- Several key metrics underlay AAVE’s expected rally, although its success hinged on overcoming a major resistance level on the third try.

- If this resistance is not overcome, the price could drop to $116 or $113.5.

As of the time of writing, Aave [AAVE] posted a 6.63% gain in the last 24 hours, despite inconsistent performance throughout the week.

Maintaining this momentum could erase the week’s losses and position AAVE for a higher trajectory than in the past two weeks.

What’s next for AAVE? Is there a major rally on the horizon, or is it still a long way off?

The AAVE rally seems imminent

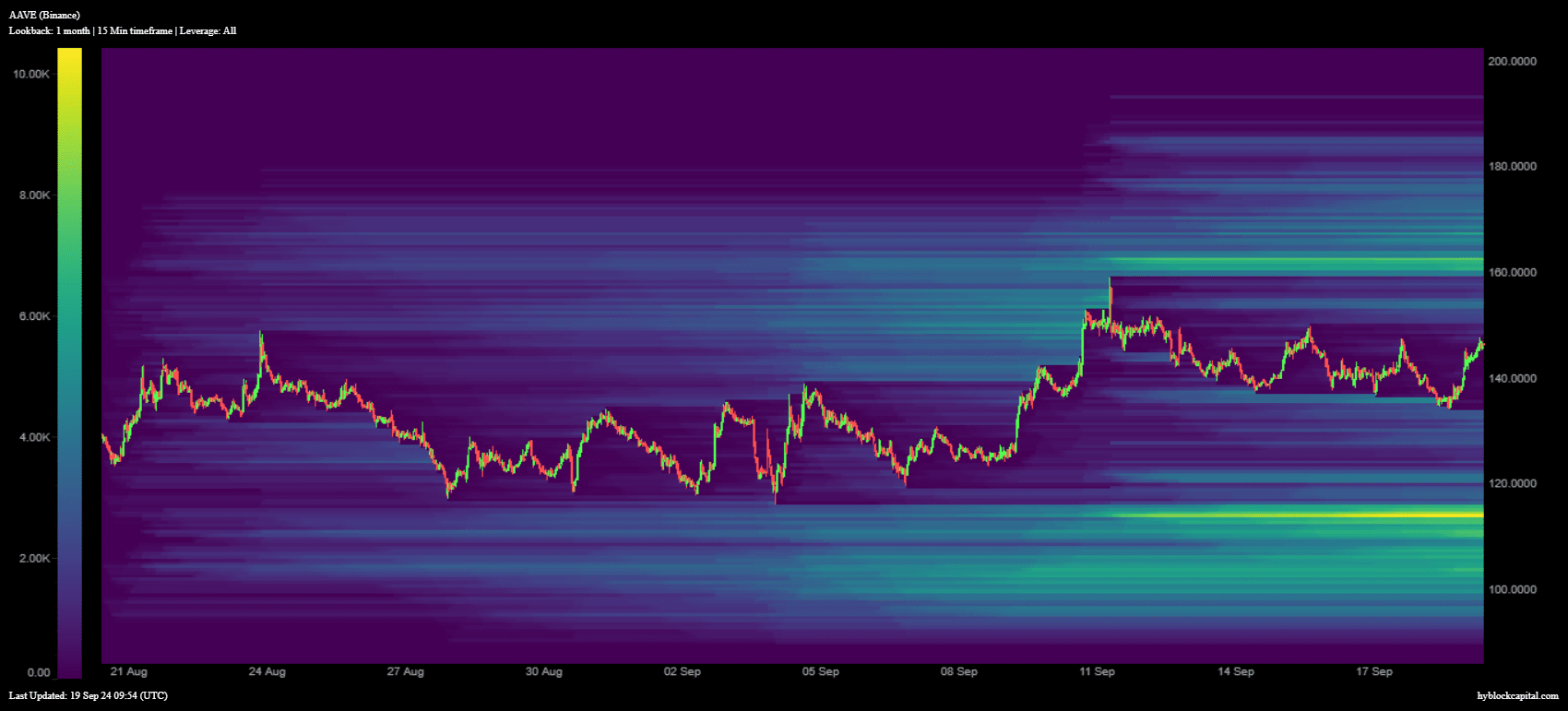

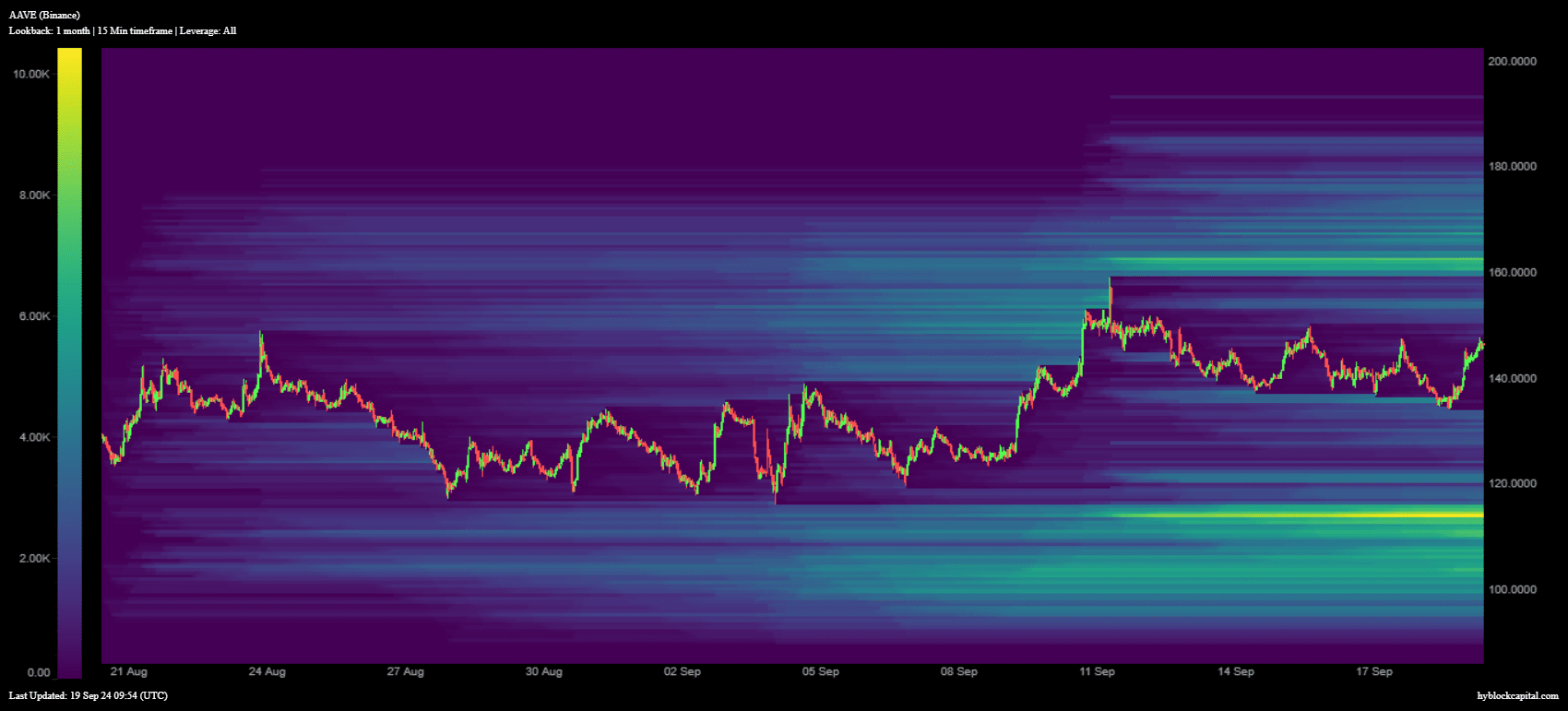

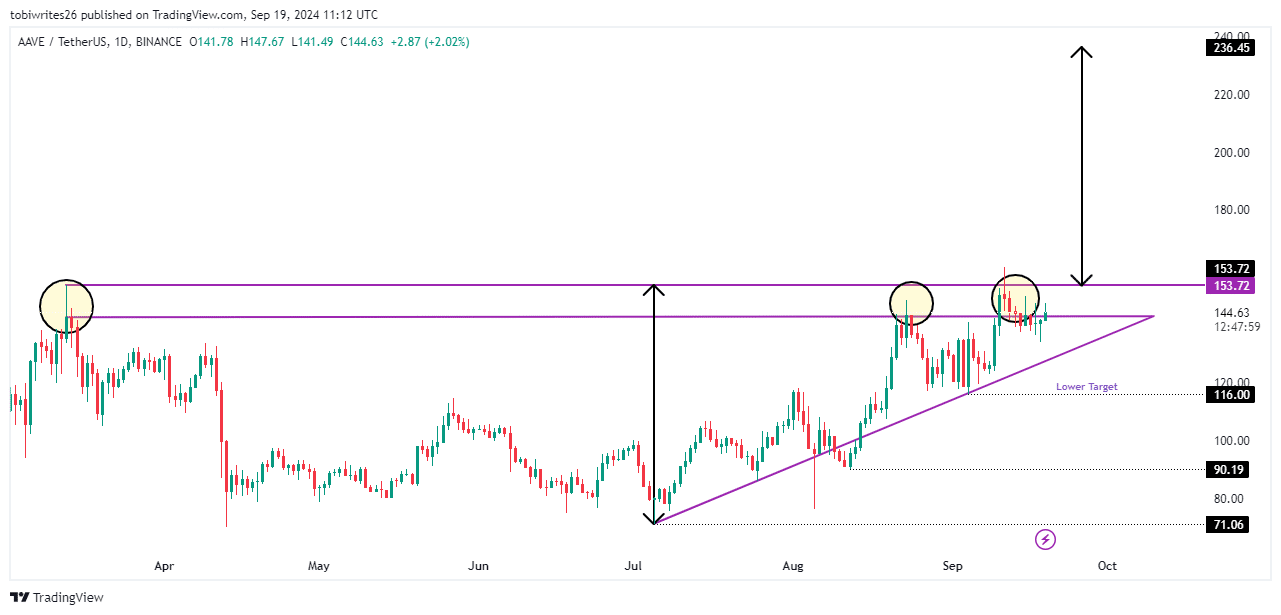

At the time of writing, AAVE has been gaining momentum in its attempts to break the resistance at $153.72 – a level known for significant selling pressure that has previously driven the price down three times.

If this resistance is successfully broken, the next target for AAVE is $236.45, with the chart indicating a substantial liquidity cluster.

However, a closer target is at $162.60, a level with nearby resting liquidity identified by Hyblock.

Should AAVE fail to attract traders at this point, the price could fall to $113.50, another area of notable concentration of liquidity.

