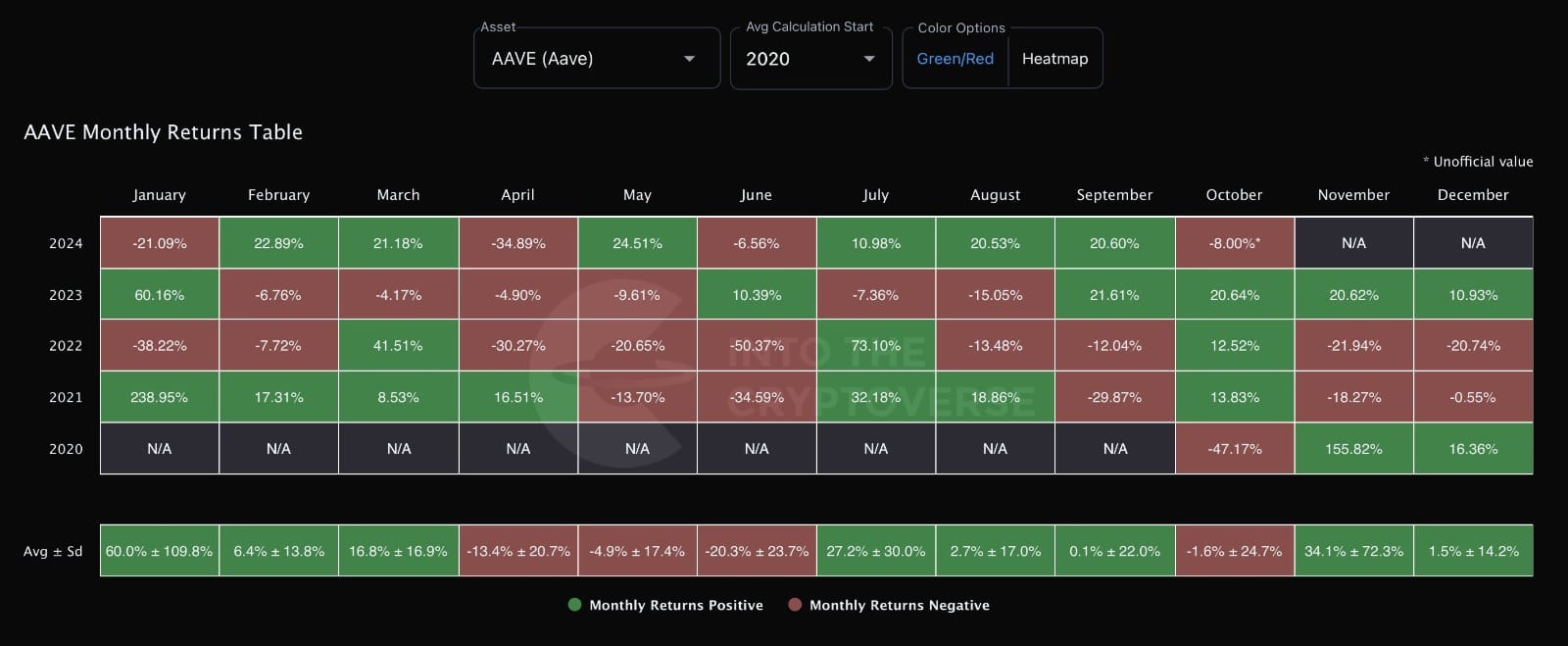

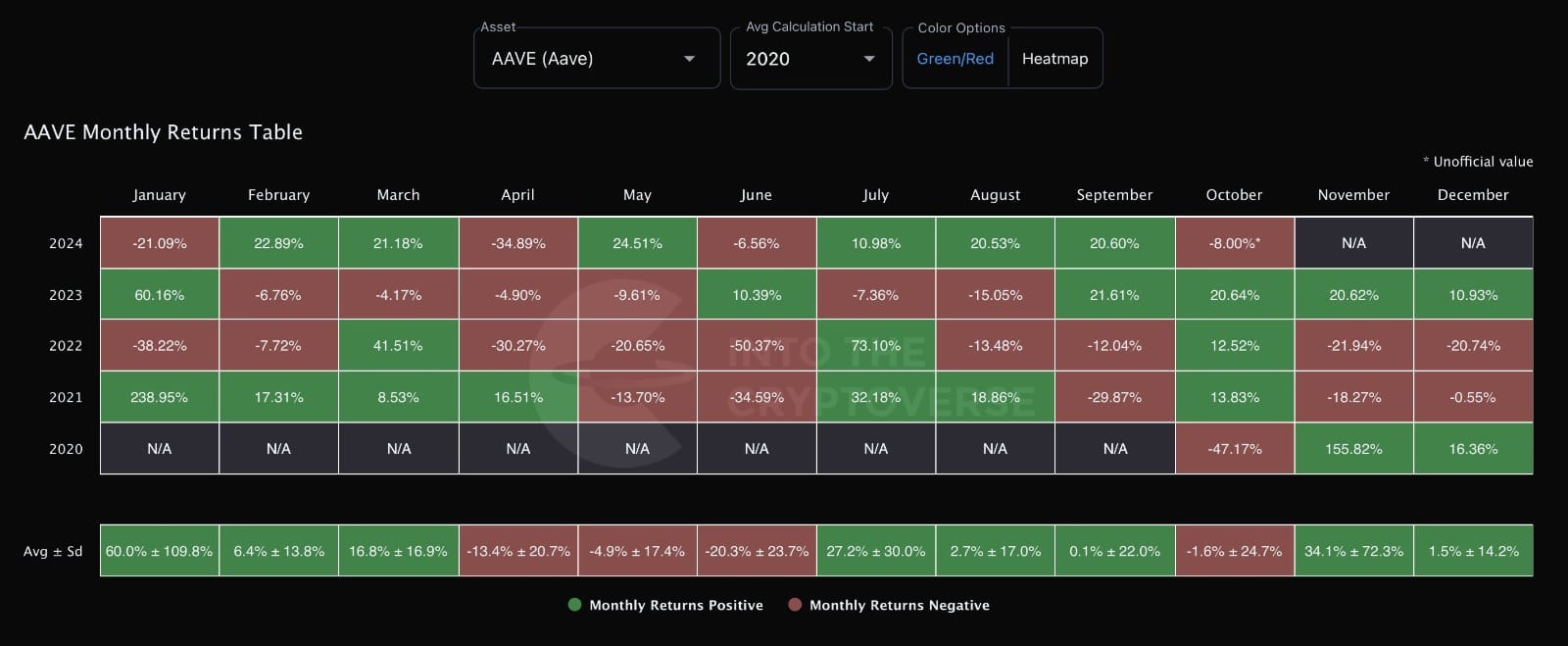

- As at the time of writing, Aave was down 8% in October.

- It looks like Aave will break the cup-and-handle pattern.

Aaf [AAVE] has become one of the standout protocols in the crypto space, mainly due to its focus on decentralized lending.

After three straight months of bullish momentum, Aave has caught the attention of traders and investors.

In July, it posted a gain of more than 10%, signaling a shift in market sentiment. The next two months saw even more impressive gains, with closes of over 20%.

Despite the current 8% decline in October, historical trends suggest that losses can be reversed and gains of more than 20% can be achieved by the end of the month.

Source: IntoTheCryptoverse

With the broader crypto market expected to perform well in the fourth quarter, Aave presents an opportunity for those looking to capitalize on the recent dip.

Examining Aave’s price action, we see a promising cup-and-handle pattern forming on the weekly chart. This often indicates a possible outbreak.

After a healthy pullback, the price tested the USD 140 support zone again. This set the stage for continuation towards the $151 level and possibly higher.

Source: TradingView

Traders should keep an eye on the confirmation of the breakout as it could lead to significant gains.

When markets come out of a long period of consolidation, they often rise for extended periods, and Aave may be no exception.

The value of Aave and 365D ROI

When comparing the performance of Aave with Bitcoin (BTC), Aave has shown strength even in the correction phase.

BTC valuation bottomed as the broader crypto bull market ended, but Aave remained in a consolidation phase.

It wasn’t until August that Aave’s token finally broke out of this range. With Aave outperforming Bitcoin, it is well positioned for further gains.

Source: IntoTheCryptoverse

This recent correction could be seen as a temporary pullback before it continues its upward trajectory. This could potentially lead to a bullish close towards the end of the month.

Adding to the optimism surrounding Aave is its 365-day return on investment (ROI), which currently stands at 2.2.

This indicates that most bondholders are making profits so far, further strengthening investor confidence.

Source: IntoTheCryptoverse

With the majority of holders posting profits, selling pressure is expected to remain low, reducing the likelihood of a significant price decline.

Read Aave’s [AAVE] Price forecast 2024–2025

Instead, traders will likely hold their positions and expect even higher returns in the near future.

With historical data pointing to a bullish fourth quarter, a potential turnaround and further gains for Aave are expected despite a temporary dip in October.