Source: Hyblock Capital

Profitable traders will maintain buying pressure on AAVE

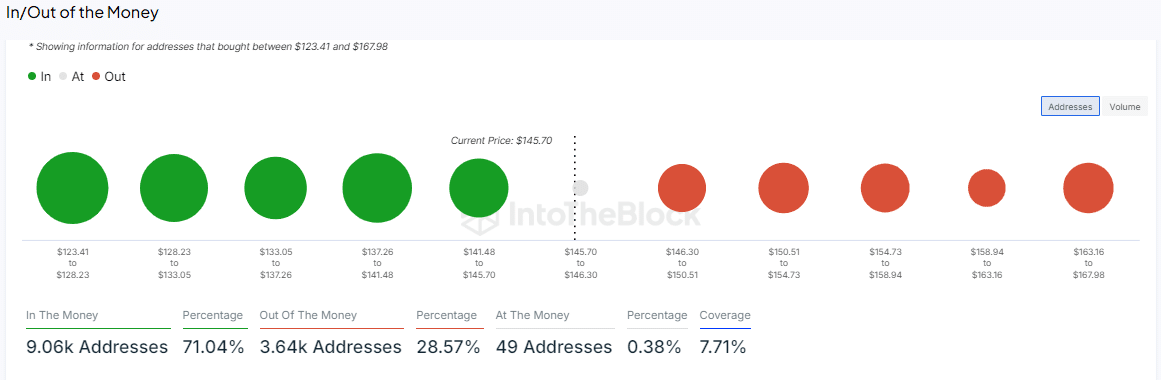

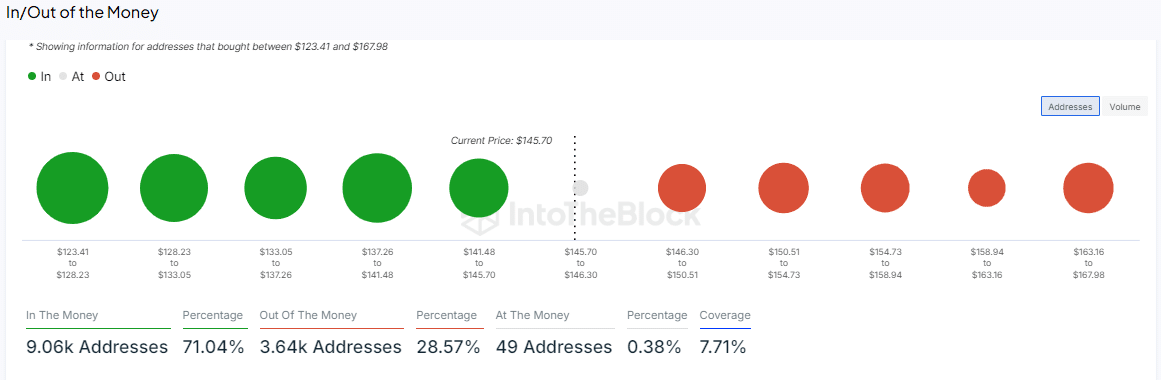

According to InTheBlokThe “In/Out of the Money Around Price” indicator shows that a significant number of traders were “In the Money” at the time of writing, indicating profitability from holding AAVE.

At the time of writing, 9,06,000 addresses were profitable, or 71.04% of all AAVE holders, suggesting that these investors may continue to push the price higher.

Source: IntoTheBlock

The 46.48% decline in active addresses was a bullish indicator, indicating that fewer holders are likely to sell and prefer to hold their assets instead.

This trend is confirmed by a decrease in the circulating supply of AAVE on the exchanges over the past 24 hours, reflecting a strong investment pattern among investors.

A potential drop to $116 threatens growth

Over the past month, AAVE has achieved a growth of 12.84% reported by CoinMarketCap.

However, this growth hit a roadblock, failing to overcome a significant resistance band between $142.69 and $153.72 on the third attempt.

At the time of writing, AAVE was preparing for another attempt to break this critical level.

Analysis from AMBCrypto suggested that AAVE was about to cross this barrier as it trades within an ascending triangle – a pattern known for its bullish implications.

A successful breakout from the ascending triangle could mimic its previous trajectory from the base to the upper boundary of the ascending channel, potentially reaching as high as $236.45, marked with a black arrow on the chart.

Source: trading view

Read Aave’s [AAVE] Price forecast 2024–2025

Conversely, if the uptrend were to materialize, AAVE could see a drop to $116, a figure closely aligned with the $113.50 liquidation point highlighted on Hyblock’s liquidation charts.

AAVE is targeting a target of $236 but is facing crucial resistance at $153.72. Discover insights on the bullish trends and key resistance points, which influence the market trajectory.